I need help with required 6 please

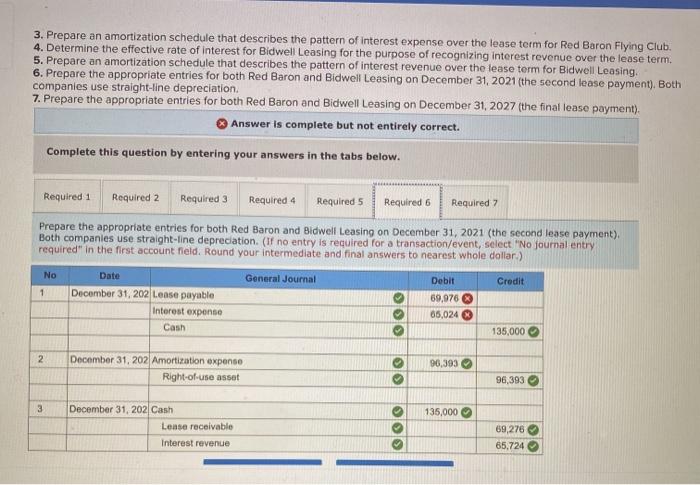

Bidwell Leasing purchased a single engine plane for its fair value of $771147 and leased it to Red Baron Flying Club on January 1, 2021 (FV of $1. PV of $1. FVA - $1. PVA of S1. FVAD of S1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Terms of the lease agreement and related facts were: a. Eight annual payments of $135,000 beginning January 1, 2021, the beginning of the loose, and at each December 31 through 2027. Red Baron knows that Bidwell Leasing's implicit interest rate was 11%. The estimated useful life of the plane is eight years, Payments were calculated as follows: Amount to be recovered (tair value) Tease payments at the beginning of each of the next eight years! (5771,14%+ 5.7122) $771,147 $135,000 "Present value of an annuity due of St.n 8,1-11% b. Red Baron's incremental borrowing rate is 12% c. Incremental Costs of negotiating and consummating the completed lease transaction incurred by Bidwell Leasing were $21.091. Required: 1. How should this lease be classified (s) by Bidwell Leasing the lessor) and (b) by Red Baron (the lessee)? 2. Prepare the appropriate entries for both Red Baron Flying Club and Bidwell Leasing on January 1, 2021 3. Prepare an amortization schedule that describes the pattern of Interest expense over the lease term for Red Baron Flying Club. 4. Determine the effective rate of interest for Bidwell Leasing for the purpose of recognizing interest revenue over the lease term. 5. Prepare an amortization schedule that describes the pattern of interest revenue over the lease term for Bidwell Leasing 6. Prepare the appropriate entries for both Red Baron and Bidwell Leasing on December 31, 2021 (the second lease payment). Both companies use straight-line depreciation, 7. Prepare the appropriate entries for both Red Baron and Bidwell Leasing on December 31, 2027 (the final lease payment), Answer is complete but not entirely correct. 3. Prepare an amortization schedule that describes the pattern of interest expense over the lease term for Red Baron Flying Club. 4. Determine the effective rate of interest for Bidwell Leasing for the purpose of recognizing interest revenue over the lease term. 5. Prepare an amortization schedule that describes the pattern of interest revenue over the lease term for Bidwell Leasing. 6. Prepare the appropriate entries for both Red Baron and Bidwell Leasing on December 31, 2021 (the second lease payment). Both companies use straight-line depreciation. 7. Prepare the appropriate entries for both Red Baron and Bidwell Leasing on December 31, 2027 (the final lease payment). Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 Required 5 Required 6 Required 7 Prepare the appropriate entries for both Red Baron and Bidwell Leasing on December 31, 2021 (the second lease payment), Both companies use straight-line depreciation (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Round your intermediate and final answers to nearest whole dollar) No Date General Journal Credit 1 December 31, 202 Lease payable Interest expense Cash Debit 69,976 65,024 135,000 2 90,393 December 31, 202 Amortization expense Right-of-use asset O 96,393 3 135,000 > December 31, 202 Cash Lease receivable Interest revenue OOO 69,276 65,724