Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I need help with the formulas for these. When I put in the numbers I keep getting -$15,699 or $1.29 which are both wrong 2

I need help with the formulas for these. When I put in the numbers I keep getting -$15,699 or $1.29 which are both wrong

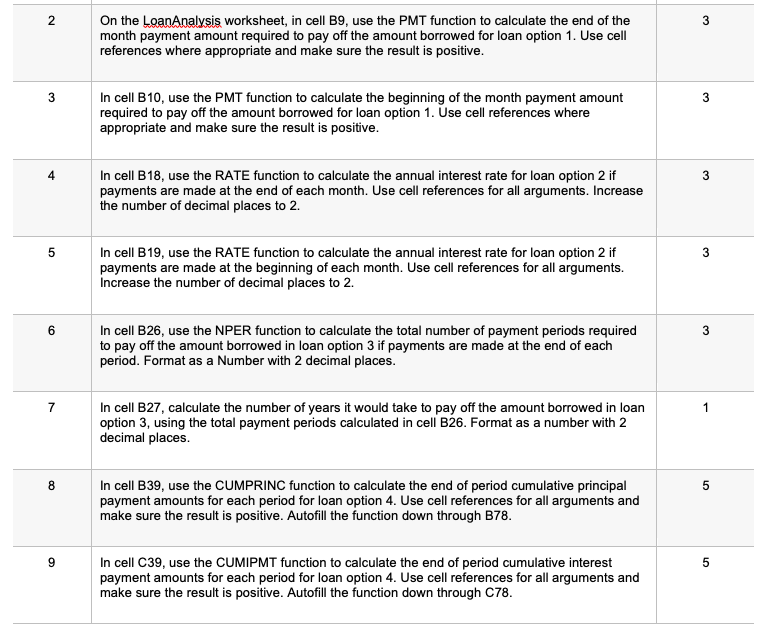

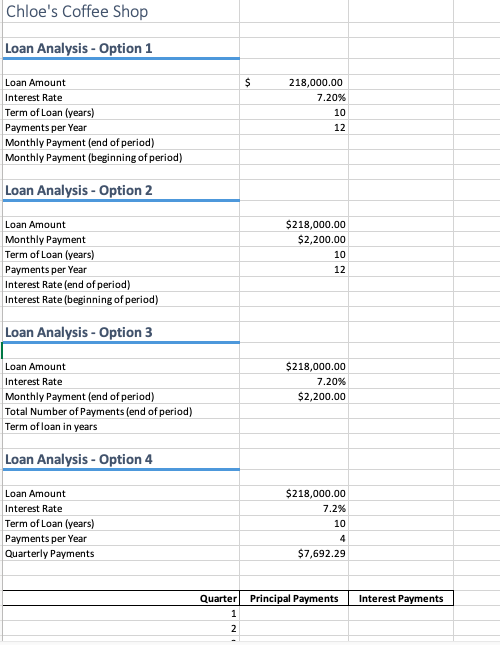

2 3 On the LoanAnalysis worksheet, in cell B9, use the PMT function to calculate the end of the month payment amount required to pay off the amount borrowed for loan option 1. Use cell references where appropriate and make sure the result is positive. 3 3 In cell B10, use the PMT function to calculate the beginning of the month payment amount required to pay off the amount borrowed for loan option 1. Use cell references where appropriate and make sure the result is positive. 4 3 In cell B18, use the RATE function to calculate the annual interest rate for loan option 2 if payments are made at the end of each month. Use cell references for all arguments. Increase the number of decimal places to 2. 5 3 In cell B19, use the RATE function to calculate the annual interest rate for loan option 2 if payments are made at the beginning of each month. Use cell references for all arguments. increase the number of decimal places to 2. 6 In cell B26, use the NPER function to calculate the total number of payment periods required to pay off the amount borrowed in loan option 3 if payments are made at the end of each period. Format as a Number with 2 decimal places. 7 1 In cell B27, calculate the number of years it would take to pay off the amount borrowed in loan option 3, using the total payment periods calculated in cell B26. Format as a number with 2 decimal places. 8 5 In cell B39, use the CUMPRINC function to calculate the end of period cumulative principal payment amounts for each period for loan option 4. Use cell references for all arguments and make sure the result is positive. Autofill the function down through 878. 9 5 In cell C39, use the CUMIPMT function to calculate the end of period cumulative interest payment amounts for each period for loan option 4. Use cell references for all arguments and make sure the result is positive. Autofill the function down through C78. Chloe's Coffee Shop Loan Analysis - Option 1 $ Loan Amount Interest Rate Term of Loan (years) Payments per Year Monthly Payment (end of period) Monthly Payment (beginning of period) 218,000.00 7.20% 10 12 Loan Analysis - Option 2 Loan Amount Monthly Payment Term of Loan (years) Payments per Year Interest Rate (end of period) Interest Rate (beginning of period) $218,000.00 $2,200.00 10 12 Loan Analysis - Option 3 Loan Amount Interest Rate Monthly Payment (end of period) Total Number of Payments (end of period) Term of loan in years $218,000.00 7.20% $2,200.00 Loan Analysis - Option 4 Loan Amount Interest Rate Term of Loan (years) Payments per Year Quarterly Payments $218,000.00 7.2% 10 4 $7,692.29 Principal Payments Interest Payments Quarter 1 2 2 3 On the LoanAnalysis worksheet, in cell B9, use the PMT function to calculate the end of the month payment amount required to pay off the amount borrowed for loan option 1. Use cell references where appropriate and make sure the result is positive. 