I need help with question 1 (f ) & (g) and question 2

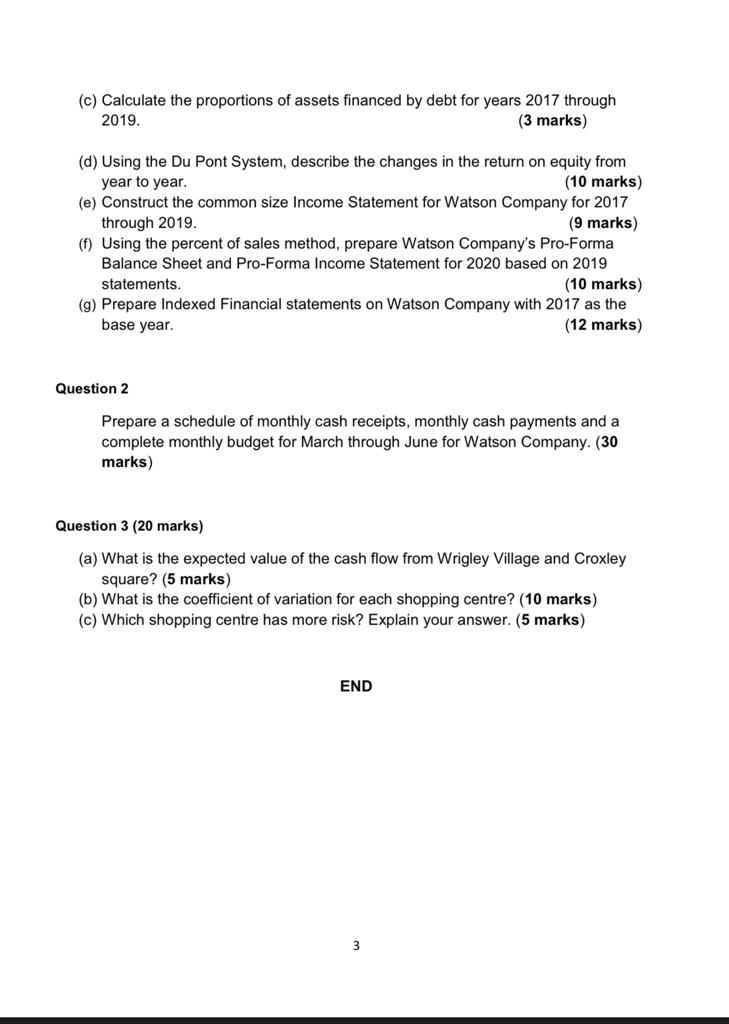

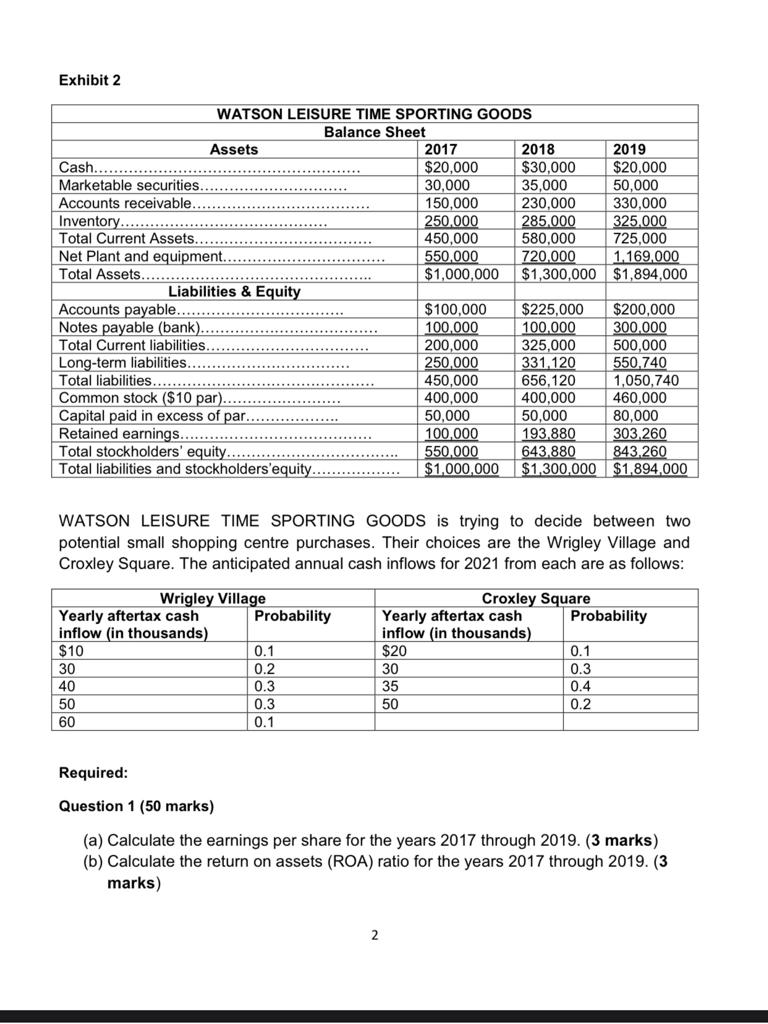

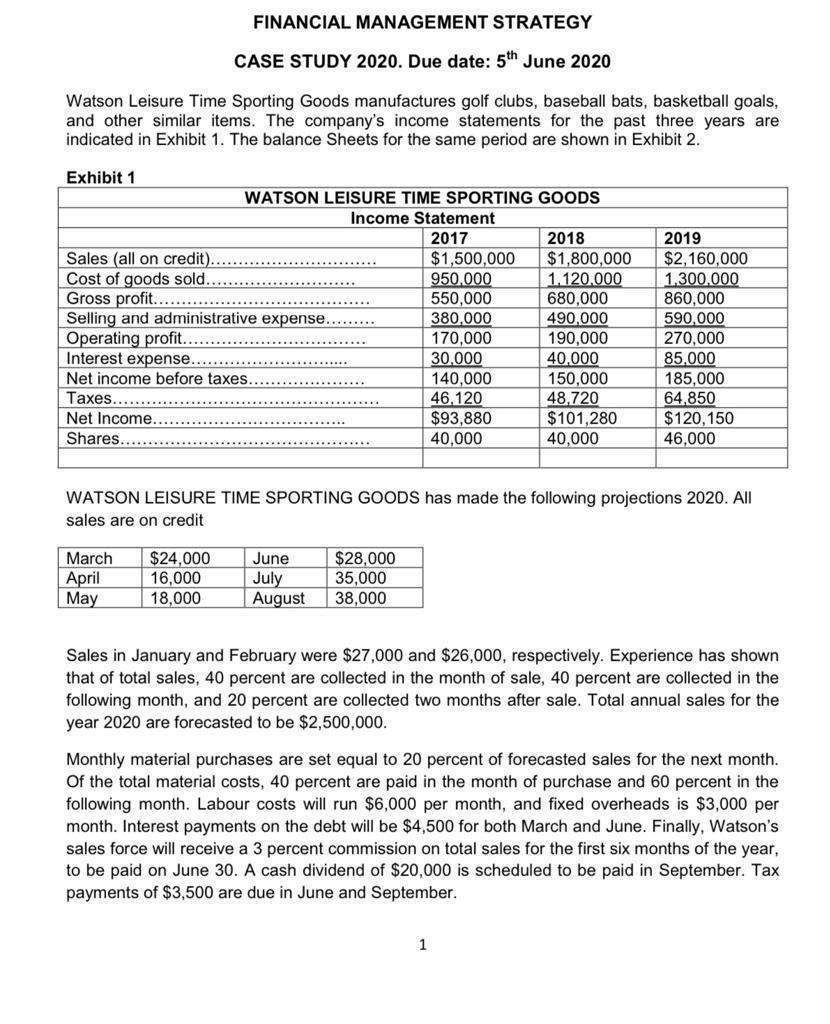

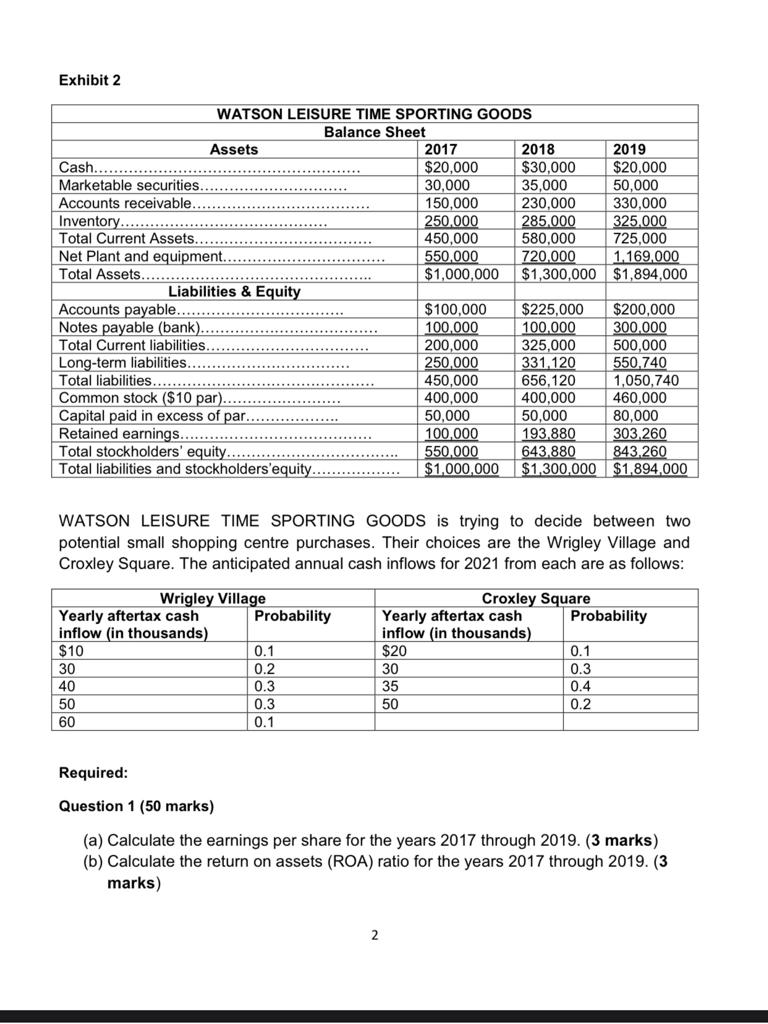

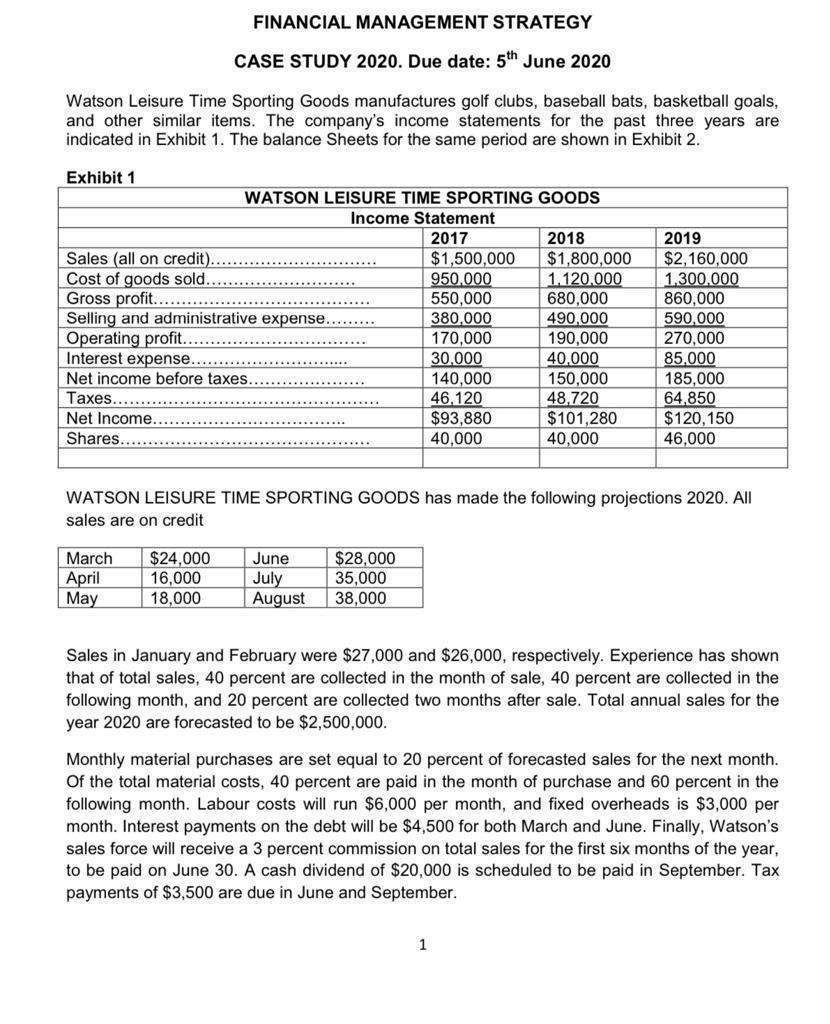

(c) Calculate the proportions of assets financed by debt for years 2017 through 2019. (3 marks) (d) Using the Du Pont System, describe the changes in the return on equity from year to year. (10 marks) (e) Construct the common size Income Statement for Watson Company for 2017 through 2019. (9 marks) () Using the percent of sales method, prepare Watson Company's Pro-Forma Balance Sheet and Pro-Forma Income Statement for 2020 based on 2019 statements. (10 marks) (9) Prepare Indexed Financial statements on Watson Company with 2017 as the base year. (12 marks) Question 2 Prepare a schedule of monthly cash receipts, monthly cash payments and a complete monthly budget for March through June for Watson Company. (30 marks) Question 3 (20 marks) (a) What is the expected value of the cash flow from Wrigley Village and Croxley square? (5 marks) (b) What is the coefficient of variation for each shopping centre? (10 marks) (c) Which shopping centre has more risk? Explain your answer. (5 marks) END 3 Exhibit 2 WATSON LEISURE TIME SPORTING GOODS Balance Sheet Assets 2017 2018 2019 Cash.. $20,000 $30,000 $20.000 Marketable securities 30,000 35,000 50,000 Accounts receivable 150,000 230.000 330,000 Inventory............... .......... 250.000 285.000 325.000 Total Current Assets. 450,000 580,000 725,000 Net Plant and equipment. 550.000 720,000 1.169,000 Total Assets.......... $1,000,000 $1,300,000 $1,894,000 Liabilities & Equity Accounts payable. $100,000 $225,000 $200,000 Notes payable (bank). 100,000 100.000 300,000 Total Current liabilities 200,000 325,000 500,000 Long-term liabilities 250,000 331.120 550.740 Total liabilities.......... 