Question

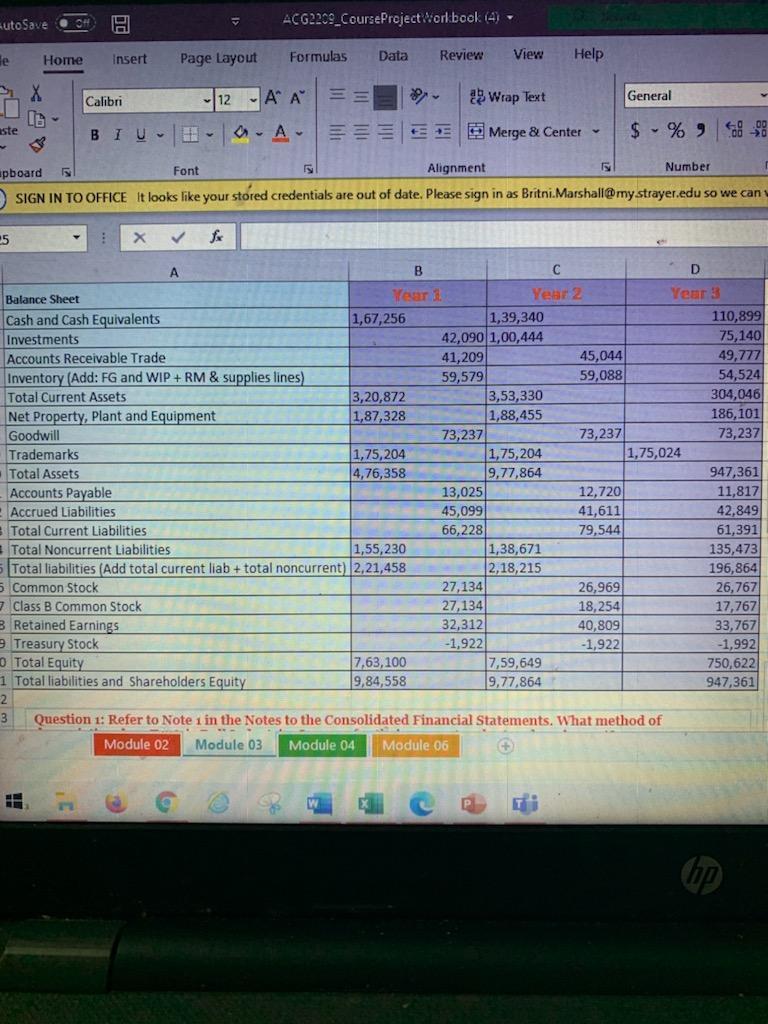

I need help with the answers below , I included the information that you use for the questions in the chart above Question 5: Calculate

I need help with the answers below , I included the information that you use for the questions in the chart above

Question 5: Calculate Tootsie Roll Industry Inc's inventory turnover ratio for the most recent year and interpret its meaning. Show your work. (Hint: Inventory turnover ratio is calculated as Product Cost of Goods Sold/Average Inventory.)

Question 6: Has the total current assets amount show an increasing or decreasing trend from one year to the next? What account or accounts experienced the largest change? (Hint: To find the amount of change, subtract the prior year amount from the current year amount. Positive answers mean the account has increased by that amount, negative answers mean the account has decreased by that amount.)

Question 7: Is the amount of current liabilities more or less than the long-term liabilities for the most recent year? What does the result mean?

Question 8: Is the total stockholders' equity more or less than total liabilities for the most recent year? What does the result mean?

Question 9: Calculate the debt ratio and current ratio for your company for the most recent year. Generally speaking, what do these ratios tell you? (Hint: Debt ratio is calculated as Total Liabilities/Total Assets; Current ratio is calculated as Total Current Assets/Total Current Liabilities.)

Question 10: What is the main reason for the change in stockholders' equity? What is the largest component of stockholders' equity?

Question 11: How many classes of common stock does the company have? For each class, how many shares are authorized, issued, and outstanding? (To find outstanding shares, subtract any treasury stock for that class from the number issued to find the number outstanding.)

