Answered step by step

Verified Expert Solution

Question

1 Approved Answer

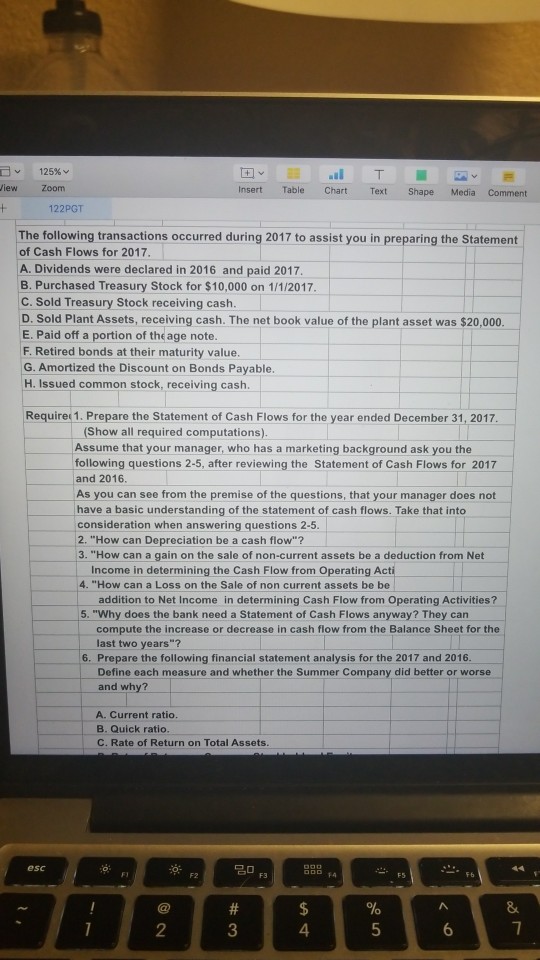

I need help with setting up and answering questions 1-5 125%v iewZoom Insert Table Chart Text Shape Media Comment 122PGT The following transactions occurred during

