Answered step by step

Verified Expert Solution

Question

1 Approved Answer

i need help with question 2. please be as detailed as you can. Alpine Cupcakes, Inc. Audit Case Assignments ion to the audio following tasks:

i need help with question 2. please be as detailed as you can.

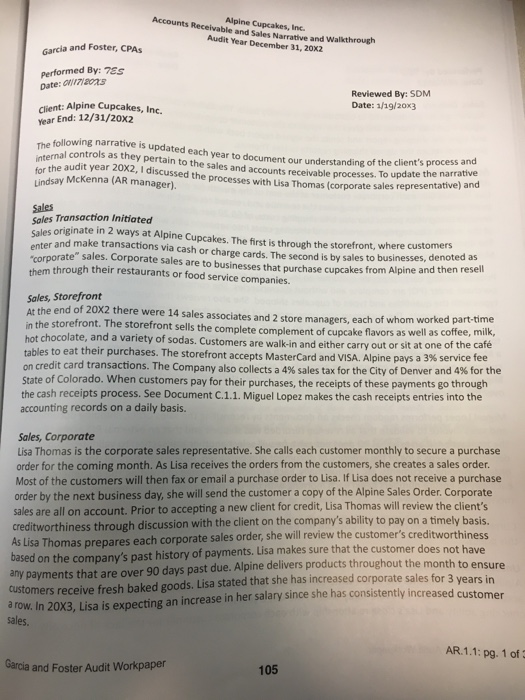

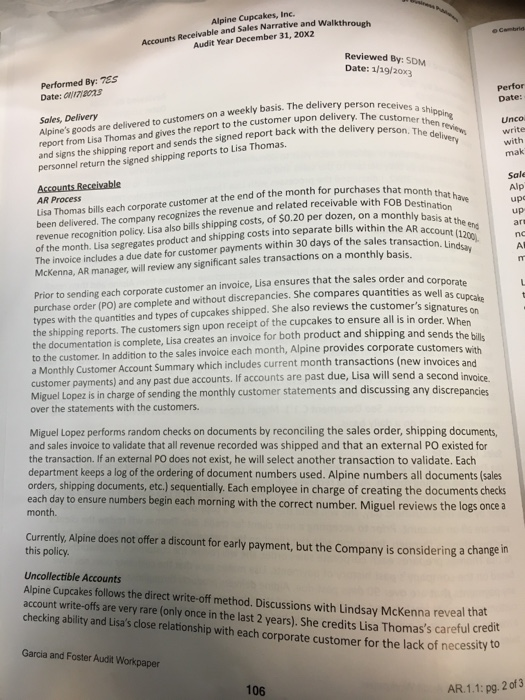

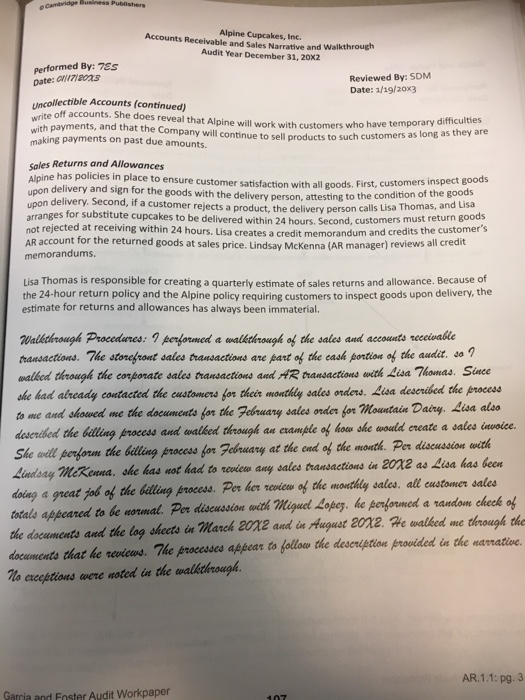

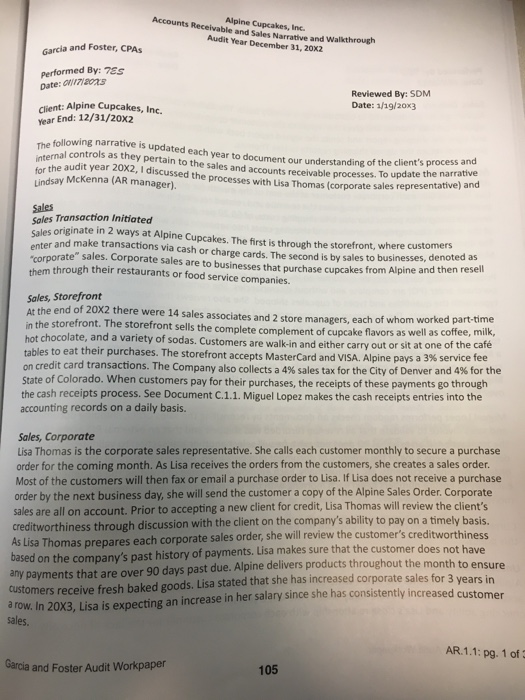

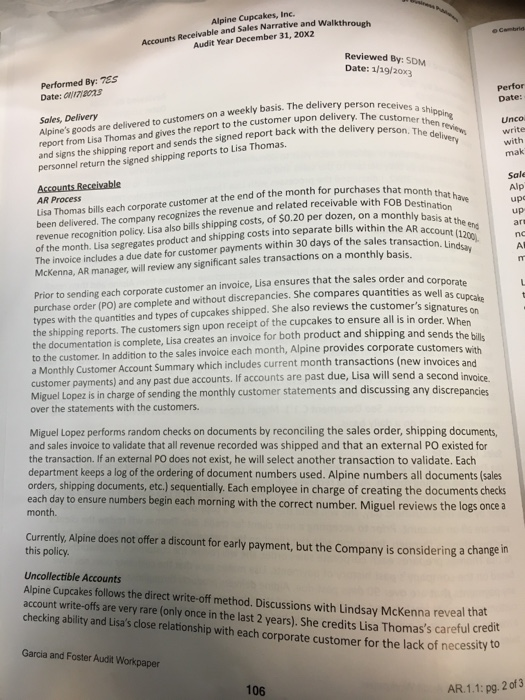

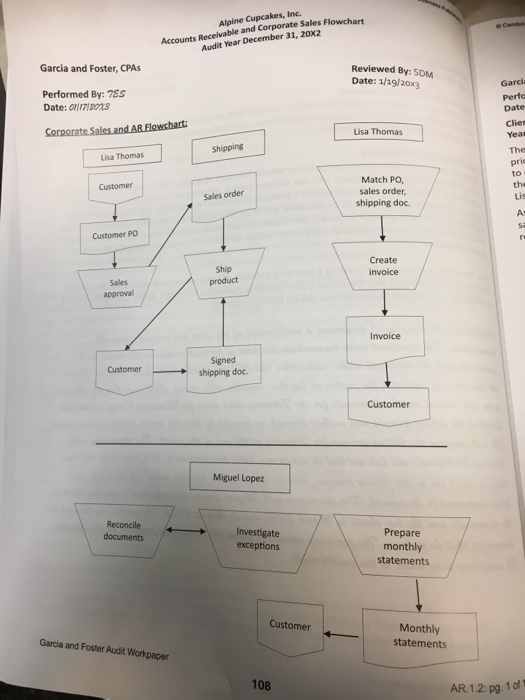

Alpine Cupcakes, Inc. Audit Case Assignments ion to the audio following tasks: e auditing standards In this part of your assignment, you will examine the firm's audit documentation in relation to Alpine's accounts receivable and sales processes and accounts. Please s please complete the following Q1. Research, cite, and summarize in one or two sentences per standard identined) the auditi that address Garcia and Foster, CPA's, responsibility in relation to se! tion to sending accounts receiva confirmations. Identify the most relevant paragraph(s) in each stand QZ. Review the accounts receivable and sales narrative and walkthrough (AR.1.1) and review the receivable and corporate sales flowchart (AR.1.2) to identify all of the internal control weak the accounts receivable and sales processes. Provide one or two sentences on why each item id is a weakness. This question relates to Sten 2 of the Garcia and Foster Audit Plan. ew the accounts col weaknesses for Alpine Cupcakes, Inc. Accounts Receivable and Sales Narrative and Walkthroue Audit Year December 31, 20X2 Garcia and Foster, CPAS Performed By: 75s Date: 7/2013 Reviewed By: SDM Date: 1/19/20x3 client: Alpine Cupcakes, Inc. Year End: 12/31/20X2 following narrative is updated each year to documentou understanding of the client's proce al controls as they pertain to the sale the audit year 20X2, I discussed the processes with lisa Thomas corporate sales represent Sales and accounts receivable processes. To update the narrative Lindsay Mckenna (AR manager derstanding of the client's process and ate sales representative) and Sales Sales Transaction initiated clas originate in 2 ways at Alpine Cupcakes. The first is through the storefront, where customers ter and make transactions via cash or charge cards The second is by sales to businesses, deno second is by sales to businesses, denoted as corporate sales. Corporate sales are to businesses that purchase cuncakes from Alpine and then reser bam through their restaurants or food service companies. Sales, Storefront At the end of 20X2 there were 14 sales associates and 2 store managers, each of whom worked part-time in the storefront. The storefront sells the complete complement of cupcake flavors as well as coffee, milk, hot chocolate, and a variety of sodas. Customers are walk-in and either carry out or sit at one of the cafe tables to eat their purchases. The storefront accepts MasterCard and VISA. Alpine pays a 3% service fee on credit card transactions. The Company also collects a 4% sales tax for the City of Denver and 4% for the State of Colorado. When customers pay for their purchases, the receipts of these payments go through the cash receipts process. See Document C.1.1. Miguel Lopez makes the cash receipts entries into the accounting records on a daily basis. Sales, Corporate Lisa Thomas is the corporate sales representative. She calls each customer monthly to secure a purchase order for the coming month. As Lisa receives the orders from the customers, she creates a sales order. Most of the customers will then fax or email a purchase order to Lisa. If Lisa does not receive a purchase order by the next business