I need help with the home work question on page 90 2-10 its in the government and non-profit accounting seventh edition. Can someone guide me?

I need help with the home work question on page 90 2-10 its in the government and non-profit accounting seventh edition. Can someone guide me?

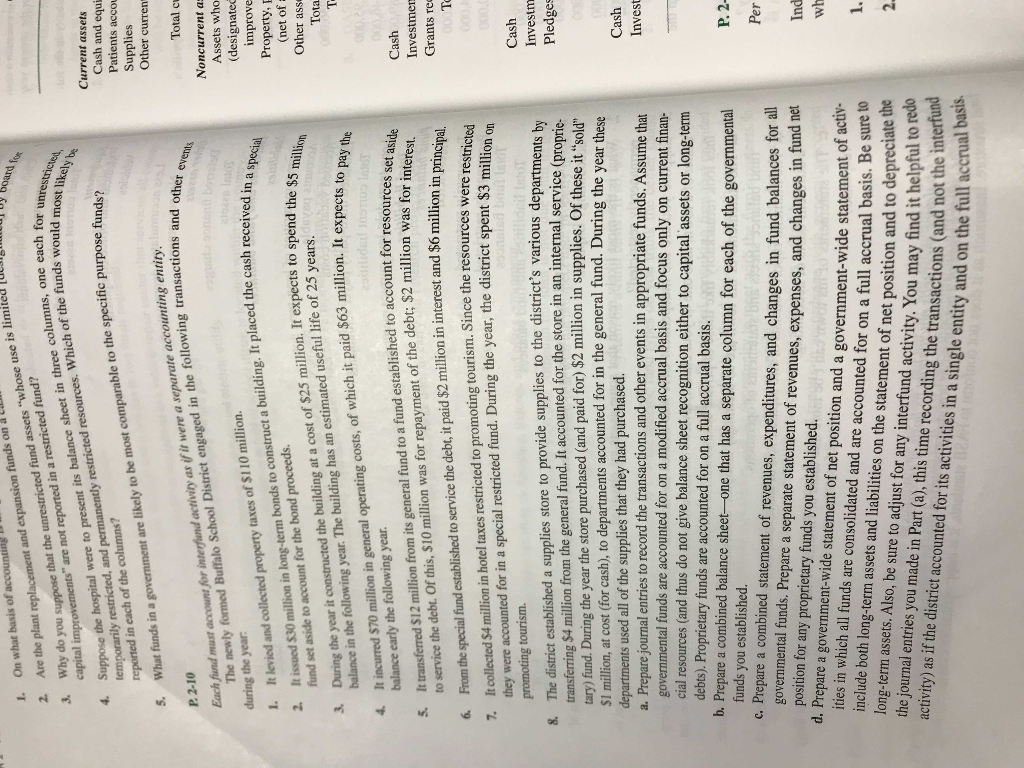

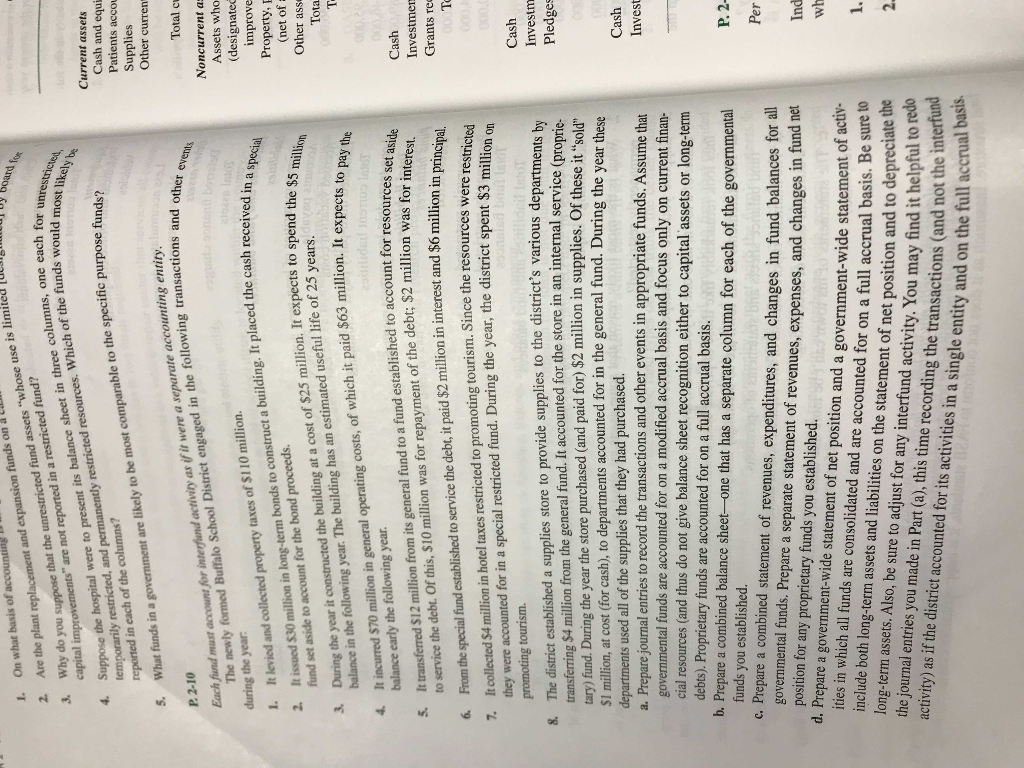

I. On what basis of acc the hospital were to present its balance sheet in three columns, one each f in a government are likely to be most comparable to the specific purpose f trict engaged in the following transactions and or would most likely temporarily restricted, and permanently restricted resources. Which of the funds reported in each of the columns? you suppose that the unrestricted fund assets "whose use is limited Current assets nds? Patients acco Supplies intefand activity as if it were a separate accounting entity Buffalo School Dis Noncurrent a The newly formed (designate property taxes of $110 million. It levied and collected bonds to construct a building. It placed the cash received 1 It issued $30 million in long-term $5 million 2. Other ass fund set aside to account for the bond proceeds. During the year it constructed the building at a cost of $25 million. It expects to spend the sS balance in the following year. The building has an estimated useful life of 25 years It incurred $70 million in general operating costs, of which it paid $63 million. It expects to balance early the following year to service the debt. Of this, $10 million was for repayment of the debt; $2 million was for i fund established to service the debt, it paid $2 million in interest and $6 million in nte It transferred S$12 million from its general fund to a fund established to account for reso Investmen Grants re 7. Itcollected $4 million in hotel taxes restricted to promoting tourism. Since the resources were restictha they were accounted for in a special restricted fund. During the year, the district spent S3 milion on Cash Investm 8. The district established a supplies store to provide supplies to the district's various departments transferring $4 million from the general fund. It accounted for the store in an internal service ( tary) fund. During the year the store purchased (and paid for) $2 million in supplies. Of these SI million, at cost (for cash), to departments accounted for in the general fund. During the year these departments used all of the supplies that they had purchased. a. Prepare journal entries to record the transactions and other events in appropriate funds. Assume that Cash governmental funds are accounted for on a modified accrual basis and focus only on current finan- cial resources (and thus do not give balance sheet recognition either to capital assets or long-term al basis. b. Prepare a combined balance sheet-one that has a separate column for each of the governmental funds you established. c. Prepare a combined statement of revenues, expendit tures, and changes in fund balances for all governmental funds. Prepare a separate statement of revenues, expenses, and changes in fund net position for any proprietary funds you established. d. Prepare a government-wide statement of net position and a government-wide statement of activ ities in which all funds are consolidated and are accounted for on a full accrual basis. Be sure t include both long-term asses and iabilties on the statement of net position and to depreciate the 1. long-term assets. Also, be sure to adjust for any interfund activity. You may find it help the journal entries you made in Part (a), this time recording the transactions (and not activity) as if the district accounted for its activities