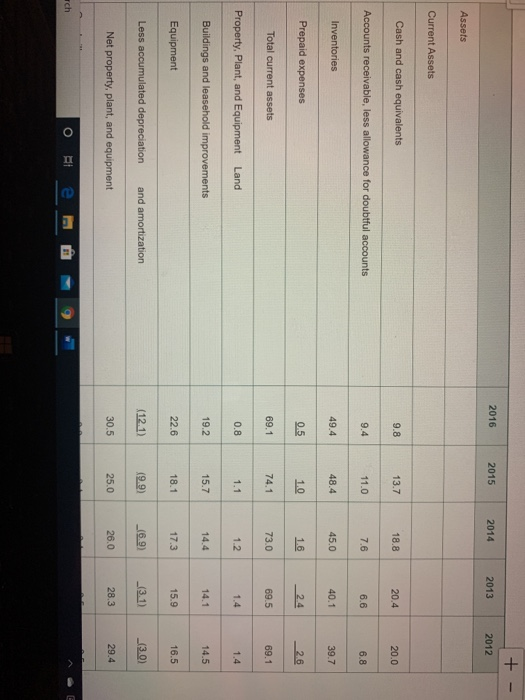

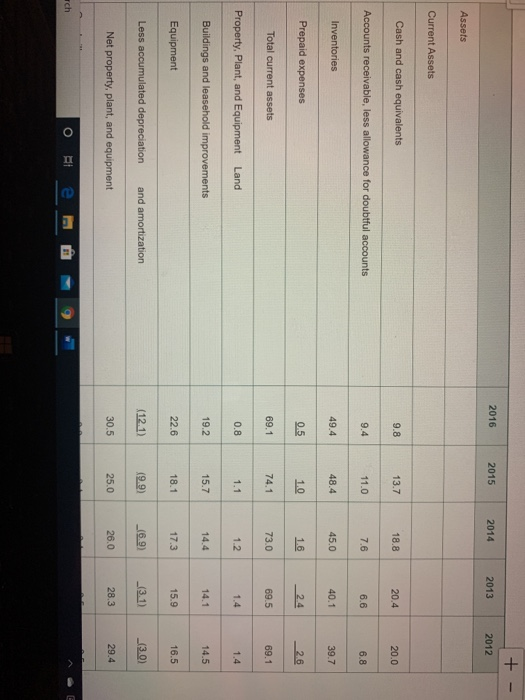

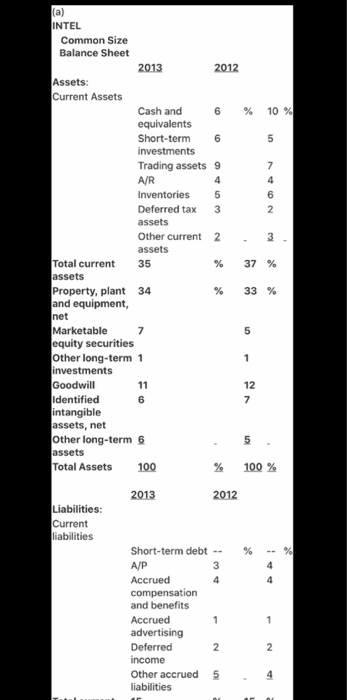

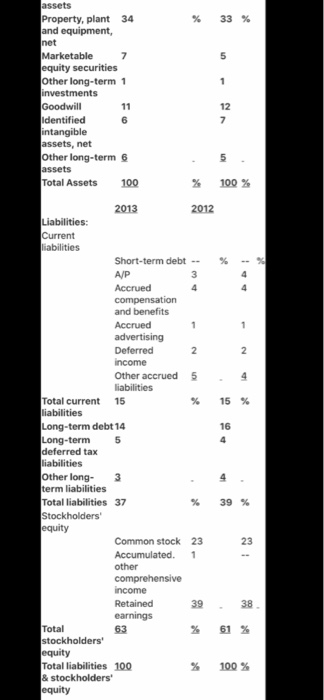

I need help with putting my balance sheet into an excel format. I have the data for 2012 and 2013, but I need Intels Fiscal Years of 2011. The attached picture is my data for 2012-13 year.

