i need help with problems 6-8 if possible and could you walk me through them as well. would be very helpful

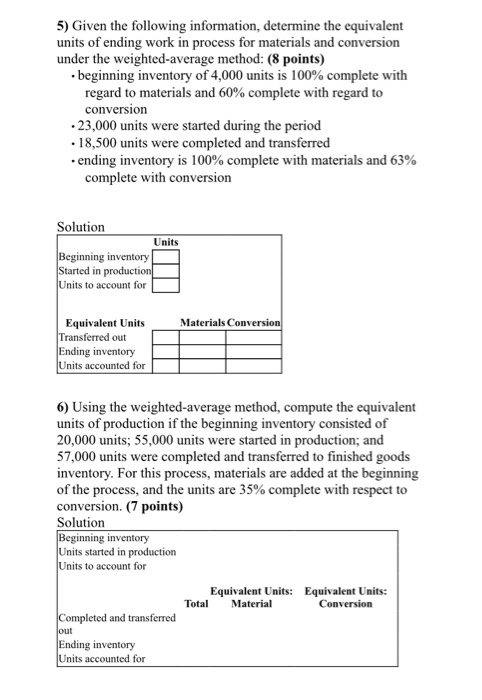

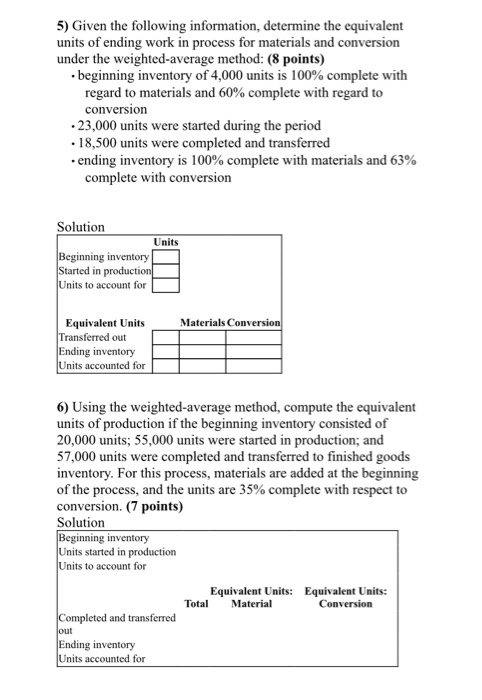

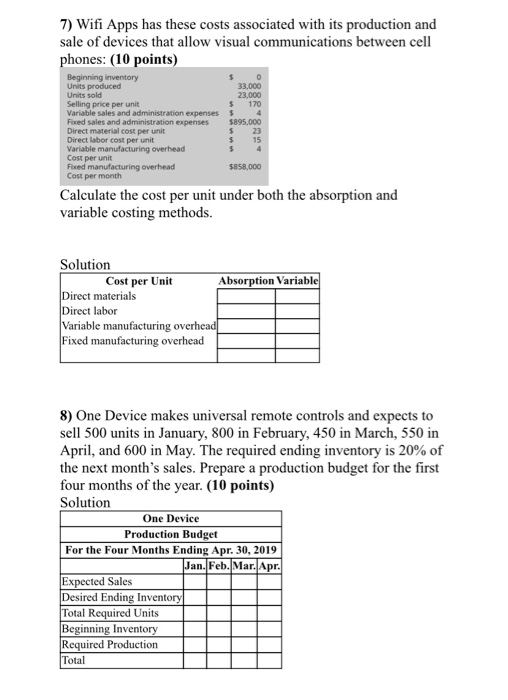

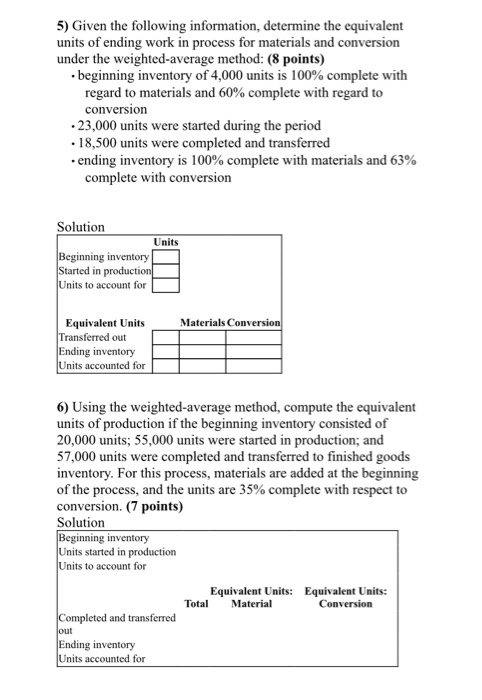

5) Given the following information, determine the equivalent units of ending work in process for materials and conversion under the weighted average method: (8 points) beginning inventory of 4,000 units is 100% complete with regard to materials and 60% complete with regard to conversion 23,000 units were started during the period 18,500 units were completed and transferred . ending inventory is 100% complete with materials and 63% complete with conversion Solution Beginning inventory Started in production Units to account for Materials Conversion Equivalent Units Transferred out Ending inventory Units accounted for 6) Using the weighted average method, compute the equivalent units of production if the beginning inventory consisted of 20,000 units; 55,000 units were started in production; and 57,000 units were completed and transferred to finished goods inventory. For this process, materials are added at the beginning of the process, and the units are 35% complete with respect to conversion. (7 points) Solution Beginning inventory Units started in production Units to account for Equivalent Units: Equivalent Units: Total Material Conversion Completed and transferred out Ending inventory Units accounted for 7) Wifi Apps has these costs associated with its production and sale of devices that allow visual communications between cell phones: (10 points) 33.000 22 000 5 $895.000 Beginning inventory Units produced Units sold Selling price per unit Variable sales and administration expenses Fored sales and administration expenses Direct material cost per unit Direct labor cost per unit Variable manufacturing overhead Cost per un Fred manufacturing overhead Cost per month 5858.000 Calculate the cost per unit under both the absorption and variable costing methods. Solution Cost per Unit Absorption Variable Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead 8) One Device makes universal remote controls and expects to sell 500 units in January, 800 in February, 450 in March, 550 in April, and 600 in May. The required ending inventory is 20% of the next month's sales. Prepare a production budget for the first four months of the year. (10 points) Solution One Device Production Budget For the Four Months Ending Apr. 30, 2019 Jan. Feb. Mar. Apr. Expected Sales Desired Ending Inventory Total Required Units Beginning Inventory Required Production Total