Answered step by step

Verified Expert Solution

Question

1 Approved Answer

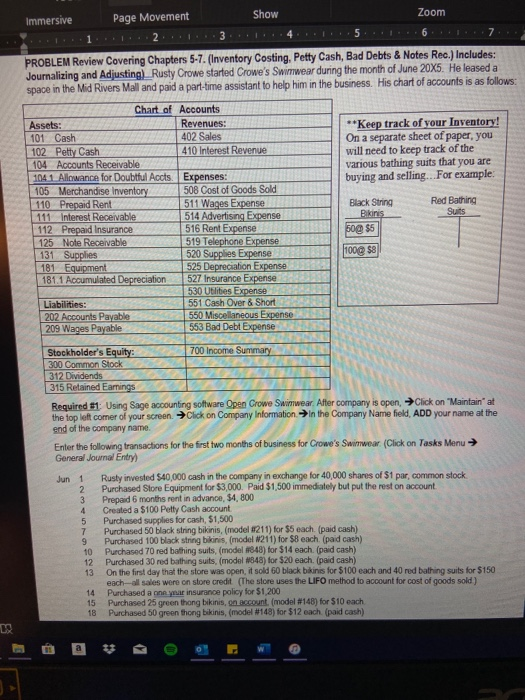

I need help with the General Journal entries on this assignment. Thank you in advance! Immersive Page Movement Show Zoom 1...2 ..1...3....4.. ..5...1...6.. ....7 PROBLEM

I need help with the General Journal entries on this assignment. Thank you in advance!