450,000 656,120 1,050.740 Common stock ($10 par.. 400.000 400,000 460,000 Capital paid in excess of par. 50,000 50,000 80,000 Retained earnings....... 100,000 193.880 303 260 Total stockholders' equity. 550.000 643.880 843.260 Total liabilities and stockholders'equity.. $1,000,000 $1,300,000 $1.894,000 WATSON LEISURE TIME SPORTING GOODS is trying to decide between two potential small shopping centre purchases. Their choices are the Wrigley Village and Croxley Square. The anticipated annual cash inflows for 2021 from each are as follows: Wrigley Village Yearly aftertax cash Probability inflow in thousands) $10 0.1 30 0.2 40 0.3 50 0.3 60 0.1 Croxley Square Yearly aftertax cash Probability inflow (in thousands) $20 0.1 30 0.3 35 0.4 50 0.2 Required: Question 1 (50 marks) (a) Calculate the earnings per share for the years 2017 through 2019. (3 marks) (b) Calculate the return on assets (ROA) ratio for the years 2017 through 2019. (3 marks) 2 FINANCIAL MANAGEMENT STRATEGY CASE STUDY 2020. Due date: 5th June 2020 Watson Leisure Time Sporting Goods manufactures golf clubs, baseball bats, basketball goals, and other similar items. The company's income statements for the past three years are indicated in Exhibit 1. The balance Sheets for the same period are shown in Exhibit 2. Exhibit 1 WATSON LEISURE TIME SPORTING GOODS Income Statement 2017 2018 Sales (all on credit). $1,500,000 $1,800,000 Cost of goods sold. 950.000 1.120.000 Gross profit... 550,000 680,000 Selling and administrative expense.. 380,000 490,000 Operating profit.. 170,000 190,000 Interest expense. 30,000 40.000 Net income before taxes. 