day, she will send the customer a copy of the Alpine Sales Order. Corporate sales are all on account. Prior to accepting a new client for credit, Lisa Thomas will review the client's creditworthiness through discussion with the client on the company's ability to pay on a timely basis. As Lisa Thomas prepares each corporate sales order, she will review the customer's creditworthiness based on the company's past history of payments. Lisa makes sure that the customer does not have any payments that are over 90 days past due. Alpine delivers products throughout the month to ensure customers receive fresh baked goods. Lisa stated that she has increased corporate sales for 3 years in dlow. In 20X3. Lisa is expecting an increase in her salary since she has consistently increased customer sales. AR.1.1: pg. 1 of Garcia and Foster Audit Workpaper Alpine Cupcakes, Inc. Accounts Receivable and Sales Narrative and Walkthr Audit Year December 31, 20X2 Reviewed By: SDM Date: 1/19/2003 Performed By: 765 Date: 2013 Perfor Date: ry person receives a shippine ary. The customer then delivery person. The deliver Sales, Delivery Alpine's goods are delivered to customers on a weekly basis. The delivery per report from Lisa Thomas and gives the report to the customer upon delivery. Th and signs the shipping report and sends the signed report back with the deliver personnel return the signed shipping reports to Lisa Thomas. Unco write with mak Sale that month that have Destination onthly basis at the end the AR account (1200 Alp upd up Accounts Receivable AR Process Lisa Thomas bills each corporate customer at the end of the month for purchases that enires the revenue and related receivable with FOB Destin been delivered. The company recognizes the revenue ar revenue recognition policy. Lisa also bills shipping costs, of $0.20 per dozen, on a monthly of the month. Lisa segregates product and shipping costs into separate bills within the AR The invoice includes a due date for customer payments within 30 days of the sales transar McKenna, AR manager, will review any significant sales transactions on a monthly basis. es transaction. Lindsay CE - the sales order and corporate es as well as cupcake Prior to sending each corporate customer an invoice, Lisa ensures that the sales order andre purchase order (PO) are complete and without discrepancies. She compares quantities as well a types with the quantities and types of cupcakes shipped. She also reviews the customer's signatur the shipping reports. The customers sign upon receipt of the cupcakes to ensure all is in order Wh the documentation is complete, Lisa creates an invoice for both product and shipping and sends then to the customer. In addition to the sales invoice each month, Alpine provides corporate customers with a Monthly Customer Account Summary which includes current month transactions (new invoices and customer payments) and any past due accounts. If accounts are past due, Lisa will send a second invoice Miguel Lopez is in charge of sending the monthly customer statements and discussing any discrepancies over the statements with the customers. Miguel Lopez performs random checks on documents by reconciling the sales order, shipping documents and sales invoice to validate that all revenue recorded was shipped and that an external PO existed for the transaction. If an external PO does not exist, he will select another transaction to validate. Each department keeps a log of the ordering of document numbers used. Alpine numbers all documents (sales orders, shipping documents, etc.) sequentially. Each employee in charge of creating the documents checks each day to ensure numbers begin each morning with