Answered step by step

Verified Expert Solution

Question

1 Approved Answer

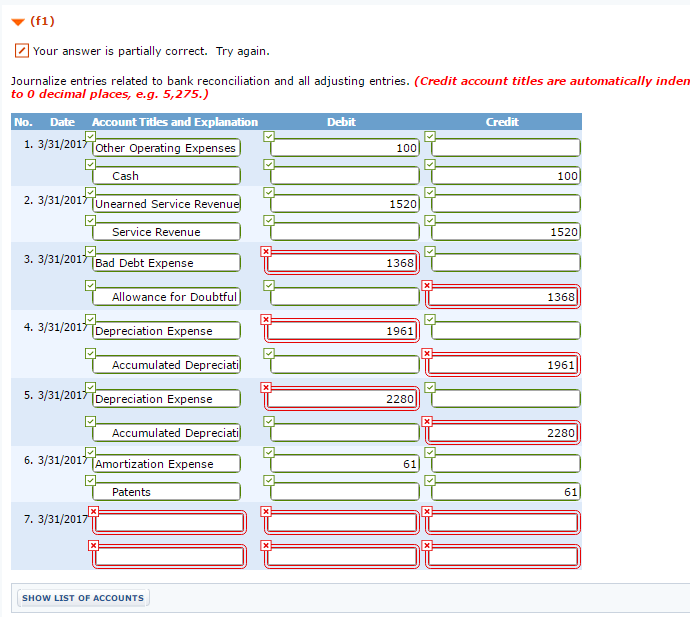

I need help with step f1 (the bottom picture). sorry that's as best as I can make it. Comprehensive Accounting Cycle Review 9-2 (Part evel

I need help with step f1 (the bottom picture).

sorry that's as best as I can make it.