3 3 In cell B10, use the PMT function to calculate the beginning of the month payment amount required to pay off the amount borrowed for loan option 1. Use cell references where appropriate and make sure the result is positive. 4 3 In cell B18, use the RATE function to calculate the annual interest rate for loan option 2 if payments are made at the end of each month. Use cell references for all arguments. Increase the number of decimal places to 2. 5 3 In cell B19, use the RATE function to calculate the annual interest rate for loan option 2 if payments are made at the beginning of each month. Use cell references for all arguments. increase the number of decimal places to 2. 6 In cell B26, use the NPER function to calculate the total number of payment periods required to pay off the amount borrowed in loan option 3 if payments are made at the end of each period. Format as a Number with 2 decimal places. 7 1 In cell B27, calculate the number of years it would take to pay off the amount borrowed in loan option 3, using the total payment periods calculated in cell B26. Format as a number with 2 decimal places. 8 5 In cell B39, use the CUMPRINC function to calculate the end of period cumulative principal payment amounts for each period for loan option 4. Use cell references for all arguments and make sure the result is positive. Autofill the function down through 878. 9 5 In cell C39, use the CUMIPMT function to calculate the end of period cumulative interest payment amounts for each period for loan option 4. Use cell references for all arguments and make sure the result is positive. Autofill the function down through C78. Chloe's Coffee Shop Loan Analysis - Option 1 $ Loan Amount Interest Rate Term of Loan (years) Payments per Year Monthly Payment (end of period) Monthly Payment (beginning of period) 218,000.00 7.20% 10 12 Loan Analysis - Option 2 Loan Amount Monthly Payment Term of Loan (years) Payments per Year Interest Rate (end of period) Interest Rate (beginning of period) $218,000.00 $2,200.00 10 12 Loan Analysis - Option 3 Loan Amount Interest Rate Monthly Payment (end of period) Total Number of Payments (end of period) Term of loan in years $218,000.00 7.20% $2,200.00 Loan Analysis - Option 4 Loan Amount Interest Rate Term of Loan (years) Payments per Year Quarterly Payments $218,000.00 7.2% 10 4 $7,692.29 Principal Payments Interest Payments Quarter 1 2Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started