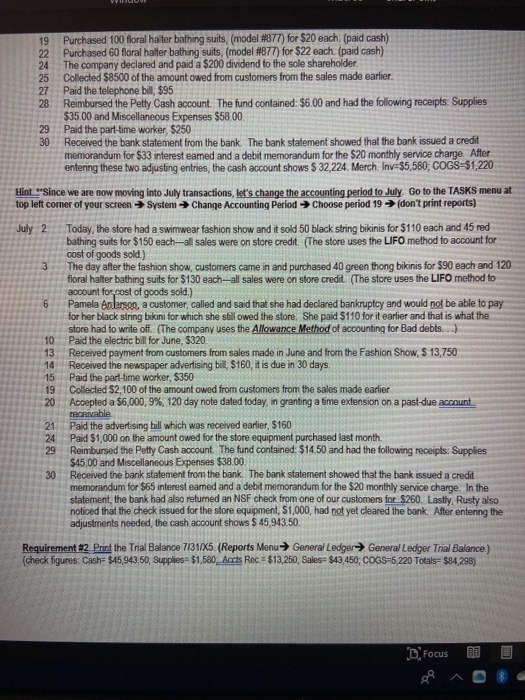

Immersive Page Movement Show Zoom 1...2 ..1...3....4.. ..5...1...6.. ....7 PROBLEM Review Covering Chapters 5-7. (Inventory Costing, Petty Cash, Bad Debts & Notes Rec.) Includes: Journalizing and Adjusting) Rusty Crowe started Crowe's Swimwear during the month of June 20X5. He leased a space in the Mid Rivers Mall and paid a part-time assistant to help him in the business. His chart of accounts is as follows Chart of Accounts Assets: Revenues: **Keep track of your Inventory! 101 Cash 402 Sales On a separate sheet of paper, you 102 Petty Cash 410 Interest Revenue will need to keep track of the 104 Accounts Receivable various bathing suits that you are 104 1 Allowance for Doubtful Accts Expenses: buying and selling...For example: 105 Merchandise Inventory 5 08 Cost of Goods Sold 110 Prepaid Rent 511 Wages Expense Black String Red Bathing 111 Interest Receivable 514 Advertising Expense Pins 112 Prepaid Insurance 516 Rent Expense 50@ $5 125 Note Receivable 519 Telephone Expense 131 Supplies 520 Supplies Expense 10058 181 Equipment 5 25 Depreciation Expense 181.1 Accumulated Depreciation 527 Insurance Expense s 530 Utlities Expense s Liabilities: E 5 51 Cash Over & Short 202 Accounts Payable 550 Miscellaneous Expense 209 Wages Payable 553 Bad Debt Expense Stockholder's Equity: 700 Income Summary 300 Common Stock 312 Dividends 315 Retained Earrings Required 11 Using Sage accounting software Open Crowe Swimwear. After company is open. Click on "Maintain at the top left comer of your screen. Click on Company Information in the Company Name field. ADD your name at the end of the company name Enter the following transactions for the first two months of business for Crowe's Swimwear (Click on Tasks Menu General Journal Entry) Jun 1 Rusly invested $40,000 cash in the company in exchange for 40,000 shares of $1 pw common stock 2 Purchased Store Equipment for $3,000. Paid $1,500 immediately but put the rest on account 3 Prepaid 6 months rent in advance, 54,800 4 Created a $100 Petty Cash account 5 Purchased supplies for cash, $1,500 7 Purchased 50 black string bikinis, (model 211) for $5 each (paid cash) 9 Purchased 100 black string bikinis (model #211) for $8 each (paid cash) 10 Purchased 70 red bathing suits (model 348) for $14each (paid cash) 12 Purchased 30 red bathing suits, (model #548) for $20 each. (paid cash) 13 On the first day that the store was open, it sold 60 black bikinis for $100 each and 40 red bathing suits for $150 each-all sales were on store credit (The store uses the LIFO method to account for cost of goods sold ) 14 Purchased a one your insurance policy for $1.200 15 Purchased 25 green thong bans, on account. (model 148) for $10 each 18 Purchased 50 green thong bikinis,model 148) for $12 each (podcash) 19 22 24 25 27 28 Purchased 100 floral halter bathing suits (model #877) for $20 each. (paid cash) Purchased 60 floral halter bathing suits, (model #877) for $22 each. (paid cash) The company declared and paid a $200 dividend to the sole shareholder. Collected $8500 of the amount owed from customers from the sales made earlier Paid the telephone bill, $95 Reimbursed the Petty Cash account. The fund contained: $6.00 and had the following receipts: Supplies $35.00 and Miscellaneous Expenses $58.00 Paid the part-time worker $250 Received the bank statement from the bank. The bank statement showed that the bank issued a credit memorandum for $33 interest eamed and a debit memorandum for the $20 monthly service charge. After entering these two adjusting entries the cash account shows $ 32.224. Merch Inv=$5,580, COGS $1,220 29 30 Hint.Since we are now moving into July transactions, let's change the accounting period to July Go to the TASKS menu at top left comer of your screen System Change Accounting Period Choose period 19 don't print reports) 10 13 14 15 19 20 Today, the store had a swimwear fashion show and it sold 50 black string bikinis for $110 each and 45 red bathing suits for $150 each-all sales were on store credit. (The store uses the LIFO method to account for cost of goods sold.) The day after the fashion show, customers came in and purchased 40 green thong bikinis for $90 each and 120 floral halter bathing suits for $130 each-all sales were on store credit. (The store uses the LIFO method to account for most of goods sold.) Pamela Anderson, a customer, called and said that she had declared bankruptcy and would not be able to pay for her black string bikini for which she still owed the store. She paid $110 for it earlier and that is what the store had to write off. (The company uses the Allowance Method of accounting for Bad debts...), Paid the electric bill for June, $320. Received payment from customers from sales made in June and from the Fashion Show, 13,750 Received the newspaper advertising bill, $160, it is due in 30 days. Paid the part-time worker. $350 Collected $2,100 of the amount owed from customers from the sales made earlier Accepted a $6,000,9%, 120 day note dated today, in granting a time extension on a past-due account receivable Paid the advertising bill which was received earlier, $160 Paid S1,000 on the amount owed for the store equipment purchased last month. Reimbursed the Petty Cash account. The fund contained: $14.50 and had the following receipts: Supplies $45.00 and Miscellaneous Expenses $38.00 Received the bank statement from the bank. The bank statement showed that the bank issued a credit memorandum for $65 interest eamed and a debit memorandum for the $20 monthly service charge. In the statement, the bank had also returned an NSF check from one of our customers for $260. Lastly, Rusty also noticed that the check issued for the store equipment, $1,000 had not yet cleared the bank. After entening the adjustments needed, the cash account shows $ 45,943.50. 