i need help with part c revised part B please

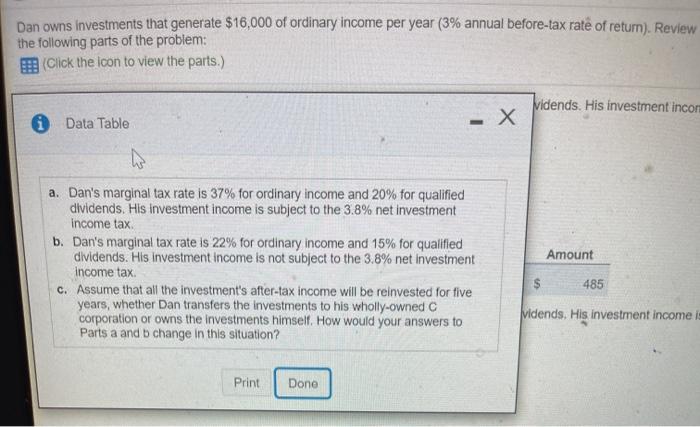

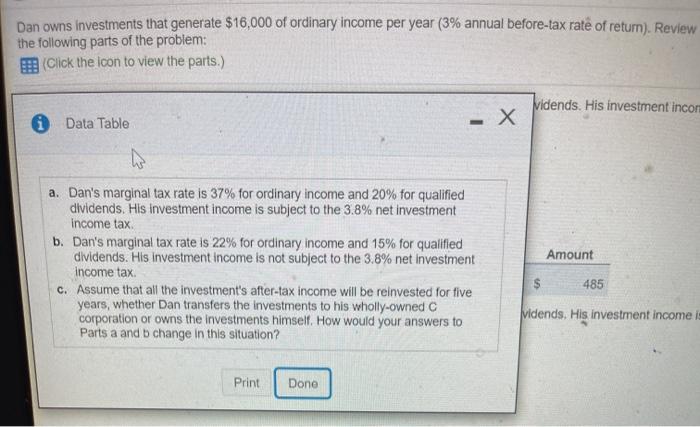

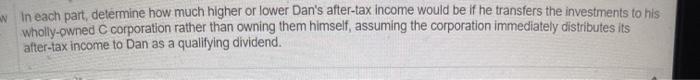

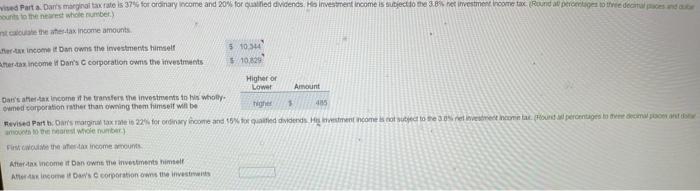

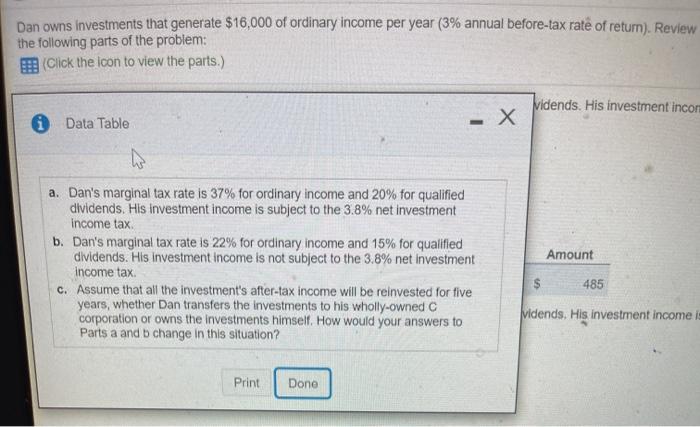

Dan owns Investments that generate $16,000 of ordinary income per year (3% annual before-tax rate of return). Review the following parts of the problem: (Click the icon to view the parts.) Vidends. His investment incom i Data Table - X Amount a. Dan's marginal tax rate is 37% for ordinary income and 20% for qualified dividends. His investment income is subject to the 3.8% net investment income tax b. Dan's marginal tax rate is 22% for ordinary income and 15% for qualified dividends. His Investment income is not subject to the 3.8% net investment income tax c. Assume that all the investment's after-tax income will be reinvested for five years, whether Dan transfers the investments to his wholly-owned C corporation or owns the investments himself. How would your answers to Parts a and b change in this situation? $ 485 vidends. His investment income is Print Done W in each part, determine how much higher or lower Dan's after-tax income would be if he transfers the investments to his wholly-owned C corporation rather than owning them himself, assuming the corporation immediately distributes its after-tax income to Dan as a qualifying dividend. vised Parta. Dants maire tax rate is 37% for ordinary income and 20w for wified vidends Ho Investment income is subject to the 3.8% fet vestment come to Round a percentages to the decitur haces and cu out to the nearest whole number the the wax income amounts The income in owns the investments himself 10344 et income Dan's corporation owns the investments 10329 Higher or Lower Amount Dat's alerta income the transfers the investito is wholly higher 485 owned corporation rather than wing them himself will be Revised Parts Our main taxe 16 22' for income and storie dides en comes out to see the ord percentagem moest wole number) Finish the income out Atax income i Danows the investments himself Alle income corporation was to investis Dan owns Investments that generate $16,000 of ordinary income per year (3% annual before-tax rate of return). Review the following parts of the problem: (Click the icon to view the parts.) Vidends. His investment incom i Data Table - X Amount a. Dan's marginal tax rate is 37% for ordinary income and 20% for qualified dividends. His investment income is subject to the 3.8% net investment income tax b. Dan's marginal tax rate is 22% for ordinary income and 15% for qualified dividends. His Investment income is not subject to the 3.8% net investment income tax c. Assume that all the investment's after-tax income will be reinvested for five years, whether Dan transfers the investments to his wholly-owned C corporation or owns the investments himself. How would your answers to Parts a and b change in this situation? $ 485 vidends. His investment income is Print Done W in each part, determine how much higher or lower Dan's after-tax income would be if he transfers the investments to his wholly-owned C corporation rather than owning them himself, assuming the corporation immediately distributes its after-tax income to Dan as a qualifying dividend. vised Parta. Dants maire tax rate is 37% for ordinary income and 20w for wified vidends Ho Investment income is subject to the 3.8% fet vestment come to Round a percentages to the decitur haces and cu out to the nearest whole number the the wax income amounts The income in owns the investments himself 10344 et income Dan's corporation owns the investments 10329 Higher or Lower Amount Dat's alerta income the transfers the investito is wholly higher 485 owned corporation rather than wing them himself will be Revised Parts Our main taxe 16 22' for income and storie dides en comes out to see the ord percentagem moest wole number) Finish the income out Atax income i Danows the investments himself Alle income corporation was to investis