Answered step by step

Verified Expert Solution

Question

1 Approved Answer

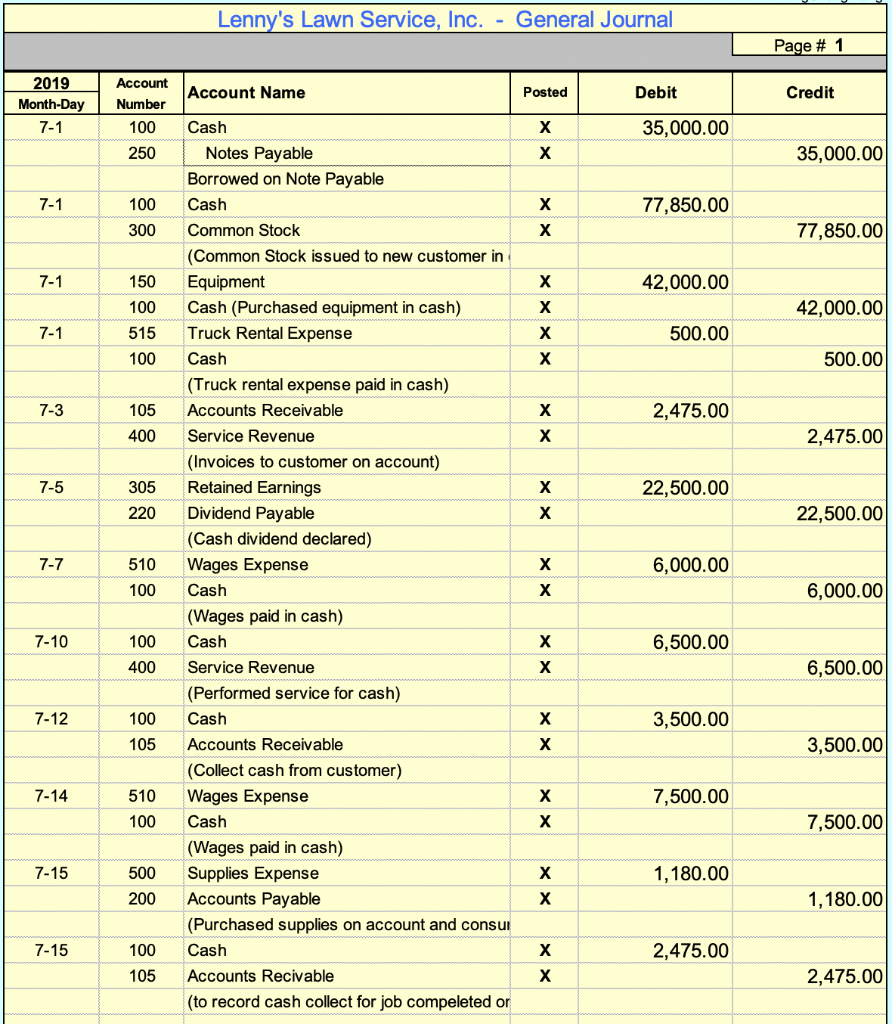

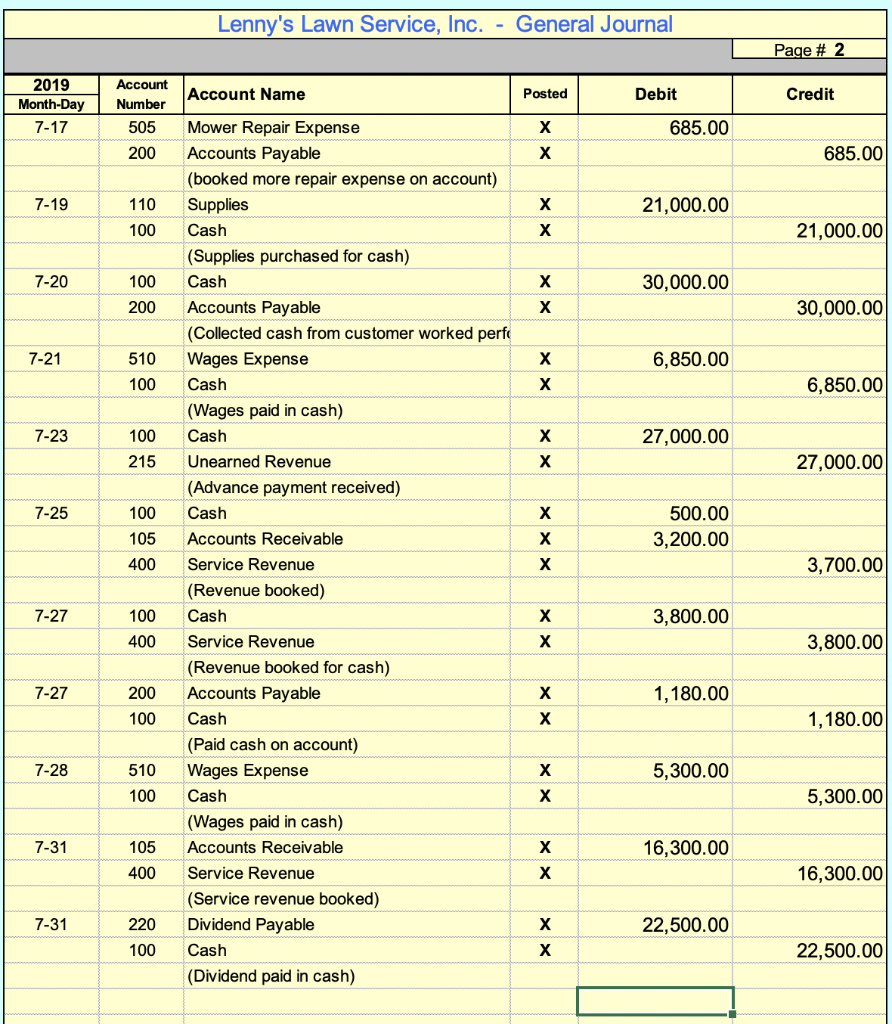

# I need help with post transaction to the general ledger account and make a trial calculation. Lenny's Lawn Service, Inc. - General Journal Page