Question 12: Calculate the Return on Stockholder's Equity for the most recent year and interpret its meaning. Show your work. (Hint: Return on Stockholders Equity is calculated as Net Earnings/Average Total Equity.)

AutoSave H ACG2209_Course Project Workbook (4) - Home de Insert Page Layout Formulas Data Review View Help X Calibri 12 - A A == 2 Wrap Text General aste BIU a-A- E Merge & Center $ % 9 pboard Font Alignment Number SIGN IN TO OFFICE It looks like your stored credentials are out of date. Please sign in as Britni. Marshall@my.strayer.edu so we can 5 fx A B D Balance Sheet Wear Year 2 Year 3 Cash and Cash Equivalents 1,67,256 1,39,340 110,899 Investments 42,090 1,00,444 75,140 Accounts Receivable Trade 41,209 45,044 49,777 Inventory (Add: FG and WIP + RM & supplies lines) 59,579 59,088 54,524 Total Current Assets 3,20,872 3,53,330 304,046 Net Property, Plant and Equipment 1,87,328 1,88,455 186, 101 Goodwill 73,237 73,237 73,237 Trademarks 1,75,204 1,75, 204 1,75,024 Total Assets 4,76,358 9,77,864 947,361 Accounts Payable 13,025 12,720 11,817 Accrued Liabilities 45,099 41,611 42,849 Total Current Liabilities 66,228 79,544 61,391 Total Noncurrent Liabilities 1,55,230 1,38,671 135,473 Total liabilities (Add total current liab + total noncurrent) 2,21,458 2,18,215 196,864 5 Common Stock 27,134 26,969 26,767 Class B Common Stock 27,134 18,254 17,767 B Retained Earnings 32,312 40,809 33,767 Treasury Stock -1,922 -1,922 -1,992 Total Equity 7,63,100 7,59,649 750,622 1 Total liabilities and Shareholders Equity 19,84,558 19,77,864 947,361 2 3 Question 1: Refer to Note 1 in the Notes to the Consolidated Financial Statements. What method of Module 02 Module 03 Module 04 Module 06 HH op AutoSave H ACG2209_Course Project Workbook (4) - Home de Insert Page Layout Formulas Data Review View Help X Calibri 12 - A A == 2 Wrap Text General aste BIU a-A- E Merge & Center $ % 9 pboard Font Alignment Number SIGN IN TO OFFICE It looks like your stored credentials are out of date. Please sign in as Britni. Marshall@my.strayer.edu so we can 5 fx A B D Balance Sheet Wear Year 2 Year 3 Cash and Cash Equivalents 1,67,256 1,39,340 110,899 Investments 42,090 1,00,444 75,140 Accounts Receivable Trade 41,209 45,044 49,777 Inventory (Add: FG and WIP + RM & supplies lines) 59,579 59,088 54,524 Total Current Assets 3,20,872 3,53,330 304,046 Net Property, Plant and Equipment 1,87,328 1,88,455 186, 101 Goodwill 73,237 73,237 73,237 Trademarks 1,75,204 1,75, 204 1,75,024 Total Assets 4,76,358 9,77,864 947,361 Accounts Payable 13,025 12,720 11,817 Accrued Liabilities 45,099 41,611 42,849 Total Current Liabilities 66,228 79,544 61,391 Total Noncurrent Liabilities 1,55,230 1,38,671 135,473 Total liabilities (Add total current liab + total noncurrent) 2,21,458 2,18,215 196,864 5 Common Stock 27,134 26,969 26,767 Class B Common Stock 27,134 18,254 17,767 B Retained Earnings 32,312 40,809 33,767 Treasury Stock -1,922 -1,922 -1,992 Total Equity 7,63,100 7,59,649 750,622 1 Total liabilities and Shareholders Equity 19,84,558 19,77,864 947,361 2 3 Question 1: Refer to Note 1 in the Notes to the Consolidated Financial Statements. What method of Module 02 Module 03 Module 04 Module 06 HH opStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started