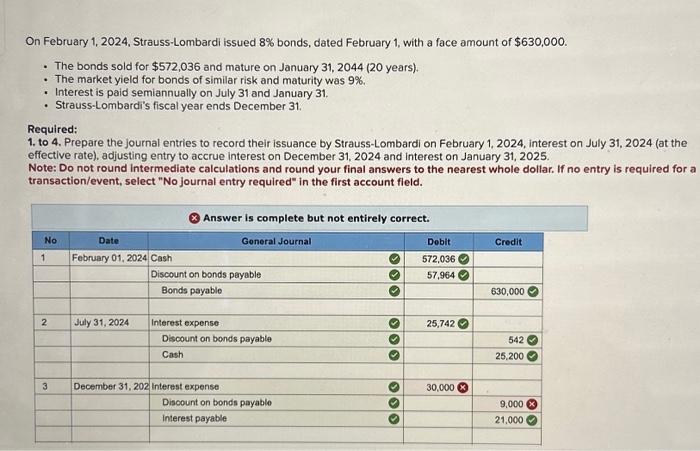

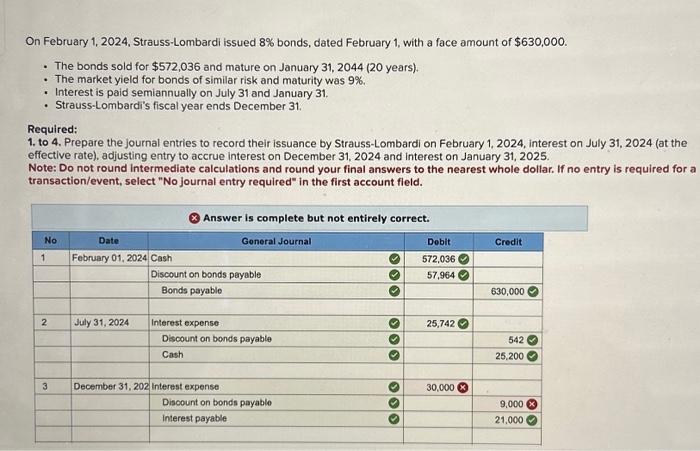

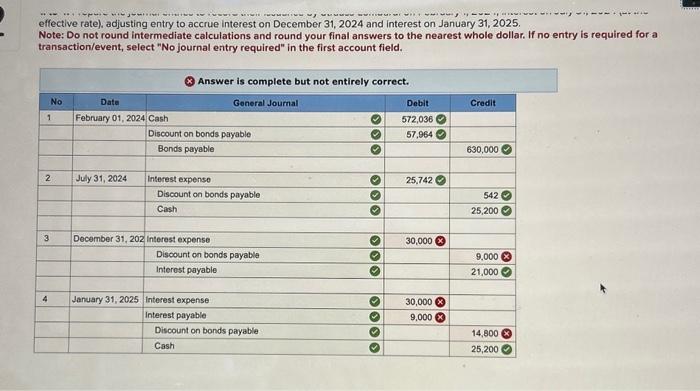

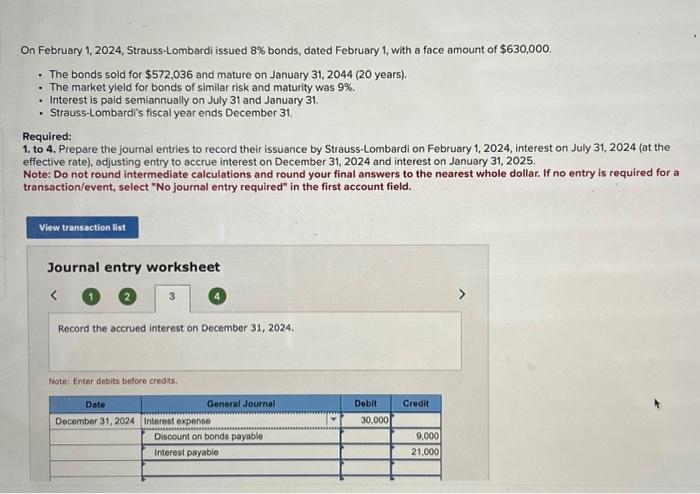

I need help with tabs 3 and 4 the debit and credit dollar amounts, thank you!