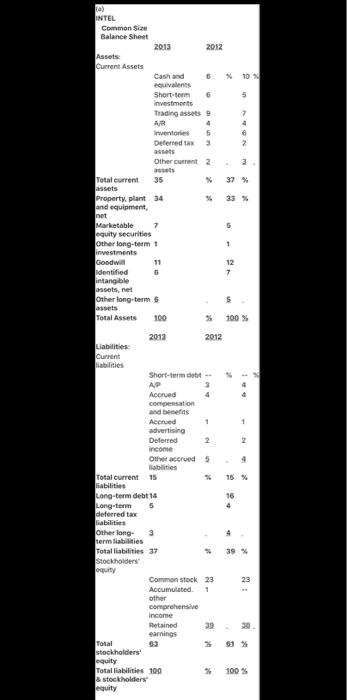

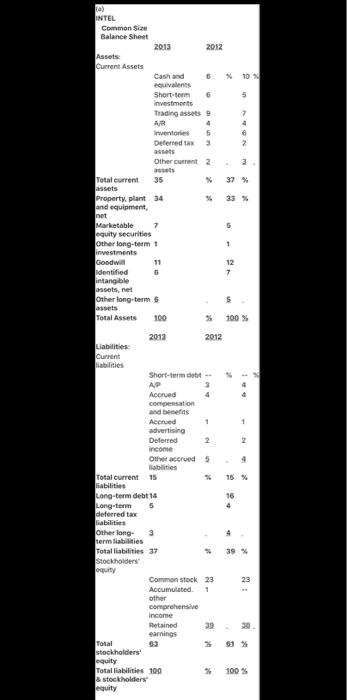

I have this sheet as a reference rubric to go off of in my textbook (2nd photo).

