I need help with Q7 ,8 ,9 ,10. ASAP...

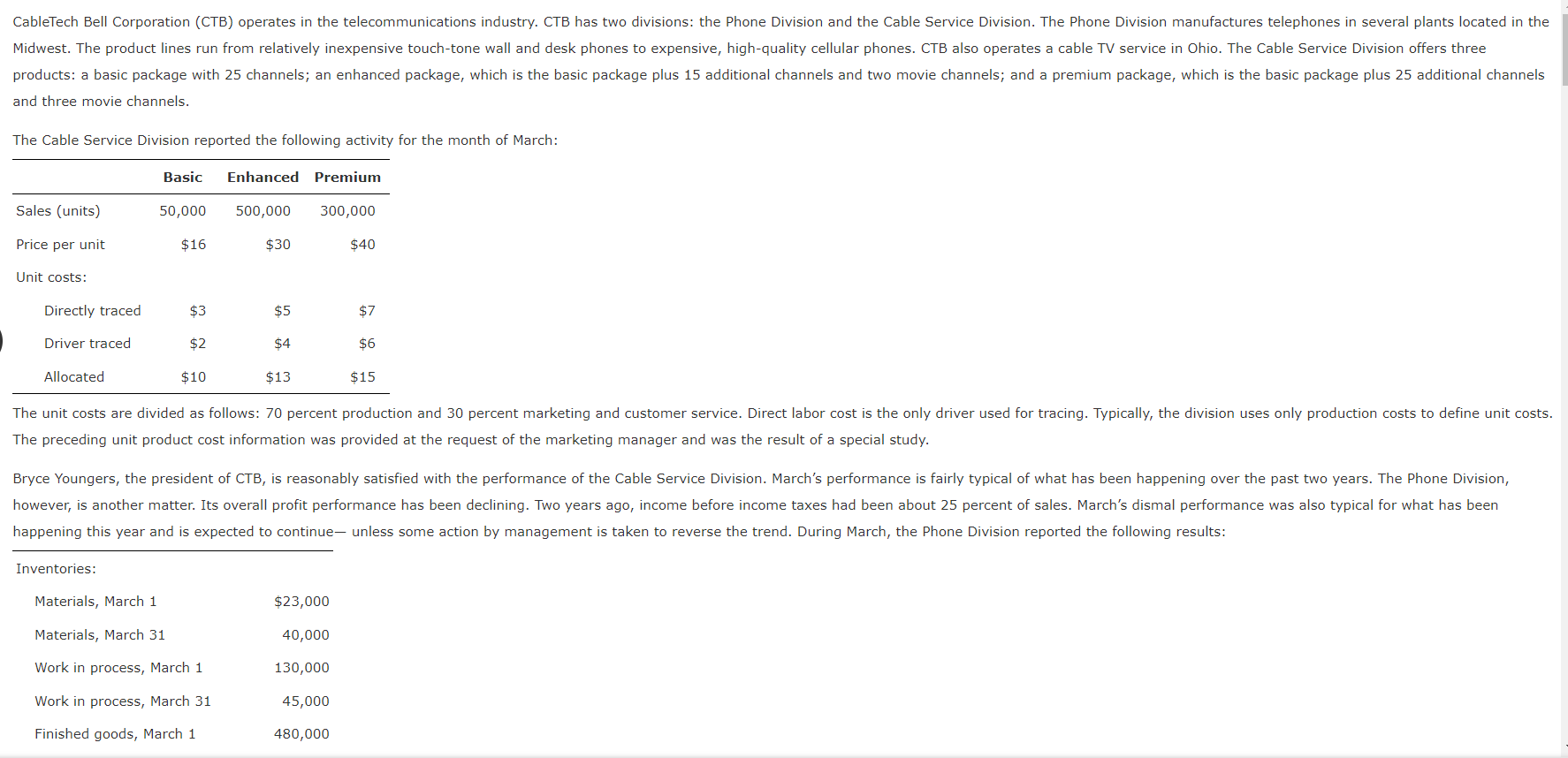

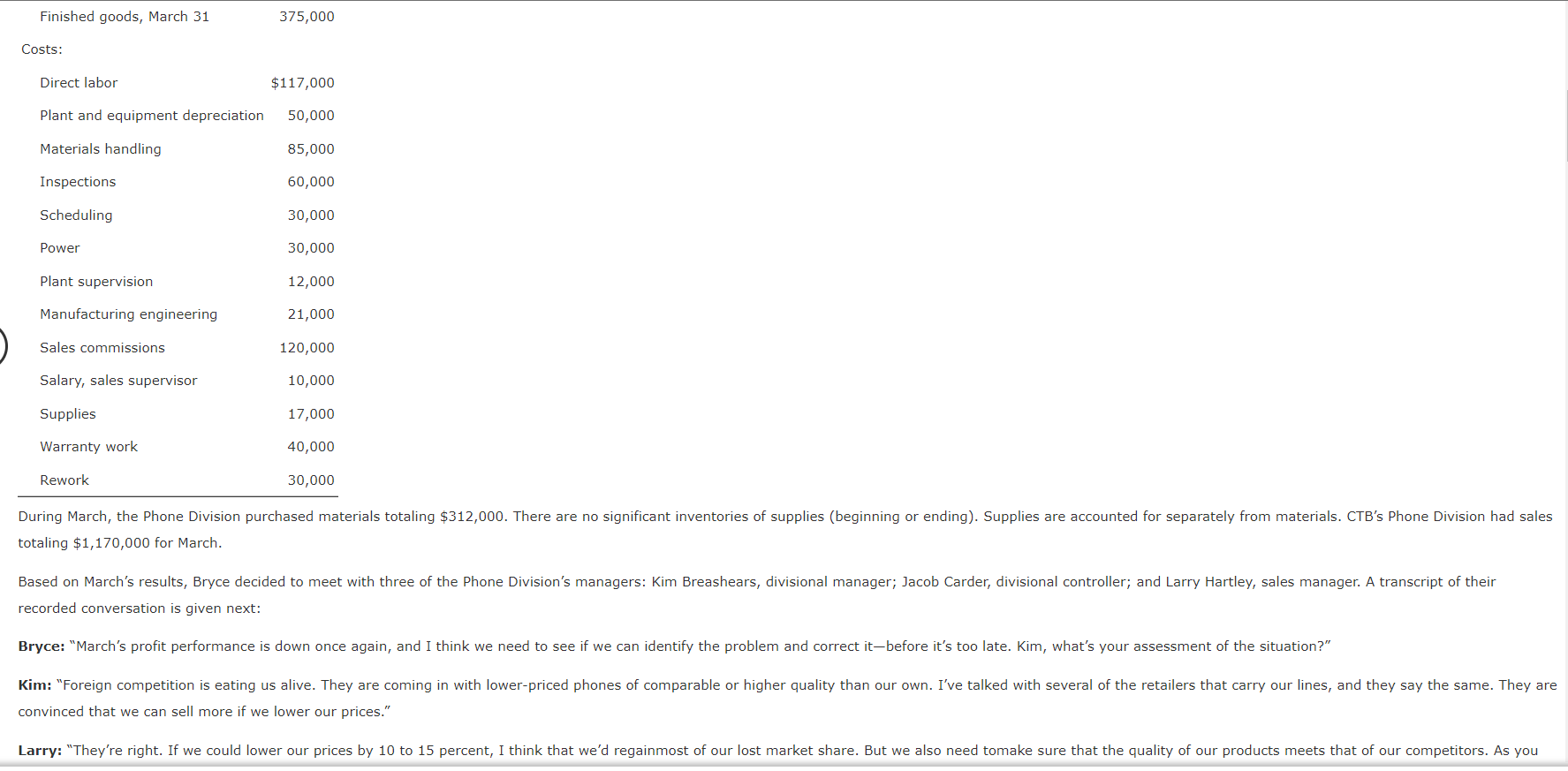

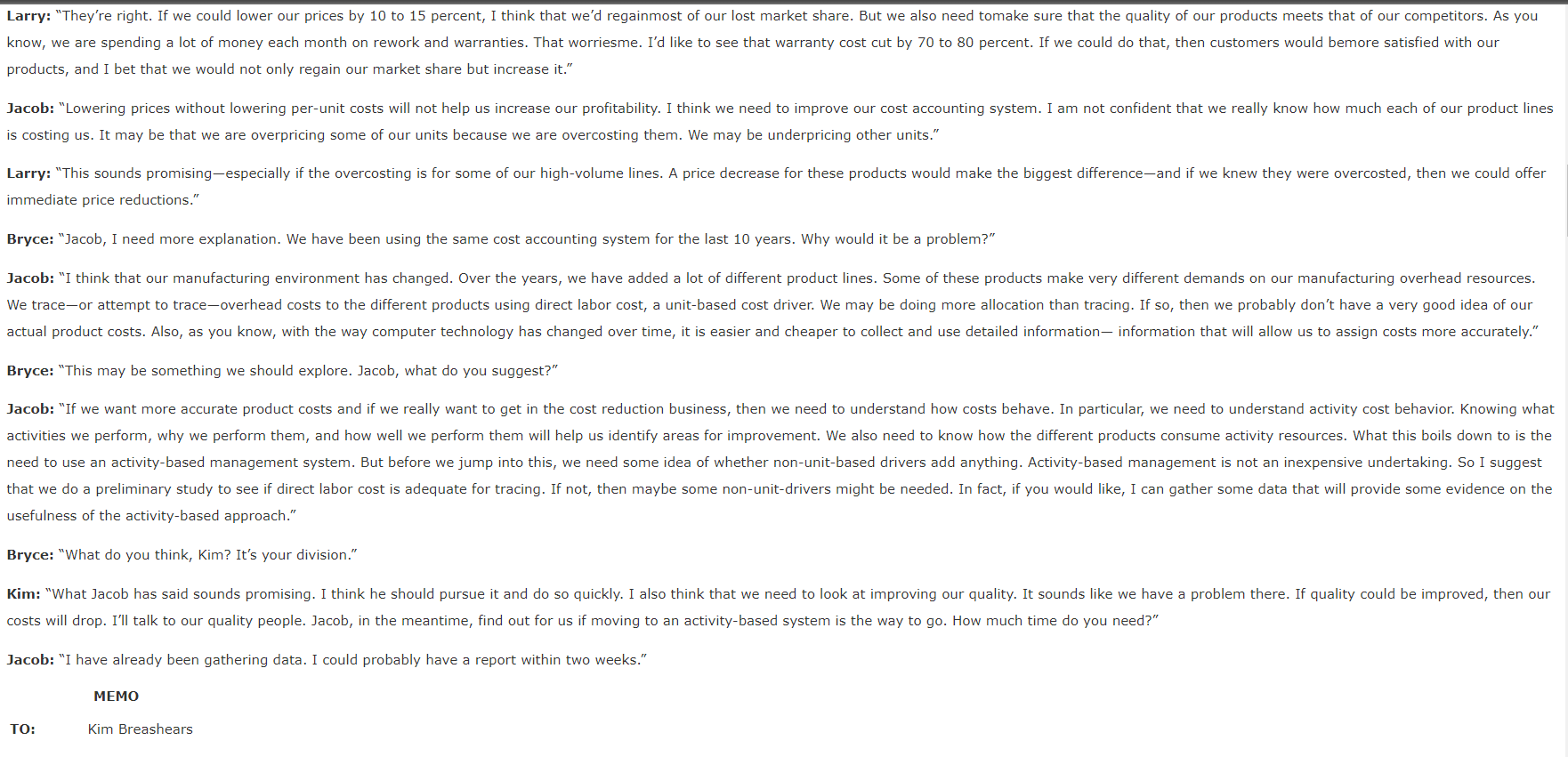

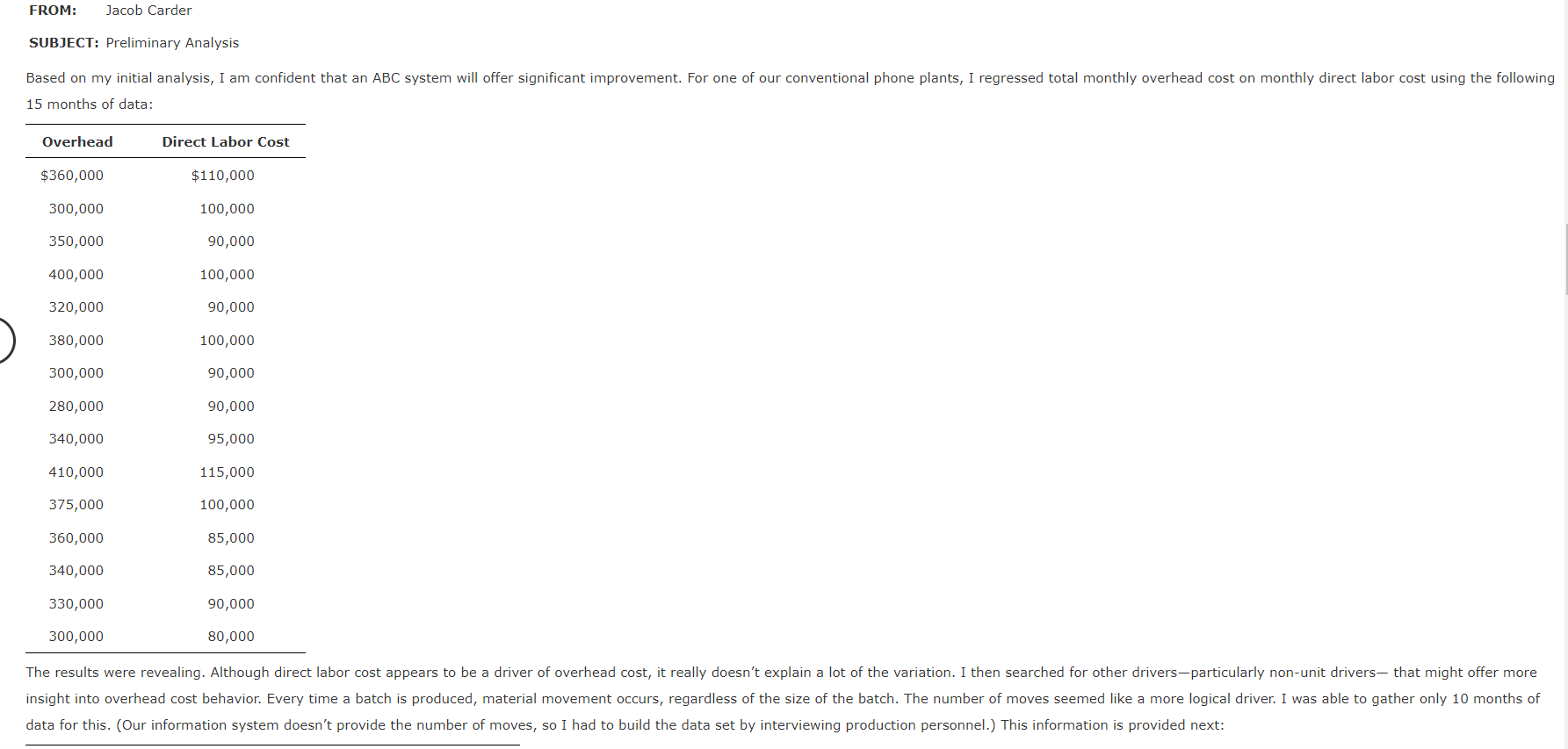

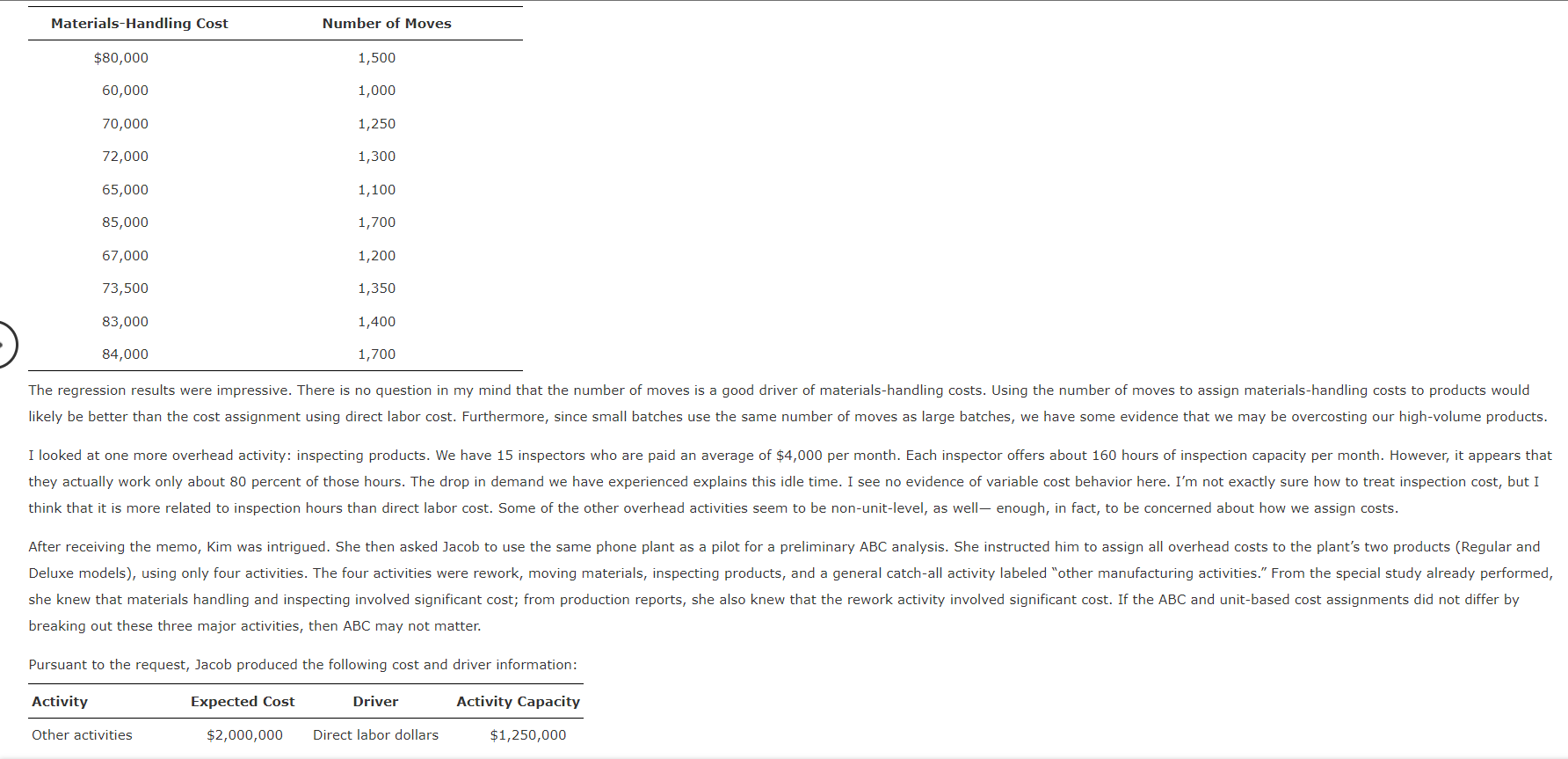

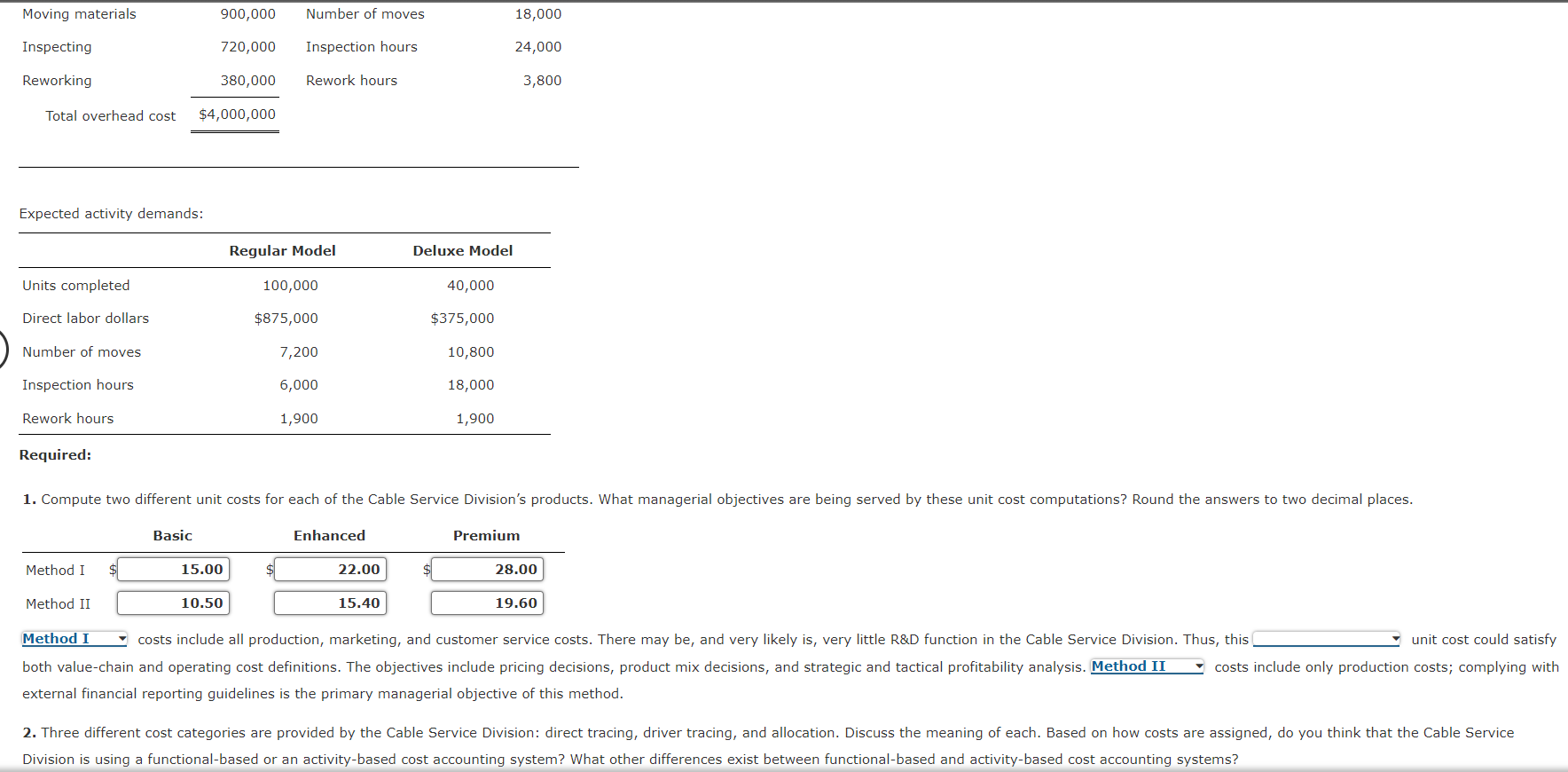

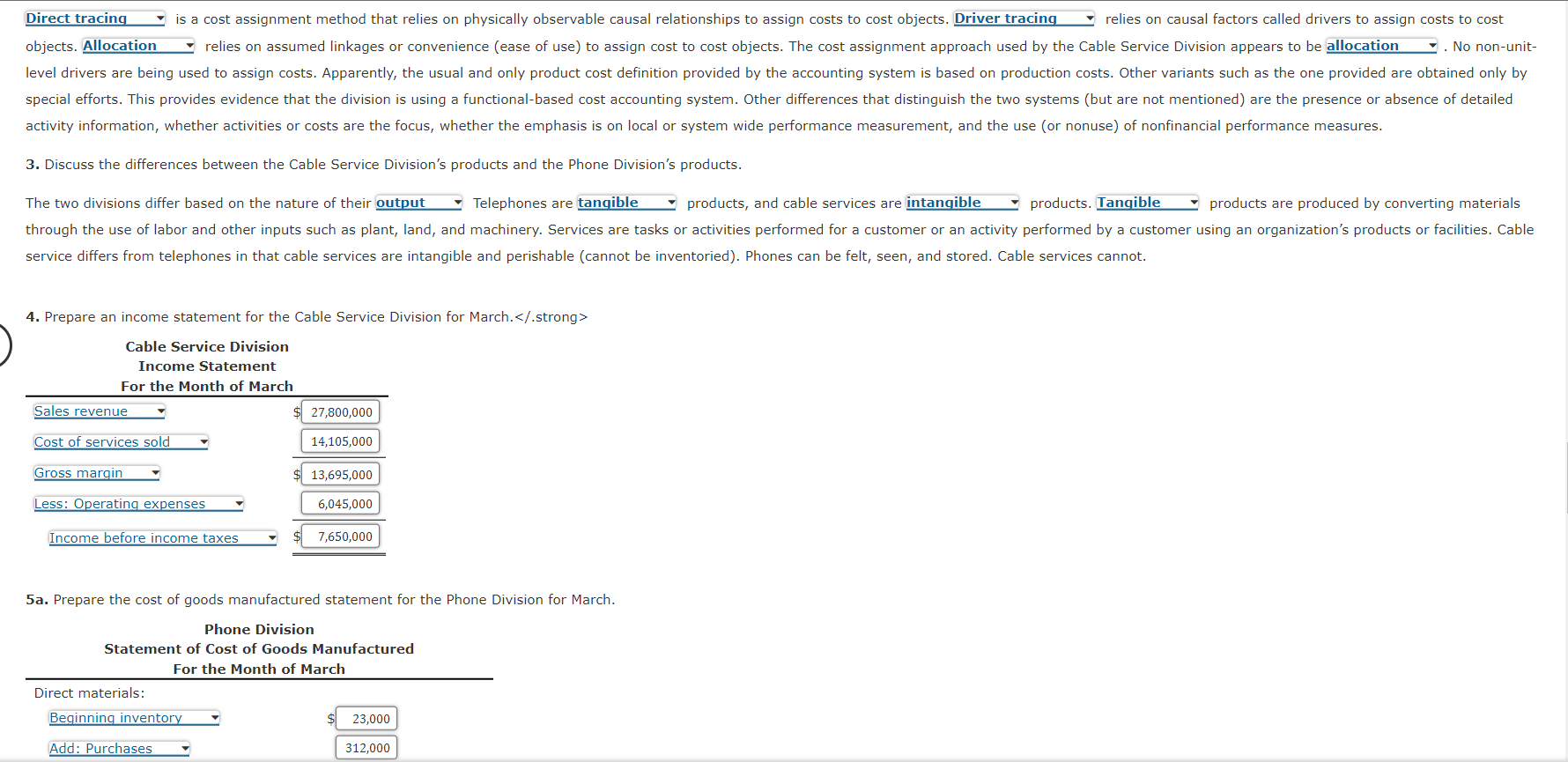

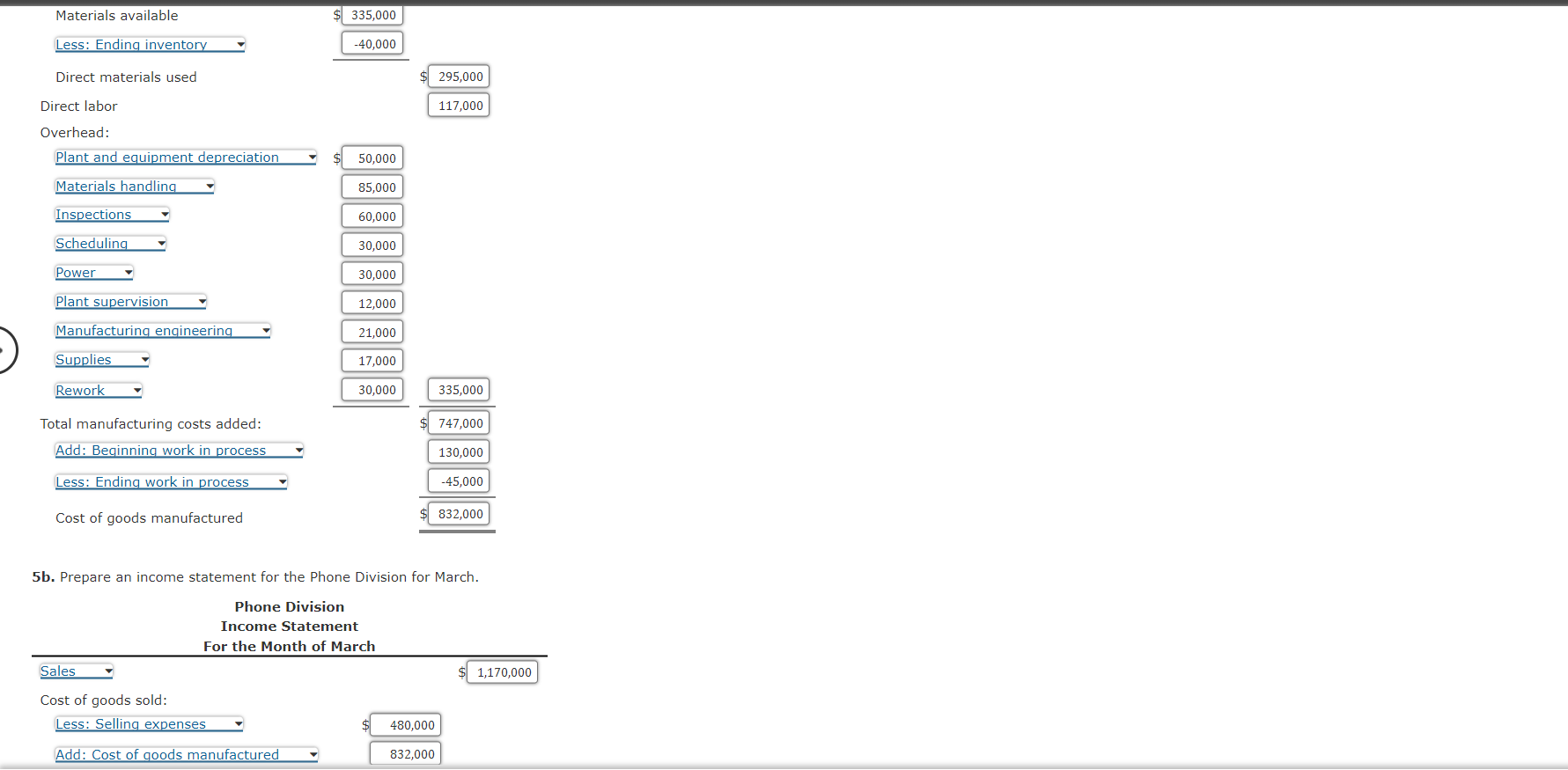

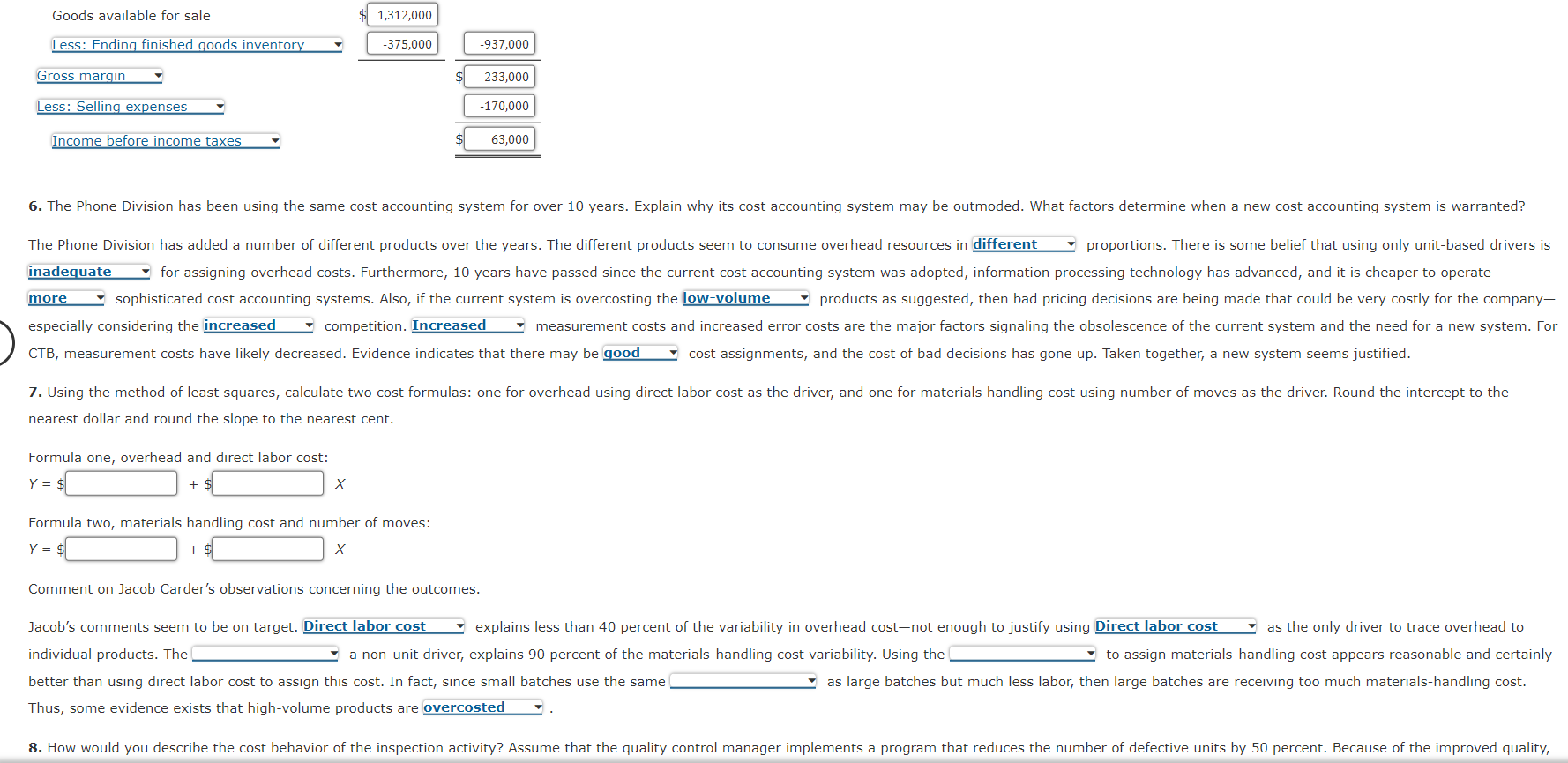

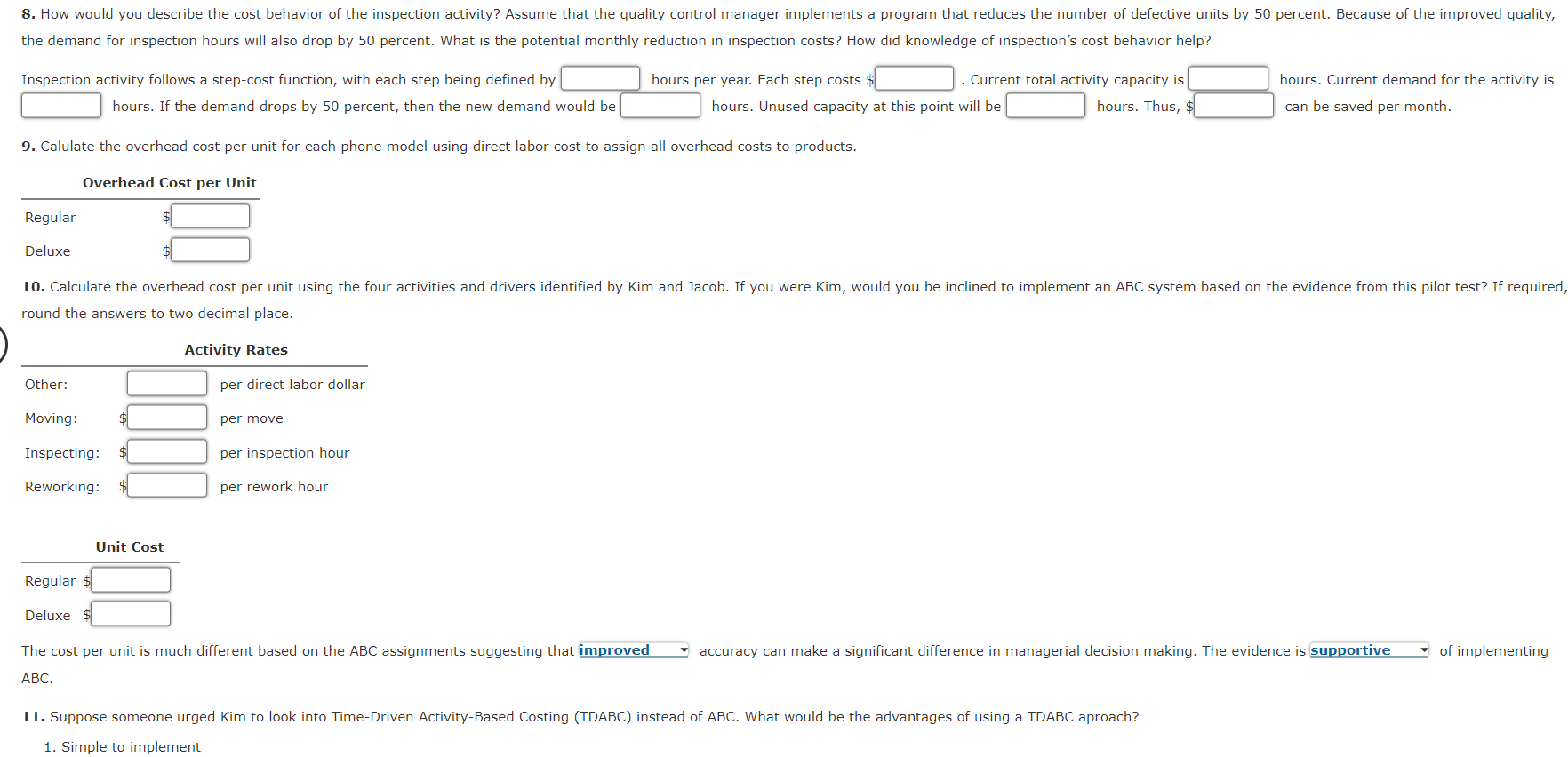

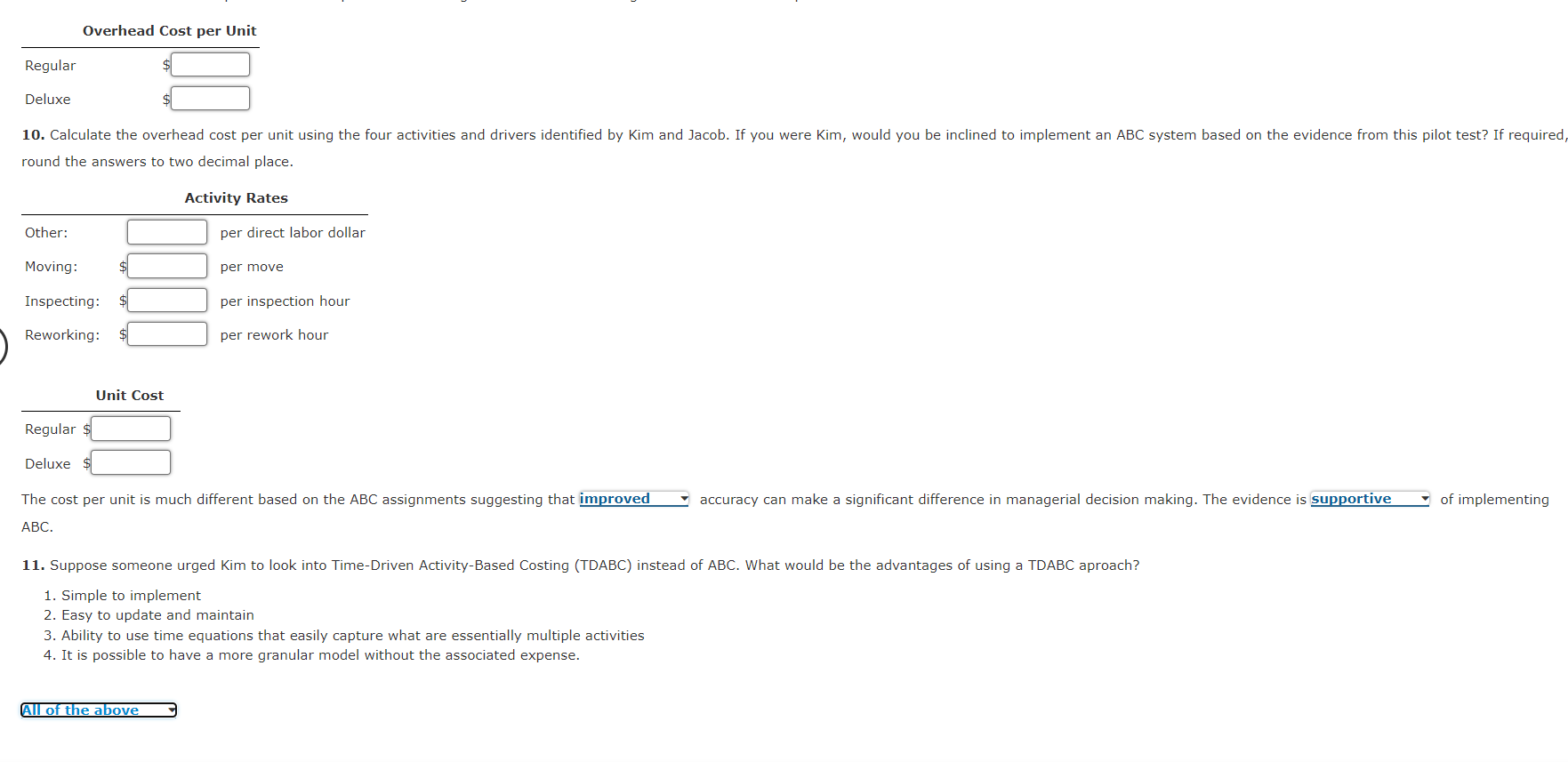

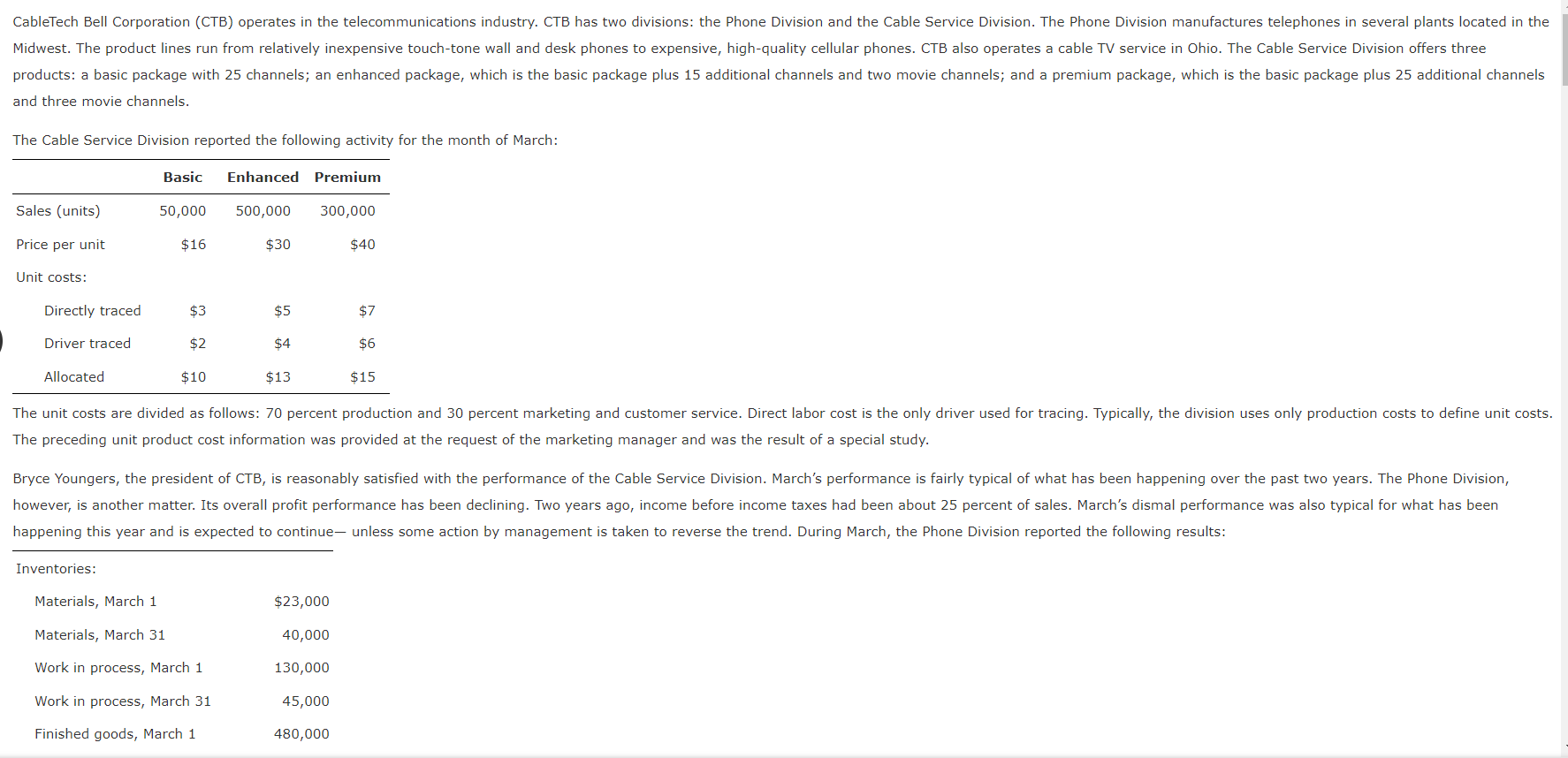

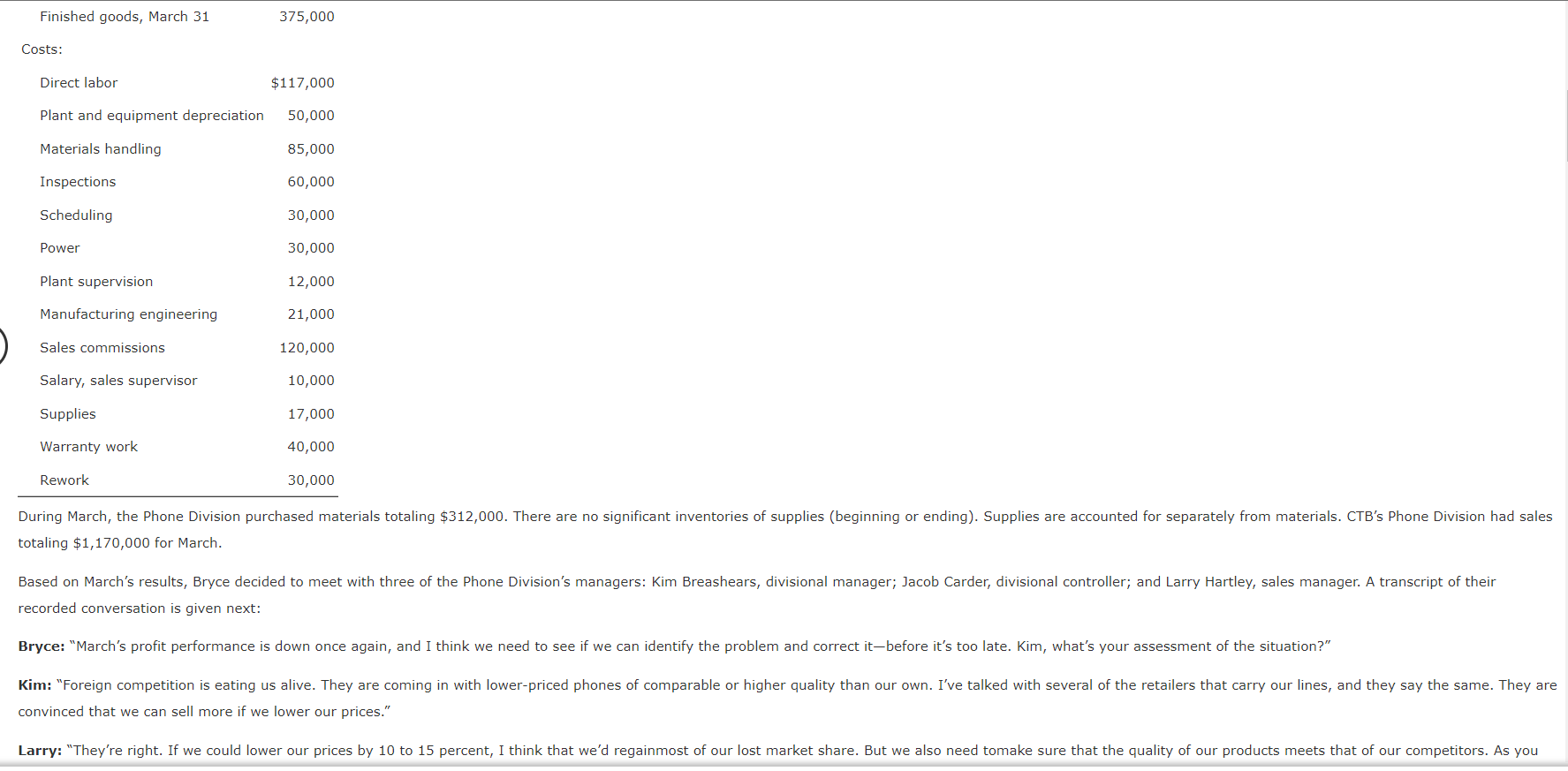

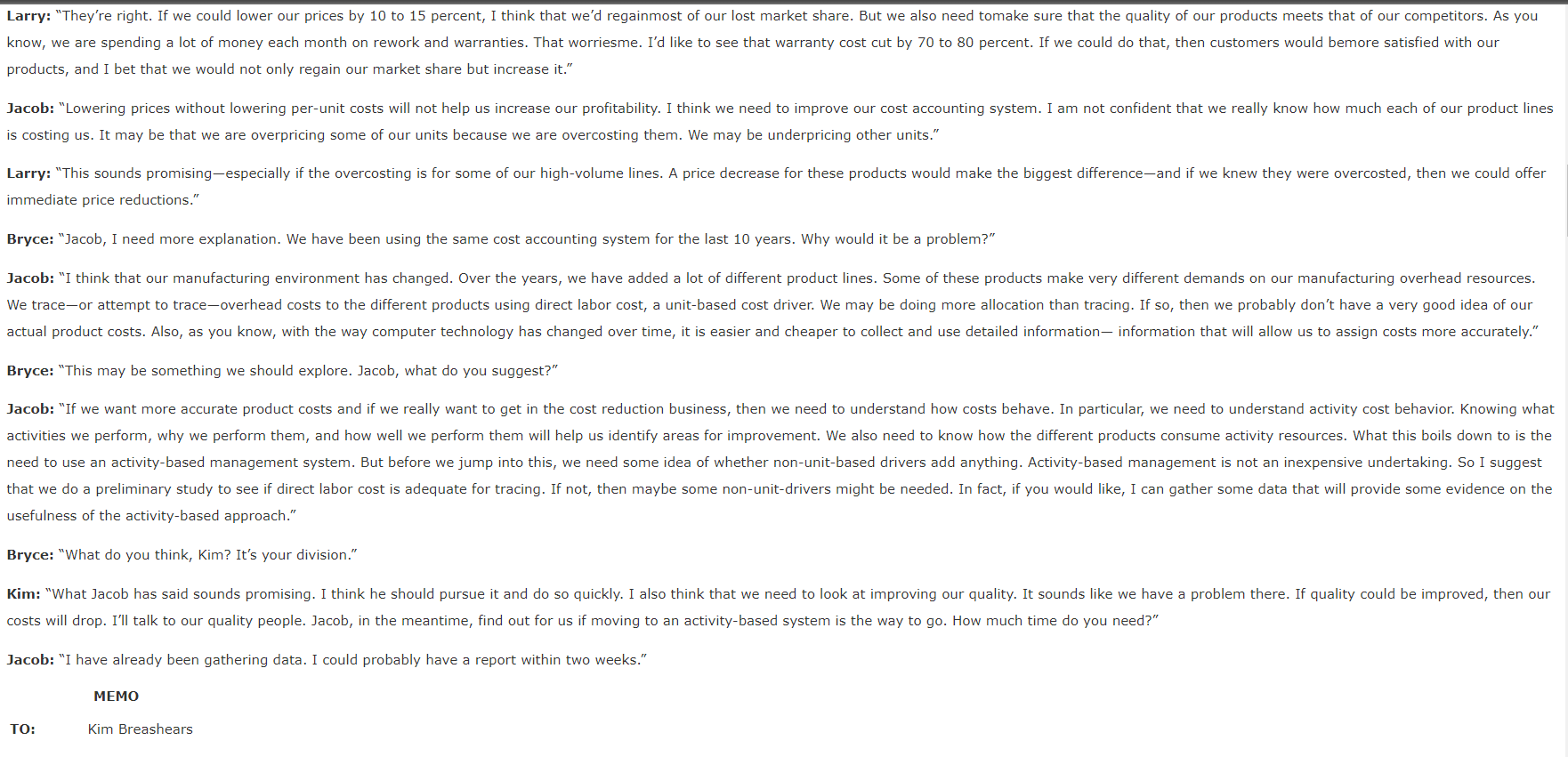

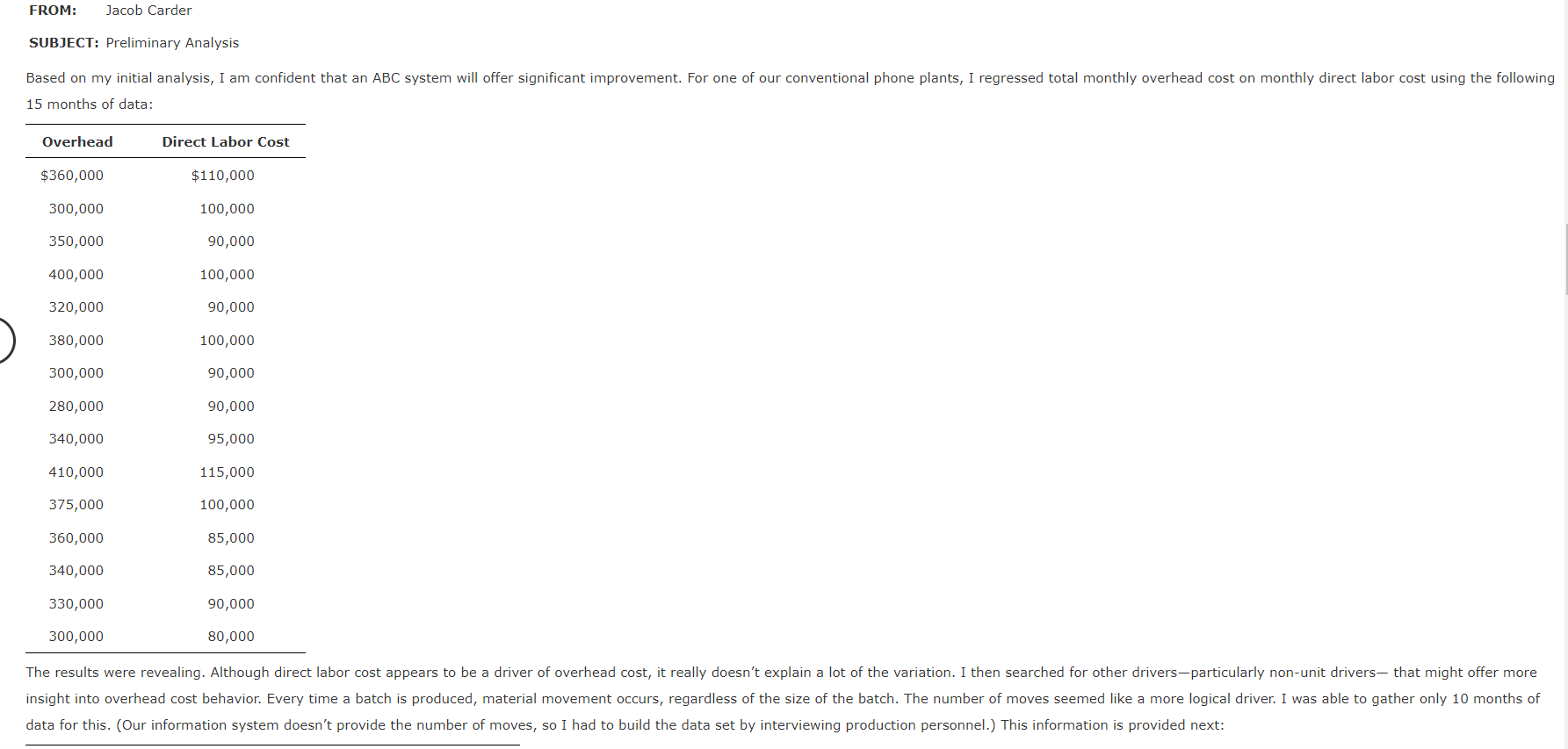

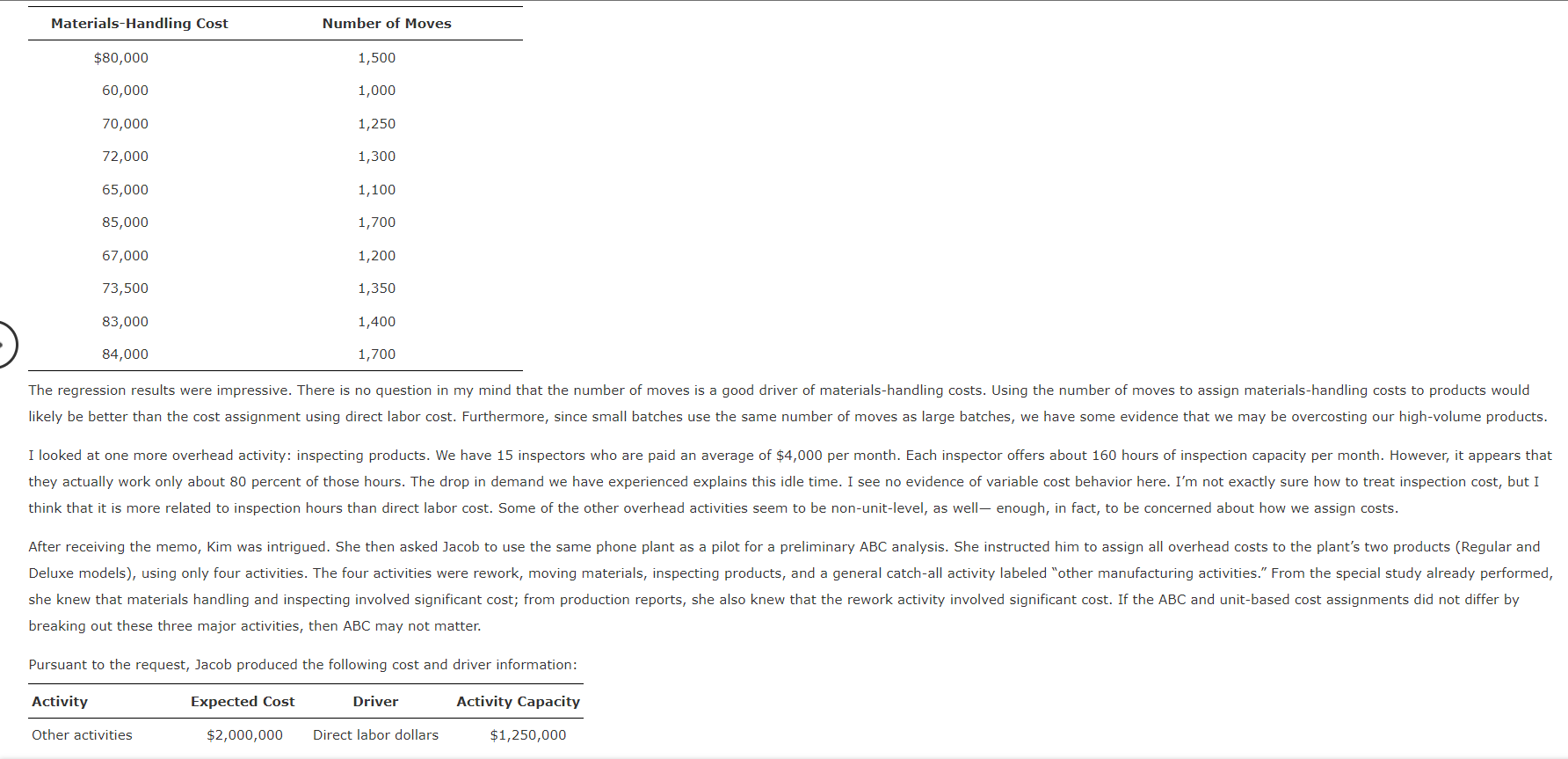

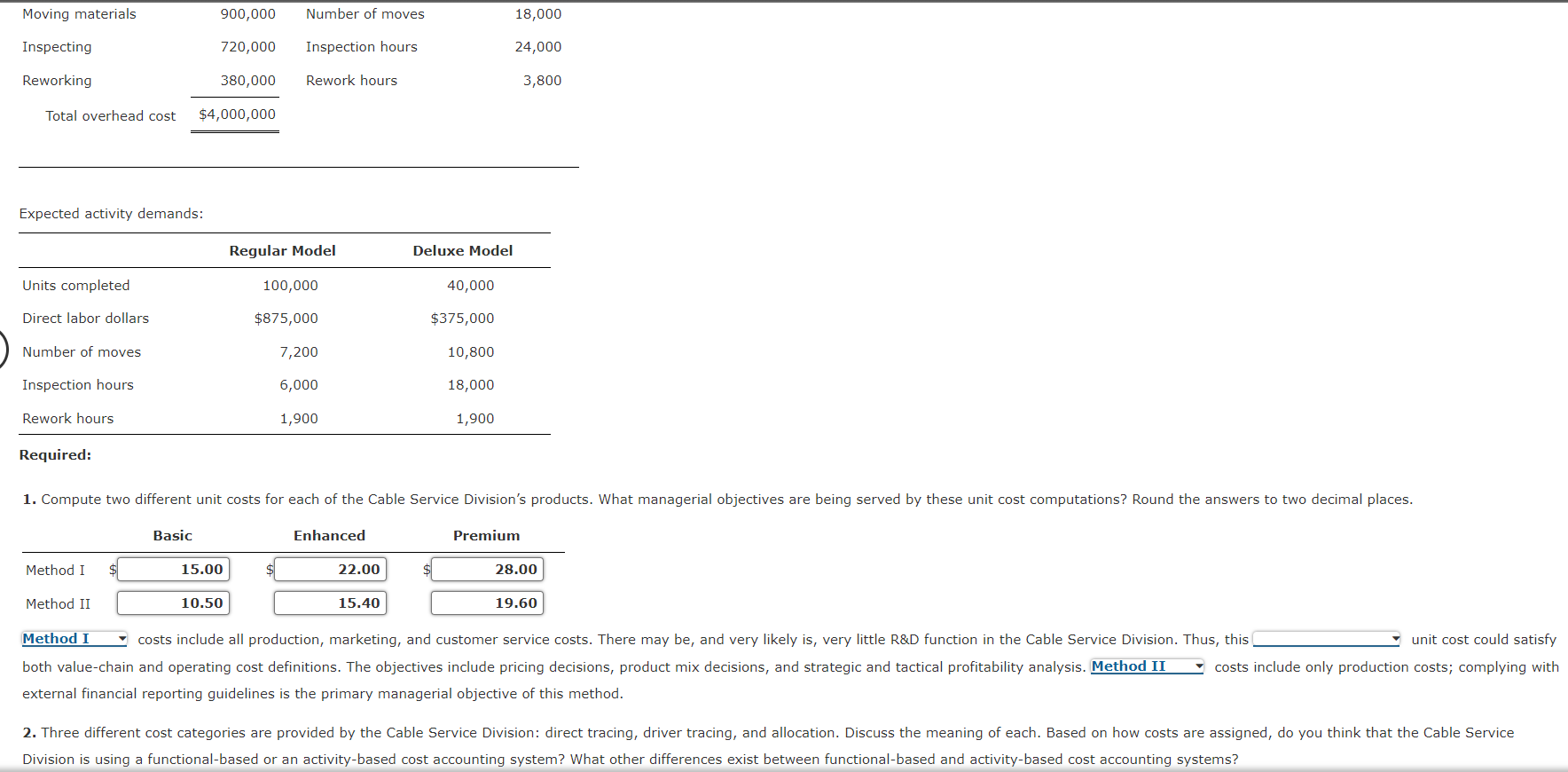

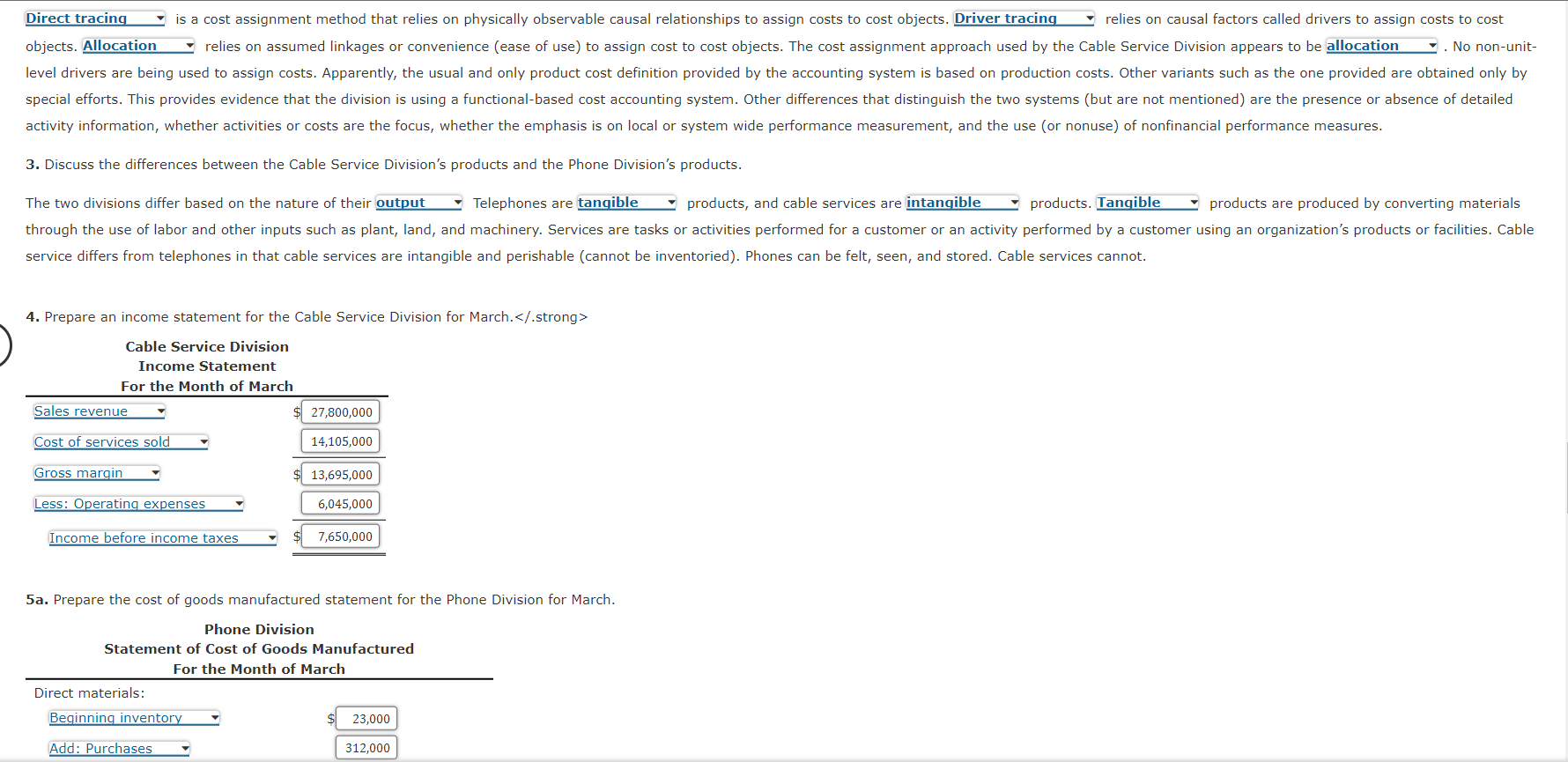

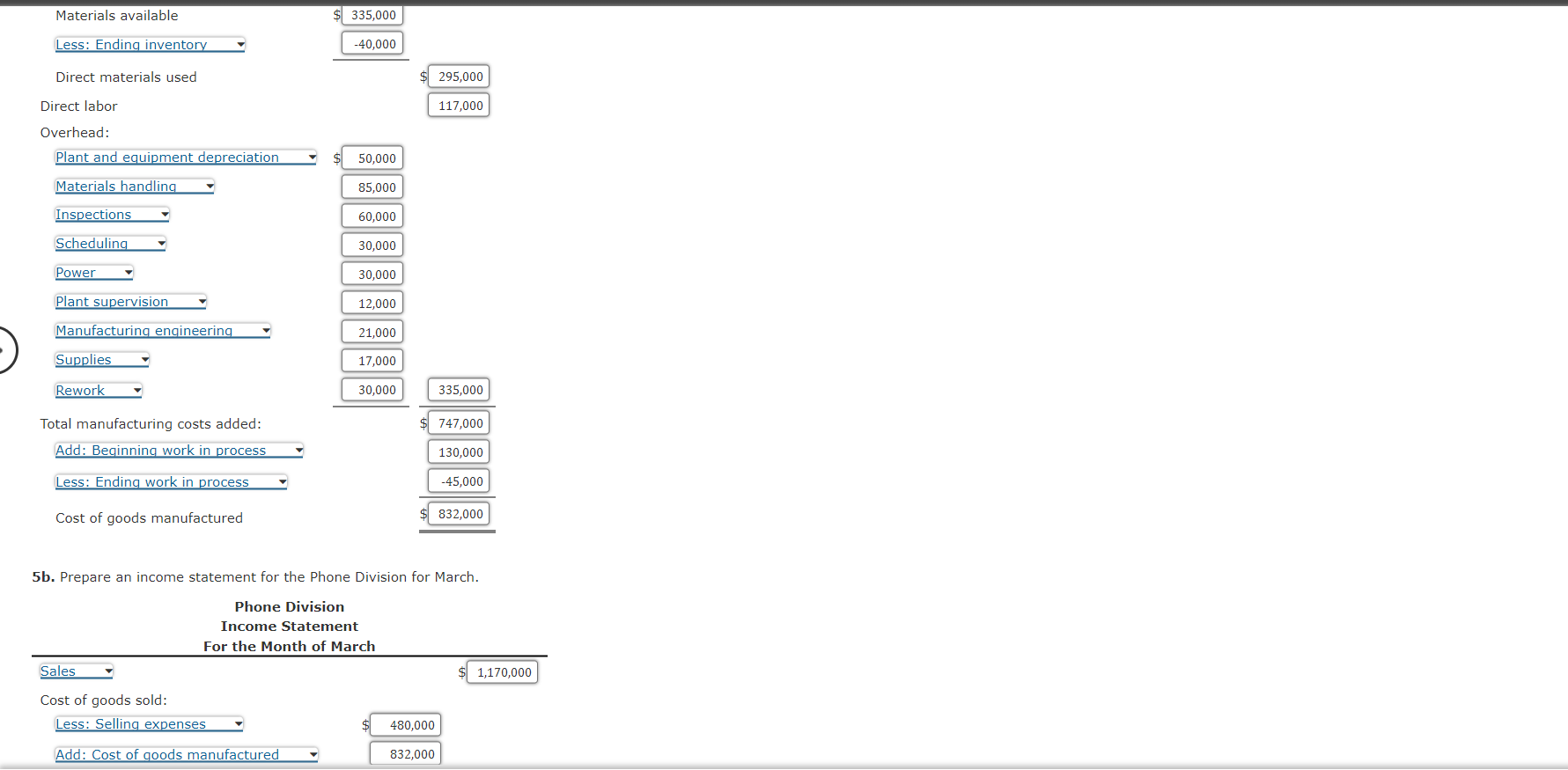

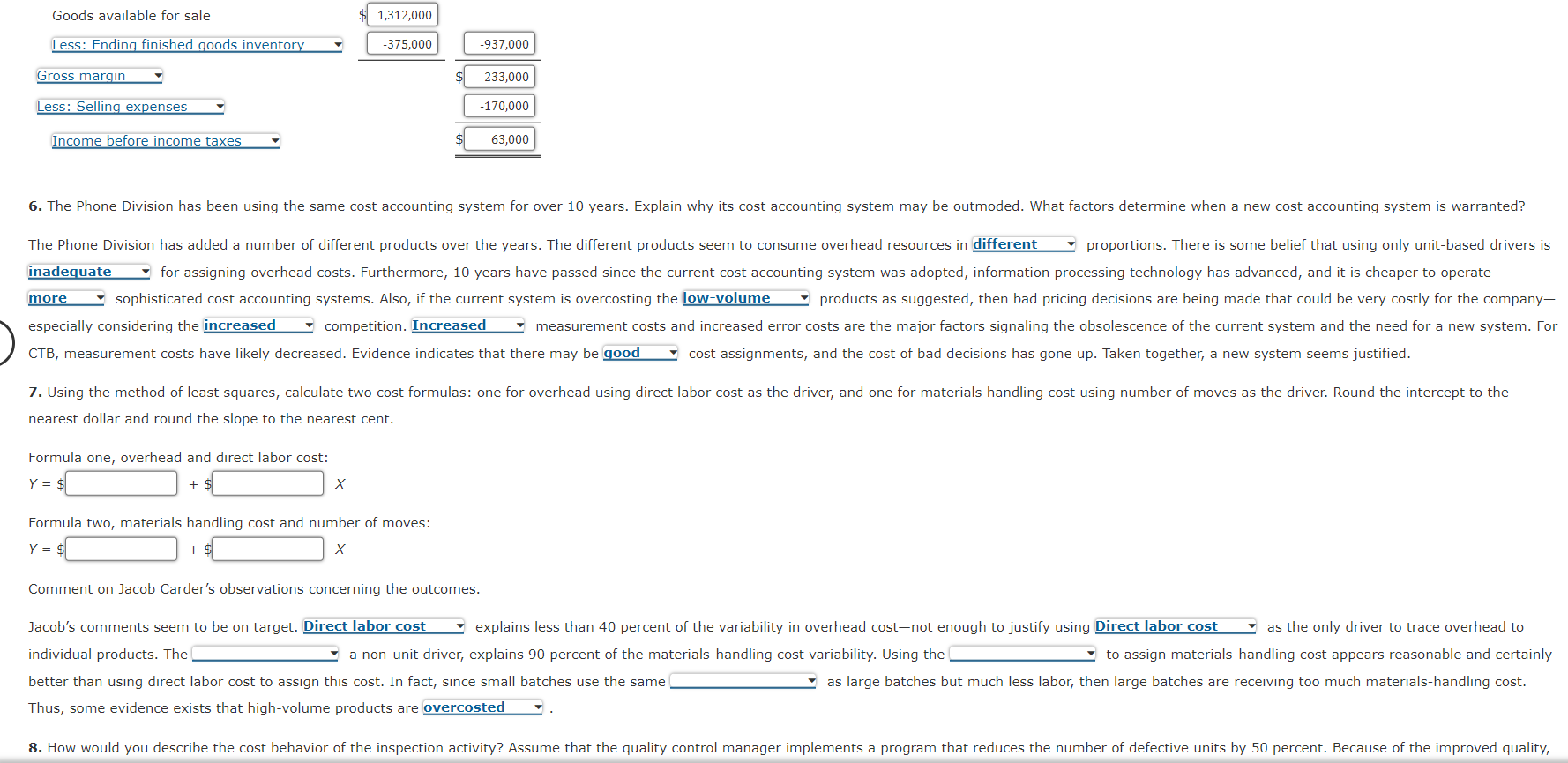

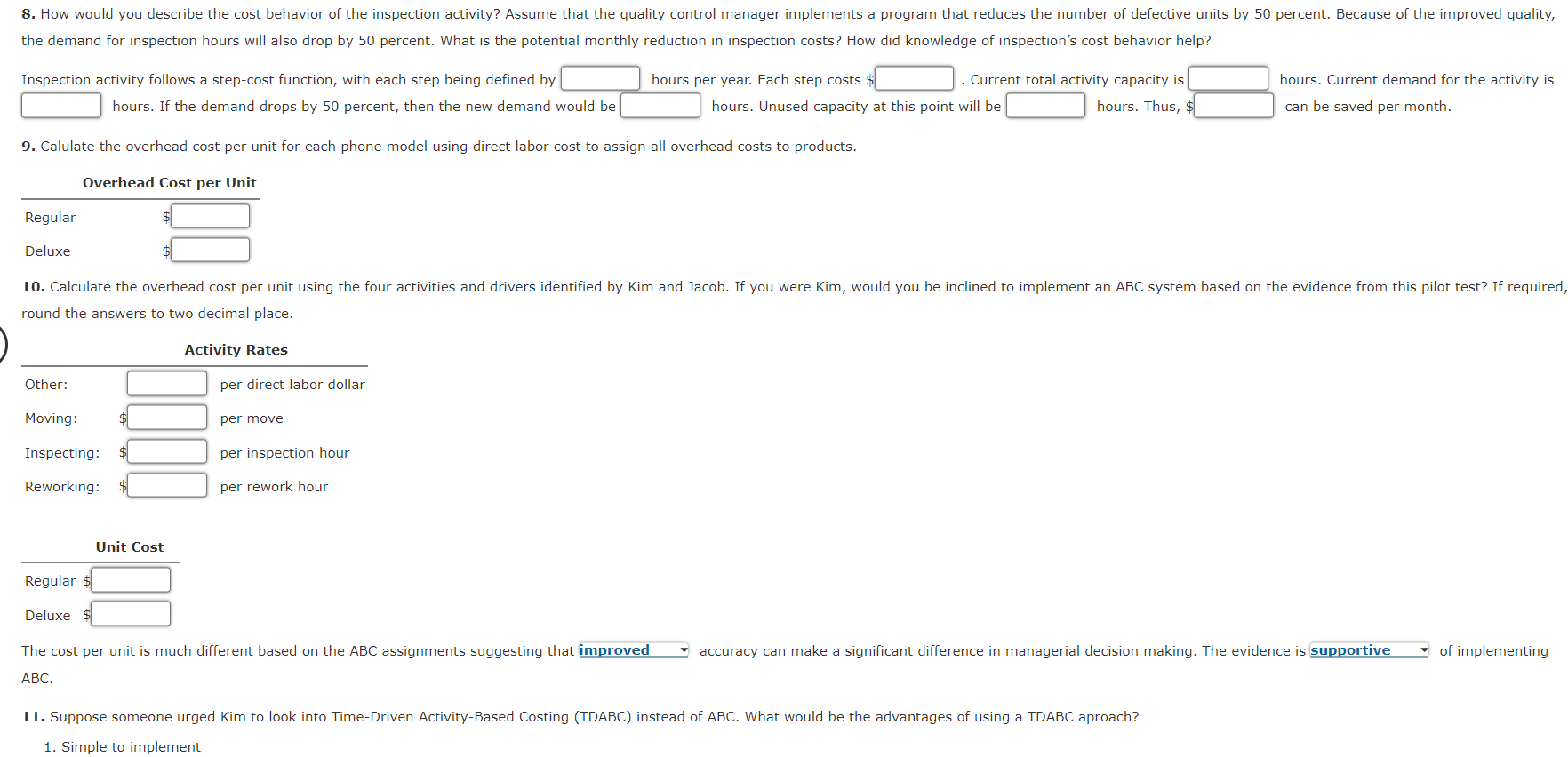

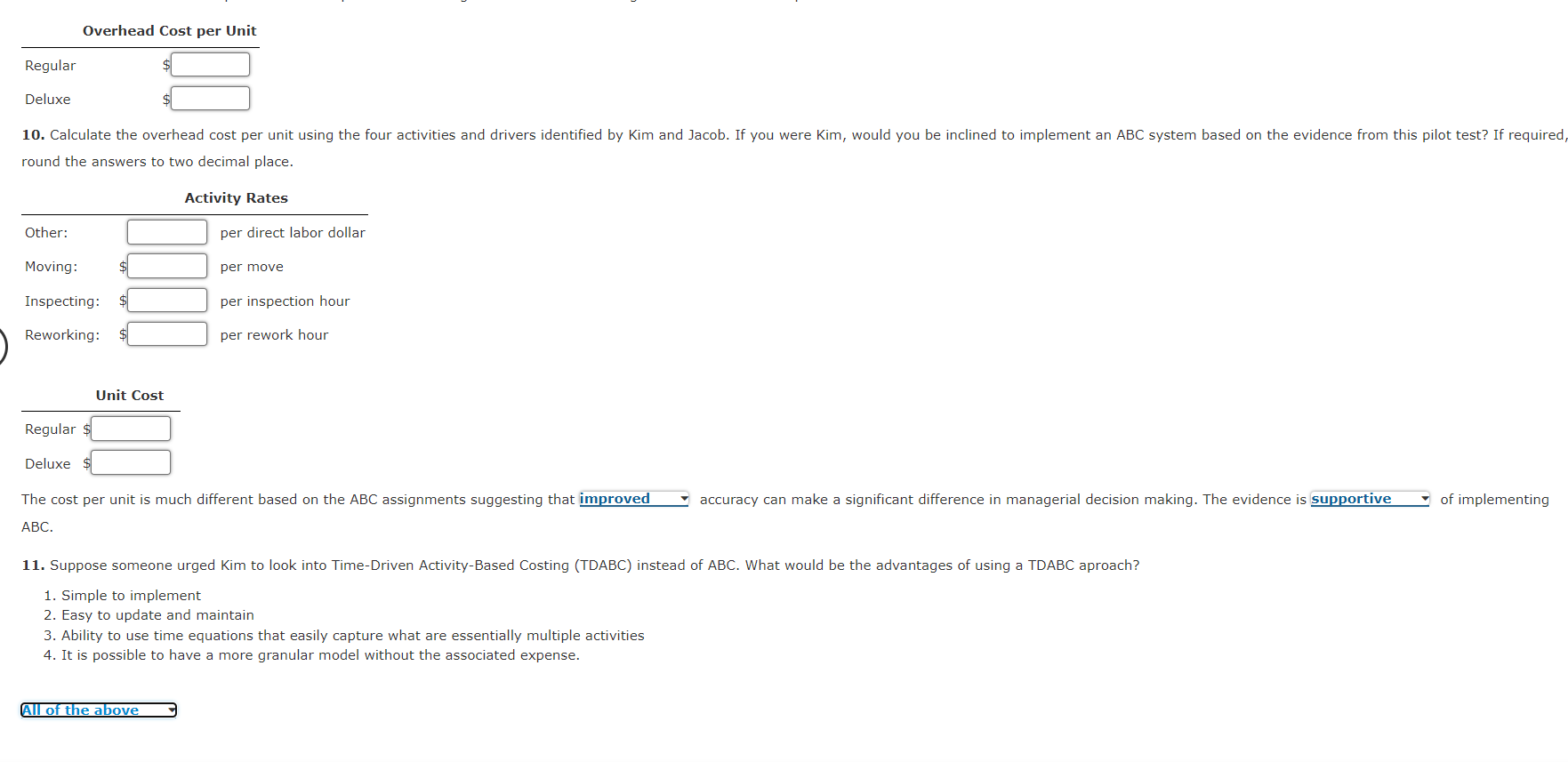

and three movie channels. The Cable Service Division reported the following activity for the month of March: The preceding unit product cost information was provided at the request of the marketing manager and was the result of a special study. happening this year and is expected to continue- unless some action by management is taken to reverse the trend. During March, the Phone Division reported the following results: totaling $1,170,000 for March. recorded conversation is given next: convinced that we can sell more if we lower our prices." products, and I bet that we would not only