Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I need help with Requirement 3. Top managers of Maine Flooring are alarmed by their operating losses. They are considering dropping the laminate flooring product

I need help with Requirement 3.

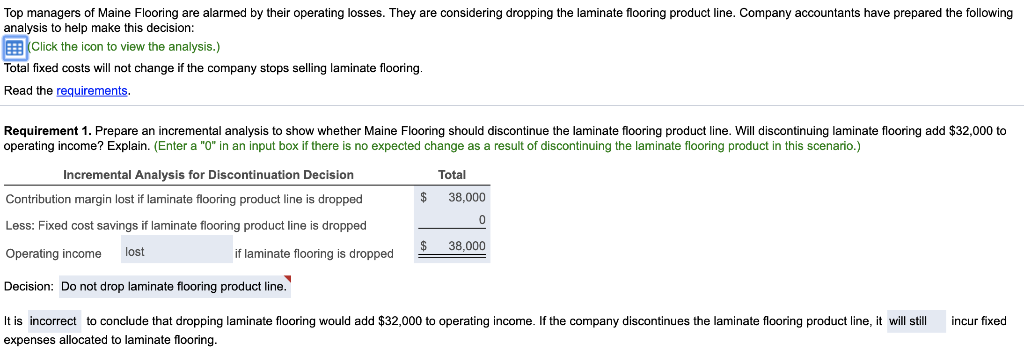

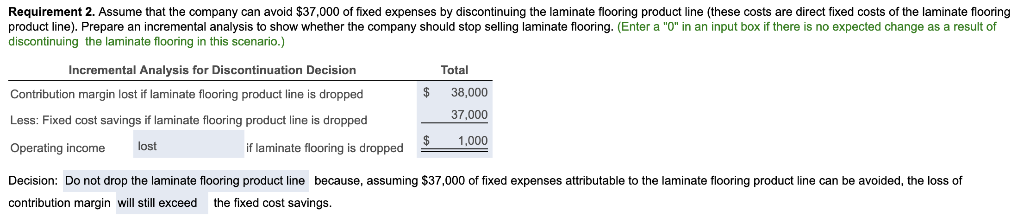

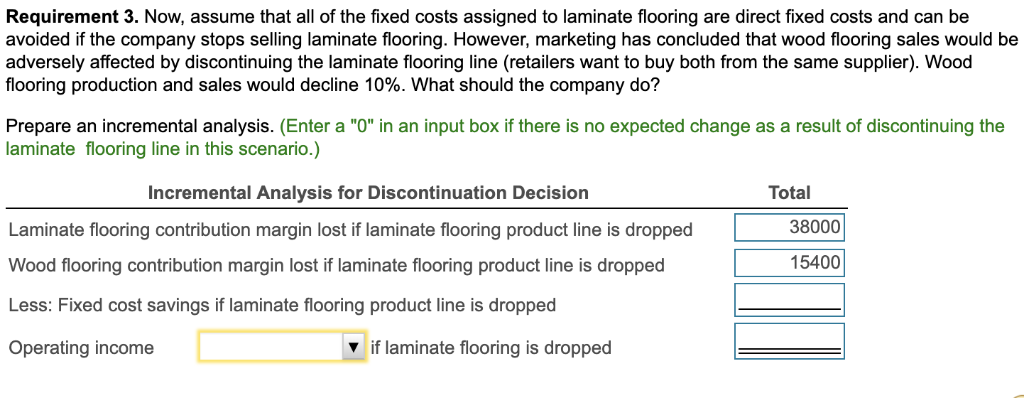

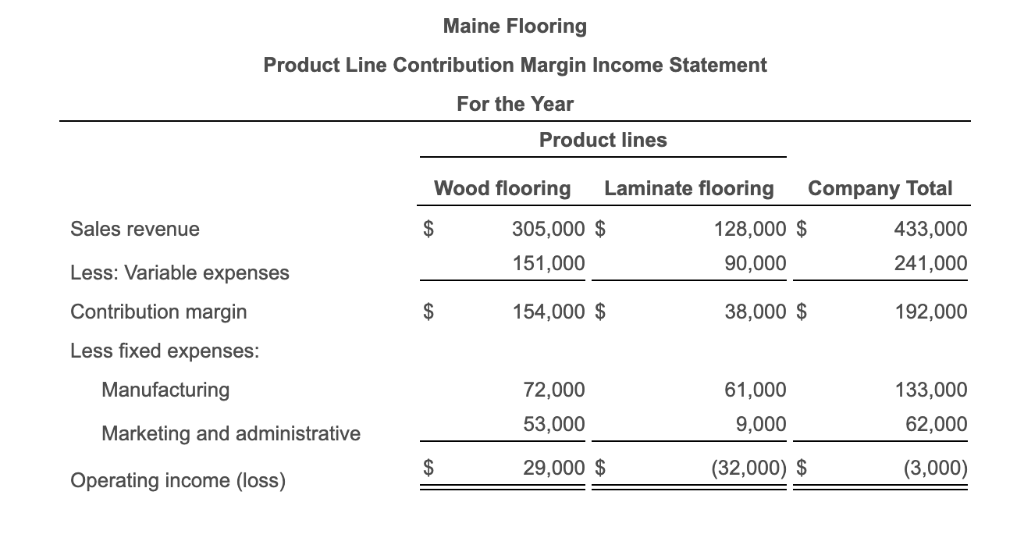

Top managers of Maine Flooring are alarmed by their operating losses. They are considering dropping the laminate flooring product line. Company accountants have prepared the following analysis to help make this decision: Click the icon to view the analysis.) Total fixed costs will not change if the company stops selling laminate flooring. Read the requirements. Requirement 1. Prepare an incremental analysis to show whether Maine Flooring should discontinue the laminate flooring product line. Will discontinuing laminate flooring add $32,000 to operating income? Explain. (Enter a "0" in an input box if there is no expected change as a result of discontinuing the laminate flooring product in this scenario.) Incremental Analysis for Discontinuation Decision $ Contribution margin lost if laminate flooring product line is dropped Less: Fixed cost savings if laminate flooring product line is dropped Operating income lost if laminate flooring is dropped Total 38,000 0 38,000 $ Decision: Do not drop laminate flooring product line. incur fixed It is incorrect to conclude that dropping laminate flooring would add $32,000 to operating income. If the company discontinues the laminate flooring product line, it will still expenses allocated to laminate flooring. Requirement 2. Assume that the company can avoid $37,000 of fixed expenses by discontinuing the laminate flooring product line (these costs are direct fixed costs of the laminate flooring product line). Prepare an incremental analysis to show whether the company should stop selling laminate flooring. (Enter a "0" in an input box if there is no expected change