Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I need help with preparing the financial position Statement and financial activity statement for 2025. I have included the transactions Nash Library, a nonprofit organization,

I need help with preparing the financial position Statement and financial activity statement for 2025. I have included the transactions

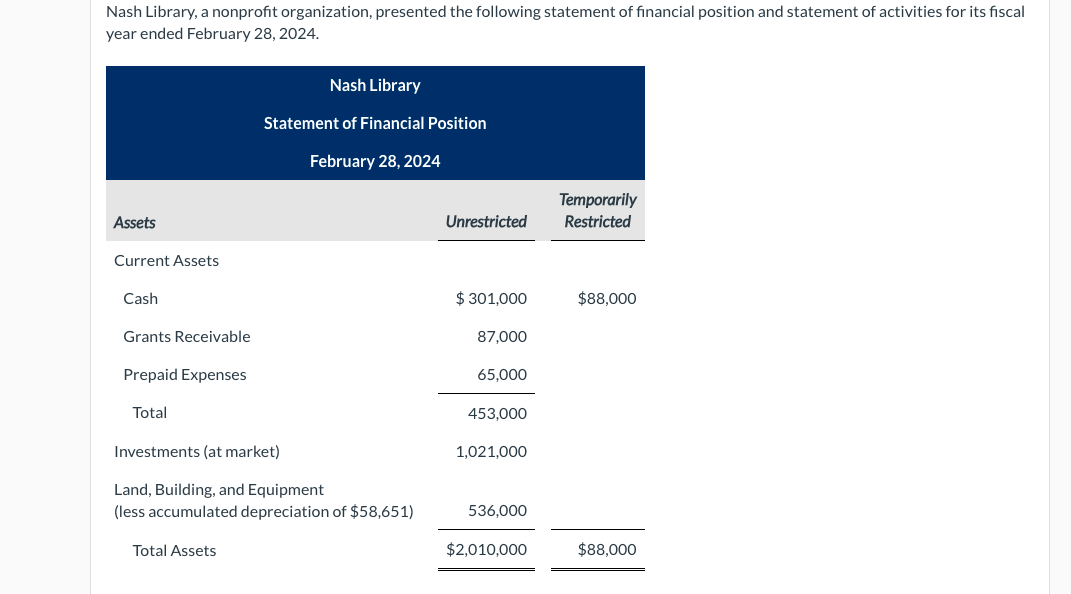

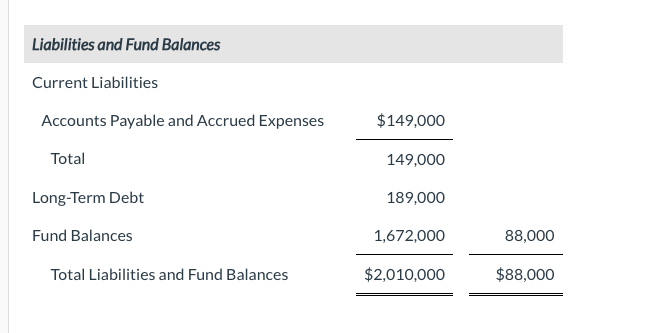

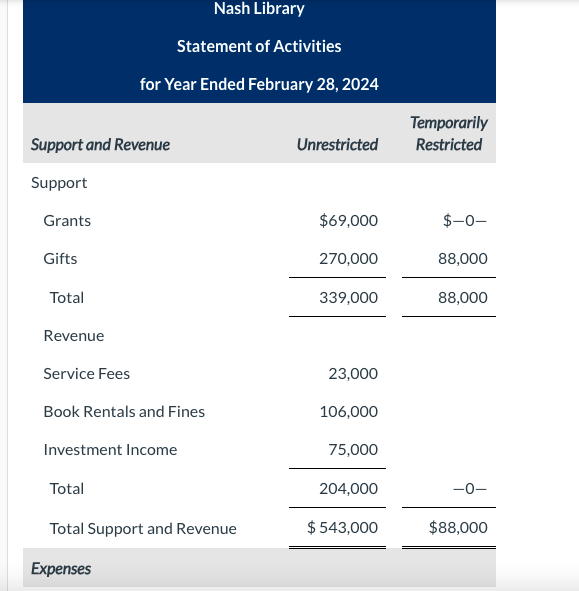

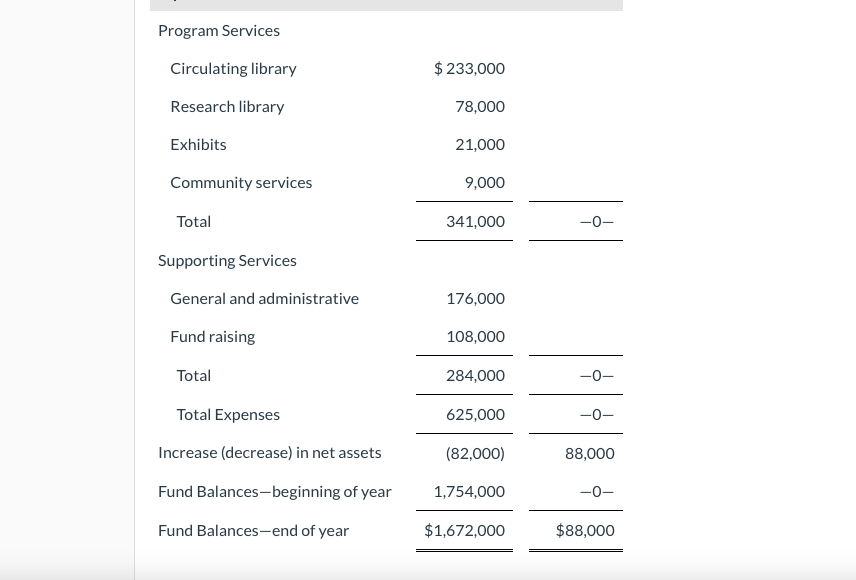

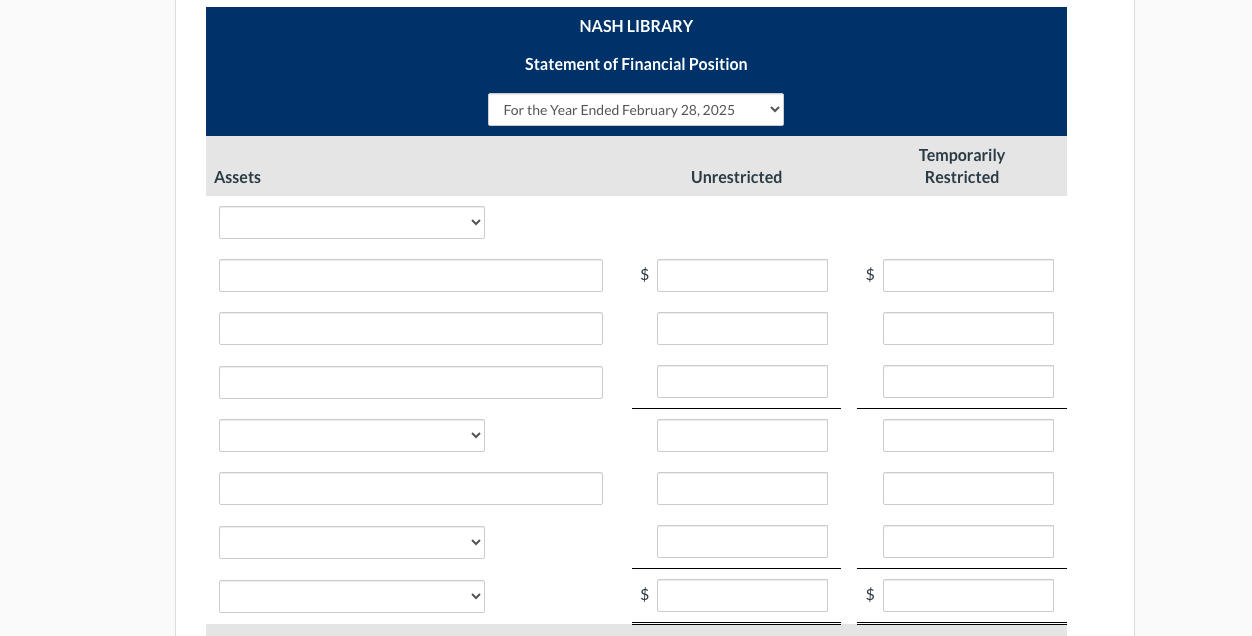

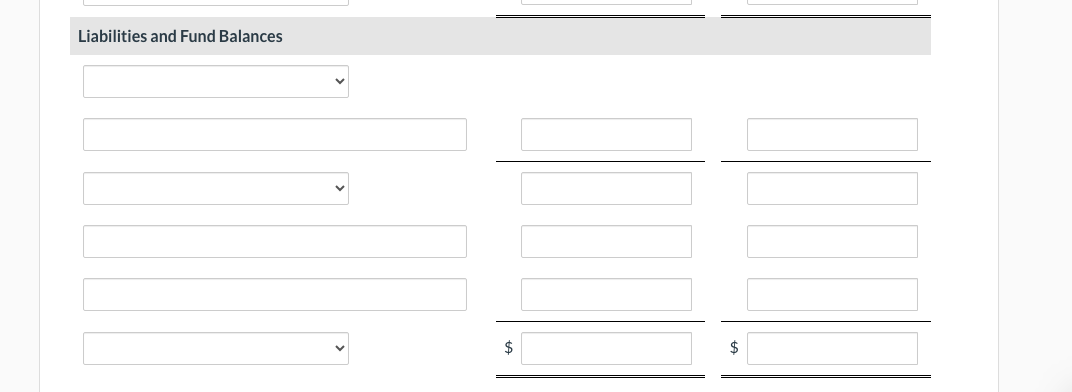

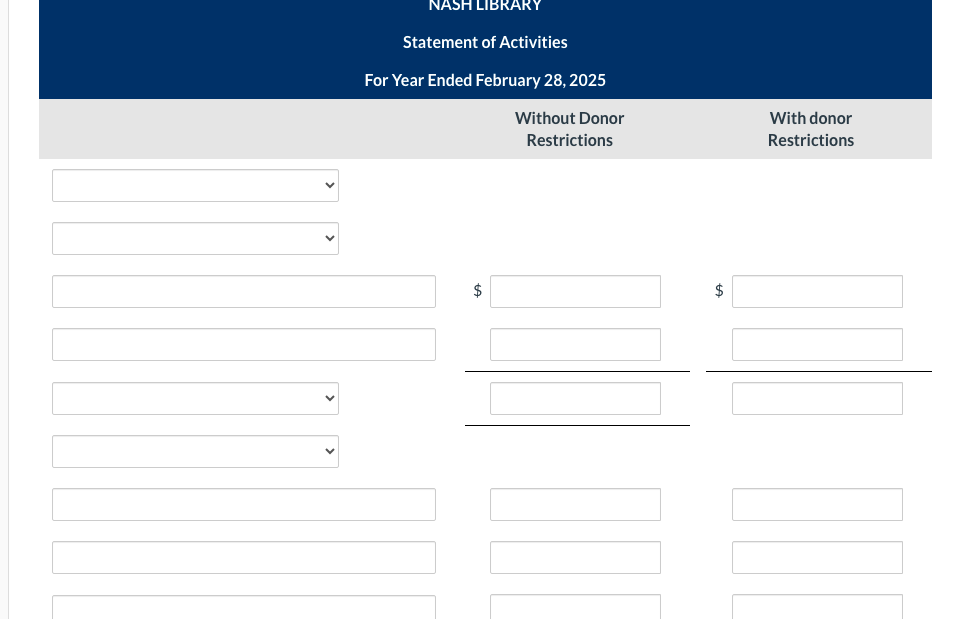

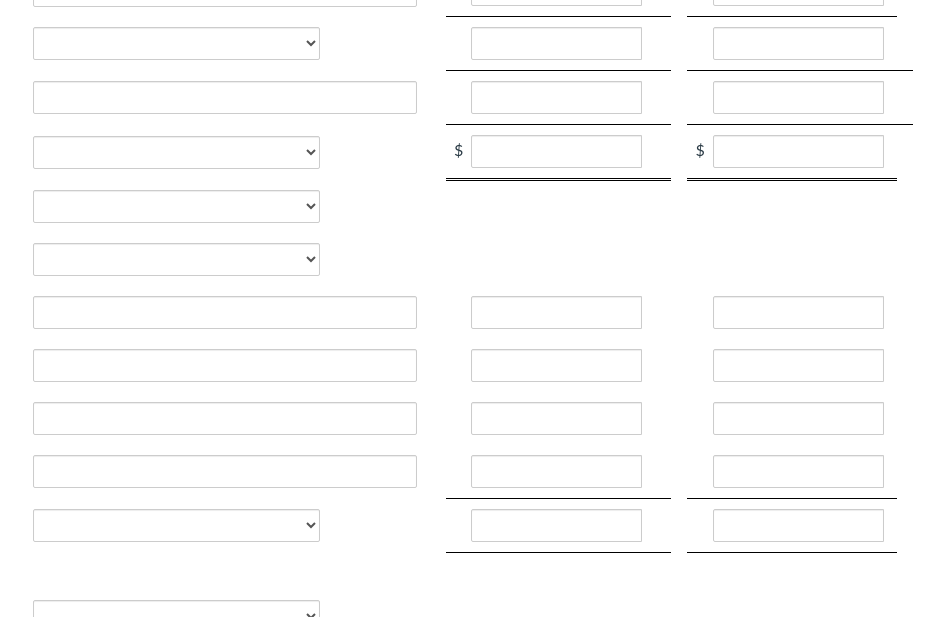

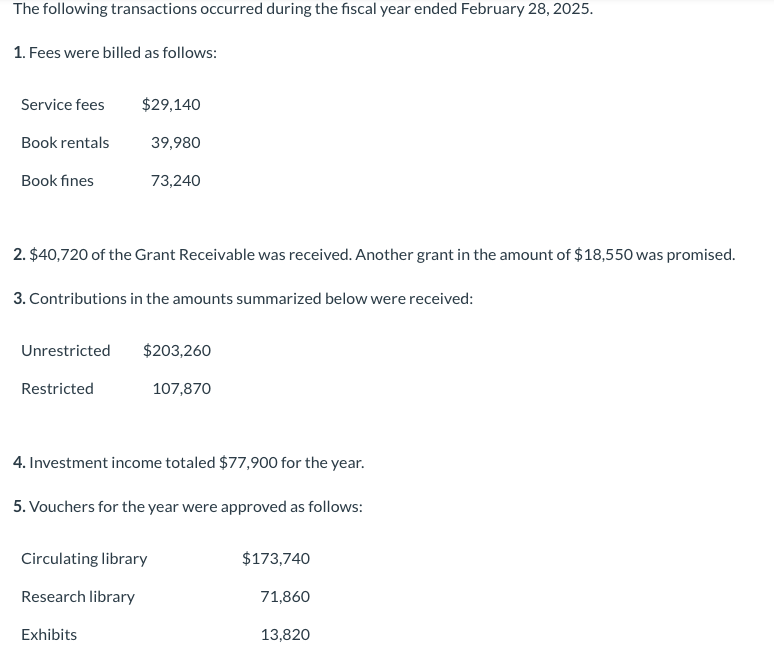

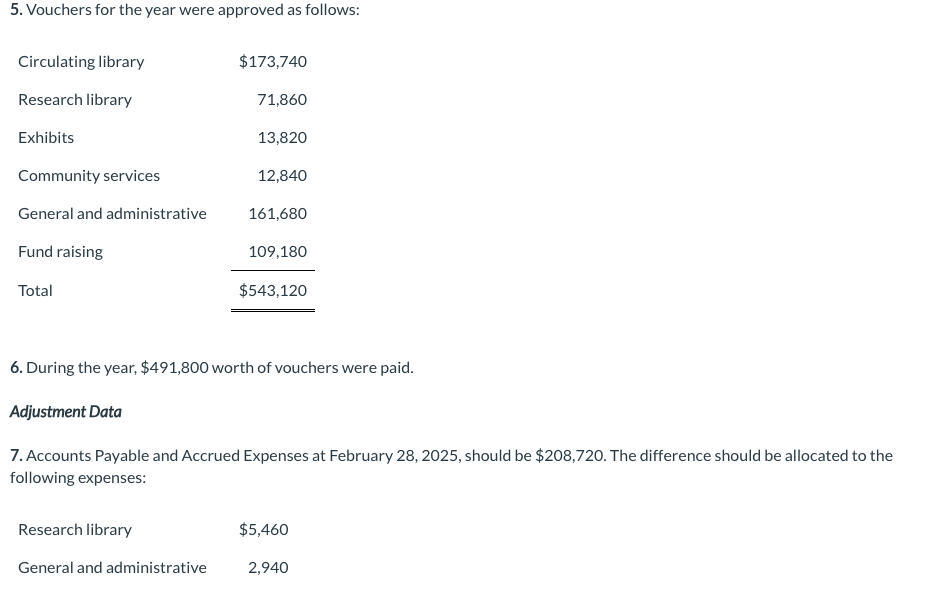

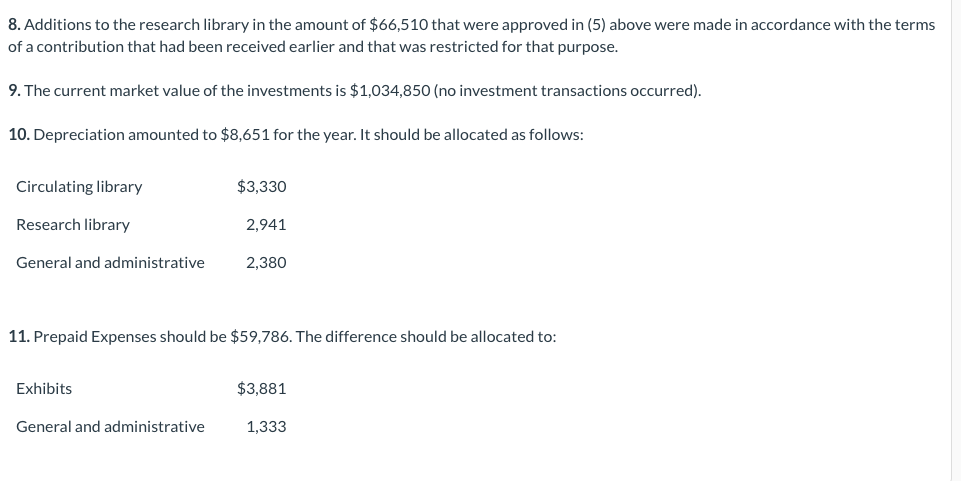