140,000 150,000 Taxes 46,120 48,720 Net Income. $93,880 $101,280 Shares 40,000 40,000 2019 $2,160,000 1.300.000 860,000 590,000 270,000 85,000 185,000 64,850 $120, 150 46,000 WATSON LEISURE TIME SPORTING GOODS has made the following projections 2020. All sales are on credit March April May $24,000 16.000 18,000 June July August $28,000 35,000 38,000 Sales in January and February were $27,000 and $26,000, respectively. Experience has shown that of total sales, 40 percent are collected in the month of sale, 40 percent are collected in the following month, and 20 percent are collected two months after sale. Total annual sales for the year 2020 are forecasted to be $2,500,000. Monthly material purchases are set equal to 20 percent of forecasted sales for the next month. Of the total material costs, 40 percent are paid in the month of purchase and 60 percent in the following month. Labour costs will run $6,000 per month, and fixed overheads is $3,000 per month. Interest payments on the debt will be $4,500 for both March and June. Finally, Watson's sales force will receive a 3 percent commission on total sales for the first six months of the year, to be paid on June 30. A cash dividend of $20,000 is scheduled to be paid in September. Tax payments of $3,500 are due in June and September. 1 (c) Calculate the proportions of assets financed by debt for years 2017 through 2019. (3 marks) (d) Using the Du Pont System, describe the changes in the return on equity from year to year. (10 marks) (e) Construct the common size Income Statement for Watson Company for 2017 through 2019. (9 marks) () Using the percent of sales method, prepare Watson Company's Pro-Forma Balance Sheet and Pro-Forma Income Statement for 2020 based on 2019 statements. (10 marks) (9) Prepare Indexed Financial statements on Watson Company with 2017 as the base year. (12 marks) Question 2 Prepare a schedule of monthly cash receipts, monthly cash payments and a complete monthly budget for March through June for Watson Company. (30 marks) Question 3 (20 marks) (a) What is the expected value of the cash flow from Wrigley