24 Requirement #2 Print the Trial Balance 7/31/35. (Reports Menu General Ledger General Ledger Trial Balance.) (check figures: Cash= $45,943.50, Supplies $1,680, Acts Rec. $13,250, Sales= $43,450, COGS=5,220 Totals=$84.298) Focus 3 Immersive Page Movement Show Zoom 1...2 ..1...3....4.. ..5...1...6.. ....7 PROBLEM Review Covering Chapters 5-7. (Inventory Costing, Petty Cash, Bad Debts & Notes Rec.) Includes: Journalizing and Adjusting) Rusty Crowe started Crowe's Swimwear during the month of June 20X5. He leased a space in the Mid Rivers Mall and paid a part-time assistant to help him in the business. His chart of accounts is as follows Chart of Accounts Assets: Revenues: **Keep track of your Inventory! 101 Cash 402 Sales On a separate sheet of paper, you 102 Petty Cash 410 Interest Revenue will need to keep track of the 104 Accounts Receivable various bathing suits that you are 104 1 Allowance for Doubtful Accts Expenses: buying and selling...For example: 105 Merchandise Inventory 5 08 Cost of Goods Sold 110 Prepaid Rent 511 Wages Expense Black String Red Bathing 111 Interest Receivable 514 Advertising Expense Pins 112 Prepaid Insurance 516 Rent Expense 50@ $5 125 Note Receivable 519 Telephone Expense 131 Supplies 520 Supplies Expense 10058 181 Equipment 5 25 Depreciation Expense 181.1 Accumulated Depreciation 527 Insurance Expense s 530 Utlities Expense s Liabilities: E 5 51 Cash Over & Short 202 Accounts Payable 550 Miscellaneous Expense 209 Wages Payable 553 Bad Debt Expense Stockholder's Equity: 700 Income Summary 300 Common Stock 312 Dividends 315 Retained Earrings Required 11 Using Sage accounting software Open Crowe Swimwear. After company is open. Click on "Maintain at the top left comer of your screen. Click on Company Information in the Company Name field. ADD your name at the end of the company name Enter the following transactions for the first two months of business for Crowe's Swimwear (Click on Tasks Menu General Journal Entry) Jun 1 Rusly invested $40,000 cash in the company in exchange for 40,000 shares of $1 pw common stock 2 Purchased Store Equipment for $3,000. Paid $1,500 immediately but put the rest on account 3 Prepaid 6 months rent in advance, 54,800 4 Created a $100 Petty Cash account 5 Purchased supplies for cash, $1,500 7 Purchased 50 black string bikinis, (model 211) for $5 each (paid cash) 9 Purchased 100 black string bikinis (model #211) for $8 each (paid cash) 10 Purchased 70 red bathing suits (model 348) for $14each (paid cash) 12 Purchased 30 red bathing suits, (model #548) for $20 each. (paid cash) 13 On the first day that the store was open, it sold 60 black bikinis for $100 each and 40 red bathing suits for $150 each-all sales were on store credit (The store uses the LIFO method to account for cost of goods sold ) 14 Purchased a one your insurance policy for $1.200 15 Purchased 25 green thong bans, on account. (model 148) for $10 each 18 Purchased 50 green thong bikinis,model 148) for $12 each (podcash) 19 22 24 25 27 28 Purchased 100 floral halter bathing suits (model #877) for $20 each. (paid cash) Purchased 60 floral halter bathing suits, (model #877) for $22 each. (paid cash) The company declared and paid a $200 dividend to the sole shareholder. Collected $8500 of the amount owed from customers from the sales made earlier Paid the telephone bill, $95 Reimbursed the Petty Cash account. The fund contained: $6.00 and had the following receipts: Supplies $35.00 and Miscellaneous Expenses $58.00 Paid the part-time worker $250 Received the bank statement from the bank. The bank statement showed that the bank issued a credit memorandum for $33 interest eamed and a debit memorandum for the $20 monthly service charge. After entering these two adjusting entries the cash account shows $ 32.224. Merch Inv=$5,580, COGS $1,220 29 30 Hint.Since we are now moving into July transactions, let's change the accounting period to July Go to the TASKS menu at top left comer of your screen System Change Accounting Period Choose period 19 don't print reports) 10 13 14 15 19 20 Today, the store had a swimwear fashion show and it sold 50 black string bikinis for $110 each and 45 red bathing suits for $150 each-all sales were on store credit. (The store uses the LIFO method to account for cost of goods sold.) The day after the fashion show, customers came in and purchased 40 green thong bikinis for $90 each and 120 floral halter bathing suits for $130 each-all sales were on store credit. (The store uses the LIFO method to account for most of goods sold.) Pamela Anderson, a customer, called and said that she had declared bankruptcy and would not be able to pay for her black string bikini for which she still owed the store. She paid $110 for it earlier and that is what the store had to write off. (The company uses the Allowance Method of accounting for Bad debts...), Paid the electric bill for June, $320. Received payment from customers from sales made in June and from the Fashion Show, 13,750 Received the newspaper advertising bill, $160, it is due in 30 days. Paid the part-time worker. $350 Collected $2,100 of the amount owed from customers from the sales made earlier Accepted a $6,000,9%, 120 day note dated today, in granting a time extension on a past-due account receivable Paid the advertising bill which was received earlier, $160 Paid S1,000 on the amount owed for the store equipment purchased last month. Reimbursed the Petty Cash account. The fund contained: $14.50 and had the following receipts: Supplies $45.00 and Miscellaneous Expenses $38.00 Received the bank statement from the bank. The bank statement showed that the bank issued a credit memorandum for $65 interest eamed and a debit memorandum for the $20 monthly service charge. In the statement, the bank had also returned an NSF check from one of our customers for $260. Lastly, Rusty also noticed that the check issued for the store equipment, $1,000 had not yet cleared the bank. After entening the adjustments needed, the cash account shows $ 45,943.50. 24 Requirement #2 Print the Trial Balance 7/31/35. (Reports Menu General Ledger General Ledger Trial Balance.) (check figures: Cash= $45,943.50, Supplies $1,680, Acts Rec. $13,250, Sales= $43,450, COGS=5,220 Totals=$84.298) Focus 3 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started