the correct number. Miguel reviews the logs once a month. Currently, Alpine does not offer a discount for early payment, but the Company is considering a change in this policy. Uncollectible Accounts Alpine Cupcakes follows the direct write-off method. Discussions with Lindsay McKenna reveal that account write-offs are very rare (only once in the last 2 years). She credits Lisa Thomas's careful cred checking ability and Lisas close relationship with each corporate customer for the lack of necessity w Garcia and Foster Audit Workpaper 106 AR.1.1: pg.2 of 3 Cambridge Business Publis Alpine Cupcakes, Inc. Accounts Receivable and Sales Narrative and Walkthrough Audit Year December 31, 20X2 performed By: 785 Date: 7/2023 Reviewed By: SDM Date: 1/19/20x3 collectible Accounts (continued write off accounts. She does reve es reveal that Alpine will work with customers who have temporary difficuite with payments, and that the Company will continue to sell products to such customers as waking payments on past due amounts All products to such customers as long as they are Sales Returns and Allowances Alpine has policies in place to ensure customer satisfaction with all goods. First, customers upon delivery and sign for the goods with the delivery person attesting to the condition of the good sfaction with all goods. First, customers inspect goods condition of the goods upon delivery. Second, if a customer relects a product the delivery person calls Lisa Thomas, and is allie Thomas and Lisa arranges for substitute cupcakes to be delivered within 24 hours second customers must return goods not rejected at receiving within 24 hours. Lisa creates a credit memorandum and credits the customers AR account for the returned goods at sales price. Lindsay McKenna (AR manager) reviews all credit memorandums. Lisa Thomas is responsible for creating a quarterly estimate of sales returns and allowance. Because of the 24-hour return policy and the Alpine policy requiring customers to inspect goods upon delivery, the estimate for returns and allowances has always been immaterial. Walkthrough Procedures: 7 performed a walkthrough of the sales and accounts receivable transactions. The storefront sales transactions are part of the cash portion of the audit.do? walked through the corporate sales transactions and AR transactions with Lisa Thomas. Sluce dhe had already contacted the customers for their monthly sales orders. Lia described the process to me and showed me the documents for the February sales onder for Mountalu Dairy. Lisa also described the billing process and walked through an example of how she would create a sales ouvoice. She will perform the billing process for February at the end of the mouth. Per discussion with Lindsay Mekenea, se kas not had to score day sales transactions in 2012 as Lisa has been doing a great job of the belling process. Per ker review of the mouthly sales, all customer sales totals appeared to be moreal. Per discussion with Miguel Lopes, ke performed a random check of the documents and the log sheets in March 2012 and in August 2012. He walked me through the documents that he devices. The processes appear to follow the description provided in the narrative. No exceptions were noted in the walkthrough AR.1.1: Pg. 3 Garcia and Foster Audit Workpaper Alpine Cupcakes, Inc. Accounts Receivable and Corporate Sales Flowcha Audit Year December 31, 20X2 Garcia and Foster, CPAS Reviewed By: SDM Date: 1/19/20x3 Performed By: 755 Date: 01/17/2013 Garci Perfo Date Cliet Yea! The prie Corporate Sales and AR Flowchart: Lisa Thomas Shipping Lisa Thomas to Customer the Sales order Match PO, sales order, shipping doc. Customer PO Ship Create invoice