I need help with the following journal entries:

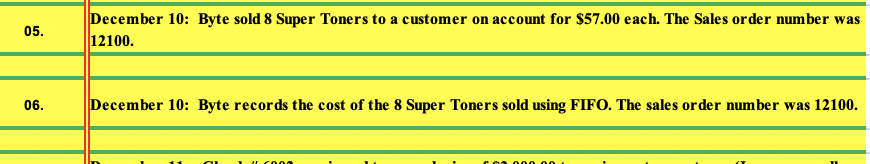

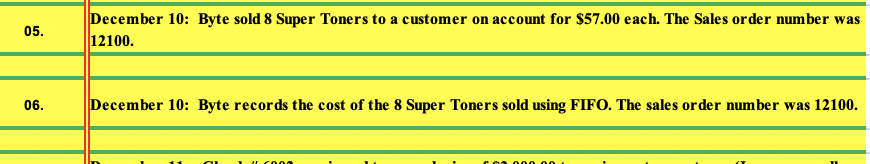

- Journal Entry #6

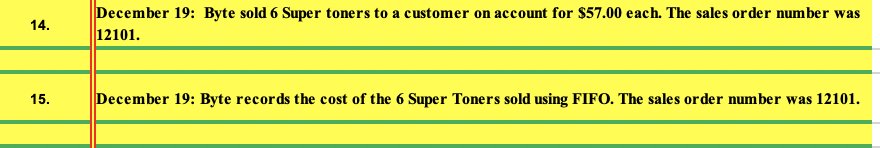

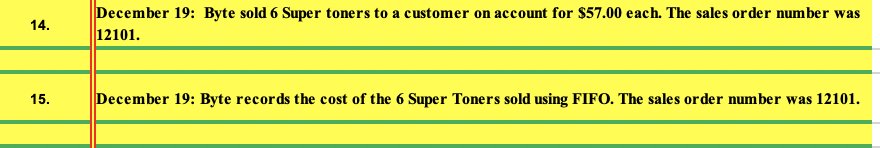

- Journal Entry #15

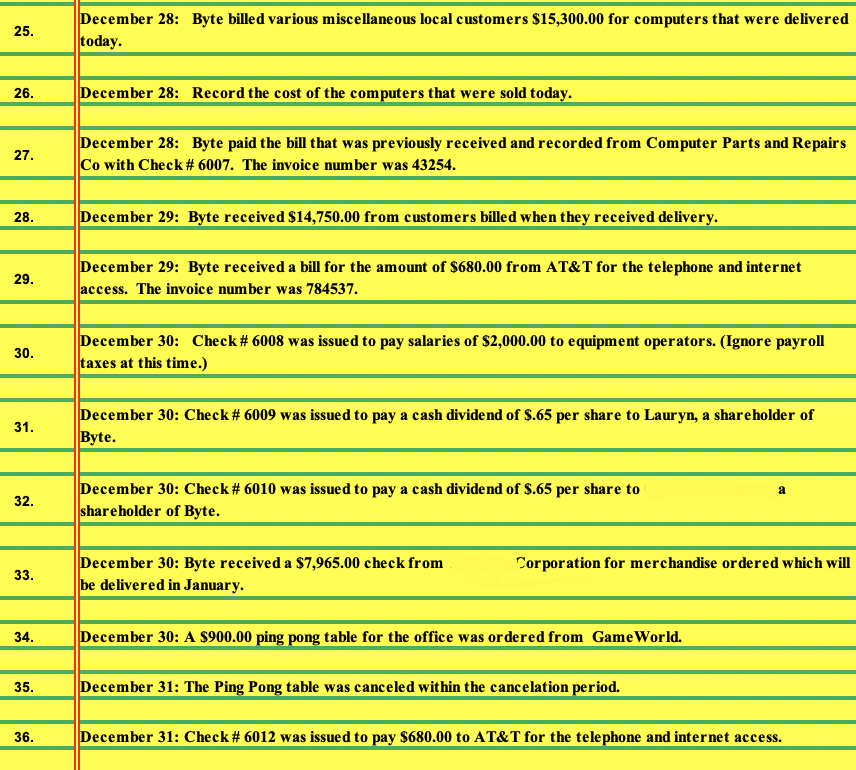

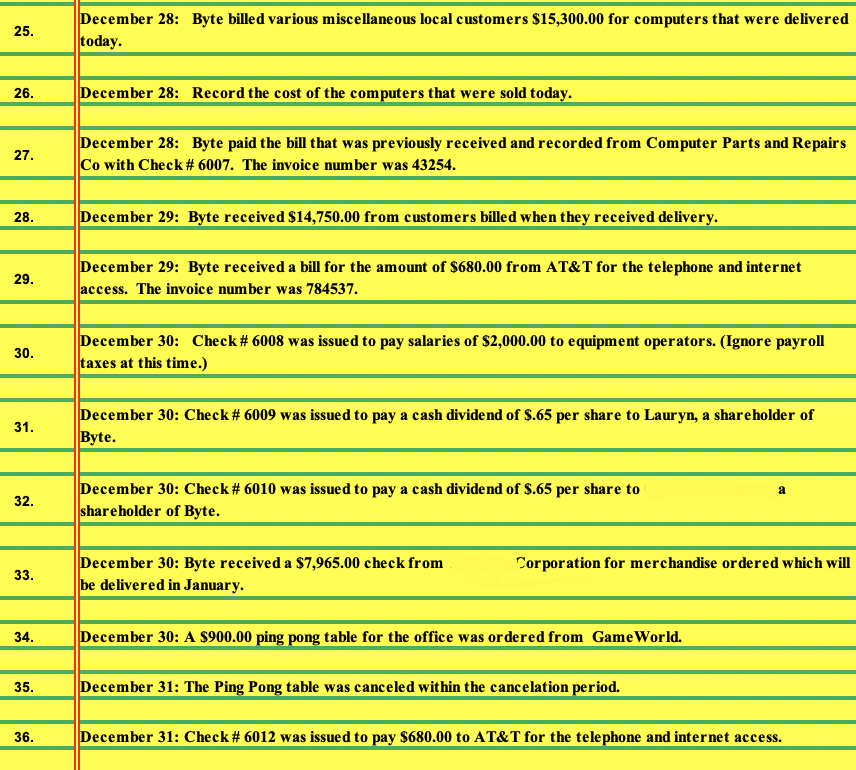

- Journal Entry #25-36

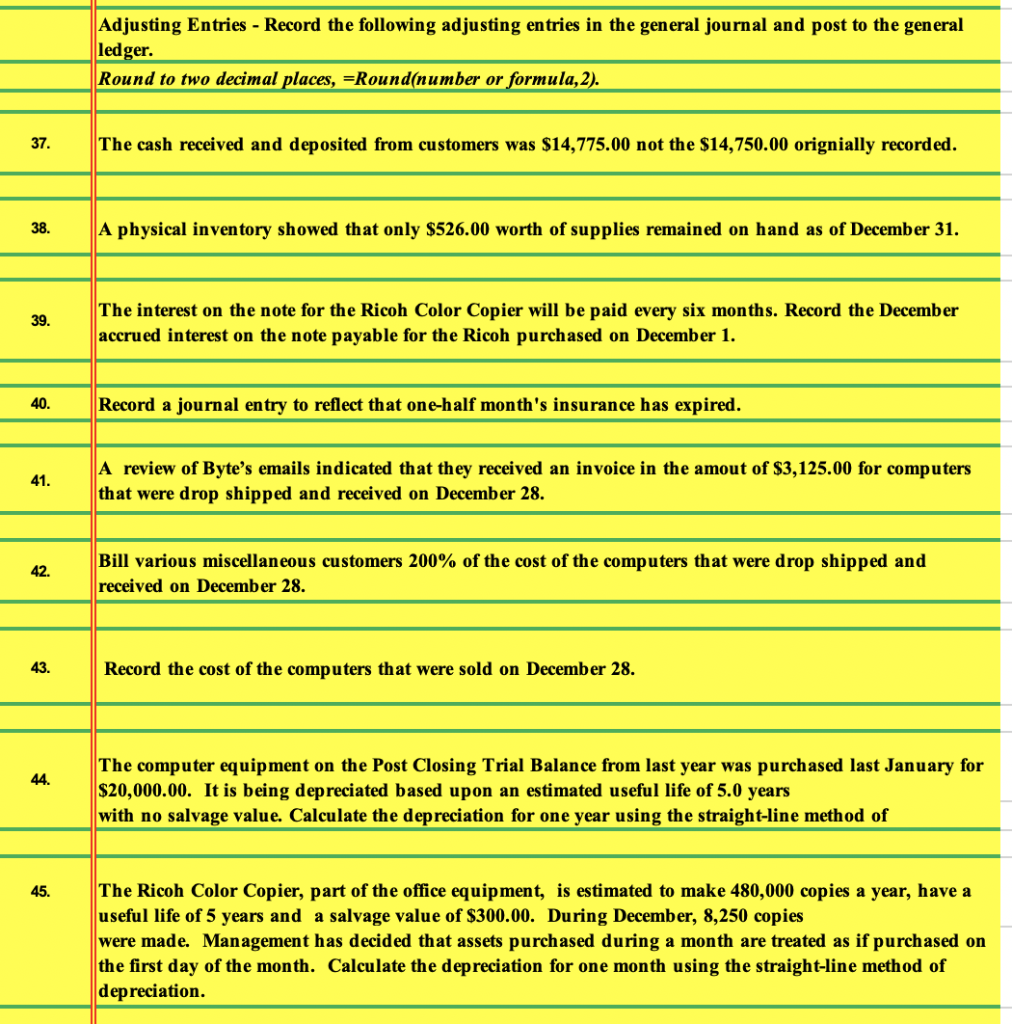

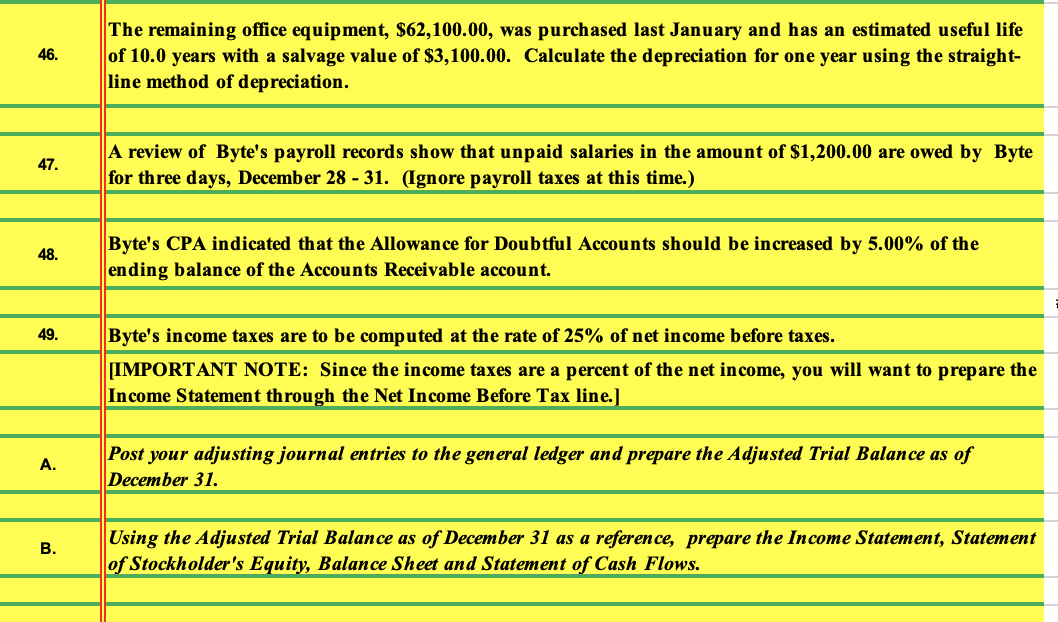

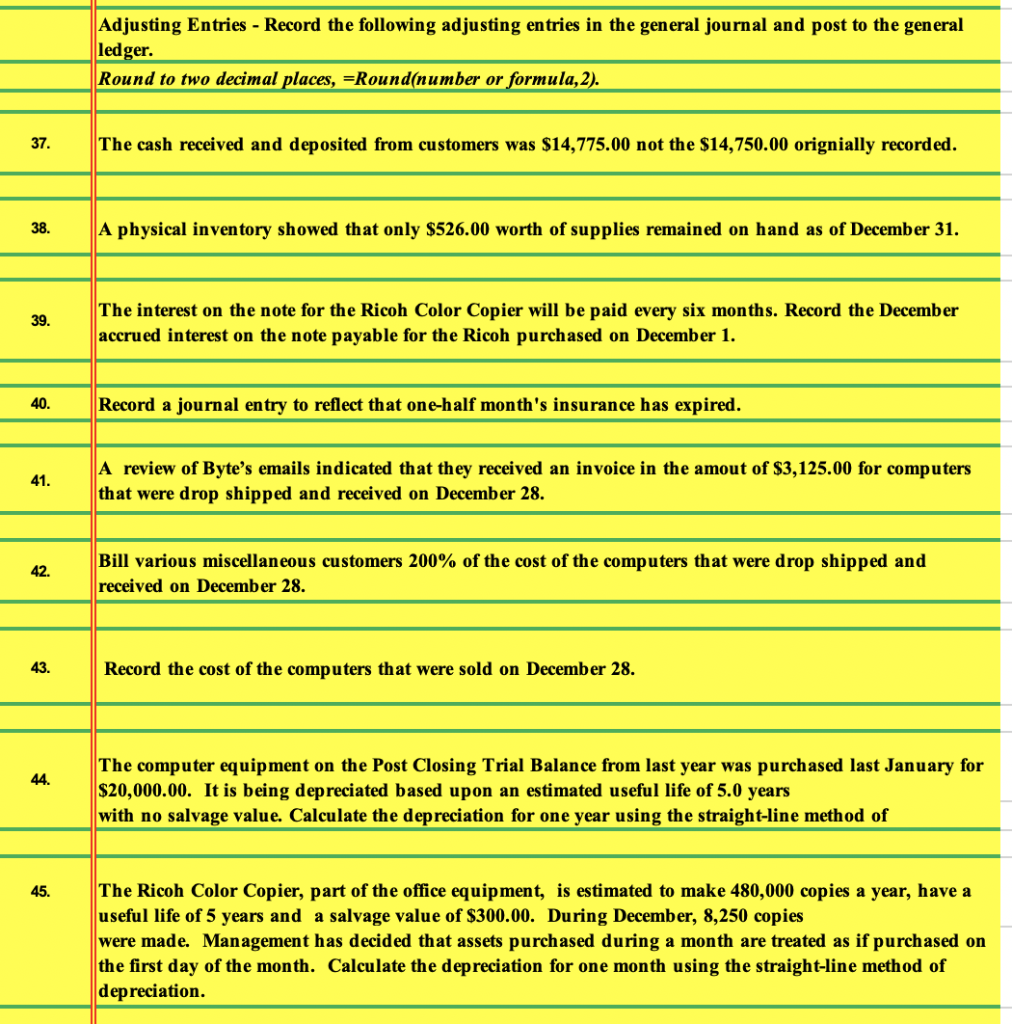

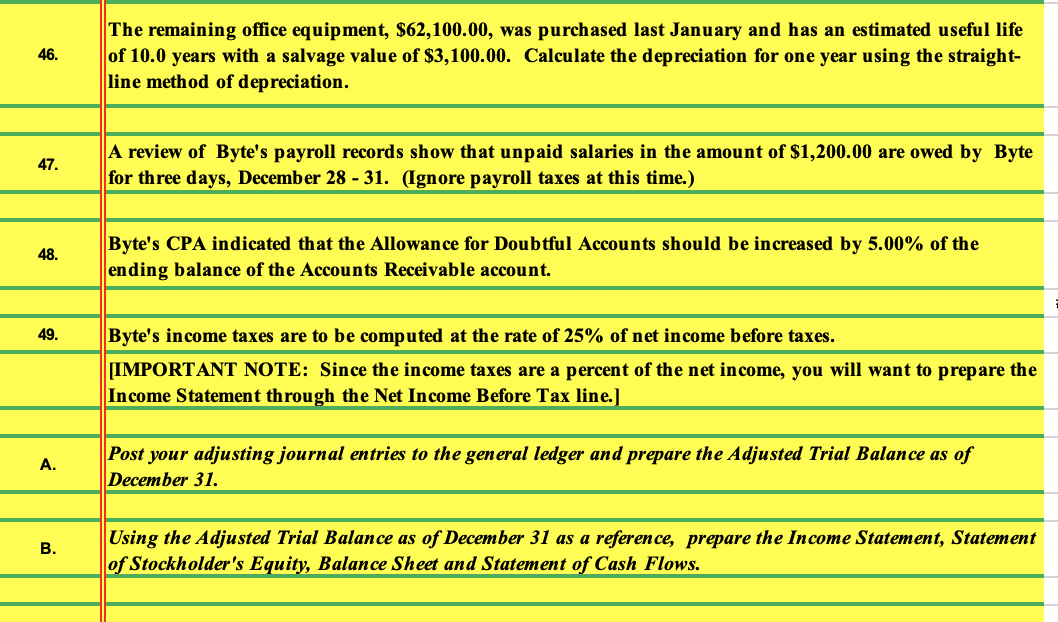

- Journal Entry #37 - #49 A&B

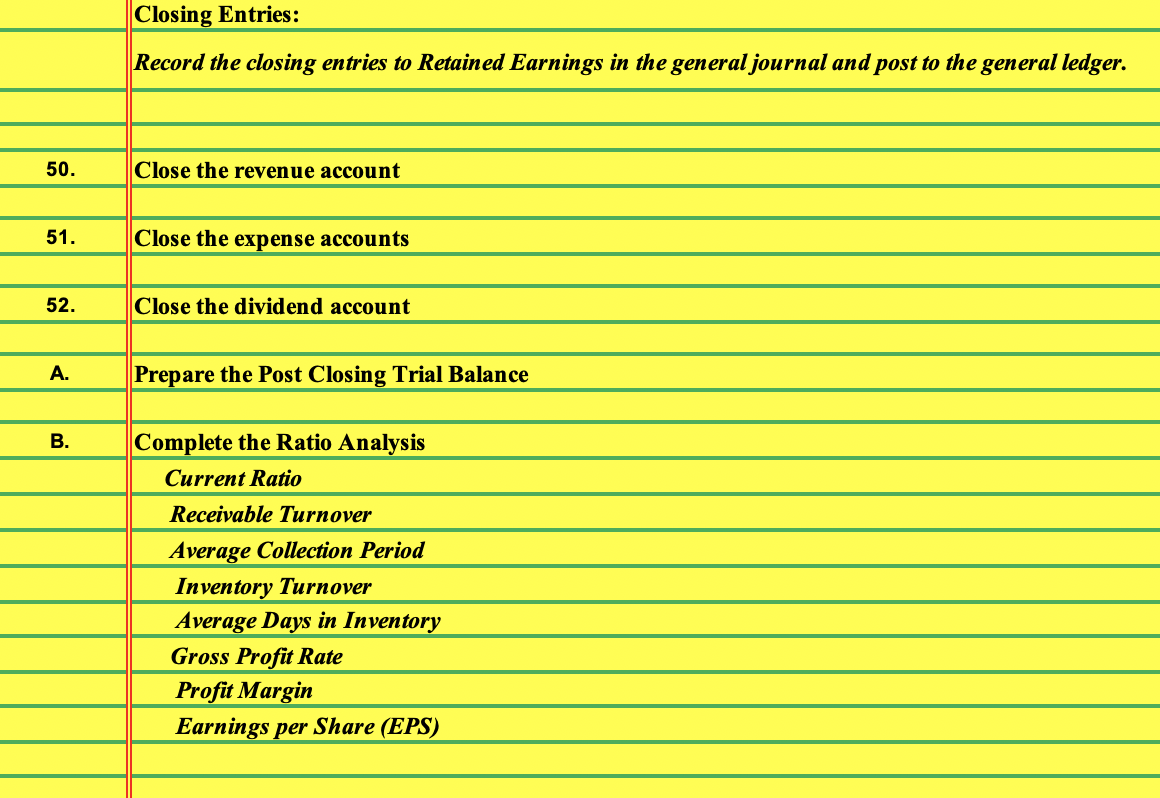

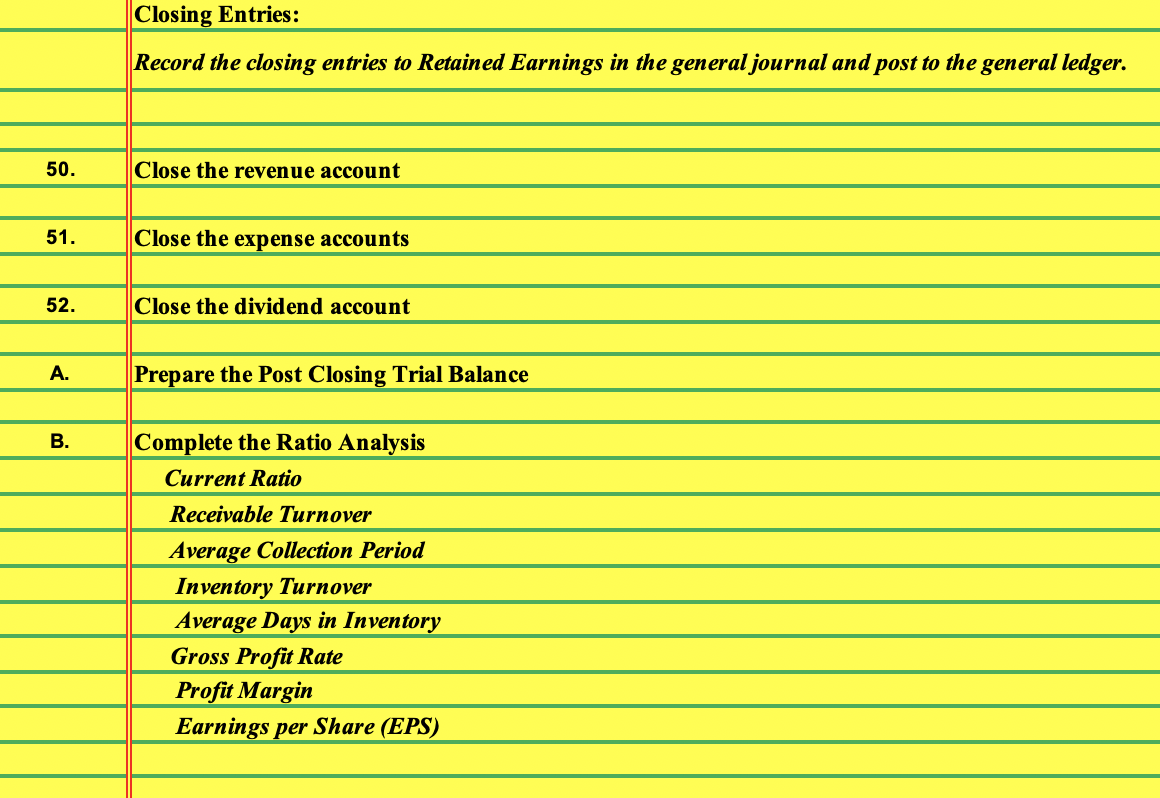

- Journal Entry #50 - #52 A&B

05. December 10: Byte sold 8 Super Toners to a customer on account for $57.00 each. The Sales order number was 12100. 