(a) INTEL Common Size Balance Sheet 2013 2012 Assets: Current Assets Cash and 6 % 10 equivalents Short-term 6 5 Investments Trading assets 9 7 AR 4 Inventories 5 6 Deferred tax 3 2 Other current 2 3 Total current 35 % 37 % Property, plant 34 % 33 % and equipment, net Marketable 7 5 equity securities Other long-term 1 1 investments Goodwill 12 Identified 7 intangible assets, net Other long-term 6 assets Total Assets 100 100% 4 4 1 2 4 15 % 16 4 2013 2012 Llabilities: Current liabilities Short-term debt AP Accrued 4 compensation and benefits Accrued 1 advertising Deferred 2 income Other accrued liabilities Total current 15 liabilities Long-term debt 14 Long-term 5 deferred tax liabilities other tong. 3 term liabilities Total liabilities 37 Stockholders equity Common stock 23 Accumulated other comprehensive income Retained earnings Total stockholders' equity Total liabilities 100 & stockholders equity 39 % 23 100% + -- 2016 2015 2014 2013 2012 Assets Current Assets Cash and cash equivalents 9.8 13.7 18.8 20.4 20.0 Accounts receivable, less allowance for doubtful accounts 9.4 11.0 7.6 6.6 6.8 Inventories 49.4 48.4 45.0 40.1 39.7 Prepaid expenses 0.5 1.0 1.6 2.4 26 Total current assets 69.1 74.1 73.0 69.5 69.1 Property, Plant, and Equipment Land 0.8 1.1 1.2 1.4 1.4 Buildings and leasehold improvements 19.2 15.7 14.4 14.1 14.5 Equipment 22.6 18.1 17.3 15.9 16.5 Less accumulated depreciation and amortization (12.1) (6.9) (3.1) (30) Net property, plant, and equipment 30.5 25.0 26.0 28.3 29.4 Tch O 6 (a) INTEL Common Size Balance Sheet 2013 2012 Assets: Current Assets Cash and % 10 % equivalents Short-term 6 5 investments Trading assets 9 7 A/R 4 4 Inventories 5 6 Deferred tax 3 2 assets Other current 2 3 assets Total current 35 % 37 % assets Property, plant 34 33 % and equipment, net Marketable 7 5 equity securities Other long-term 1 investments Goodwill 11 12 Identified 6 7 intangible assets, net Other long-term 6 5 assets Total Assets 100 % 100 % 1 2013 2012 Liabilities: Current liabilities Short-term debt - A/P 3 Accrued 4 compensation and benefits Accrued advertising Deferred 2 income Other accrued 5 liabilities 1 2 4 1 1 assets Property, plant 34 % 33 % and equipment, net Marketable 7 5 equity securities Other long-term 1 investments Goodwill 11 12 identified 6 7 intangible assets, net Other long-term 6 5 assets Total Assets 100 % 100% 2013 2012 Liabilities: Current liabilities Short-term debt - A/P 4 Accrued 4 compensation and benefits Accrued advertising Deferred 2 2 income Other accrued 5 - 4 liabilities Total current 15 15 % liabilities Long-term debt 14 16 Long-term 5 4 deferred tax liabilities Other long- term liabilities Total liabilities 37 39 % Stockholders' equity Common stock 23 23 Accumulated 1 other comprehensive income Retained 39. 38 earnings Total 63 stockholders' equity Total liabilities 100 % 100% & stockholders' equity (a) INTEL Common Size Balance Sheet 2013 2012 Assets: Current Assets Cash and 6 % 10 equivalents Short-term 6 5 Investments Trading assets 9 7 AR 4 Inventories 5 6 Deferred tax 3 2 Other current 2 3 Total current 35 % 37 % Property, plant 34 % 33 % and equipment, net Marketable 7 5 equity securities Other long-term 1 1 investments Goodwill 12 Identified 7 intangible assets, net Other long-term 6 assets Total Assets 100 100% 4 4 1 2 4 15 % 16 4 2013 2012 Llabilities: Current liabilities Short-term debt AP Accrued 4 compensation and benefits Accrued 1 advertising Deferred 2 income Other accrued liabilities Total current 15 liabilities Long-term debt 14 Long-term 5 deferred tax liabilities other tong. 3 term liabilities Total liabilities 37 Stockholders equity Common stock 23 Accumulated other comprehensive income Retained earnings Total stockholders' equity Total liabilities 100 & stockholders equity 39 % 23 100% + -- 2016 2015 2014 2013 2012 Assets Current Assets Cash and cash equivalents 9.8 13.7 18.8 20.4 20.0 Accounts receivable, less allowance for doubtful accounts 9.4 11.0 7.6 6.6 6.8 Inventories 49.4 48.4 45.0 40.1 39.7 Prepaid expenses 0.5 1.0 1.6 2.4 26 Total current assets 69.1 74.1 73.0 69.5 69.1 Property, Plant, and Equipment Land 0.8 1.1 1.2 1.4 1.4 Buildings and leasehold improvements 19.2 15.7 14.4 14.1 14.5 Equipment 22.6 18.1 17.3 15.9 16.5 Less accumulated depreciation and amortization (12.1) (6.9) (3.1) (30) Net property, plant, and equipment 30.5 25.0 26.0 28.3 29.4 Tch O 6 (a) INTEL Common Size Balance Sheet 2013 2012 Assets: Current Assets Cash and % 10 % equivalents Short-term 6 5 investments Trading assets 9 7 A/R 4 4 Inventories 5 6 Deferred tax 3 2 assets Other current 2 3 assets Total current 35 % 37 % assets Property, plant 34 33 % and equipment, net Marketable 7 5 equity securities Other long-term 1 investments Goodwill 11 12 Identified 6 7 intangible assets, net Other long-term 6 5 assets Total Assets 100 % 100 % 1 2013 2012 Liabilities: Current liabilities Short-term debt - A/P 3 Accrued 4 compensation and benefits Accrued advertising Deferred 2 income Other accrued 5 liabilities 1 2 4 1 1 assets Property, plant 34 % 33 % and equipment, net Marketable 7 5 equity securities Other long-term 1 investments Goodwill 11 12 identified 6 7 intangible assets, net Other long-term 6 5 assets Total Assets 100 % 100% 2013 2012 Liabilities: Current liabilities Short-term debt - A/P 4 Accrued 4 compensation and benefits Accrued advertising Deferred 2 2 income Other accrued 5 - 4 liabilities Total current 15 15 % liabilities Long-term debt 14 16 Long-term 5 4 deferred tax liabilities Other long- term liabilities Total liabilities 37 39 % Stockholders' equity Common stock 23 23 Accumulated 1 other comprehensive income Retained 39. 38 earnings Total 63 stockholders' equity Total liabilities 100 % 100% & stockholders' equity