Sales product approval Invoice Customer Signed shipping doc. Customer Miguel Lopez Reconcile documents Investigate exceptions Prepare monthly statements Customer Monthly statements Garcia and Foster Audit Workpaper 108 AR.1.2: pg. 1 of 1 Alpine Cupcakes, Inc. Audit Case Assignments ion to the audio following tasks: e auditing standards In this part of your assignment, you will examine the firm's audit documentation in relation to Alpine's accounts receivable and sales processes and accounts. Please s please complete the following Q1. Research, cite, and summarize in one or two sentences per standard identined) the auditi that address Garcia and Foster, CPA's, responsibility in relation to se! tion to sending accounts receiva confirmations. Identify the most relevant paragraph(s) in each stand QZ. Review the accounts receivable and sales narrative and walkthrough (AR.1.1) and review the receivable and corporate sales flowchart (AR.1.2) to identify all of the internal control weak the accounts receivable and sales processes. Provide one or two sentences on why each item id is a weakness. This question relates to Sten 2 of the Garcia and Foster Audit Plan. ew the accounts col weaknesses for Alpine Cupcakes, Inc. Accounts Receivable and Sales Narrative and Walkthroue Audit Year December 31, 20X2 Garcia and Foster, CPAS Performed By: 75s Date: 7/2013 Reviewed By: SDM Date: 1/19/20x3 client: Alpine Cupcakes, Inc. Year End: 12/31/20X2 following narrative is updated each year to documentou understanding of the client's proce al controls as they pertain to the sale the audit year 20X2, I discussed the processes with lisa Thomas corporate sales represent Sales and accounts receivable processes. To update the narrative Lindsay Mckenna (AR manager derstanding of the client's process and ate sales representative) and Sales Sales Transaction initiated clas originate in 2 ways at Alpine Cupcakes. The first is through the storefront, where customers ter and make transactions via cash or charge cards The second is by sales to businesses, deno second is by sales to businesses, denoted as corporate sales. Corporate sales are to businesses that purchase cuncakes from Alpine and then reser bam through their restaurants or food service companies. Sales, Storefront At the end of 20X2 there were 14 sales associates and 2 store managers, each of whom worked part-time in the storefront. The storefront sells the complete complement of cupcake flavors as well as coffee, milk, hot chocolate, and a variety of sodas. Customers are walk-in and either carry out or sit at one of the cafe tables to eat their purchases. The storefront accepts MasterCard and VISA. Alpine pays a 3% service fee on credit card transactions. The Company also collects a 4% sales tax for the City of Denver and 4% for the State of Colorado. When customers pay for their purchases, the receipts of these payments go through the cash receipts process. See Document C.1.1. Miguel Lopez makes the cash receipts entries into the accounting records on a daily basis. Sales, Corporate Lisa Thomas is the corporate sales representative. She calls each customer monthly to secure a purchase order for the coming month. As Lisa receives the orders from the customers, she creates a sales order. Most of the customers will then fax or email a purchase order to Lisa. If Lisa does not receive a purchase order by the next business day, she will send the customer a copy of the Alpine Sales Order. Corporate sales are all on account. Prior to accepting a new client for credit, Lisa Thomas will review the client's creditworthiness through discussion with the client on the company's ability to pay on a timely basis. As Lisa