# I need help with post transaction to the general ledger account and make a trial calculation.

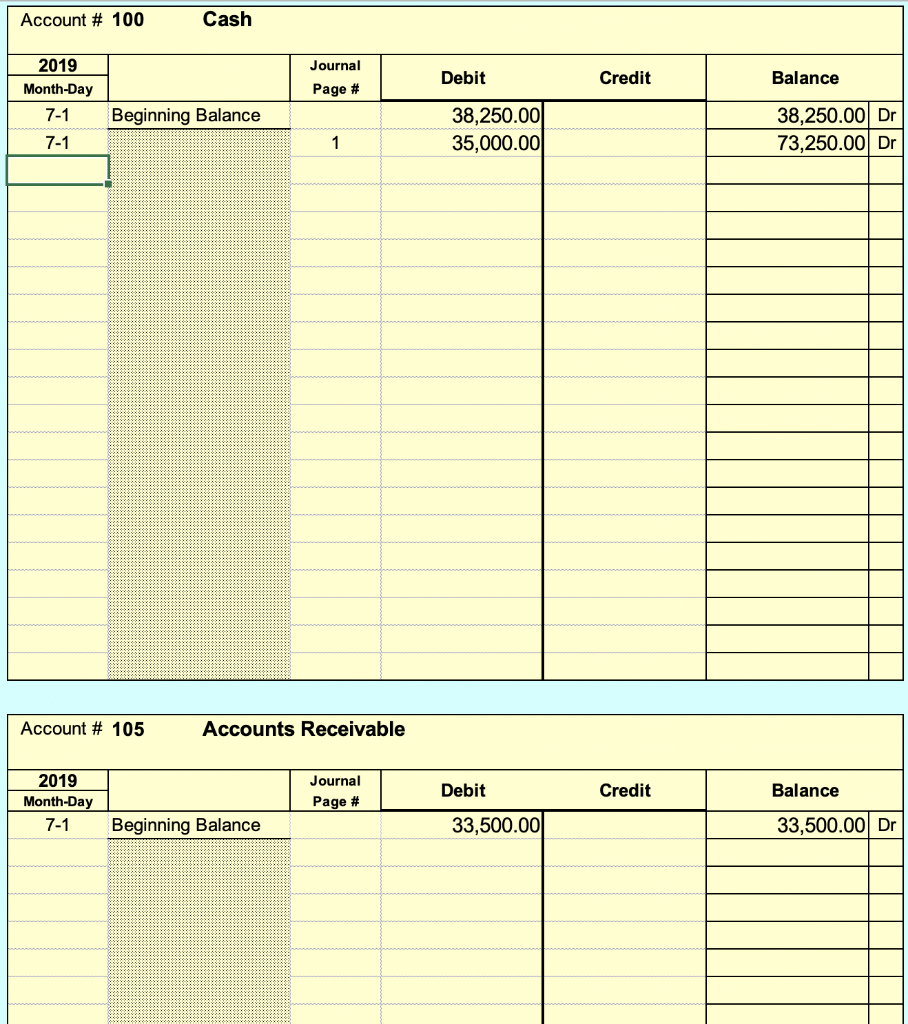

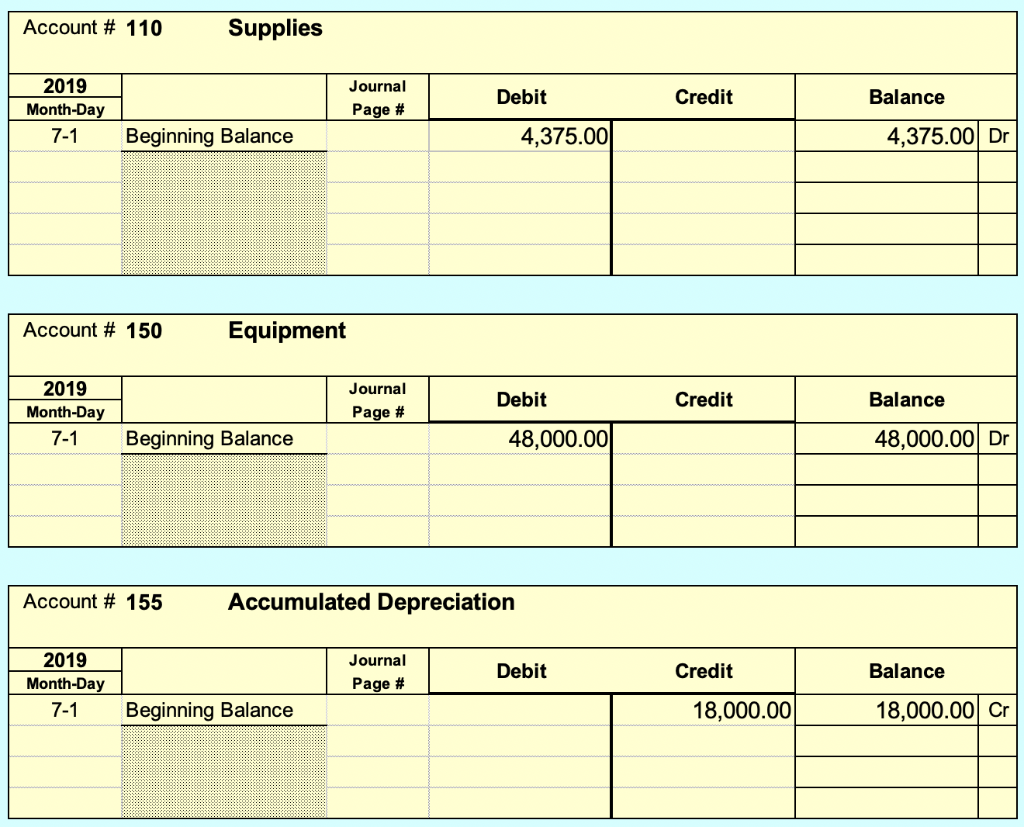

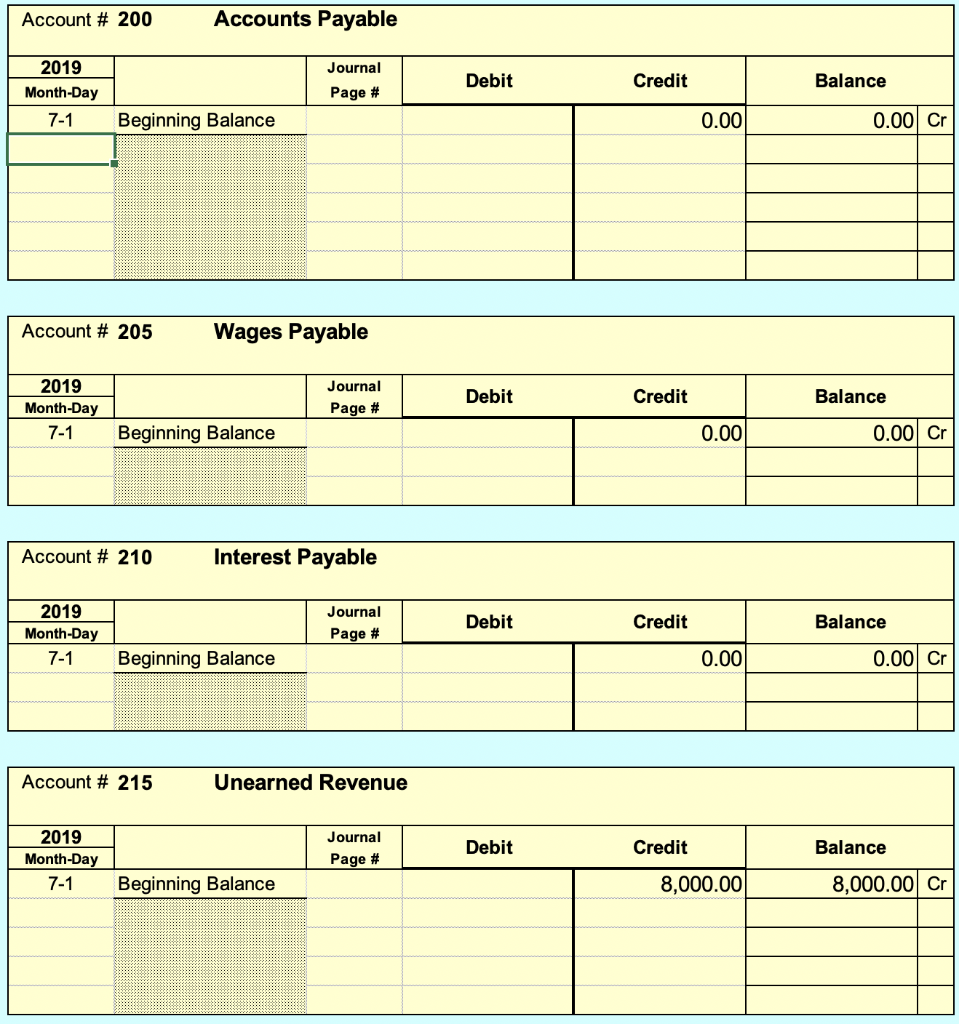

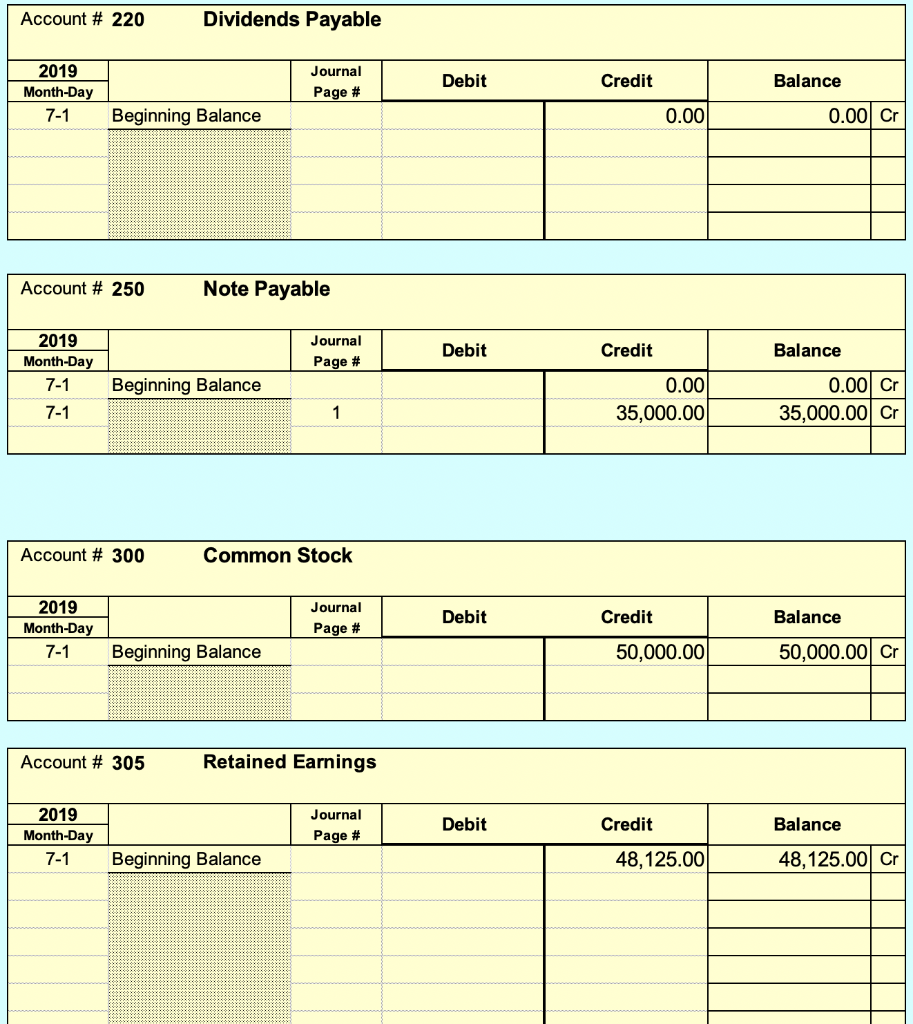

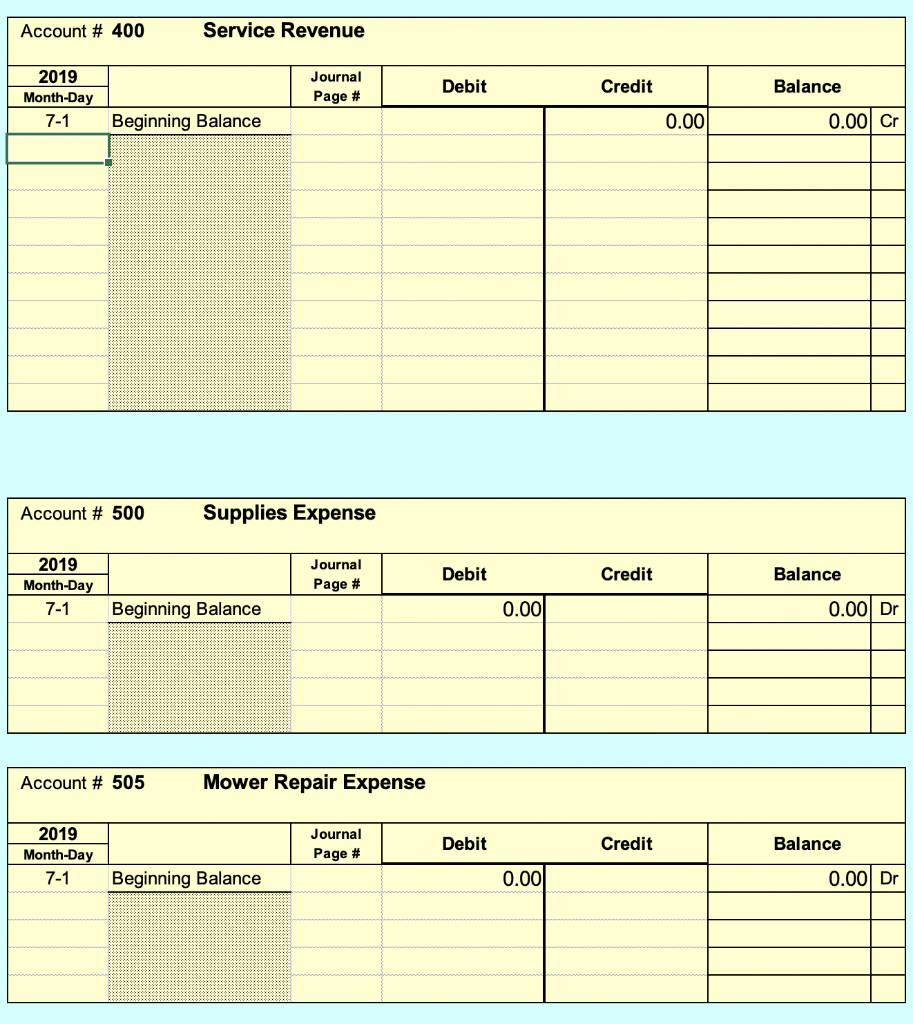

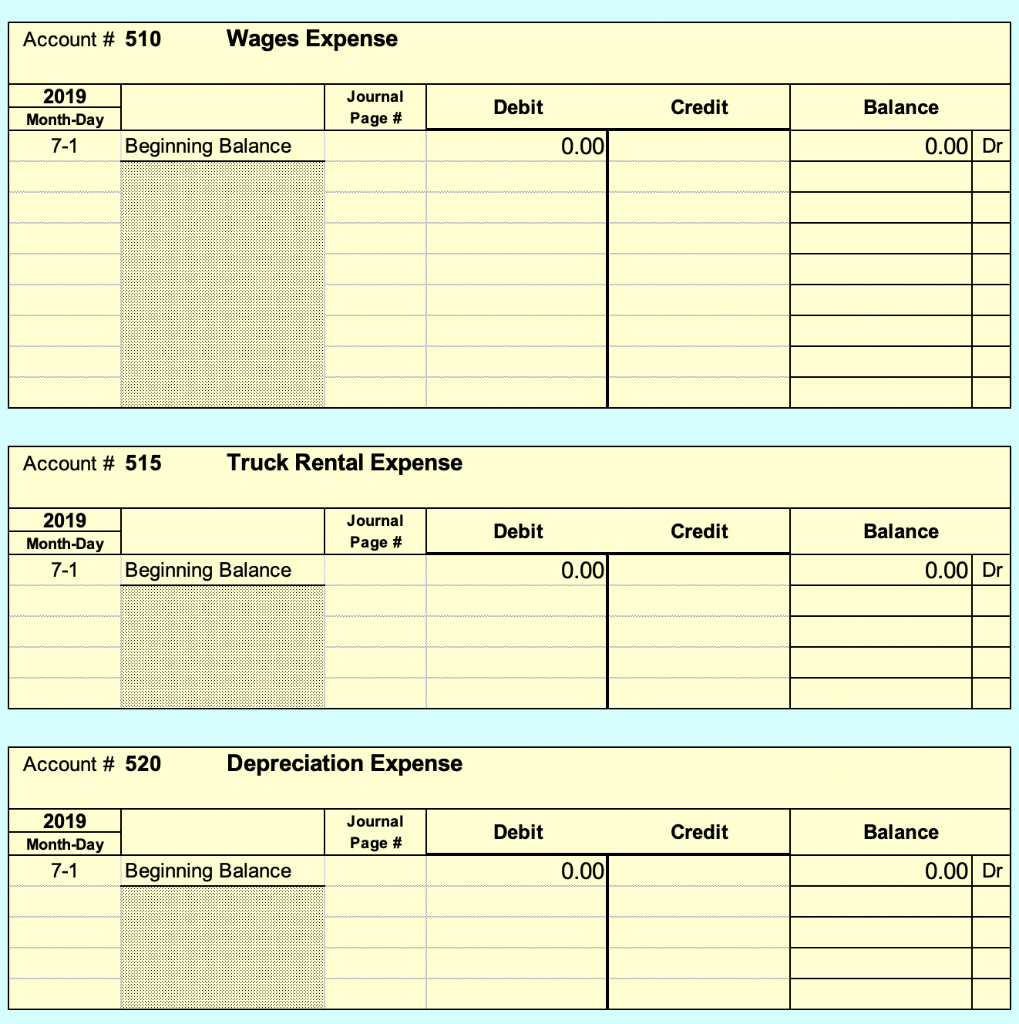

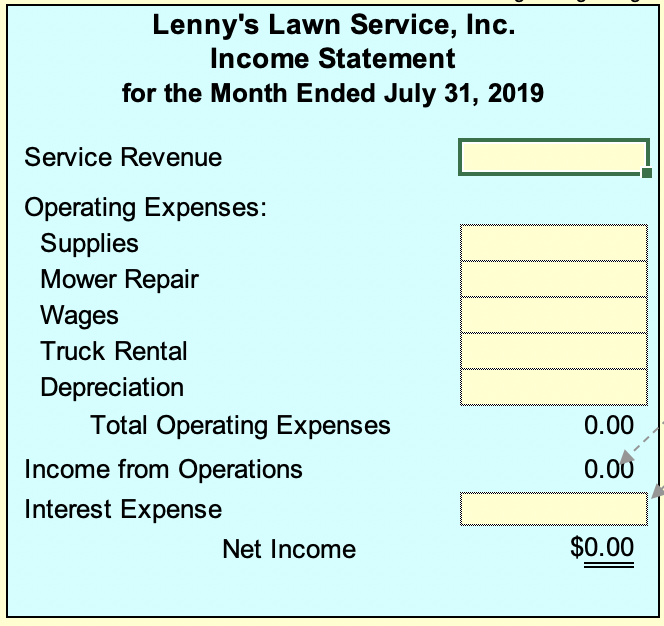

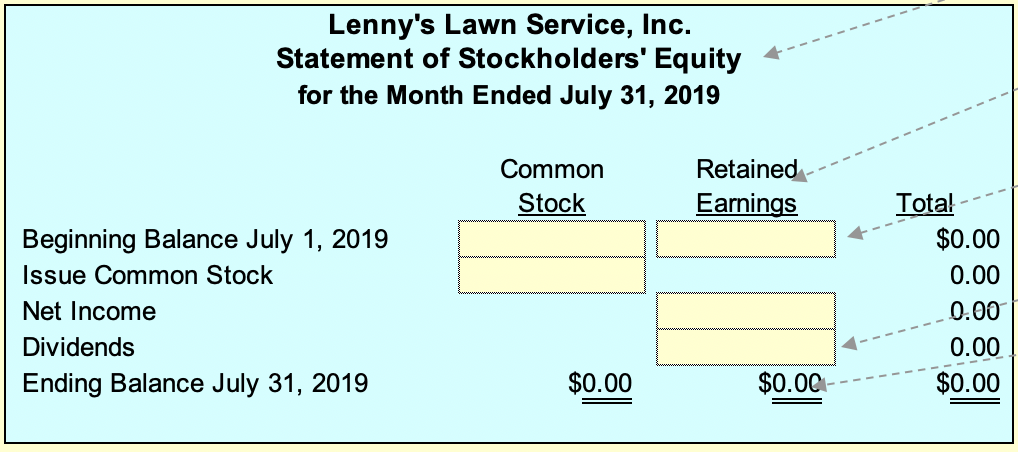

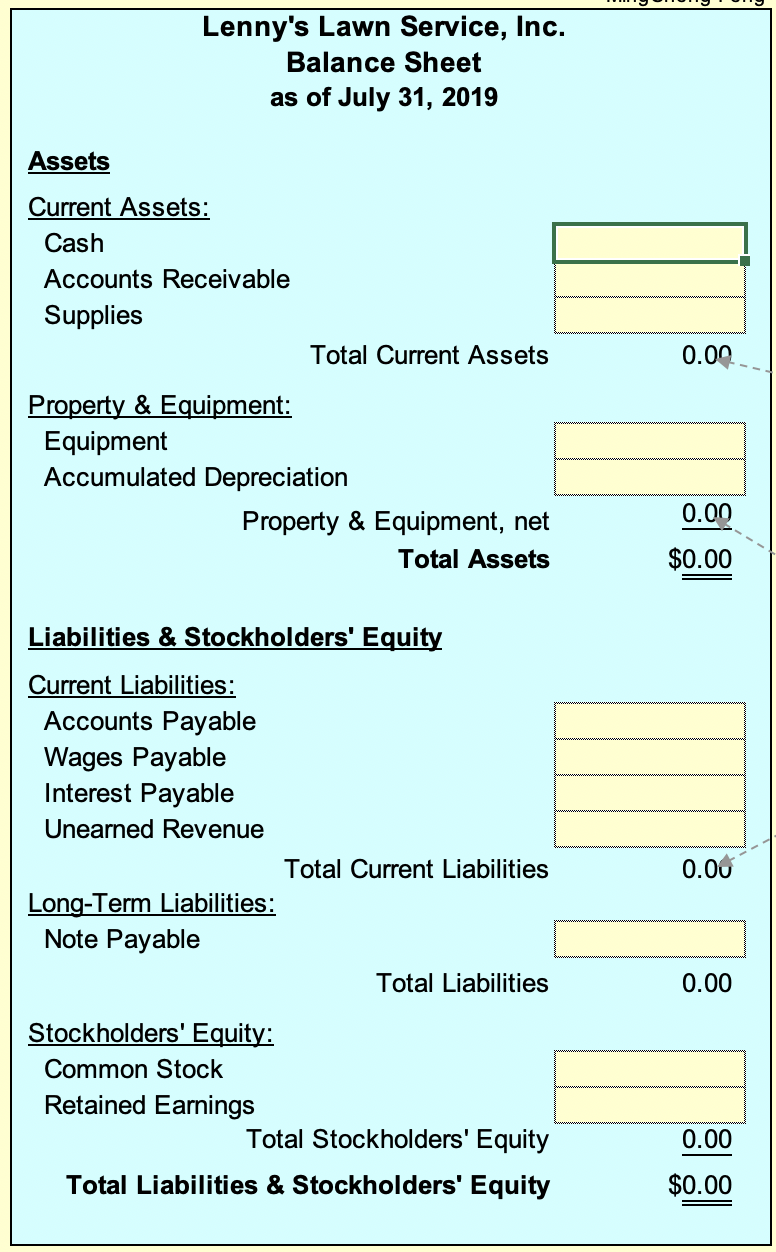

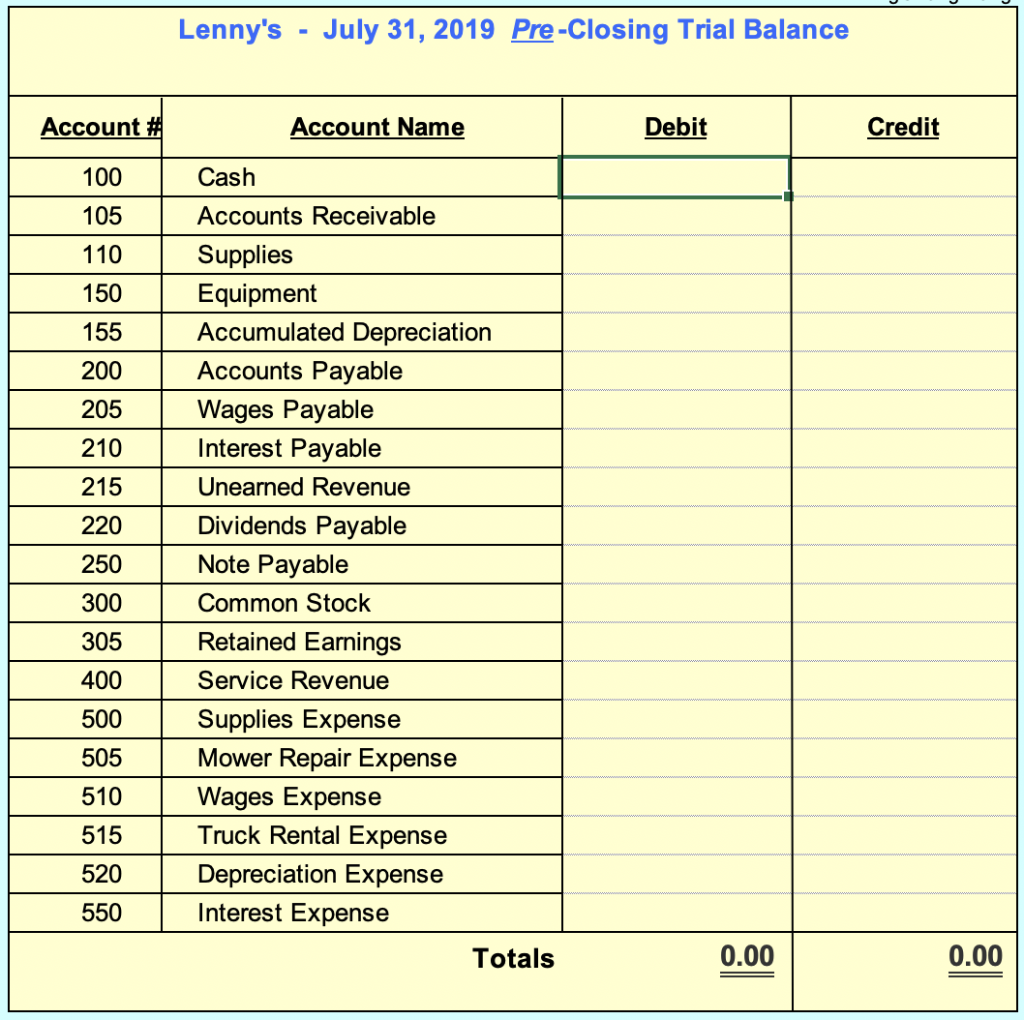

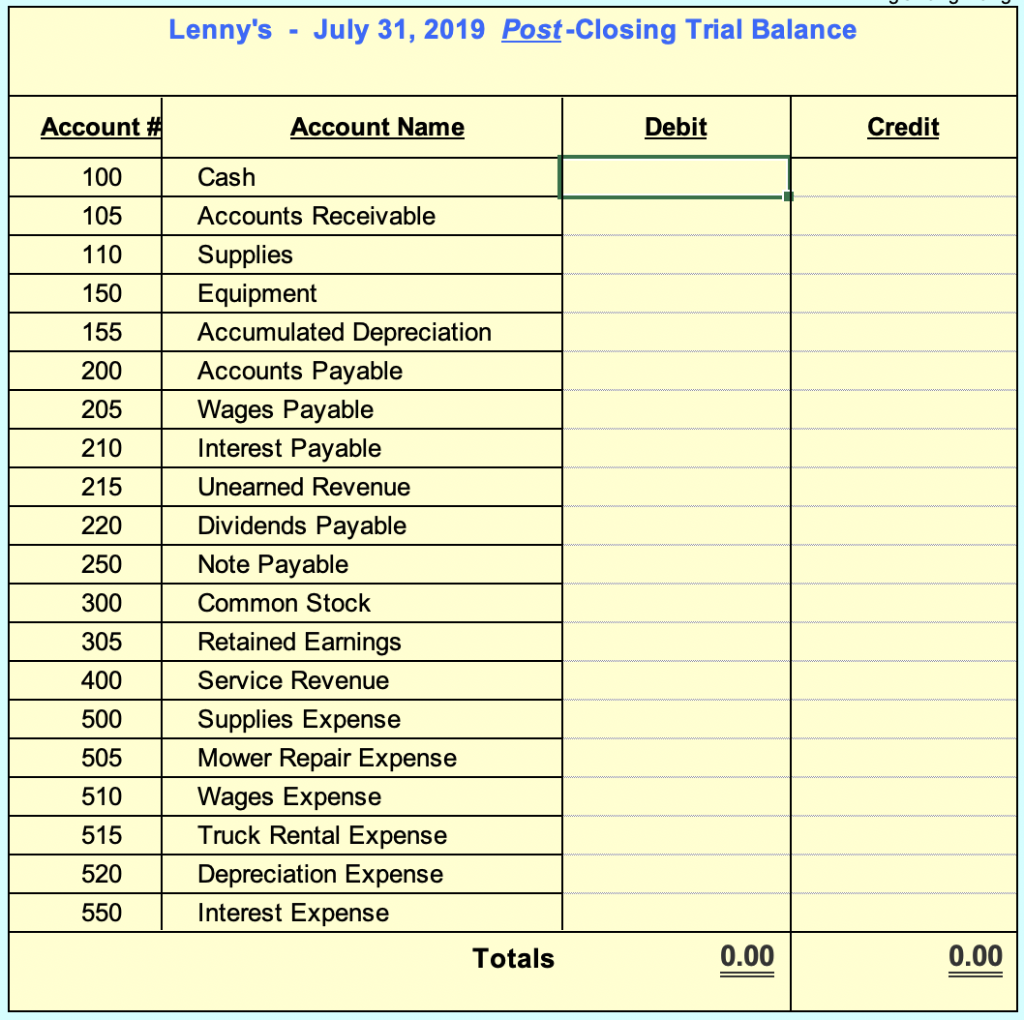

Lenny's Lawn Service, Inc. - General Journal Page # 1 Account Name Posted Debit Credit 2019 Month-Day 7-1 Account Number 100 250 35,000.00 35,000.00 7-1 100 77,850.00 300 77,850.00 7-1 42,000.00 42,000.00 150 100 515 100 7-1 500.00 500.00 7-3 2,475.00 105 400 2,475.00 7-5 305 22,500.00 220 X 22,500.00 7-7 Cash Notes Payable Borrowed on Note Payable Cash Common Stock (Common Stock issued to new customer in Equipment Cash (Purchased equipment in cash) Truck Rental Expense Cash (Truck