Village and Croxley square? (5 marks) (b) What is the coefficient of variation for each shopping centre? (10 marks) (c) Which shopping centre has more risk? Explain your answer. (5 marks) END 3 Exhibit 2 WATSON LEISURE TIME SPORTING GOODS Balance Sheet Assets 2017 2018 2019 Cash.. $20,000 $30,000 $20.000 Marketable securities 30,000 35,000 50,000 Accounts receivable 150,000 230.000 330,000 Inventory............... .......... 250.000 285.000 325.000 Total Current Assets. 450,000 580,000 725,000 Net Plant and equipment. 550.000 720,000 1.169,000 Total Assets.......... $1,000,000 $1,300,000 $1,894,000 Liabilities & Equity Accounts payable. $100,000 $225,000 $200,000 Notes payable (bank). 100,000 100.000 300,000 Total Current liabilities 200,000 325,000 500,000 Long-term liabilities 250,000 331.120 550.740 Total liabilities.......... 450,000 656,120 1,050.740 Common stock ($10 par.. 400.000 400,000 460,000 Capital paid in excess of par. 50,000 50,000 80,000 Retained earnings....... 100,000 193.880 303 260 Total stockholders' equity. 550.000 643.880 843.260 Total liabilities and stockholders'equity.. $1,000,000 $1,300,000 $1.894,000 WATSON LEISURE TIME SPORTING GOODS is trying to decide between two potential small shopping centre purchases. Their choices are the Wrigley Village and Croxley Square. The anticipated annual cash inflows for 2021 from each are as follows: Wrigley Village Yearly aftertax cash Probability inflow in thousands) $10 0.1 30 0.2 40 0.3 50 0.3 60 0.1 Croxley Square Yearly aftertax cash Probability inflow (in thousands) $20 0.1 30 0.3 35 0.4 50 0.2 Required: Question 1 (50 marks) (a) Calculate the earnings per share for the years 2017 through 2019. (3 marks) (b) Calculate the return on assets (ROA) ratio for the years 2017 through 2019. (3 marks) 2 FINANCIAL MANAGEMENT STRATEGY CASE STUDY 2020. Due date: 5th June 2020 Watson Leisure Time