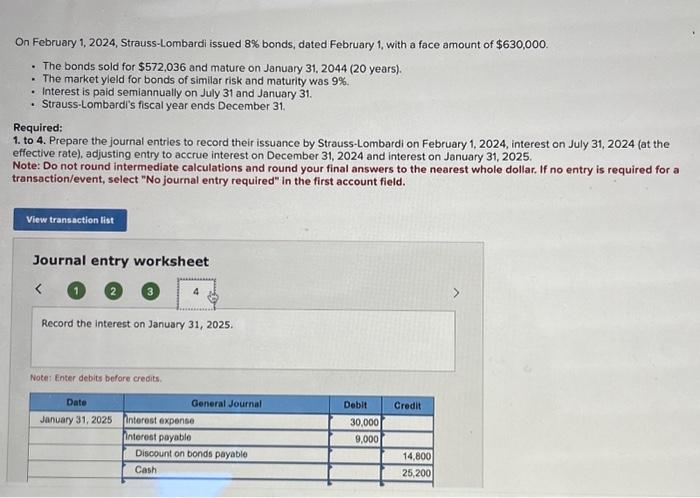

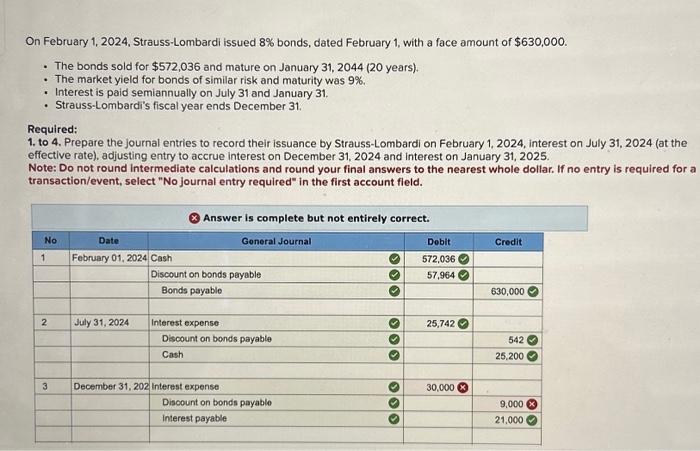

On February 1, 2024, Strauss-Lombardi issued 8% bonds, dated February 1 , with a face amount of $630,000. - The bonds sold for $572,036 and mature on January 31,2044 (20 years). - The market yield for bonds of similar risk and maturity was 9%. - Interest is paid semiannually on July 31 and January 31. - Strauss-Lombardi's fiscal year ends December 31. Required: 1. to 4. Prepare the journal entries to record their issuance by Strauss-Lombardi on February 1, 2024, interest on July 31,2024 (at the effective rate), adjusting entry to accrue interest on December 31, 2024 and interest on January 31, 2025. Note: Do not round intermediate calculations and round your final answers to the nearest whole dollar. If no entry is required for a transaction/event, select "No journal entry required" in the first account field. On February 1, 2024, Strauss-Lombardi issued 8% bonds, dated February 1, with a face amount of $630,000. - The bonds sold for $572,036 and mature on January 31,2044 (20 years). - The market yleid for bonds of similar risk and maturity was 9%. - Interest is paid semiannually on July 31 and January 31. - Strauss-Lombardi's fiscal year ends December 31. Required: 1. to 4. Prepare the journal entries to record their issuance by Strauss-Lombardi on February 1, 2024, interest on July 31,2024 (at the effective rate), adjusting entry to accrue interest on December 31, 2024 and interest on January 31, 2025. Note: Do not round intermediate calculations and round your final answers to the nearest whole dollar. If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Journal entry worksheet Record the interest on January 31, 2025. Note: Enter debits before credits. On February 1, 2024, Strauss-Lombardi issued 8% bonds, dated February 1, with a face amount of $630,000. - The bonds sold for $572,036 and mature on January 31,2044 (20 years). - The market yleld for bonds of similar risk and maturity was 9%. - Interest is paid semiannually on July 31 and January 31. - Strauss-Lombardi's fiscal year ends December 31. Required: 1. to 4. Prepare the journal entries to record their issuance by Strauss-Lombardi on February 1, 2024, interest on July 31,2024 (at the effective rate), adjusting entry to accrue interest on December 31, 2024 and interest on January 31, 2025. Note: Do not round intermediate calculations and round your final answers to the nearest whole dollar. If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Journal entry worksheet Record the accrued interest on December 31, 2024. Note: Enter debits before credits. effective rate), adjusting entry to accrue interest on December 31, 2024 and interest on January 31, 2025. Note: Do not round intermediate calculations and round your final answers to the nearest whole dollar. If no entry is required for a transaction/event, select "No journal entry required" in the first account field