i need help with requirement 1 and 2 please

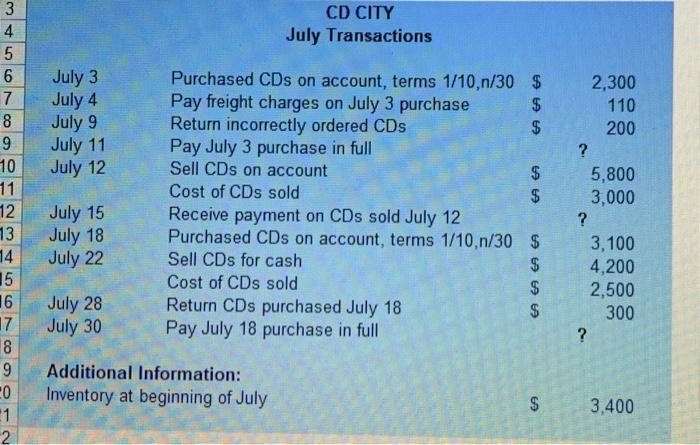

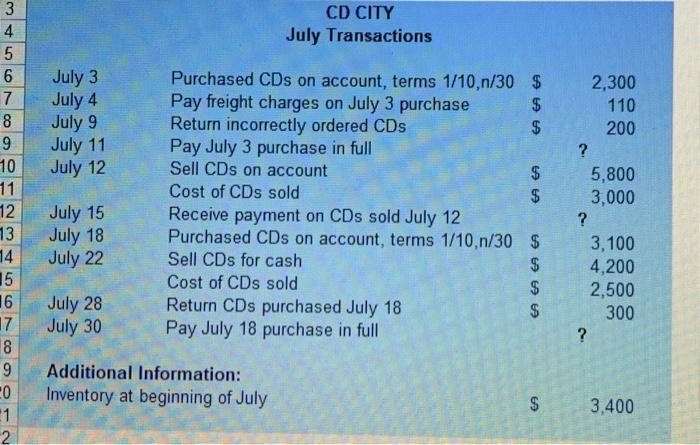

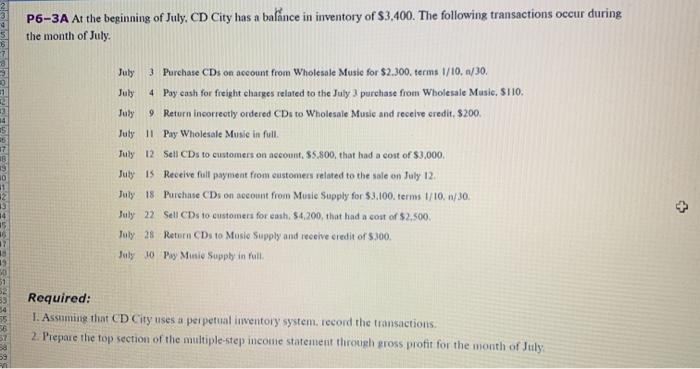

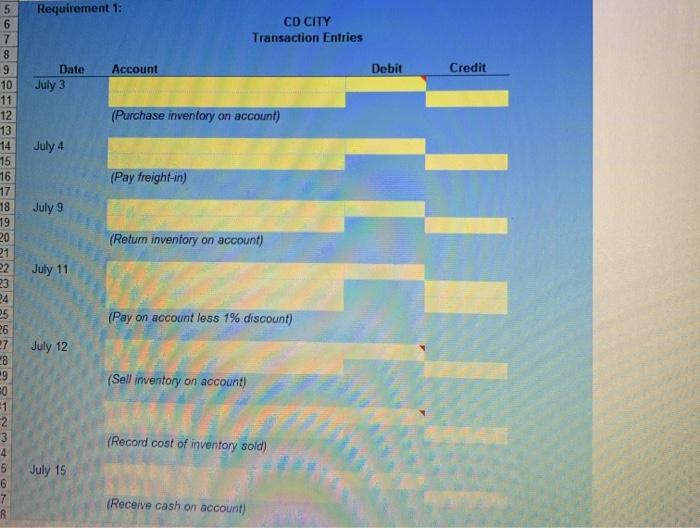

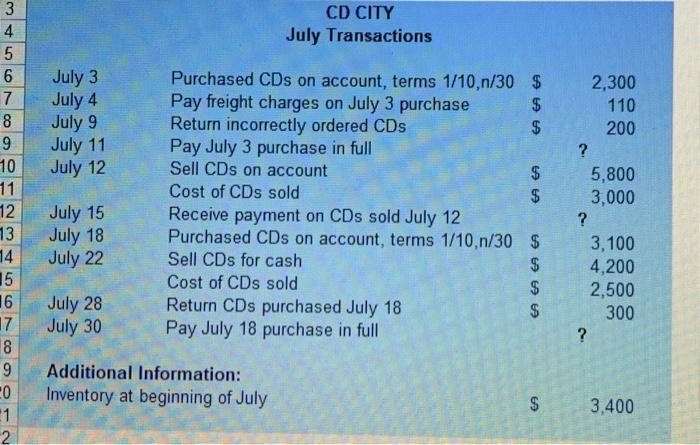

CD CITY July Transactions July 3 July 4 July 9 July 11 July 12 A A A EA TA 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 9 20 1 2 Purchased CDs on account, terms 1/10,n/30 $ Pay freight charges on July 3 purchase $ Return incorrectly ordered CDs Pay July 3 purchase in full Sell CDs on account $ Cost of CDs sold $ Receive payment on CDs sold July 12 Purchased CDs on account, terms 1/10,n/30 $ Sell CDs for cash Cost of CDs sold Return CDs purchased July 18 Pay July 18 purchase in full 2,300 110 200 ? 5,800 3,000 ? 3,100 4,200 2,500 300 July 15 July 18 July 22 6 6 69 July 28 July 30 $ ? Additional Information: Inventory at beginning of July CA $ 3,400 P6-3A At the beginning of July, CD City has a balance in inventory of $3,400. The following transactions occur during the month of July. July 3 Purchase CDs on account from Wholesale Music for $2.300, terms 1/10, /30. July 4 Pay cash for freight charges related to the July 3 purchase from Wholesale Music, S110. July 9 Return incorrectly ordered CDs to Wholesale Music and receive credit, $200 July 11 Pay Wholesale Musie in full July 12 Sell CDs to customers on account. $5.800, that had a cost of $3.000. July 15 Receive full payment from customers related to the sale on July 12 July 18 Purchase CD. on secount from Musie Supply for $3.100. terms 1/10, 1/30 July 22 Sell CDs to customers for cash. 54,200, that had a cost of $2.500 July 28 Return CDs to Music Supply and receive credit of 5.300 July 0 Pay Mini Supply in full 10 14 02 1 19 30 Required: 1. Assuming that CD City uses a perpetual inventory system, record the transactions 2. Prepare the top section of the multiple-step income statement through gross profit for the month of July 56 Requirement 1: CD CITY Transaction Entries Account Debit Credit Date July 3 (Purchase inventory on account) July 4 (Pay freight-in) 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 7 8 -9 July 9 (Return inventory on account) July 11 (Pay on accountless 1% discount) July 12 (Sell inventory on account) No (Record cost of inventory sold) 3 4 5 6 7 R July 15 (Receive cash on account)