Answered step by step

Verified Expert Solution

Question

1 Approved Answer

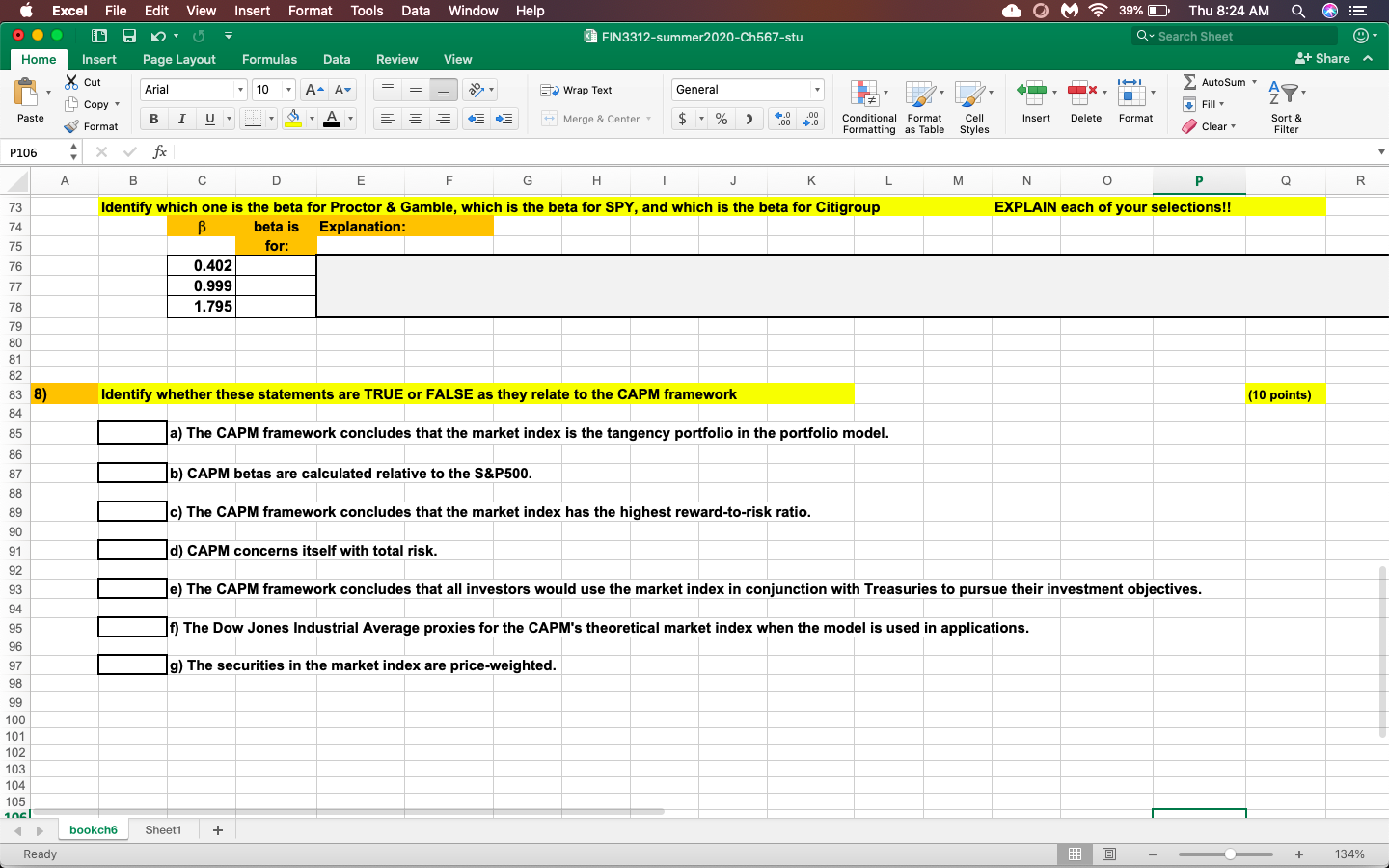

I need help with question 8 that is shown in the excel. Excel File Edit View Insert Format Tools Data Window Help 39% O Thu

I need help with question 8 that is shown in the excel.

Excel File Edit View Insert Format Tools Data Window Help 39% O Thu 8:24 AM a FIN3312-summer2020-Ch567-stu Q Search Sheet Home Insert Page Layout Formulas Data Review View + Share Cut 14! Auto Sum- X 49 Fill Paste $ +.0 .00 .00 0 Insert Delete Format Format Cell Styles Clear Sort & Filter P106 - A M N 0 R Arial 10 A- A Wrap Text General Copy B I U A Merge & Center %) Conditional Format Formatting as Table A x fx B D E F G H J K L Identify which one is the beta for Proctor & Gamble, which is the beta for SPY, and which is the beta for Citigroup B beta is Explanation: for: 0.402 0.999 1.795 73 EXPLAIN each of your selections!! 74 75 76 77 78 79 80 81 82 83 8) 84 Identify whether these statements are TRUE or FALSE as they relate to the CAPM framework (10 points) a) The CAPM framework concludes that the market index is the tangency portfolio in the portfolio model. 85 86 87 b) CAPM betas are calculated relative to the S&P500. 88 89 90 c) The CAPM framework concludes that the market index has the highest reward-to-risk ratio. 91 d) CAPM concerns itself with total risk. 92 93 e) The CAPM framework concludes that all investors would use the market index in conjunction with Treasuries to pursue their investment objectives. 94 95 f) The Dow Jones Industrial Average proxies for the CAPM's theoretical market index when the model is used in applications. 96 g) The securities in the market index are price-weighted. 97 98 99 100 101 102 103 104 105 10cl bookch6 Sheet1 + Ready @ + 134%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started