Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I need help with the cost of sale t-accounts and the income statement Steven & Joseph, a consulting firm, specializes in providing internal audit services

I need help with the cost of sale t-accounts and the income statement

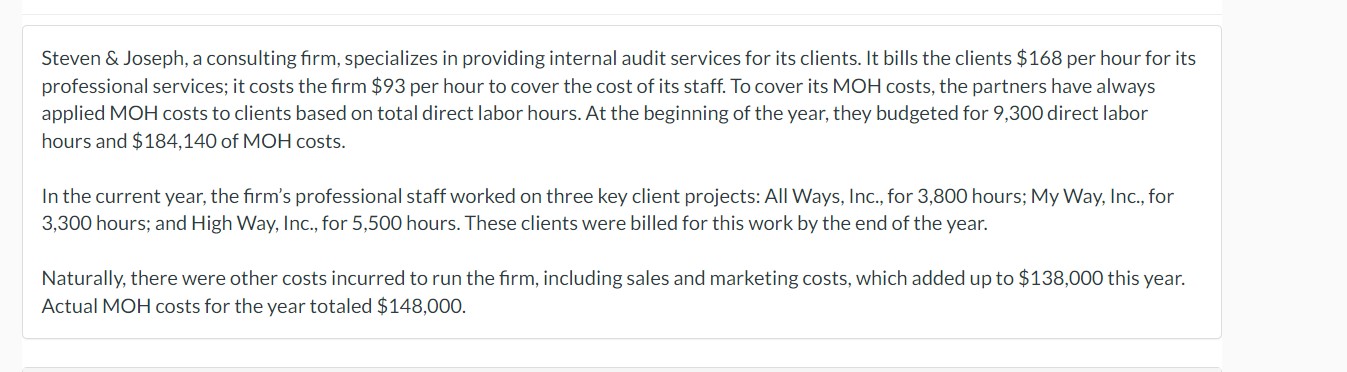

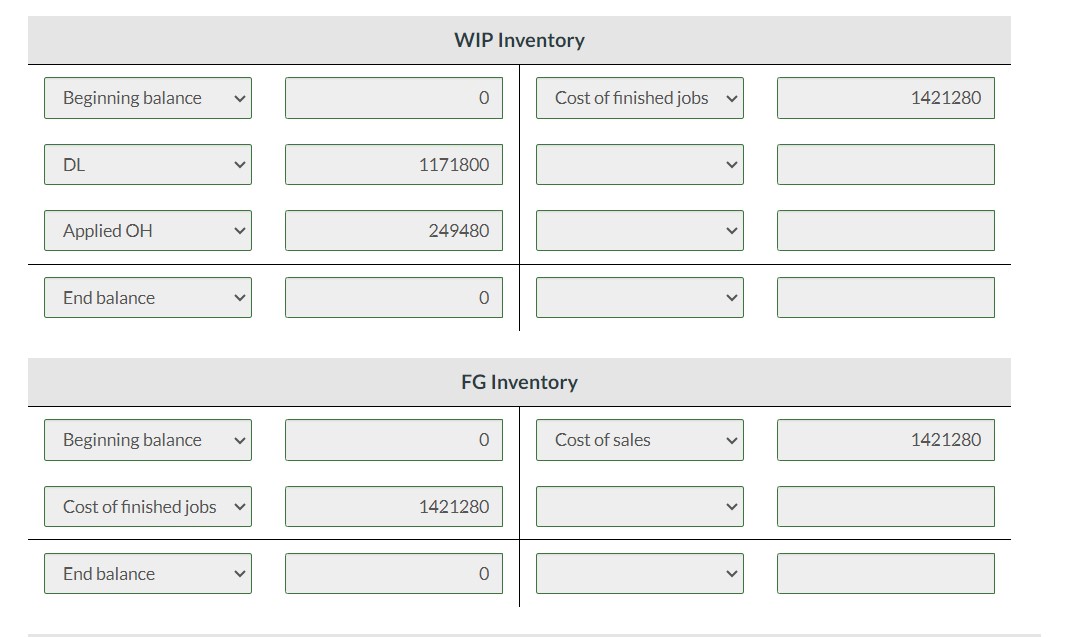

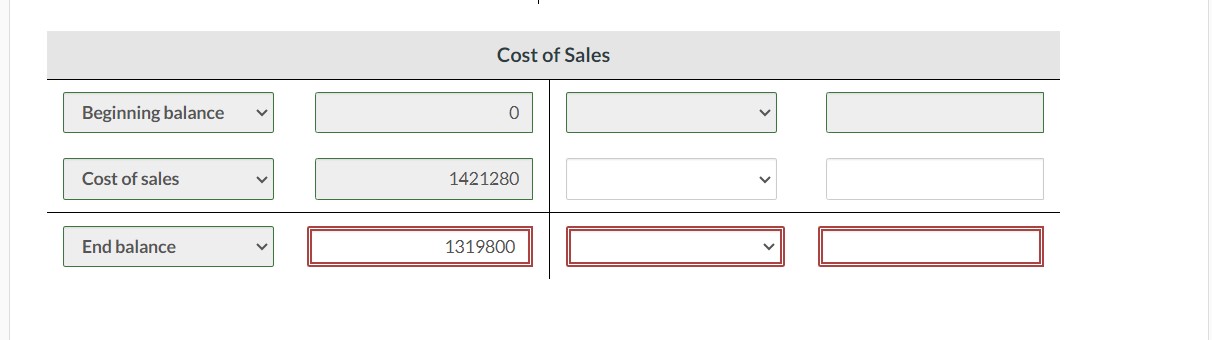

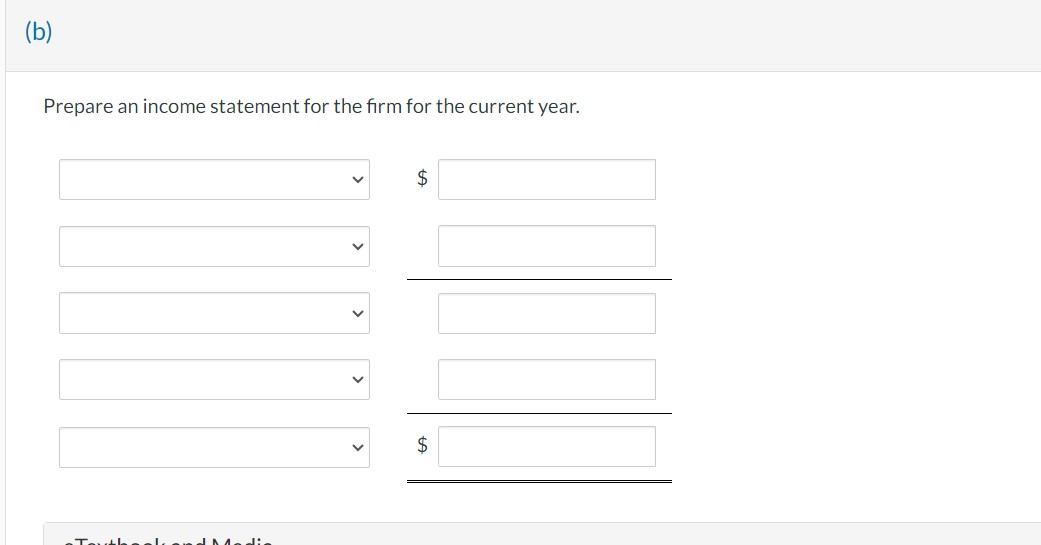

Steven \& Joseph, a consulting firm, specializes in providing internal audit services for its clients. It bills the clients $168 per hour for its professional services; it costs the firm $93 per hour to cover the cost of its staff. To cover its MOH costs, the partners have always applied MOH costs to clients based on total direct labor hours. At the beginning of the year, they budgeted for 9,300 direct labor hours and $184,140 of MOH costs. In the current year, the firm's professional staff worked on three key client projects: All Ways, Inc., for 3,800 hours; My Way, Inc., for 3,300 hours; and High Way, Inc., for 5,500 hours. These clients were billed for this work by the end of the year. Naturally, there were other costs incurred to run the firm, including sales and marketing costs, which added up to $138,000 this year. Actual MOH costs for the year totaled $148,000. WIP Inventory Beginning balance End balance Beginning balance Cost of finished jobs End balance Cost of finished jobs FG Inventory Cost of sales (b) Prepare an income statement for the firm for the current year. $ $ Determine the gross margin percentage and the profit margin percentage. (Round answers to 2 decimal places, e.g. 52.75%.) Gross margin percentage Profit margin percentage % % eTextbook and Media

Steven \& Joseph, a consulting firm, specializes in providing internal audit services for its clients. It bills the clients $168 per hour for its professional services; it costs the firm $93 per hour to cover the cost of its staff. To cover its MOH costs, the partners have always applied MOH costs to clients based on total direct labor hours. At the beginning of the year, they budgeted for 9,300 direct labor hours and $184,140 of MOH costs. In the current year, the firm's professional staff worked on three key client projects: All Ways, Inc., for 3,800 hours; My Way, Inc., for 3,300 hours; and High Way, Inc., for 5,500 hours. These clients were billed for this work by the end of the year. Naturally, there were other costs incurred to run the firm, including sales and marketing costs, which added up to $138,000 this year. Actual MOH costs for the year totaled $148,000. WIP Inventory Beginning balance End balance Beginning balance Cost of finished jobs End balance Cost of finished jobs FG Inventory Cost of sales (b) Prepare an income statement for the firm for the current year. $ $ Determine the gross margin percentage and the profit margin percentage. (Round answers to 2 decimal places, e.g. 52.75%.) Gross margin percentage Profit margin percentage % % eTextbook and Media Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started