06. December 10: Byte records the cost of the 8 Super Toners sold using FIFO. The sales order number was 12100. 11 14 . December 19: Byte sold 6 Super toners to a customer on account for $57.00 each. The sales order number was 12101. 15. December 19: Byte records the cost of the 6 Super Toners sold using FIFO. The sales order number was 12101. 25. December 28: Byte billed various miscellaneous local customers $15,300.00 for computers that were delivered today. 26. December 28: Record the cost of the computers that were sold today. 27. December 28: Byte paid the bill that was previously received and recorded from Computer Parts and Repairs Co with Check # 6007. The invoice number was 43254. 28. December 29: Byte received $14,750.00 from customers billed when they received delivery. 29. December 29: Byte received a bill for the amount of $680.00 from AT&T for the telephone and internet access. The invoice number was 784537. 30. December 30: Check# 6008 was issued to pay salaries of $2,000.00 to equipment operators. (Ignore payroll taxes at this time.) 31. December 30: Check# 6009 was issued to pay a cash dividend of $.65 per share to Lauryn, a shareholder of Byte. a 32. December 30: Check#6010 was issued to pay a cash dividend of $.65 per share to shareholder of Byte. December 30: Byte received a $7,965.00 check from be delivered in January. Corporation for merchandise ordered which will 33. 34. December 30: A $900.00 ping pong table for the office was ordered from Game World. 35. December 31: The Ping Pong table was canceled within the cancelation period. 