Sporting Goods manufactures golf clubs, baseball bats, basketball goals, and other similar items. The company's income statements for the past three years are indicated in Exhibit 1. The balance Sheets for the same period are shown in Exhibit 2. Exhibit 1 WATSON LEISURE TIME SPORTING GOODS Income Statement 2017 2018 Sales (all on credit). $1,500,000 $1,800,000 Cost of goods sold. 950.000 1.120.000 Gross profit... 550,000 680,000 Selling and administrative expense.. 380,000 490,000 Operating profit.. 170,000 190,000 Interest expense. 30,000 40.000 Net income before taxes. 140,000 150,000 Taxes 46,120 48,720 Net Income. $93,880 $101,280 Shares 40,000 40,000 2019 $2,160,000 1.300.000 860,000 590,000 270,000 85,000 185,000 64,850 $120, 150 46,000 WATSON LEISURE TIME SPORTING GOODS has made the following projections 2020. All sales are on credit March April May $24,000 16.000 18,000 June July August $28,000 35,000 38,000 Sales in January and February were $27,000 and $26,000, respectively. Experience has shown that of total sales, 40 percent are collected in the month of sale, 40 percent are collected in the following month, and 20 percent are collected two months after sale. Total annual sales for the year 2020 are forecasted to be $2,500,000. Monthly material purchases are set equal to 20 percent of forecasted sales for the next month. Of the total material costs, 40 percent are paid in the month of purchase and 60 percent in the following month. Labour costs will run $6,000 per month, and fixed overheads is $3,000 per month. Interest payments on the debt will be $4,500 for both March and June. Finally, Watson's sales force will receive a 3 percent commission on total sales for the first six months of the year, to be paid on June 30. A cash dividend of $20,000 is scheduled to be paid in September. Tax payments of $3,500 are due in June and September. 1