Answered step by step

Verified Expert Solution

Question

1 Approved Answer

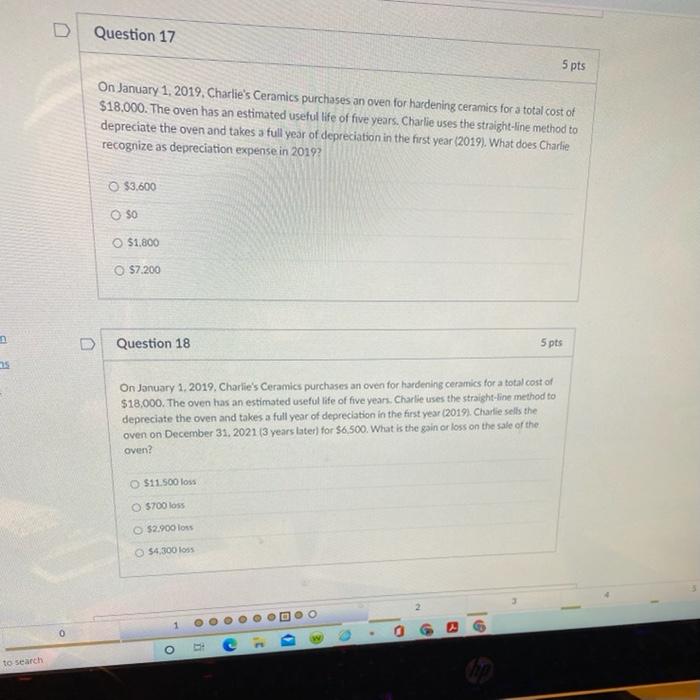

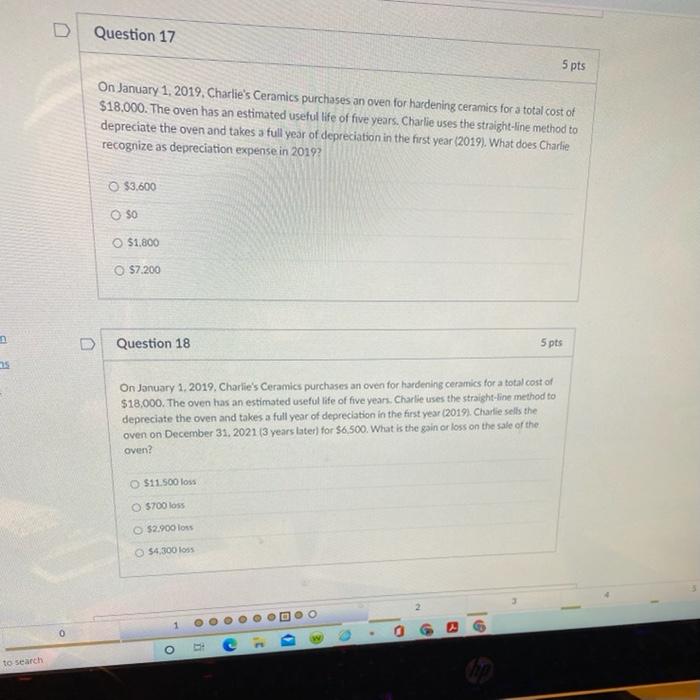

I need help with the gollowing questions D Question 17 5 pts On January 1, 2019, Charlie's Ceramics purchases an oven for hardening ceramics for

