i need help with the adjusted trial balance

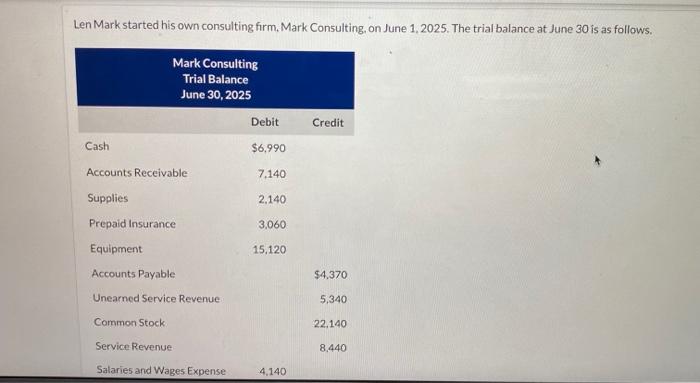

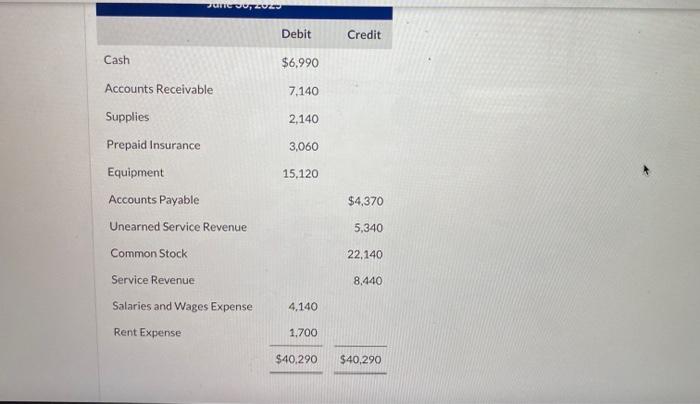

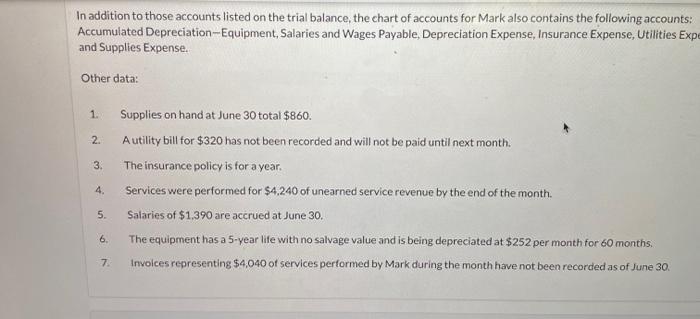

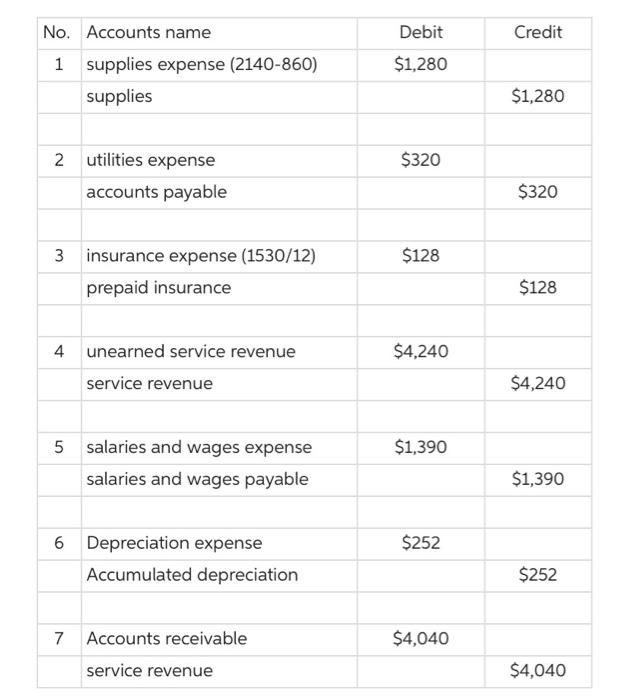

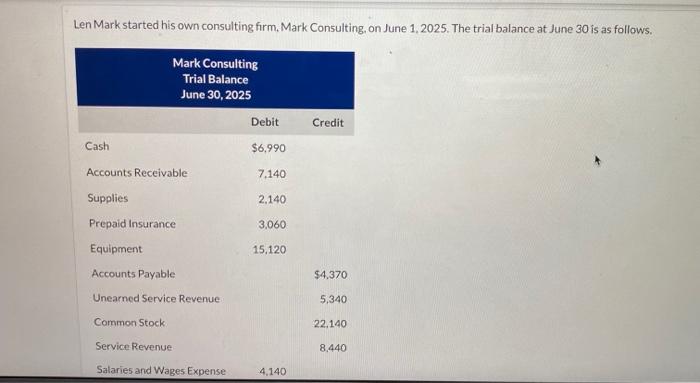

Len Mark started his own consulting firm, Mark Consulting, on June 1,2025. The trial balance at June 30 is as follows. \begin{tabular}{|c|c|c|} \hline & Debit & Credit \\ \hline Cash & $6,990 & \\ \hline Accounts Receivable & 7,140 & \\ \hline Supplies & 2,140 & \\ \hline Prepaid Insurance & 3,060 & \\ \hline Equipment & 15,120 & \\ \hline Accounts Payable & & $4,370 \\ \hline Unearned Service Revenue & & 5,340 \\ \hline Common Stock & & 22,140 \\ \hline Service Revenue & & 8,440 \\ \hline Salaries and Wages Expense & 4,140 & \\ \hline \multirow[t]{2}{*}{ Rent Expense } & 1,700 & \\ \hline & $40,290 & $40,290 \\ \hline \end{tabular} Prepare an adjusted trial balance at June 30,2025 . \begin{tabular}{|c|c|c|c|} \hline No. & Accounts name & Debit & Credit \\ \hline \multirow[t]{2}{*}{1} & supplies expense (2140-860) & $1,280 & \\ \hline & supplies & & $1,280 \\ \hline \multirow[t]{2}{*}{2} & utilities expense & $320 & \\ \hline & accounts payable & & $320 \\ \hline \multirow[t]{2}{*}{3} & insurance expense (1530/12) & $128 & \\ \hline & prepaid insurance & & $128 \\ \hline \multirow{2}{*}{4} & & $4240 & \\ \hline & service revenue & & $4,240 \\ \hline \multirow[t]{2}{*}{5} & salaries and wages expense & $1,390 & \\ \hline & salaries and wages payable & & $1,390 \\ \hline \multirow[t]{2}{*}{6} & Depreciation expense & $252 & \\ \hline & Accumulated depreciation & & $252 \\ \hline \multirow[t]{2}{*}{7} & Accounts receivable & $4,040 & \\ \hline & service revenue & & $4,040 \\ \hline \end{tabular} In addition to those accounts listed on the trial balance, the chart of accounts for Mark also contains the following accounts: Accumulated Depreciation-Equipment, Salaries and Wages Payable, Depreciation Expense, Insurance Expense, Utilities Exp and Supplies Expense. Other data: 1. Supplies on hand at June 30 total $860. 2. A utility bill for $320 has not been recorded and will not be paid until next month. 3. The insurance policy is for a year. 4. Services were performed for $4,240 of unearned service revenue by the end of the month. 5. Salaries of $1,390 are accrued at June 30. 6. The equipment has a 5 -year life with no salvage value and is being depreciated at $252 per month for 60 months. 7. Invoices representing $4,040 of services performed by Mark during the month have not been recorded as of June 30