rental expense paid in cash) Accounts Receivable Service Revenue (Invoices to customer on Retained Earnings Dividend Payable (Cash dividend declared) Wages Expense Cash (Wages paid in cash) Cash Service Revenue (Performed service for cash) Cash Accounts Receivable (Collect cash from customer) Wages Expense Cash (Wages paid in cash) Supplies Expense Accounts Payable (Purchased supplies on account and consul Cash Accounts Recivable (to record cash collect for job compeleted or 510 100 6,000.00 X X 6,000.00 7-10 100 6,500.00 X 400 6,500.00 7-12 3,500.00 100 105 3,500.00 7-14 510 7,500.00 100 7,500.00 7-15 1,180.00 500 200 1,180.00 7-15 100 2,475.00 X 105 2,475.00 Lenny's Lawn Service, Inc. - General Journal Page # 2 Account Name Posted Debit Credit 2019 Month-Day 7-17 Account Number 505 X 685.00 200 685.00 7-19 21,000.00 110 100 21,000.00 7-20 100 30,000.00 200 30,000.00 7-21 510 100 6,850.00 6,850.00 7-23 27,000.00 100 215 27,000.00 7-25 100 105 Mower Repair Expense Accounts Payable (booked more repair expense on account) Supplies Cash (Supplies purchased for cash) Cash Accounts Payable (Collected cash from customer worked perfo Wages Expense Cash (Wages paid in cash) Cash Unearned Revenue (Advance payment received) Cash Accounts Receivable Service Revenue (Revenue booked) Cash Service Revenue (Revenue booked for cash) Accounts Payable Cash (Paid cash on account) Wages Expense Cash (Wages paid in cash) Accounts Receivable Service Revenue (Service revenue booked) Dividend Payable Cash (Dividend paid in cash) X 500.00 3,200.00 400 3,700.00 7-27 3,800.00 100 400 3,800.00 7-27 X 1,180.00 200 100 1,180.00 7-28 5,300.00 510 100 X 5,300.00 7-31 16,300.00 105 400 16,300.00 7-31 X 22,500.00 220 100 22,500.00 Account # 100 Cash Journal Debit Credit Balance Page # 2019 Month-Day 7-1 7-1 Beginning Balance 38,250.00 35,000.00 38,250.00 Dr 73,250.00 Dr 1 Account # 105 Accounts Receivable Journal Page # Debit Credit 2019 Month-Day 7-1 Balance Beginning Balance 33,500.00 33,500.00 Dr Account # 110 Supplies Journal Page # Debit Credit 2019 Month-Day 7-1 Balance Beginning