Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I need help with the following questions; 7.5 pts Question 19 A charitable foundation wishes to establish a trust that subsidizes dental services for families

I need help with the following questions;

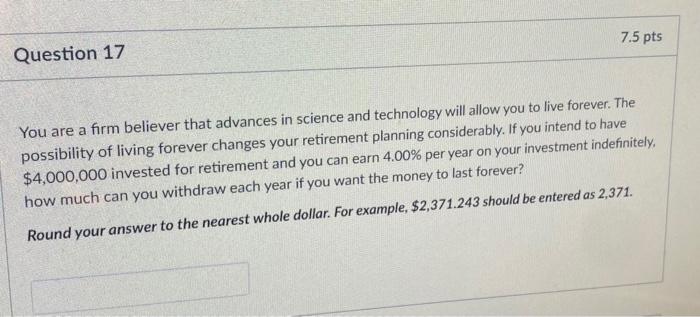

7.5 pts Question 19 A charitable foundation wishes to establish a trust that subsidizes dental services for families in need. The foundation intends to provide the equivalent of $500,000 per year in perpetuity for dental services, so it needs to account for the projected 2.00% per year inflation. The foundation plans to make a one-time cash contribution now to capitalize the trust. If invested funds can earn a return of 7.00% per year, how much money should the foundation contribute to the trust today to provide dental assistance of $500,000 at the end of the first year and payments that then grow at the inflation rate of 2.00% per year in perpetuity? Round your answer to the nearest whole dollar. For example, $2,371.24 should be entered as 2,371. 2 ots 7.5 pts Question 17 You are a firm believer that advances in science and technology will allow you to live forever. The possibility of living forever changes your retirement planning considerably. If you intend to have $4,000,000 invested for retirement and you can earn 4.00% per year on your investment indefinitely, how much can you withdraw each year if you want the money to last forever? Round your answer to the nearest whole dollar. For example, $2,371.243 should be entered as 2,371

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started