I need help with the gollowing questions

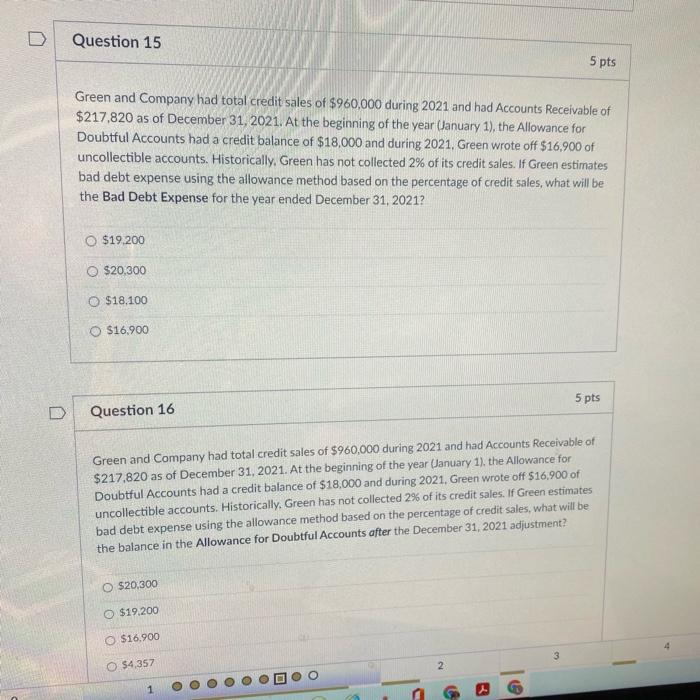

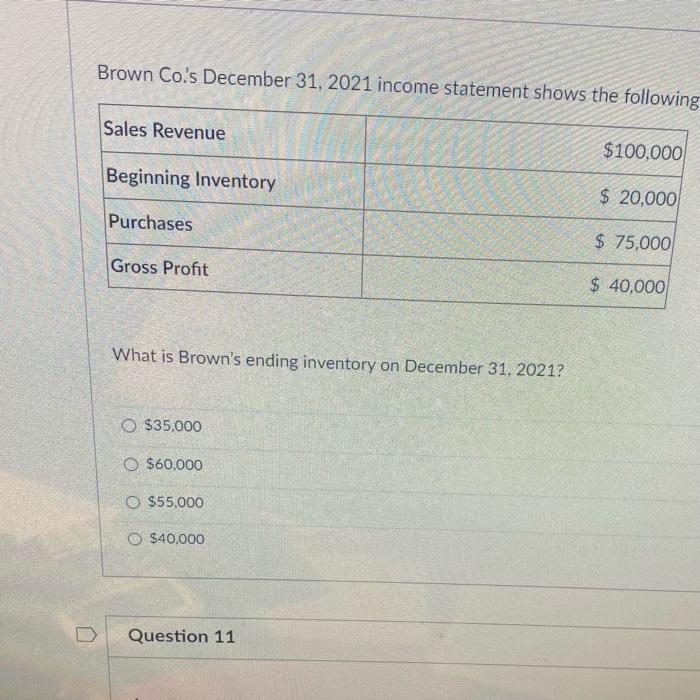

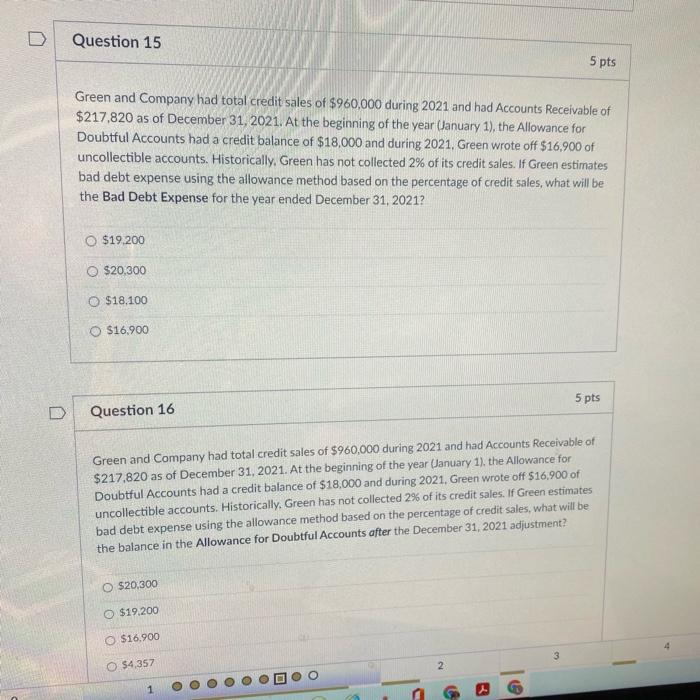

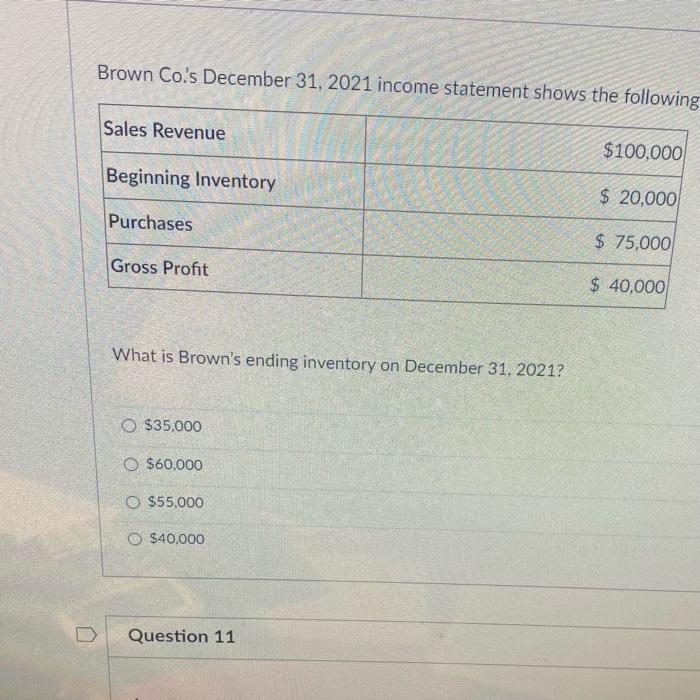

D Question 17 5 pts On January 1, 2019, Charlie's Ceramics purchases an oven for hardening ceramics for a total cost of $18,000. The oven has an estimated useful life of five years. Charlie uses the straight-line method to depreciate the oven and takes a full year of depreciation in the first year (2019). What does Charlie recognize as depreciation expense in 2019? O $3,600 50 $1.800 O $7.200 Question 18 5 pts 15 On January 1, 2019. Charlie's Ceramics purchases an oven for hardening ceramics for a total cost of $18,000. The oven has an estimated useful life of five years. Charlie uses the straight-line method to depreciate the oven and takes a full year of depreciation in the first year (2019). Charlie sells the oven on December 31, 2021 (3 years later) for $6.500. What is the gain or loss on the sale of the oven? O $11.500 loss 5700 loss $2.900 loss 54.300 loss 2 O G DO . 6 R w o O to search D Question 15 5 pts Green and Company had total credit sales of $960,000 during 2021 and had Accounts Receivable of $217,820 as of December 31, 2021. At the beginning of the year (January 1), the Allowance for Doubtful Accounts had a credit balance of $18,000 and during 2021. Green wrote off $16,900 of uncollectible accounts. Historically. Green has not collected 2% of its credit sales. If Green estimates bad debt expense using the allowance method based on the percentage of credit sales, what will be the Bad Debt Expense for the year ended December 31, 2021? $19.200 $20.300 O $18,100 $16.900 5 pts Question 16 Green and Company had total credit sales of $960,000 during 2021 and had Accounts Receivable of $217,820 as of December 31, 2021. At the beginning of the year (January 1). the Allowance for Doubtful Accounts had a credit balance of $18,000 and during 2021, Green wrote off $16,900 of uncollectible accounts. Historically. Green has not collected 2% of its credit sales. If Green estimates bad debt expense using the allowance method based on the percentage of credit sales, what will be the balance in the Allowance for Doubtful Accounts after the December 31, 2021 adjustment? O $20,300 O $19.200 $16.900 3 $4357 2 o G 1 Brown Co.'s December 31, 2021 income statement shows the following Sales Revenue $100,000 Beginning Inventory $ 20,000 Purchases $ 75,000 Gross Profit $ 40,000 What is Brown's ending inventory on December 31, 2021? O $35.000 O $60,000 $55,000 O $40.000 Question 11

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started