regain our market share but increase it." is costing us. It may be that we are overpricing some of our units because we are overcosting them. We may be underpricing other units." immediate price reductions." Bryce: "Jacob, I need more explanation. We have been using the same cost accounting system for the last 10 years. Why would it be a problem?" Bryce: "This may be something we should explore. Jacob, what do you suggest?" usefulness of the activity-based approach." Bryce: "What do you think, Kim? It's your division." costs will drop. I'll talk to our quality people. Jacob, in the meantime, find out for us if moving to an activity-based system is the way to go. How much time do you need?" Jacob: "I have already been gathering data. I could probably have a report within two weeks." MEMO FROM: Jacob Carder SUBJECT: Preliminary Analysis 15 months of data: data for this. (Our information system doesn't provide the number of moves, so I had to build the data set by interviewing production personnel.) This information is provided next: breaking out these three major activities, then ABC may not matter. Expected activity demands: kequirea: unit cost could satisf costs include only production costs; complying wit external financial reporting guidelines is the primary managerial objective of this method. is a cost assignment method that relies on physically observable causal relationships to assign costs to cost objects. relies on causal factors called drivers to assign costs to cost objects. . No non-unit- 3. Discuss the differences between the Cable Service Division's products and the Phone Division's products. The two divisions differ based on the nature of their Telephones are products, and cable services are products. products are produced by converting materials 4. Prepare an income statement for the Cable Service Division for March. strong > 5a. Prepare the cost of goods manufactured statement for the Phone Division for March. 5b. Prepare an income statement for the Phone Division for March. The Phone Division has added a number of different products over the years. The different products seem to consume overhead resources in proportions. There is some belief that using only unit-based drivers is sophisticated cost accounting systems. Also, if the current system is overcosting the products as suggested, then bad pricing decisions are being made that could be very costly for the companyespecially considering the competition. measurement costs and increased error costs are the major factors signaling the obsolescence of the current system and the need for a new system. For CTB, measurement costs have likely decreased. Evidence indicates that there may be cost assignments, and the cost of bad decisions has gone up. Taken together, a new system seems justified. nearest dollar and round the slope to the nearest cent. Formula one, overhead and direct labor cost: Y=+$X Formula two, materials handling cost and number of moves: Y=$+$X Comment on Jacob Carder's observations concerning the outcomes. Jacob's comments seem to be on target. explains less than 40 percent