Answered step by step

Verified Expert Solution

Question

1 Approved Answer

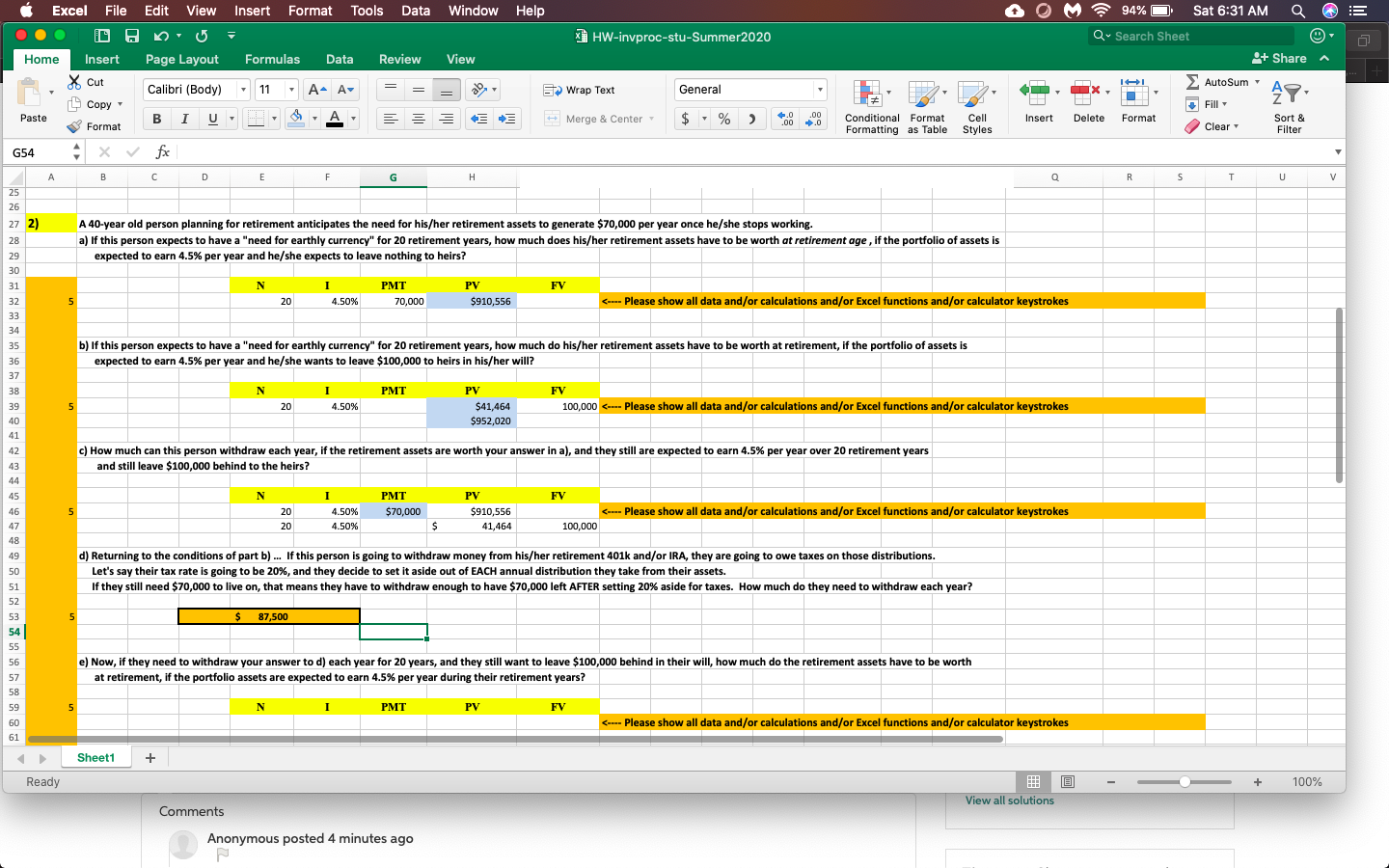

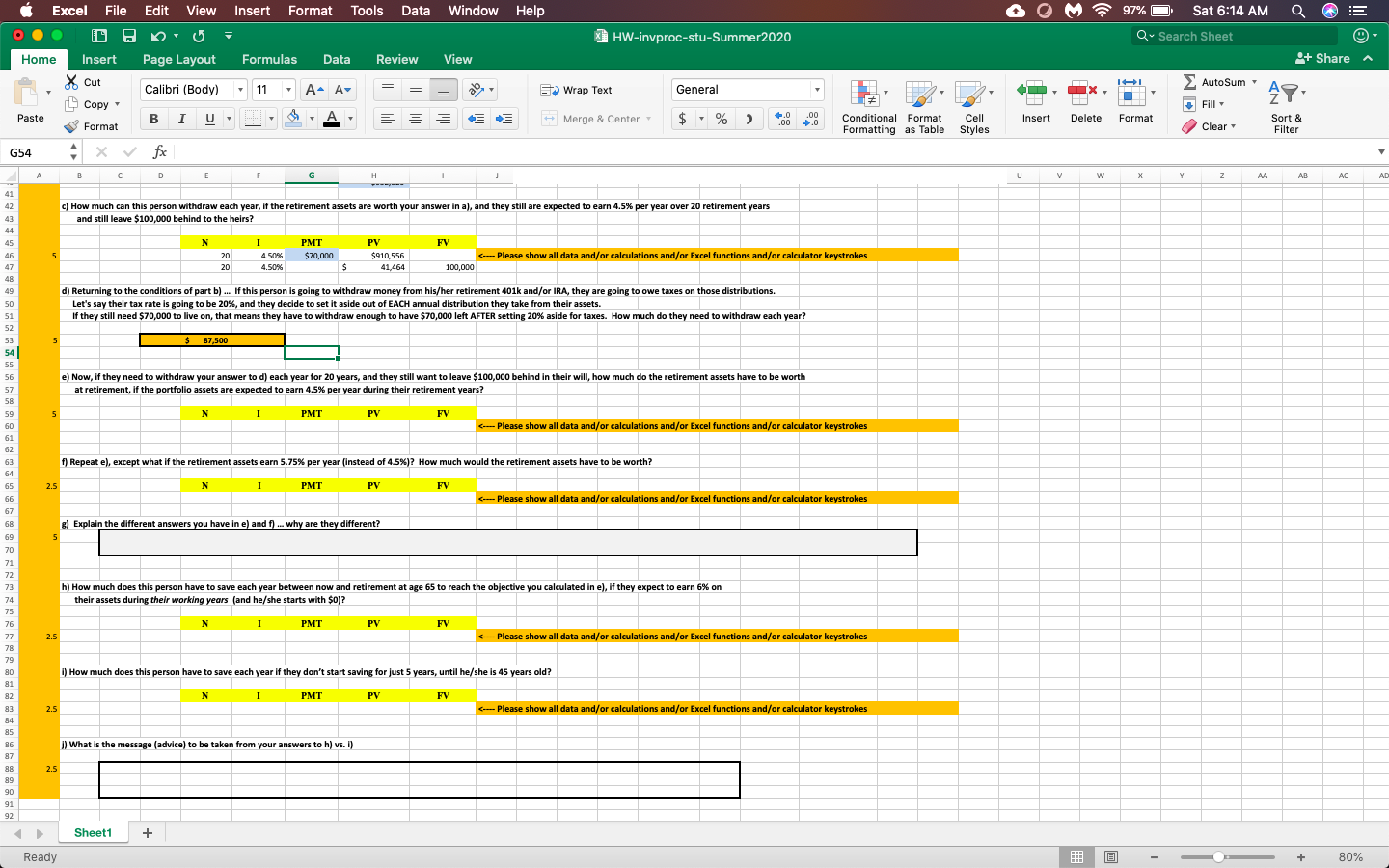

I need help with question 2 (e-J) thanks!! Excel File Edit View Insert Format Tools Data Window Window Help 94% O Sat 6:31 AM Q

I need help with question 2 (e-J) thanks!!

Excel File Edit View Insert Format Tools Data Window Window Help 94% O Sat 6:31 AM Q A HW-invproc-stu-Summer2020 Q- Search Sheet Home Page Layout Formulas Data Review View 2+ Share Insert Cut Copy AutoSum Calibri (Body) 11 A- A Wrap Text General H H Fill - Paste Biu Merge & Center $ % %) 10 .00 .00 0 Insert Delete Format Format Conditional Format Formatting as Table Cell Styles Clear Sort & Filter G54 for A B C D E F G H Q R s T U V 25 A 40-year old person planning for retirement anticipates the need for his/her retirement assets to generate $70,000 per year once he/she stops working. a) If this person expects to have a "need for earthly currency" for 20 retirement years, how much does his/her retirement assets have to be worth at retirement age, if the portfolio of assets is expected to earn 4.5% per year and he/she expects to leave nothing to heirs? N I FV 20 PMT 70,000 5 4.50% PV $910,556Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started