Nash Library, a nonprofit organization, presented the following statement of financial position and statement of activities for its fiscal year ended February 28, 2024. Liabilities and Fund Balances Current Liabilities Nash Library Statement of Activities for Year Ended February 28, 2024 \begin{tabular}{ll} Support and Revenue Unrestricted & TemporarilyRestricted \\ \hline Support \end{tabular} Support Expenses Program Services Supporting Services NASH LIBRARY Statement of Financial Position For the Year Ended February 28, 2025 Temporarily Assets Unrestricted Restricted $ $ Liabilities and Fund Balances Statement of Activities For Year Ended February 28, 2025 Without Donor Restrictions With donor Restrictions $ $ The following transactions occurred during the fiscal year ended February 28, 2025. 1. Fees were billed as follows: 2. $40,720 of the Grant Receivable was received. Another grant in the amount of $18,550 was promised. 3. Contributions in the amounts summarized below were received: 4. Investment income totaled $77,900 for the year. 5. Vouchers for the year were approved as follows: 5. Vouchers for the year were approved as follows: 6. During the year, $491,800 worth of vouchers were paid. Adjustment Data 7. Accounts Payable and Accrued Expenses at February 28, 2025, should be $208,720. The difference should be allocated to the following expenses: 8. Additions to the research library in the amount of $66,510 that were approved in (5) above were made in accordance with the terms of a contribution that had been received earlier and that was restricted for that purpose. 9. The current market value of the investments is $1,034,850 (no investment transactions occurred). 10. Depreciation amounted to $8,651 for the year. It should be allocated as follows: 11. Prepaid Expenses should be $59,786. The difference should be allocated to