Balance 4,375.00 4,375.00 Dr Account # 150 Equipment Journal Page # Debit Credit 2019 Month-Day 7-1 Balance Beginning Balance 48,000.00 48,000.00 Dr Account # 155 Accumulated Depreciation Journal Page # Debit Credit 2019 Month-Day 7-1 Balance Beginning Balance 18,000.00 18,000.00 Cr Account # 200 Accounts Payable Journal Debit Credit Balance 2019 Month-Day 7-1 Page # Beginning Balance 0.00 0.00 Cr Account # 205 Wages Payable 2019 Month-Day Journal Page # Debit Credit Balance 7-1 Beginning Balance 0.00 0.00 Cr Account # 210 Interest Payable Journal Page # Debit Credit 2019 Month-Day 7-1 Balance Beginning Balance 0.00 0.00 Cr Account # 215 Unearned Revenue Journal Page # Debit Credit 2019 Month-Day 7-1 Balance Beginning Balance 8,000.00 8,000.00 Cr Account # 220 Dividends Payable Journal Page # Debit Credit 2019 Month-Day 7-1 Balance Beginning Balance 0.00 0.00 Cr Account # 250 Note Payable Journal Page # Debit Credit 2019 Month-Day 7-1 Balance Beginning Balance 0.00 35,000.00 0.00 Cr 35,000.00 Cr 7-1 1 Account # 300 Common Stock