Answered step by step

Verified Expert Solution

Question

1 Approved Answer

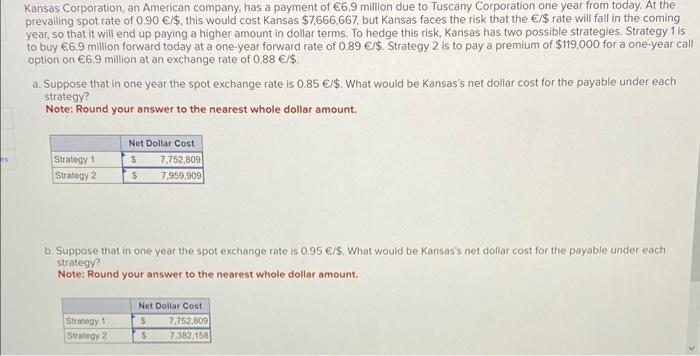

I need help with Part B please. part A has been marked correct but part B was flagged as wrong Kansas Corporation, an American company,

I need help with Part B please. part A has been marked correct but part B was flagged as wrong

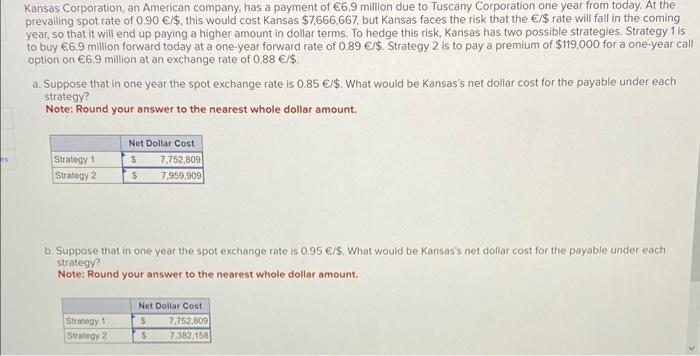

Kansas Corporation, an American company, has a payment of 6.9 million due to Tuscany Corporation one year from today. At the prevaling spot rate of 0.90/$, this would cost Kansas $7,666,667, but Kansas faces the risk that the /$ rate will fall in the coming year, so that it will end up paying a higher amount in dollar terms. To hedge this risk, Kansas has two possible strategies. Strategy 1 is to buy 66.9 million forward today at a one-year forward rate of 0.89/$. Strategy 2 is to pay a premium of $119,000 for a one-year call option on 6.9 million at an exchange rate of 0.88/$. a. Suppose that in one year the spot exchange rate is 0.85E/$. What would be Kansas's net dollar cost for the payable under each strategy? Note: Round your answer to the nearest whole dollar amount. b. Suppose that in one year the spot exchange rate is 0.95/$. What would be Kansas's net dollar cost for the payable under each strategy? Note: Round your answer to the nearest whole dollar amount

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started