I need help with setting up and answering questions 1-5

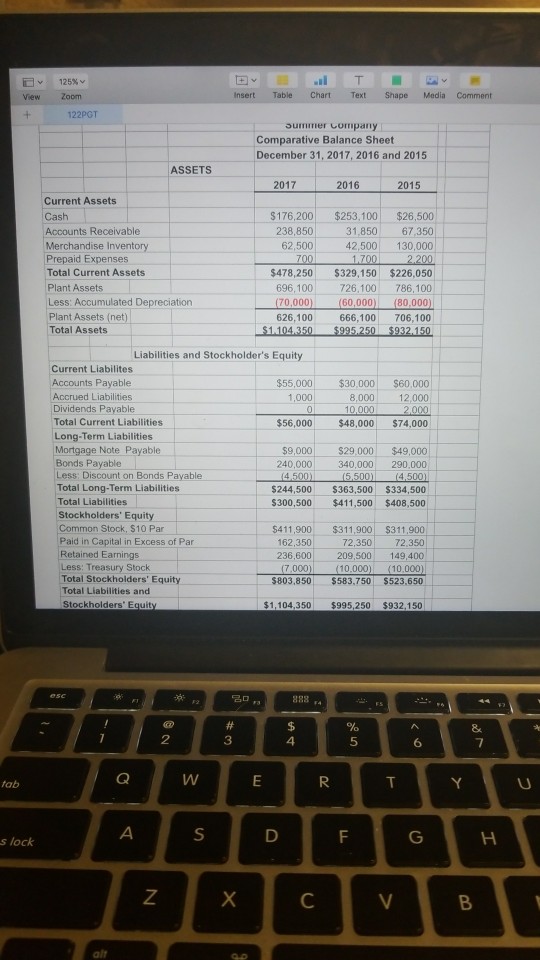

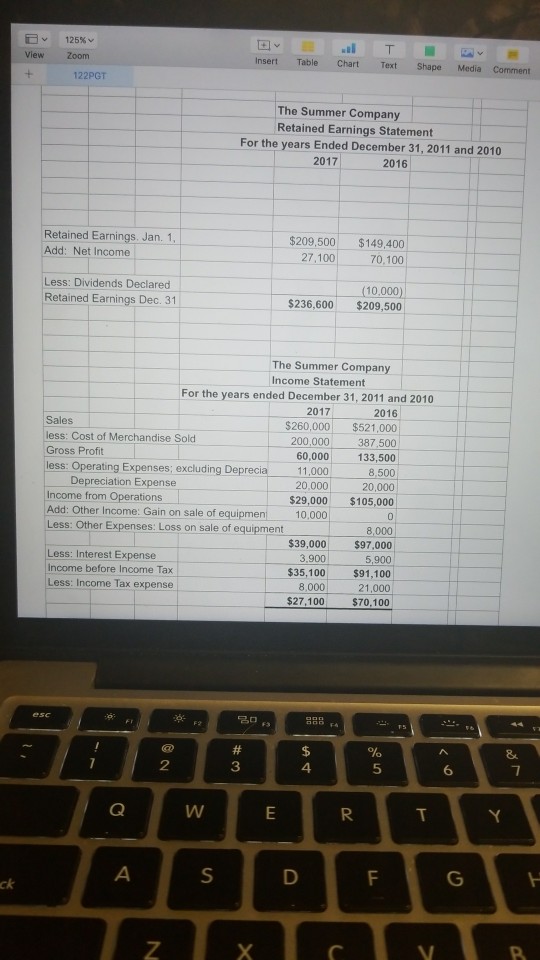

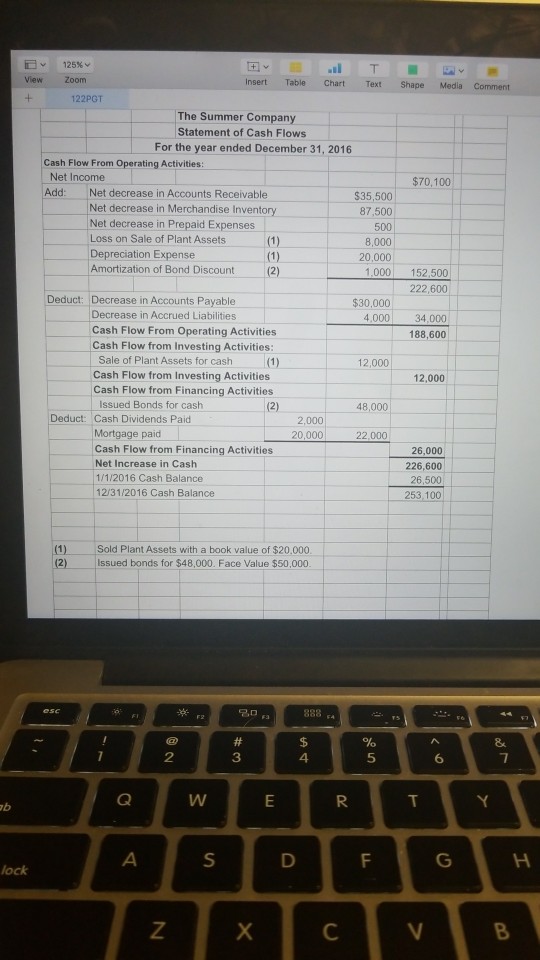

125%v iewZoom Insert Table Chart Text Shape Media Comment 122PGT The following transactions occurred during 2017 to assist you in preparing the Statement of Cash Flows for 2017 A. Dividends were declared in 2016 and paid 2017 B. Purchased Treasury Stock for $10,000 on 1/1/2017 C. Sold Treasury Stock receiving cash D. Sold Plant Assets, receiving cash. The net book value of the plant asset was $20,000. E. Paid off a portion of theage note. F. Retired bonds at their maturity value G. Amortized the Discount on Bonds Payable. H. Issued common stock, receiving cash Require 1. Prepare the Statement of Cash Flows for the year ended December 31, 2017 (Show all required computations) Assume that your manager, who has a marketing background ask you the following questions 2-5, after reviewing the Statement of Cash Flows for 2017 and 2016. As you can see from the premise of the questions, that your manager does not have a basic understanding of the statement of cash flows. Take that into consideration when answering questions 2-5. 2. "How can Depreciation be a cash flow"? 3. "How can a gain on the sale of non-current assets be a deduction from Net Income in determining the Cash Flow from Operating Acti 4. "How can a Loss on the Sale of non current assets be be addition to Net Income in determining Cash Flow from Operating Activities? 5. "Why does the bank need a Statement of Cash Flows anyway? They can compute the increase or decrease in cash flow from the Balance Sheet for the last two years"? 6. Prepare the following financial statement analysis for the 2017 and 2016 Define each measure and whether the Summer Company did better or worse and why? A. Current ratio. B. Quick ratio C. Rate of Return on Total Assets esc F2 F6 2 4 6

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started