Journal Page # Debit Credit 2019 Month-Day 7-1 Balance Beginning Balance 50,000.00 50,000.00 Cr Account # 305 Retained Earnings Journal Debit Credit Balance 2019 Month-Day 7-1 Page # Beginning Balance 48,125.00 48,125.00 Cr Account # 400 Service Revenue Journal Page # Debit Credit 2019 Month-Day 7-1 Balance Beginning Balance 0.00 0.00 Cr Account # 500 Supplies Expense Journal Page # Debit Credit 2019 Month-Day 7-1 Balance Beginning Balance 0.00 0.00 Dr Account # 505 Mower Repair Expense Journal Page # Debit Credit 2019 Month-Day 7-1 Balance Beginning Balance 0.00 0.001 Dr Account # 510 Wages Expense Journal Page # Debit Credit 2019 Month-Day 7-1 Balance Beginning Balance 0.001 0.001 Dr Account # 515 Truck Rental Expense Journal Page # Debit Credit 2019 Month-Day 7-1 Balance Beginning Balance 0.00 0.00) Dr Account # 520 Depreciation Expense Journal Page # Debit Credit 2019 Month-Day 7-1 Balance Beginning Balance 0.00 0.00 Dr Lenny's Lawn Service, Inc. Income Statement for the Month Ended July 31, 2019 Service Revenue Operating