36. December 31: Check #6012 was issued to pay $680.00 to AT&T for the telephone and internet access. Adjusting Entries - Record the following adjusting entries in the general journal and post to the general ledger. Round to two decimal places, =Round(number or formula,2). 37. The cash received and deposited from customers was $14,775.00 not the $14,750.00 orignially recorded. 38. A physical inventory showed that only $526.00 worth of supplies remained on hand as of December 31. 39. The interest on the note for the Ricoh Color Copier will be paid every six months. Record the December accrued interest on the note payable for the Ricoh purchased on December 1. 40. Record a journal entry to reflect that one-half month's insurance has expired. 41. A review of Byte's emails indicated that they received an invoice in the amout of $3,125.00 for computers that were drop shipped and received on December 28. 42. Bill various miscellaneous customers 200% of the cost of the computers that were drop shipped and received on December 28. 43. . Record the cost of the computers that were sold on December 28. 44. The computer equipment on the Post Closing Trial Balance from last year was purchased last January for $20,000.00. It is being depreciated based upon an estimated useful life of 5.0 years with no salvage value. Calculate the depreciation for one year using the straight-line method of 45. The Ricoh Color Copier, part of the office equipment, is estimated to make 480,000 copies a year, have a useful life of 5 years and a salvage value of $300.00. During December, 8,250 copies were made. Management has decided that assets purchased during a month are treated as if purchased on the first day of the month. Calculate the depreciation for one month using the straight-line method of depreciation. 