I need help with parts B, E, F, G, and H, please. I have parts A, C, and D finished but am confused about the others. PLEASE HELP!!!!!

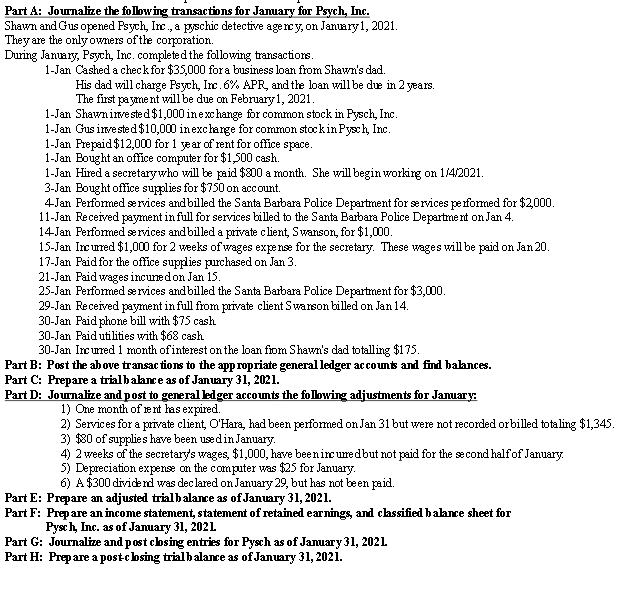

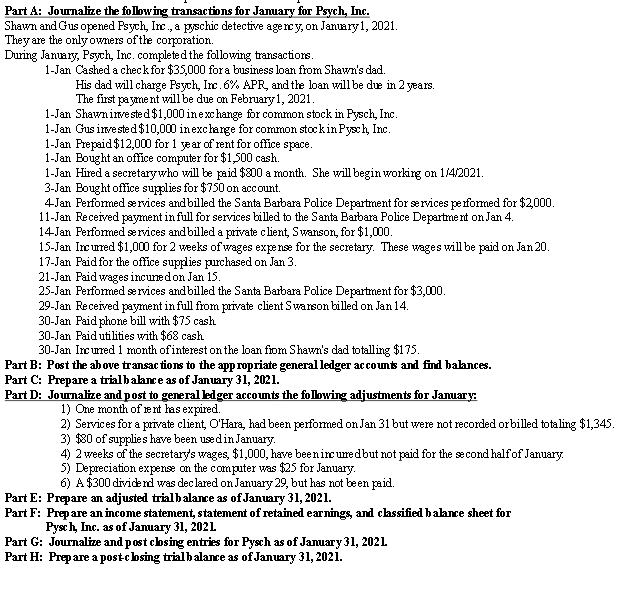

Part A: Journalize the following transactions for January for Psych, Inc. Shawn and Gus opened Psych, Inc., a pyschic detective agency, on January1, 2021. They are the only owners of the corporation. During January, Psych, Inc. completed the following transactions. 1-Jan Cashed a check for $35,000 for a business loan from Shawn's dad. His dad will charge Psych, Inc. 6% APR, and the loan will be due in 2 years. The first payment will be due on February 1, 2021. 1-Jan Shawninvested $1,000 inexchange for common stock in Pysch, Inc. 1-Jan Gus invested $10,000 inexcharge for common stockin Pysch, Inc. 1-Jan Prepaid $12,000 for 1 year of rent for office space. 1-Jan Bought an office computer for $1,500 cash. 1-Jan Hired a secretary who will be paid $800 a month. She will begin working on 1/4/2021. 3-Jan Bought office supplies for $750 on account. 4 Jan Performed services and billed the Santa Barbara Police Department for services performed for $2,000. 11-Jan Received payment in full for services billed to the Santa Barbara Police Department on Jan 4. 14-Jan Performed services and billed a private client, Swanson, for $1,000. 15-Jan Ircurred $1,000 for 2 weeks of wages expense for the secretary. These wages will be paid on Jan 20. 17-Jan Paid for the office supplies purchased on Jan 3. 21-Jan Paid wages incurredon Jan 15. 25-Jan Perfomed services and billed the Santa Barbara Police Department for $3,000. 29-Jan Received payment in full from private client Swarson billed on Jan 14. 30-Jan Paid phone bill with $75 cash 30-Jan Paid utilities with $68 cash 30-Jan Inc urred 1 month of interest on the loan from Shawn's dad totalling $175. Part B: Post the above transactions to the appropriate general ledger accounts and find balances. Part C: Prepare a trialbalance as of January 31, 2021. Part D: Journalize and post to general ledger accounts the following adjustments for January 1) One month of rent has expired. 2) Services for a private client O'Hara, had been performed on Jan 31 but were not recorded orbilled totaling $1,345. 3) $80 of supplies have been used in January 4) 2 weeks of the secretary's wages, $1,000, have beenincurred but not paid for the second half of January 5) Depreciation expense on the computer was $25 for January 6) A $300 dividend was declared on January 29, but has not been paid. Part E: Prepare an adjusted trialbalance as of January 31, 2021. Part F: Prepare an income statement, statement of retained earnings, and classified balance sheet for Pysch, Inc. as of January 31, 2021 Part G: Journalize and post cbsing entries for Pysch as of January 31, 202L Part H: Prepare a postc bsing trialbalance as of January 31, 2021