in a single entity and on the full redo I. On what basis of acc the hospital were to present its balance sheet in three columns, one each f in a government are likely to be most comparable to the specific purpose f trict engaged in the following transactions and or would most likely temporarily restricted, and permanently restricted resources. Which of the funds reported in each of the columns? you suppose that the unrestricted fund assets "whose use is limited Current assets nds? Patients acco Supplies intefand activity as if it were a separate accounting entity Buffalo School Dis Noncurrent a The newly formed (designate property taxes of $110 million. It levied and collected bonds to construct a building. It placed the cash received 1 It issued $30 million in long-term $5 million 2. Other ass fund set aside to account for the bond proceeds. During the year it constructed the building at a cost of $25 million. It expects to spend the sS balance in the following year. The building has an estimated useful life of 25 years It incurred $70 million in general operating costs, of which it paid $63 million. It expects to balance early the following year to service the debt. Of this, $10 million was for repayment of the debt; $2 million was for i fund established to service the debt, it paid $2 million in interest and $6 million in nte It transferred S$12 million from its general fund to a fund established to account for reso Investmen Grants re 7. Itcollected $4 million in hotel taxes restricted to promoting tourism. Since the resources were restictha they were accounted for in a special restricted fund. During the year, the district spent S3 milion on Cash Investm 8. The district established a supplies store to provide supplies to the district's various departments transferring $4 million from the general fund. It accounted for the store in an internal service ( tary) fund. During the year the store purchased (and paid for) $2 million in supplies. Of these SI million, at cost (for cash), to departments accounted for in the general fund. During the year these departments used all of the supplies that they had purchased. a. Prepare journal entries to record the transactions and other events in appropriate funds. Assume that Cash governmental funds are accounted for on a modified accrual basis and focus only on current finan- cial resources (and thus do not give balance sheet recognition either to capital assets or long-term al basis. b. Prepare a combined balance sheet-one that has a separate column for each of the governmental funds you established. c. Prepare a combined statement of revenues, expendit tures, and changes in fund balances for all governmental funds. Prepare a separate statement of revenues, expenses, and changes in fund net position for any proprietary funds you established. d. Prepare a government-wide statement of net position and a government-wide statement of activ ities in which all funds are consolidated and are accounted for on a full accrual basis. Be sure t include both long-term asses and iabilties on the statement of net position and to depreciate the 1. long-term assets. Also, be sure to adjust for any interfund activity. You may find it help the journal entries you made in Part (a), this time recording the transactions (and not activity) as if the district accounted for its activities in a single entity and on the full redo

I need help with the home work question on page 90 2-10 its in the government and non-profit accounting seventh edition. Can someone guide me?

I need help with the home work question on page 90 2-10 its in the government and non-profit accounting seventh edition. Can someone guide me?