46. The remaining office equipment, $62,100.00, was purchased last January and has an estimated useful life of 10.0 years with a salvage value of $3,100.00. Calculate the depreciation for one year using the straight- line method of depreciation. 47. A review of Byte's payroll records show that unpaid salaries in the amount of $1,200.00 are owed by Byte for three days, December 28 - 31. (Ignore payroll taxes at this time.) 48. Byte's CPA indicated that the Allowance for Doubtful Accounts should be increased by 5.00% of the ending balance of the Accounts Receivable account. 49. Byte's income taxes are to be computed at the rate of 25% of net income before taxes. (IMPORTANT NOTE: Since the income taxes are a percent of the net income, you will want to prepare the Income Statement through the Net Income Before Tax line. A. Post your adjusting journal entries to the general ledger and prepare the Adjusted Trial Balance as of December 31. B. Using the Adjusted Trial Balance as of December 31 as a reference, prepare the Income Statement, Statement of Stockholder's Equity, Balance Sheet and Statement of Cash Flows. Closing Entries: Record the closing entries to Retained Earnings in the general journal and post to the general ledger. 50. Close the revenue account 51. Close the expense accounts 52. Close the dividend account A. Prepare the Post Closing Trial Balance B. Complete the Ratio Analysis Current Ratio Receivable Turnover Average Collection Period Inventory Turnover Average Days in Inventory Gross Profit Rate Profit Margin Earnings per Share (EPS)