as a result of discontinuing the laminate flooring in this scenario.) Total Incremental Analysis for Discontinuation Decision Contribution margin lost if laminate flooring product line is dropped $ 38,000 37,000 Less: Fixed cost savings if laminate flooring product line is dropped $ lost Operating income 1,000 if laminate flooring is dropped Decision: Do not drop the laminate flooring product line because, assuming $37,000 of fixed expenses attributable to the laminate flooring product line can be avoided, the loss of contribution margin will still exceed the fixed cost savings. Requirement 3. Now, assume that all of the fixed costs assigned to laminate flooring are direct fixed costs and can be avoided if the company stops selling laminate flooring. However, marketing has concluded that wood flooring sales would be adversely affected by discontinuing the laminate flooring line (retailers want to buy both from the same supplier). Wood flooring production and sales would decline 10%. What should the company do? Prepare an incremental analysis. (Enter a "0" in an input box if there is no expected change as a result of discontinuing the laminate flooring line in this scenario.) Incremental Analysis for Discontinuation Decision Total Laminate flooring contribution margin lost if laminate flooring product line is dropped Wood flooring contribution margin lost if laminate flooring product line is dropped 38000 15400 Less: Fixed cost savings if laminate flooring product line is dropped Operating income vif laminate flooring is dropped Maine Flooring Product Line Contribution Margin Income Statement For the Year Product lines Sales revenue Wood flooring Laminate flooring Company Total 305,000 $ 128,000 $ 433,000 151,000 90,000 241,000 Less: Variable expenses Contribution margin 154,000 $ 38,000 $ 192,000 Less fixed expenses: Manufacturing 72,000 53,000 29,000 $ 61,000 9,000 133,000 62,000 Marketing and administrative Operating income (loss) $ (32,000) $ (3,000)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started