Expenses: Supplies Mower Repair Wages Truck Rental Depreciation Total Operating Expenses Income from Operations Interest Expense Net Income 0.00 0.00 $0.00 Lenny's Lawn Service, Inc. Statement of Stockholders' Equity for the Month Ended July 31, 2019 Common Stock Retained Earnings Beginning Balance July 1, 2019 Issue Common Stock Net Income Dividends Ending Balance July 31, 2019 Tota! $0.00 0.00 0.00 0.00 $0.00 $0.00 $0.00 Lenny's Lawn Service, Inc. Balance Sheet as of July 31, 2019 Assets Current Assets: Cash Accounts Receivable Supplies Total Current Assets 0.00 Property & Equipment: Equipment Accumulated Depreciation Property & Equipment, net Total Assets 0.00 $0.00 Liabilities & Stockholders' Equity Current Liabilities: Accounts Payable Wages Payable Interest Payable Unearned Revenue Total Current Liabilities Long-Term Liabilities: Note Payable Total Liabilities 0.00 0.00 Stockholders' Equity: Common Stock Retained Earnings Total Stockholders' Equity Total Liabilities & Stockholders' Equity 0.00 $0.00 Lenny's - July 31, 2019 Pre-Closing Trial Balance Account # Account Name Debit Credit 100 105 110 Cash Accounts Receivable 150 155 200 205 210 215 220 250 300 Supplies Equipment Accumulated Depreciation Accounts Payable Wages Payable Interest Payable Unearned Revenue Dividends Payable Note Payable Common Stock Retained Earnings Service Revenue Supplies Expense Mower Repair Expense Wages Expense Truck Rental Expense Depreciation Expense Interest Expense Totals 305 400 500 505 510 515 520 550 0.00 0.00 Lenny's July 31, 2019 Post-Closing Trial Balance Account # Account Name Debit Credit 100 105 110 Cash Accounts Receivable 150 155 200 205 210 215 220 250 300 Supplies Equipment Accumulated Depreciation Accounts Payable Wages Payable Interest Payable Unearned Revenue Dividends Payable Note Payable Common Stock Retained Earnings Service Revenue Supplies Expense Mower Repair Expense Wages Expense Truck Rental Expense Depreciation Expense Interest Expense Totals 305 400 500 505 510 515 520 550 0.00 0.00

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started