Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I need help with requirements 2 & 3 please Franklin Company uses ABC to account for its chrome wheel manufacturing process. Company managers have identified

I need help with requirements 2 & 3 please

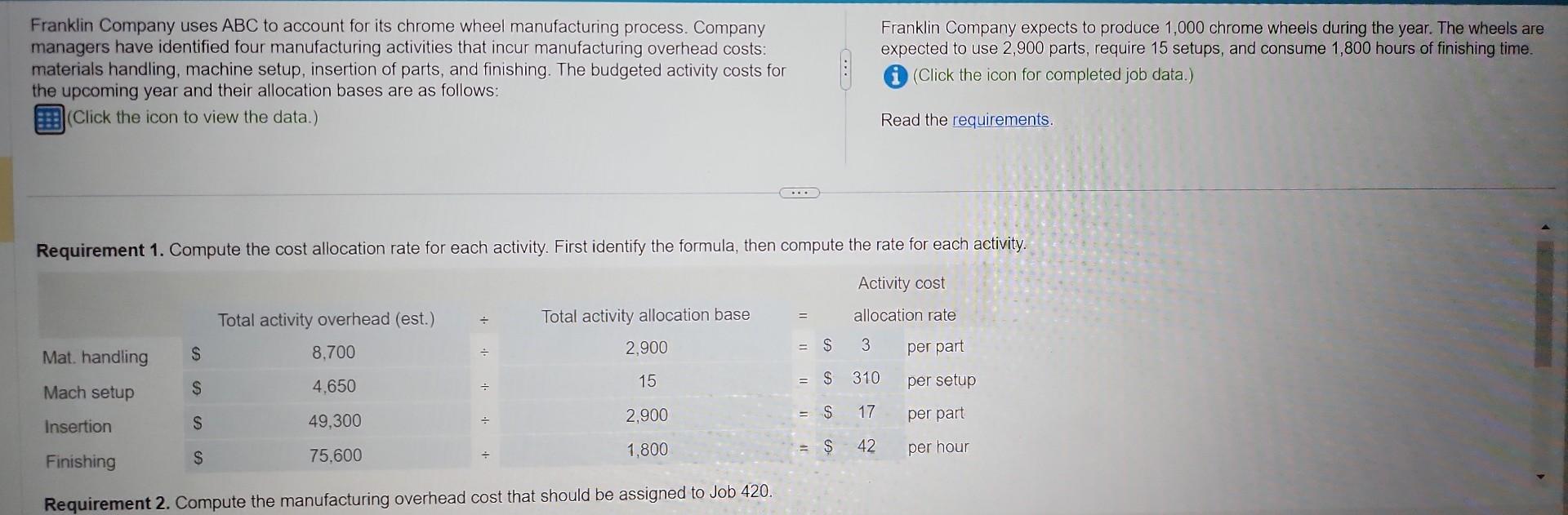

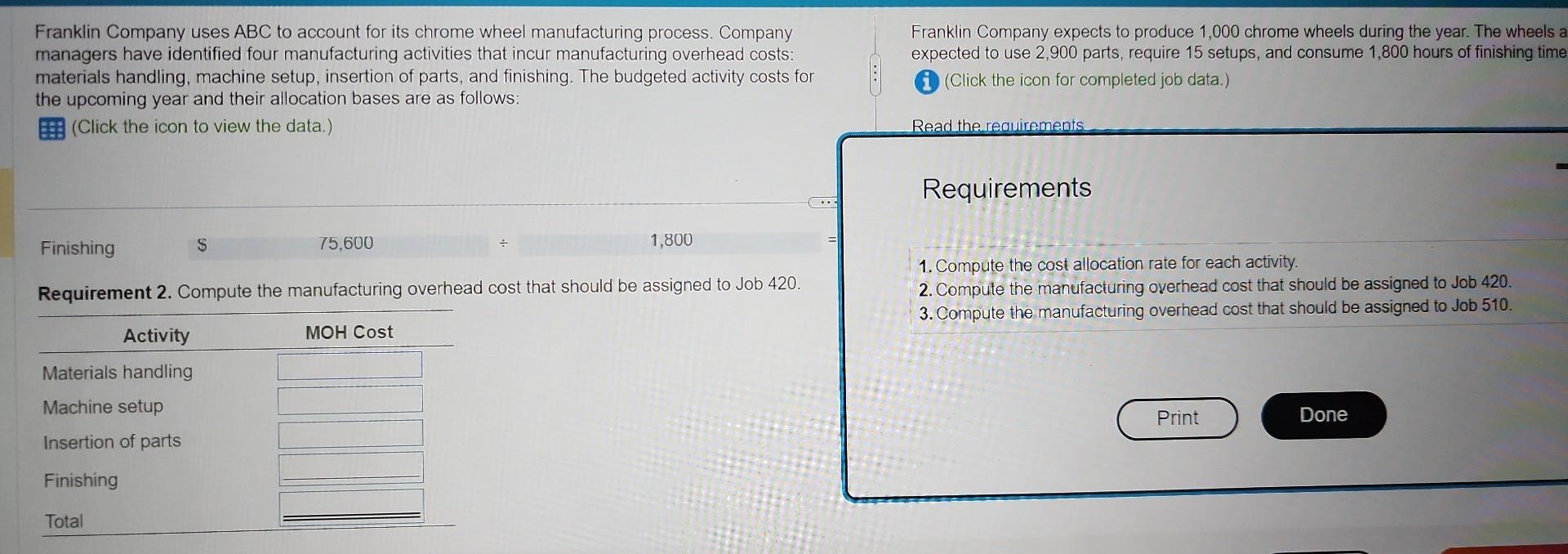

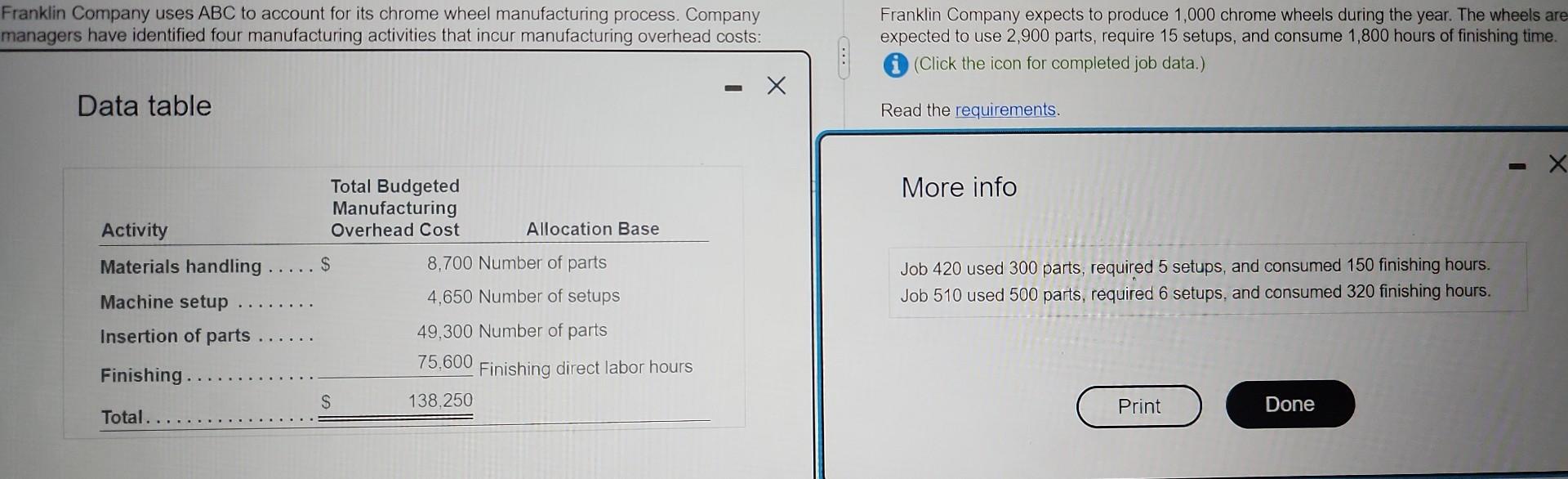

Franklin Company uses ABC to account for its chrome wheel manufacturing process. Company managers have identified four manufacturing activities that incur manufacturing overhead costs: Franklin Company expects to produce 1,000 chrome wheels during the year. The wheels are materials handling, machine setup, insertion of parts, and finishing. The budgeted activity costs for expected to use 2,900 parts, require 15 setups, and consume 1,800 hours of finishing time. the upcoming year and their allocation bases are as follows: (Click the icon to view the data.) (Click the icon for completed job data.) Read the requirements. Requirement 1. Compute the cost allocation rate for each activity. First identify the formula, then compute the rate for each activity. Requirement 2. Compute the manufacturing overhead cost that should be assigned to Job 420 . Franklin Company uses ABC to account for its chrome wheel manufacturing process. Company Franklin Company expects to produce 1,000 chrome wheels during the year. The wheels a managers have identified four manufacturing activities that incur manufacturing overhead costs: expected to use 2,900 parts, require 15 setups, and consume 1,800 hours of finishing time materials handling, machine setup, insertion of parts, and finishing. The budgeted activity costs for (Click the icon for completed job data.) the upcoming year and their allocation bases are as follows: (Click the icon to view the data.) Read the reouirements Requirements 1. Compute the cost allocation rate for each activity. Requirement 2. Compute the manufacturing overhead cost that should be assigned to Job 420. 2. Compute the manufacturing overhead cost that should be assigned to Job 420 . 3. Compute the manufacturing overhead cost that should be assigned to Job 510 . Franklin Company uses ABC to account for its chrome wheel manufacturing process. Company Franklin Company expects to produce 1,000 chrome wheels during the year. The wheels are managers have identified four manufacturing activities that incur manufacturing overhead costs: expected to use 2,900 parts, require 15 setups, and consume 1,800 hours of finishing time. (Click the icon for completed job data.) Data table Read the requirements. More info Job 420 used 300 parts, required 5 setups, and consumed 150 finishing hours. Job 510 used 500 parts, required 6 setups, and consumed 320 finishing hours

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started