Thomas prepares each corporate sales order, she will review the customer's creditworthiness based on the company's past history of payments. Lisa makes sure that the customer does not have any payments that are over 90 days past due. Alpine delivers products throughout the month to ensure customers receive fresh baked goods. Lisa stated that she has increased corporate sales for 3 years in dlow. In 20X3. Lisa is expecting an increase in her salary since she has consistently increased customer sales. AR.1.1: pg. 1 of Garcia and Foster Audit Workpaper Alpine Cupcakes, Inc. Accounts Receivable and Sales Narrative and Walkthr Audit Year December 31, 20X2 Reviewed By: SDM Date: 1/19/2003 Performed By: 765 Date: 2013 Perfor Date: ry person receives a shippine ary. The customer then delivery person. The deliver Sales, Delivery Alpine's goods are delivered to customers on a weekly basis. The delivery per report from Lisa Thomas and gives the report to the customer upon delivery. Th and signs the shipping report and sends the signed report back with the deliver personnel return the signed shipping reports to Lisa Thomas. Unco write with mak Sale that month that have Destination onthly basis at the end the AR account (1200 Alp upd up Accounts Receivable AR Process Lisa Thomas bills each corporate customer at the end of the month for purchases that enires the revenue and related receivable with FOB Destin been delivered. The company recognizes the revenue ar revenue recognition policy. Lisa also bills shipping costs, of $0.20 per dozen, on a monthly of the month. Lisa segregates product and shipping costs into separate bills within the AR The invoice includes a due date for customer payments within 30 days of the sales transar McKenna, AR manager, will review any significant sales transactions on a monthly basis. es transaction. Lindsay CE - the sales order and corporate es as well as cupcake Prior to sending each corporate customer an invoice, Lisa ensures that the sales order andre purchase order (PO) are complete and without discrepancies. She compares quantities as well a types with the quantities and types of cupcakes shipped. She also reviews the customer's signatur the shipping reports. The customers sign upon receipt of the cupcakes to ensure all is in order Wh the documentation is complete, Lisa creates an invoice for both product and shipping and sends then to the customer. In addition to the sales invoice each month, Alpine provides corporate customers with a Monthly Customer Account Summary which includes current month transactions (new invoices and customer payments) and any past due accounts. If accounts are past due, Lisa will send a second invoice Miguel Lopez is in charge of sending the monthly customer statements and discussing any discrepancies over the statements with the customers. Miguel Lopez performs random checks on documents by reconciling the sales order, shipping documents and sales invoice to validate that all revenue recorded was shipped and that an external PO existed for the transaction. If an external PO does not exist, he will select another transaction to validate. Each department keeps a log of the ordering of document numbers used. Alpine numbers all documents (sales orders, shipping documents, etc.) sequentially. Each employee in charge of creating the documents checks each day to ensure numbers begin each morning with the correct number. Miguel reviews the logs once a month. Currently, Alpine does not offer a discount for early payment, but the Company is considering a change in this policy. Uncollectible Accounts Alpine Cupcakes follows the direct write-off method. Discussions with Lindsay McKenna reveal that