Nash Library, a nonprofit organization, presented the following statement of financial position and statement of activities for its fiscal year ended February 28, 2024. Liabilities and Fund Balances Current Liabilities Nash Library Statement of Activities for Year Ended February 28, 2024 \begin{tabular}{ll} Support and Revenue Unrestricted & TemporarilyRestricted \\ \hline Support \end{tabular} Support Expenses Program Services Supporting Services NASH LIBRARY Statement of Financial Position For the Year Ended February 28, 2025 Temporarily Assets Unrestricted Restricted $ $ Liabilities and Fund Balances Statement of Activities For Year Ended February 28, 2025 Without Donor Restrictions With donor Restrictions $ $ The following transactions occurred during the fiscal year ended February 28, 2025. 1. Fees were billed as follows: 2. $40,720 of the Grant Receivable was received. Another grant in the amount of $18,550 was promised. 3. Contributions in the amounts summarized below were received: 4. Investment income totaled $77,900 for the year. 5. Vouchers for the year were approved as follows: 5. Vouchers for the year were approved as follows: 6. During the year, $491,800 worth of vouchers were paid. Adjustment Data 7. Accounts Payable and Accrued Expenses at February 28, 2025, should be $208,720. The difference should be allocated to the following expenses: 8. Additions to the research library in the amount of $66,510 that were approved in (5) above were made in accordance with the terms of a contribution that had been received earlier and that was restricted for that purpose. 9. The current market value of the investments is $1,034,850 (no investment transactions occurred). 10. Depreciation amounted to $8,651 for the year. It should be allocated as follows: 11. Prepaid Expenses should be $59,786. The difference should be allocated to

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started