of the variability in overhead cost-not enough to justify using ! as the only driver to trace overhead to individual products. The a non-unit driver, explains 90 percent of the materials-handling cost variability. Using the to assign materials-handling cost appears reasonable and certainly better than using direct labor cost to assign this cost. In fact, since small batches use the same as large batches but much less labor, then large batches are receiving too much materials-handling cost. Thus, some evidence exists that high-volume products are the demand for inspection hours will also drop by 50 percent. What is the potential monthly reduction in inspection costs? How did knowledge of inspection's cost behavior help? Inspection activity follows a step-cost function, with each step being defined by hours per year. Each step costs . Current total activity capacity is hours. Current demand for the activity is hours. If the demand drops by 50 percent, then the new demand would be hours. Unused capacity at this point will be hours. Thus, s can be saved per month. 9. Calulate the overhead cost per unit for each phone model using direct labor cost to assign all overhead costs to products. round the answers to two decimal place. The cost per unit is much different based on the ABC assignments suggesting that accuracy can make a significant difference in managerial decision making. The evidence is of implementing ABC. 11. Suppose someone urged Kim to look into Time-Driven Activity-Based Costing (TDABC) instead of ABC. What would be the advantages of using a TDABC aproach? 1. Simple to implement The cost per unit is much different based on the ABC assignments suggesting that accuracy can make a significant difference in managerial decision making. The evidence is of implementing ABC 1. Simple to implement 2. Easy to update and maintain 3. Ability to use time equations that easily capture what are essentially multiple activities 4. It is possible to have a more granular model without the associated expense. and three movie channels. The Cable Service Division reported the following activity for the month of March: The preceding unit product cost information was provided at the request of the marketing manager and was the result of a special study. happening this year and is expected to continue- unless some action by management is taken to reverse the trend. During March, the Phone Division reported the following results: totaling $1,170,000 for March. recorded conversation is given next: convinced that we can sell more if we lower our prices." products, and I bet that we would not only regain our market share but increase it." is costing us. It may be that we are overpricing some of our units because we are overcosting them. We may be underpricing other units." immediate price reductions." Bryce: "Jacob, I need more explanation. We have been using the same cost accounting system for the last 10 years. Why would it be a problem?" Bryce: "This may be something we should explore. Jacob, what do you suggest?" usefulness of the activity-based approach." Bryce: "What do you think, Kim? It's your division." costs will drop. I'll talk to our quality people. Jacob, in the meantime, find out for us if moving to an activity-based system is the way to go. How much time do you need?" Jacob: "I have already been gathering data. I could probably have a report within two weeks." MEMO FROM: Jacob Carder SUBJECT: Preliminary Analysis 15 months of data: data for this. (Our information system doesn't provide the number of moves, so I had to build the data set by interviewing production personnel.) This information is provided next: breaking out these three major activities, then ABC may not matter. Expected activity demands: kequirea: unit cost could satisf costs include only production costs; complying wit external financial reporting guidelines is the primary managerial objective of this method. is a cost assignment method that relies on physically observable causal relationships to assign costs to cost objects. relies on causal factors called drivers to assign costs to cost objects. . No non-unit- 3. Discuss the differences between the Cable Service Division's products and the Phone Division's products. The two divisions differ based on the nature of their Telephones are products, and cable services are products. products are produced by converting materials 4. Prepare an income statement for the Cable Service Division for March. strong > 5a. Prepare the cost of goods manufactured statement for the Phone Division for March. 5b. Prepare an income statement for the Phone Division for March. The Phone Division has added a number of different products over the years. The different products seem to consume overhead resources in proportions. There is some belief that using only unit-based drivers is sophisticated cost accounting systems. Also, if the current system is overcosting the products as suggested, then bad pricing decisions are being made that could be very costly for the companyespecially considering the competition. measurement costs and increased error costs are the major factors signaling the obsolescence of the current system and the need for a new system. For CTB, measurement costs have likely decreased. Evidence indicates that there may be cost assignments, and the cost of bad decisions has gone up. Taken together, a new system seems justified. nearest dollar and round the slope to the nearest cent. Formula one, overhead and direct labor cost: Y=+$X Formula two, materials handling cost and number of moves: Y=$+$X Comment on Jacob Carder's observations concerning the outcomes. Jacob's comments seem to be on target. explains less than 40 percent of the variability in overhead cost-not enough to justify using ! as the only driver to trace overhead to individual products. The a non-unit driver, explains 90 percent of the materials-handling cost variability. Using the to assign materials-handling cost appears reasonable and certainly better than using direct labor cost to assign this cost. In fact, since small batches use the same as large batches but much less labor, then large batches are receiving too much materials-handling cost. Thus, some evidence exists that high-volume products are the demand for inspection hours will also drop by 50 percent. What is the potential monthly reduction in inspection costs? How did knowledge of inspection's cost behavior help? Inspection activity follows a step-cost function, with each step being defined by hours per year. Each step costs . Current total activity capacity is hours. Current demand for the activity is hours. If the demand drops by 50 percent, then the new demand would be hours. Unused capacity at this point will be hours. Thus, s can be saved per month. 9. Calulate the overhead cost per unit for each phone model using direct labor cost to assign all overhead costs to products. round the answers to two decimal place. The cost per unit is much different based on the ABC assignments suggesting that accuracy can make a significant difference in managerial decision making. The evidence is of implementing ABC. 11. Suppose someone urged Kim to look into Time-Driven Activity-Based Costing (TDABC) instead of ABC. What would be the advantages of using a TDABC aproach? 1. Simple to implement The cost per unit is much different based on the ABC assignments suggesting that accuracy can make a significant difference in managerial decision making. The evidence is of implementing ABC 1. Simple to implement 2. Easy to update and maintain 3. Ability to use time equations that easily capture what are essentially multiple activities 4. It is possible to have a more granular model without the associated expense