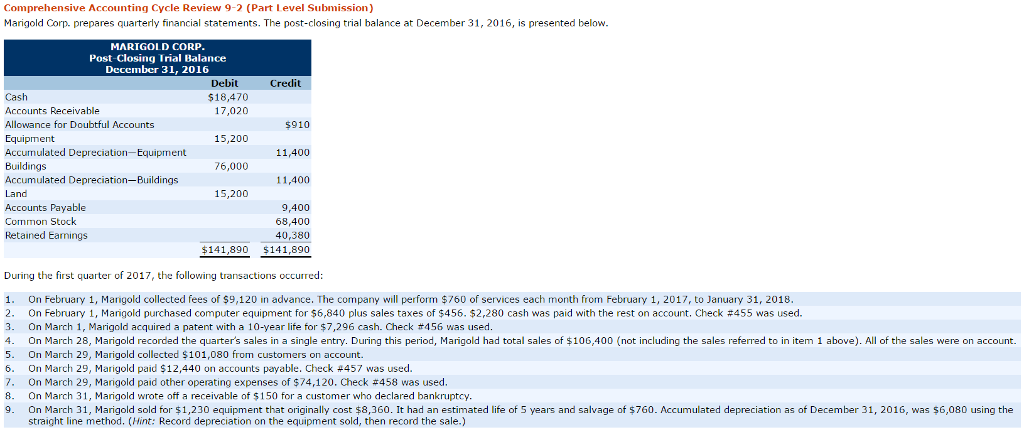

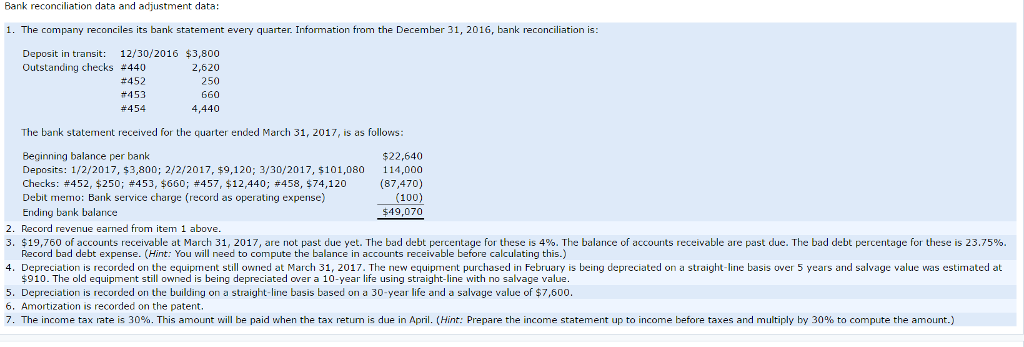

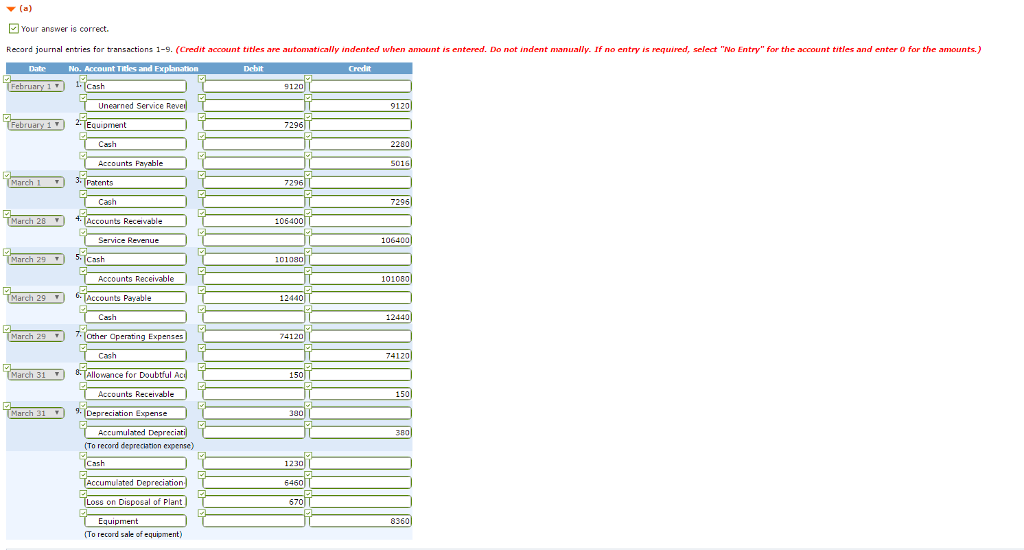

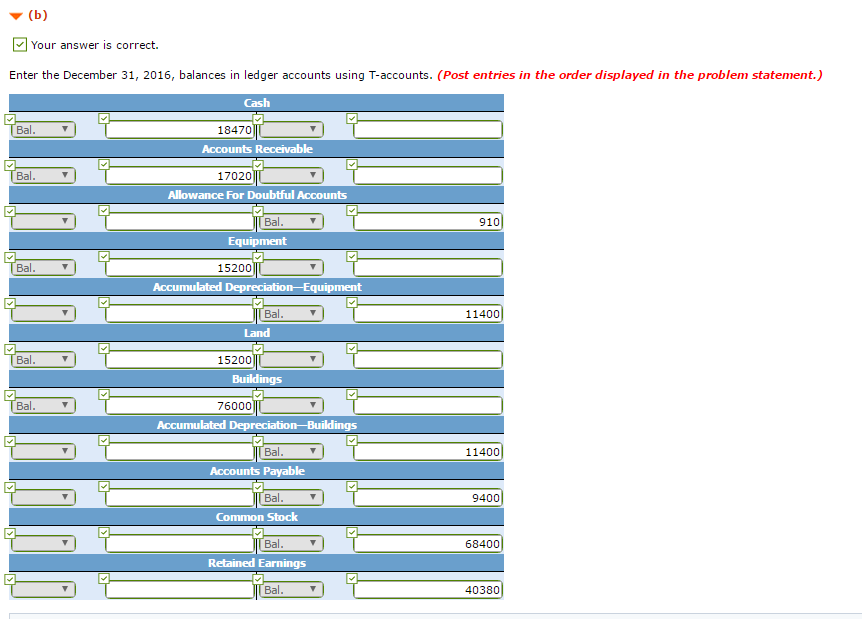

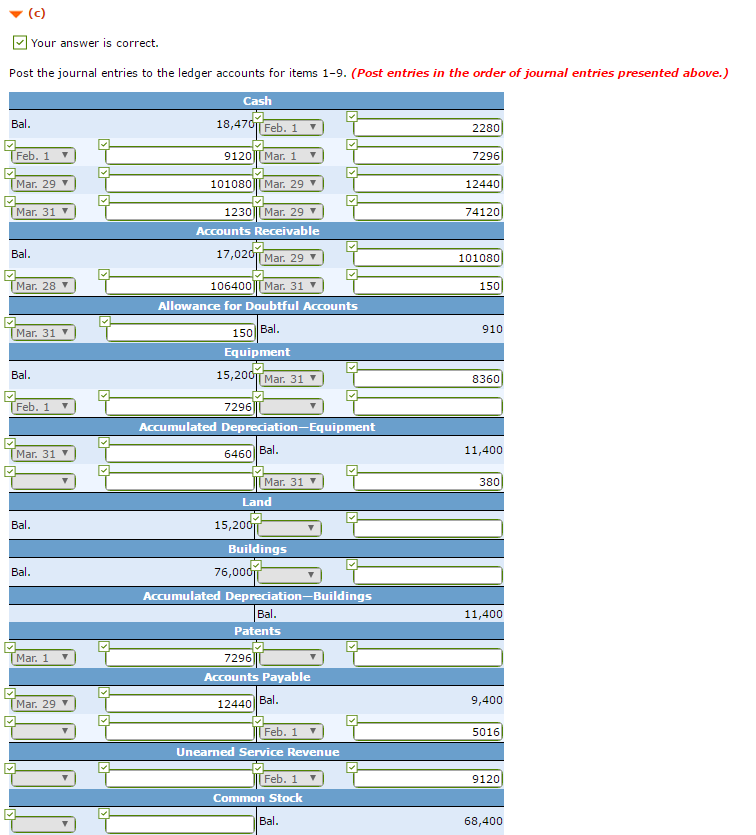

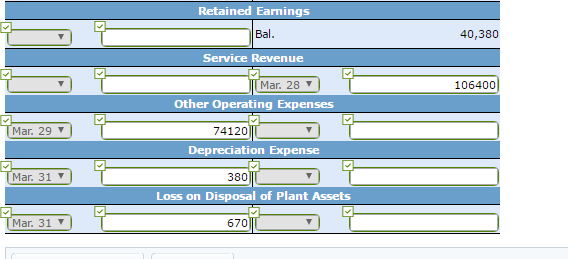

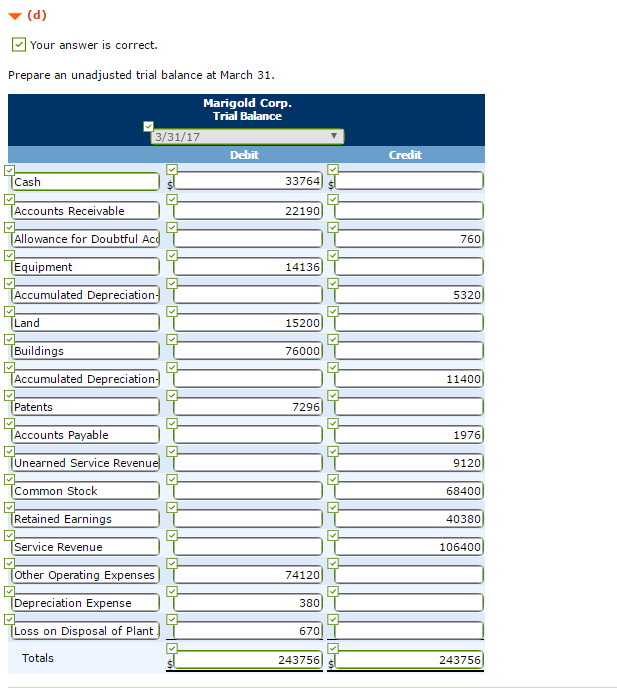

Comprehensive Accounting Cycle Review 9-2 (Part evel Submission) Marigold Corp. prepares quarterly financial statements. The post-closing trial balance at December 31, 2016, is presented below. MARIGOLD CORP. Post-Closing Trial Balance December 31, 2016 Debit Cred $18,470 Cash Accounts Receivable 17,020 Allowance for Doubtful Accounts $910 Equipment 15,200 Accumulated Depreciation-Equipment 11,400 76,000 Buildings Accumulated Depreciation-Buildings 11,400 Land 15,200 Accounts payable 9,400 Common Stock 68,400 Retained Earnings 0,380 $141,890 S141,890 During the first quarter of 2017, the following transactions occurred: 1. On February 1, Marigold collected fees of $9,120 in advance. The company will perform $760 of services each month from February 1, 2017, o January 31, 2018 2. On February 1, Marigold purchased computer equipment for $6,840 plus sales taxes of $456. $2,280 cash was paid with the rest on account. Check 455 was used 3- On March 1, Marigold acquired a patent with a 10-year life for $7,296 cash- Check th456 was used 4. On March 28, Marigold recorded the quarter's sales in a single entry. During this period, Marigold had total sales of $106,400 not including the sales referred to in item 1 above). All of the sales were on account. 5. On March 29, Marigold collected 101,080 from customers on account. 6. On March 29, Marigold paid $12,440 on accounts payable. Check #457 was used 7. On March 29, Marigold paid other operating expenses of $74,120. Check 458 was used 8. On March 3 Marigold wrote off a receivable of $150 for a customer who declared bankruptcy. 9. On March 31, Marigold sold for $1,230 equipment that originally cost $8,360. It had an estimated life of 5 years and salvage of $760. Accumulated depreciation as of December 31, 2016, was $6,080 using the straight line method. (Hint: Record depreciation on the equipment sold then record the sale

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started