Answered step by step

Verified Expert Solution

Question

1 Approved Answer

i need help with question 10, 11, & 12 and please check question 13 to see if it is right or wrong. thank you so

i need help with question 10, 11, & 12 and please check question 13 to see if it is right or wrong. thank you so so much

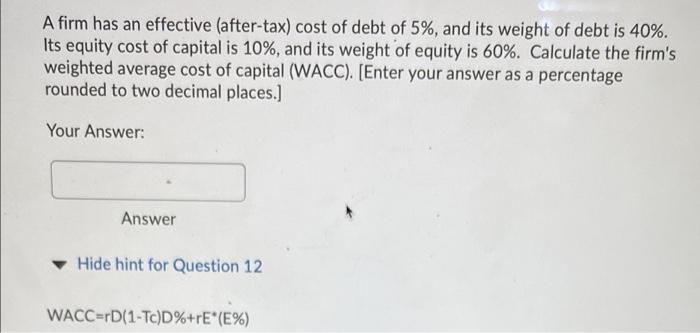

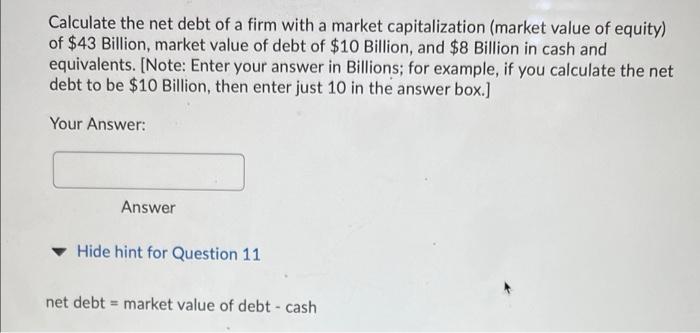

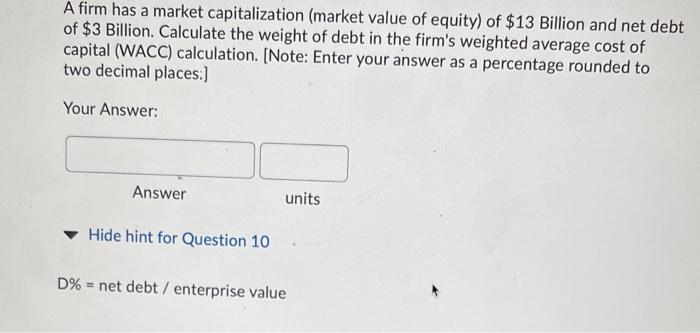

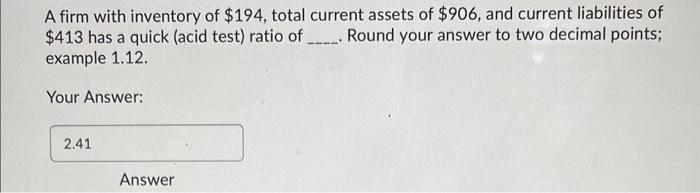

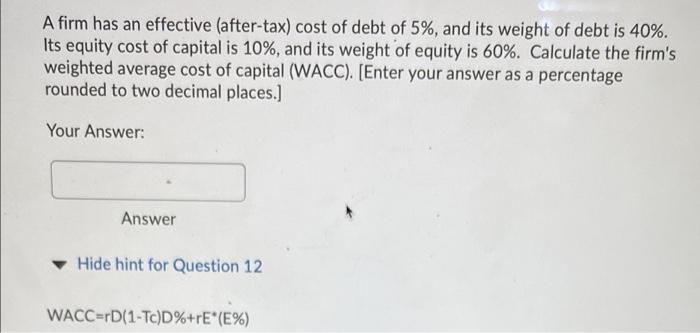

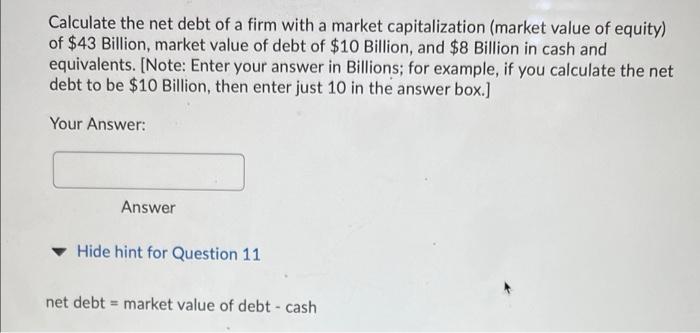

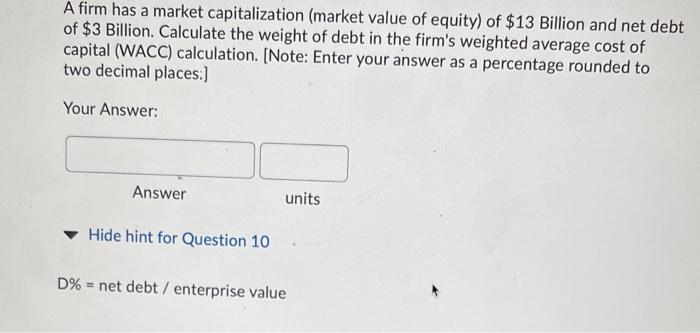

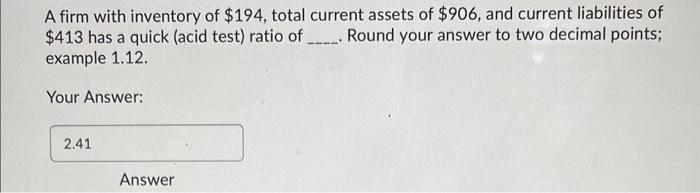

A firm has an effective (after-tax) cost of debt of 5%, and its weight of debt is 40%. Its equity cost of capital is 10%, and its weight of equity is 60%. Calculate the firm's weighted average cost of capital (WACC). [Enter your answer as a percentage rounded to two decimal places.] Your Answer: Answer Hide hint for Question 12 WACC=rD(1-Tc)D%+rE*(E%) Calculate the net debt of a firm with a market capitalization (market value of equity) of $43 Billion, market value of debt of $10 Billion, and $8 Billion in cash and equivalents. [Note: Enter your answer in Billions, for example, if you calculate the net debt to be $10 Billion, then enter just 10 in the answer box.) Your Answer: Answer Hide hint for Question 11 net debt = market value of debt - cash A firm has a market capitalization (market value of equity) of $13 billion and net debt of $3 Billion. Calculate the weight of debt in the firm's weighted average cost of capital (WACC) calculation. (Note: Enter your answer as a percentage rounded to two decimal places.) Your Answer: Answer units Hide hint for Question 10 D% = net debt / enterprise value A firm with inventory of $194, total current assets of $906, and current liabilities of $413 has a quick (acid test) ratio of Round your answer to two decimal points; example 1.12. Your Answer: 2.4

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started