account write-offs are very rare (only once in the last 2 years). She credits Lisa Thomas's careful cred checking ability and Lisas close relationship with each corporate customer for the lack of necessity w Garcia and Foster Audit Workpaper 106 AR.1.1: pg.2 of 3 Cambridge Business Publis Alpine Cupcakes, Inc. Accounts Receivable and Sales Narrative and Walkthrough Audit Year December 31, 20X2 performed By: 785 Date: 7/2023 Reviewed By: SDM Date: 1/19/20x3 collectible Accounts (continued write off accounts. She does reve es reveal that Alpine will work with customers who have temporary difficuite with payments, and that the Company will continue to sell products to such customers as waking payments on past due amounts All products to such customers as long as they are Sales Returns and Allowances Alpine has policies in place to ensure customer satisfaction with all goods. First, customers upon delivery and sign for the goods with the delivery person attesting to the condition of the good sfaction with all goods. First, customers inspect goods condition of the goods upon delivery. Second, if a customer relects a product the delivery person calls Lisa Thomas, and is allie Thomas and Lisa arranges for substitute cupcakes to be delivered within 24 hours second customers must return goods not rejected at receiving within 24 hours. Lisa creates a credit memorandum and credits the customers AR account for the returned goods at sales price. Lindsay McKenna (AR manager) reviews all credit memorandums. Lisa Thomas is responsible for creating a quarterly estimate of sales returns and allowance. Because of the 24-hour return policy and the Alpine policy requiring customers to inspect goods upon delivery, the estimate for returns and allowances has always been immaterial. Walkthrough Procedures: 7 performed a walkthrough of the sales and accounts receivable transactions. The storefront sales transactions are part of the cash portion of the audit.do? walked through the corporate sales transactions and AR transactions with Lisa Thomas. Sluce dhe had already contacted the customers for their monthly sales orders. Lia described the process to me and showed me the documents for the February sales onder for Mountalu Dairy. Lisa also described the billing process and walked through an example of how she would create a sales ouvoice. She will perform the billing process for February at the end of the mouth. Per discussion with Lindsay Mekenea, se kas not had to score day sales transactions in 2012 as Lisa has been doing a great job of the belling process. Per ker review of the mouthly sales, all customer sales totals appeared to be moreal. Per discussion with Miguel Lopes, ke performed a random check of the documents and the log sheets in March 2012 and in August 2012. He walked me through the documents that he devices. The processes appear to follow the description provided in the narrative. No exceptions were noted in the walkthrough AR.1.1: Pg. 3 Garcia and Foster Audit Workpaper Alpine Cupcakes, Inc. Accounts Receivable and Corporate Sales Flowcha Audit Year December 31, 20X2 Garcia and Foster, CPAS Reviewed By: SDM Date: 1/19/20x3 Performed By: 755 Date: 01/17/2013 Garci Perfo Date Cliet Yea! The prie Corporate Sales and AR Flowchart: Lisa Thomas Shipping Lisa Thomas to Customer the Sales order Match PO, sales order, shipping doc. Customer PO Ship Create invoice Sales product approval Invoice Customer Signed shipping doc. Customer Miguel Lopez Reconcile documents Investigate exceptions Prepare monthly statements Customer Monthly statements Garcia and Foster Audit Workpaper 108 AR.1.2: pg. 1 of 1

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started