Answered step by step

Verified Expert Solution

Question

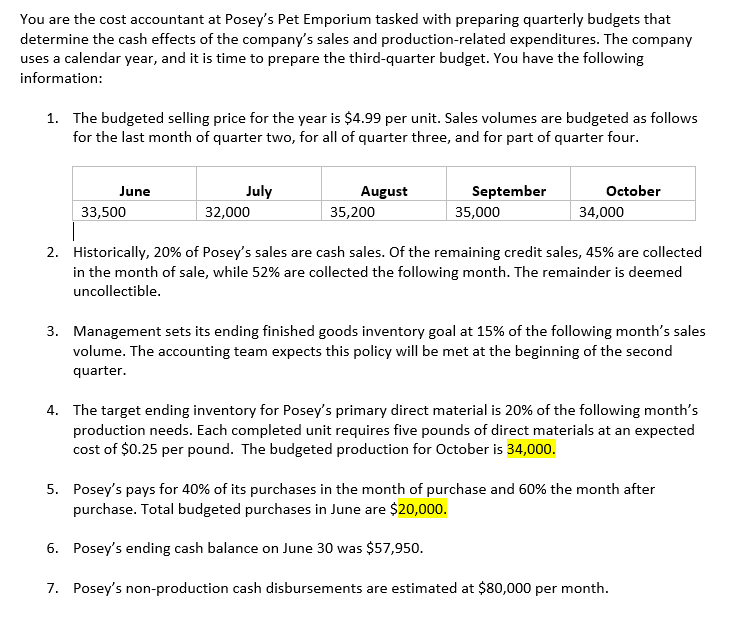

1 Approved Answer

I need help with the COGS part. Calculate accurately what the total cost of goods sold (COGS) per unit should be for the company to

I need help with the COGS part.

Calculate accurately what the total cost of goods sold (COGS) per unit should be for the company to generate 50% gross margin on its sales using correct Excel formulas. Consider the following question to guide your response:

Considering the direct material cost per unit already known, how much of this total COGS per unit is available to cover direct labor and manufacturing overhead (MOH) costs?

| Posey's Pet Emporium | |

| Selling price | 4.99 |

| Less: Target gross margin percentage | [Insert formula] |

| Cost of goods sold | [Insert formula] |

| Less: DM cost per unit | [Insert formula] |

| Additional cost per unit to cover DL and MOH | [Insert formula] |

| Posey's Pet Emporium | ||

| Budget Data | ||

| Budgeted selling price | 4.99 | |

| Sales Volume Budgets | ||

| June | 33,500 | |

| July | 32,000 | |

| August | 35,200 | |

| September | 35,000 | |

| October | 34,000 | |

| Percentage of Sales | ||

| Cash sales | 20% | |

| Credit collected in | ||

| Month of sale | 45% | |

| Following month | 52% | |

| Uncollectable | 3% | |

| FG (finished goods) inventory goal | 15% | following month's sales volume |

| Target ending inventory DM (direct materials) | 20% | |

| Pounds per completed unit of DM | 5 | |

| Expected cost per pound | 0.25 | |

| Percentage of Purchase Payments | ||

| Month of purchase | 40% | |

| Month after purchase | 60% | |

| Budgeted purchases - June | 20,000 | |

| Other cash disbursements per month | 80,000 | |

| Beginning cash balance - July | 57950 | |

| Posey's Pet Emporium -SALES FORECAST & CASH RECEIPTS | ||||

| Sales Forecast | July | August | September | Quarter |

| Budgeted sales volume | 32,000 | 35,200 | 35,000 | 102,200 |

| Budgeted selling price | 4.99 | 4.99 | 4.99 | 4.99 |

| Budgeted sales revenue | 159,680 | 175,648 | 174,650 | 509,978 |

| Cash Receipts Budget | July | August | September | Quarter |

| Beginning A/R (June collections) | 69,541 | 69,541 | ||

| July cash sales | 31,936 | 31,936 | ||

| July credit sales | 57,485 | 66,427 | 123,912 | |

| August cash sales | 35,130 | 35,130 | ||

| August credit sales | 63,233 | 73,070 | 136,303 | |

| September cash sales | 34,930 | 34,930 | ||

| September credit sales | 62,874 | 62874 | ||

| Total cash receipts | 158,961 | 164,790 | 170,874 | 494,625 |

| Posey's Pet Emporium -PRODUCTION & DM PURCHASES | ||||

| Production Budget | July | August | September | Quarter |

| Budgeted sales volume | 32,000 | 35,200 | 35,000 | 102,200 |

| Add: Target ending FG inventory | 5,280 | 5,250 | 5,100 | 15,630 |

| Total units needed | 37,280 | 40,450 | 40,100 | 117,830 |

| Less: Beginning FG inventory | 4,800 | 5,280 | 5,250 | 15,330 |

| Budgeted units to be produced | 32,480 | 35,170 | 34,850 | 102,500 |

| DM Purchases Budget | July | August | September | Quarter |

| Budgeted units to be produced | 32,480 | 35,170 | 34,850 | 102,500 |

| Pounds of DM per unit | 5 | 5 | 5 | 5 |

| Total production needs (pounds) | 162,400 | 175,850 | 174,250 | 512,500 |

| Add:Target ending DM inventory (pounds) | 35,170 | 34,850 | 34,000 | 104,020 |

| Total DM inventory needs (pounds) | 197,570 | 210,700 | 208,250 | 616,520 |

| Less: Beginning DM inventory (pounds) | 32,480 | 35,170 | 34,850 | 102,500 |

| Budgeted pounds of DM to be purchased | 165,090 | 175,530 | 173,400 | 514,020 |

| DM cost per pound | $ 0.25 | $ 0.25 | $ 0.25 | $ 0.25 |

| Total budgeted cost of DM purchases | $ 41,272.50 | $ 43,882.50 | $ 43,350.00 | $ 128,505.00 |

| Posey's Pet Emporium- CASH DISBURSEMENTS BUDGET | ||||

| DM Cash Disbursements | July | August | September | Quarter |

| A/P balance from June* | 12,000 | 12,000 | ||

| July purchases | $ 16,509.00 | $ 24,763.50 | 41,273 | |

| August purchases | $ 17,553.00 | $ 26,329.50 | 43,883 | |

| September purchases | $ 17,340.00 | 17,340 | ||

| Total DM Cash Disbursements | 28,509 | 42,317 | 43,670 | 114,495 |

| Other Cash Disbursements | 80000 | 80000 | 80000 | 240000 |

| Total Cash Disbursements | 108,509 | 122,317 | 123,670 | 354,495 |

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started