Answered step by step

Verified Expert Solution

Question

1 Approved Answer

i need help with the journal entires for 1-12 Required information Brothers Mike and Tim Hargenrater began operations of their tool and die shop (H

i need help with the journal entires for 1-12

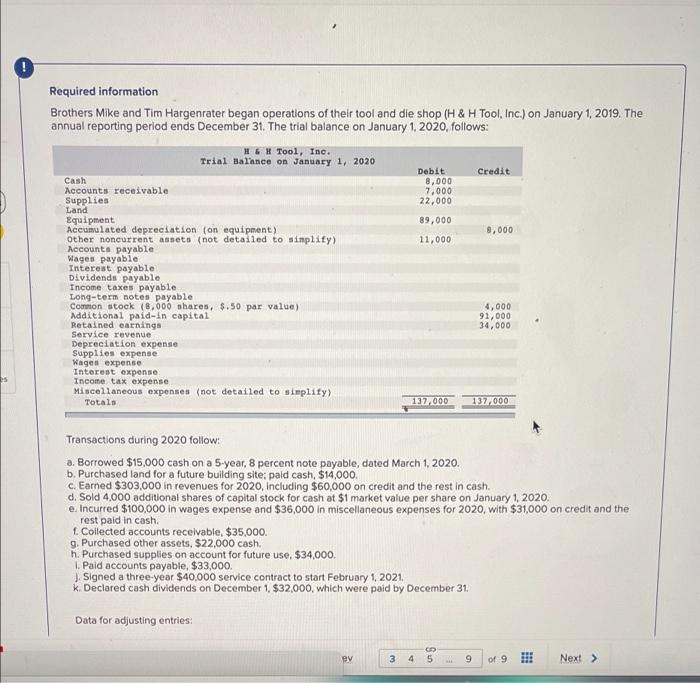

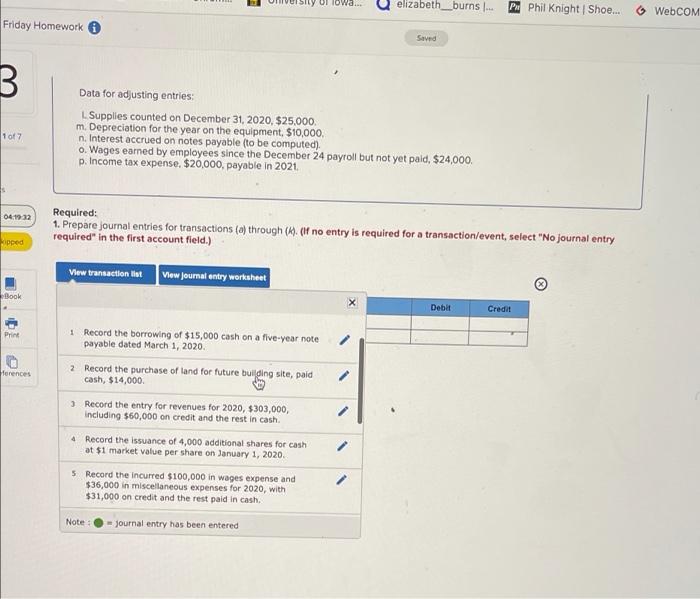

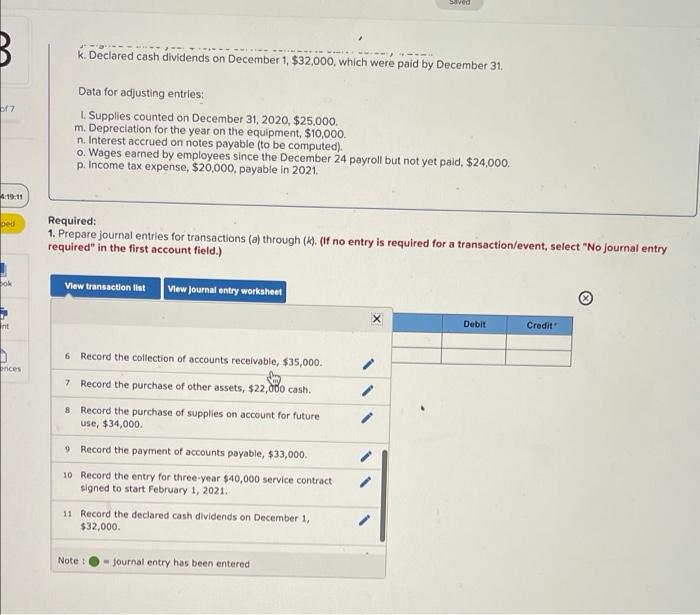

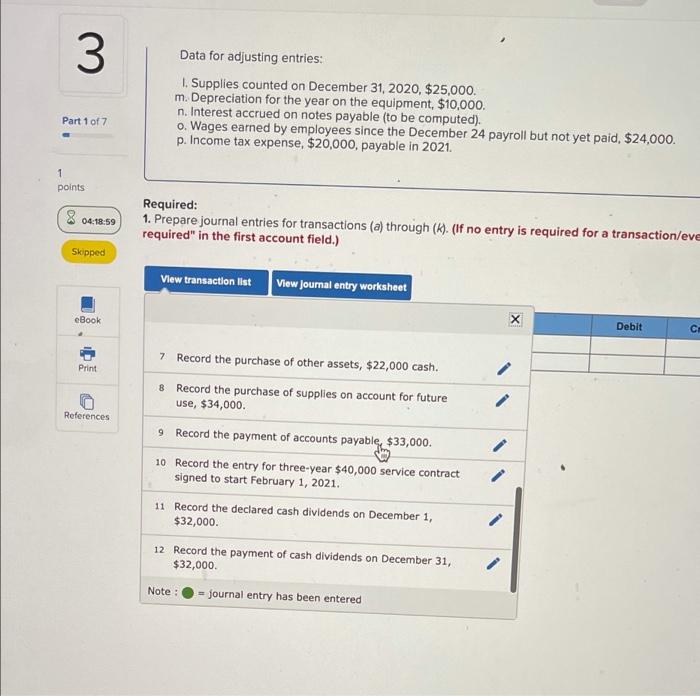

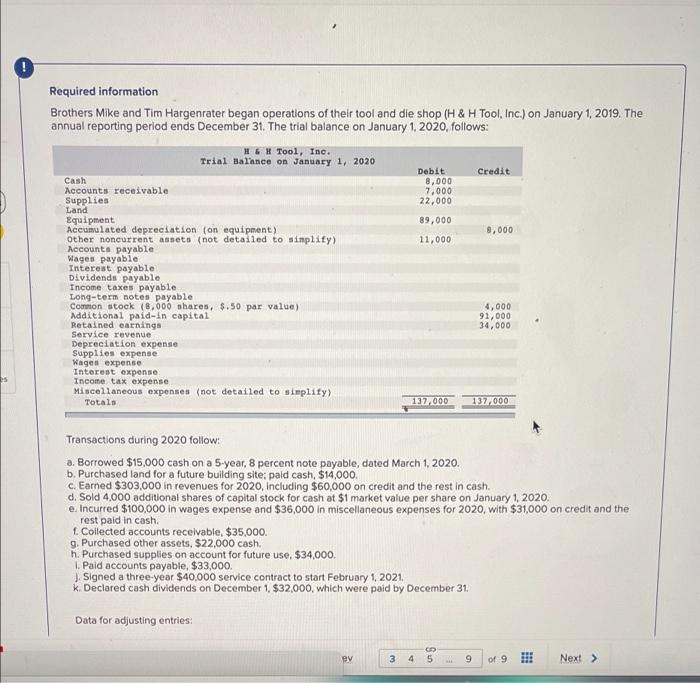

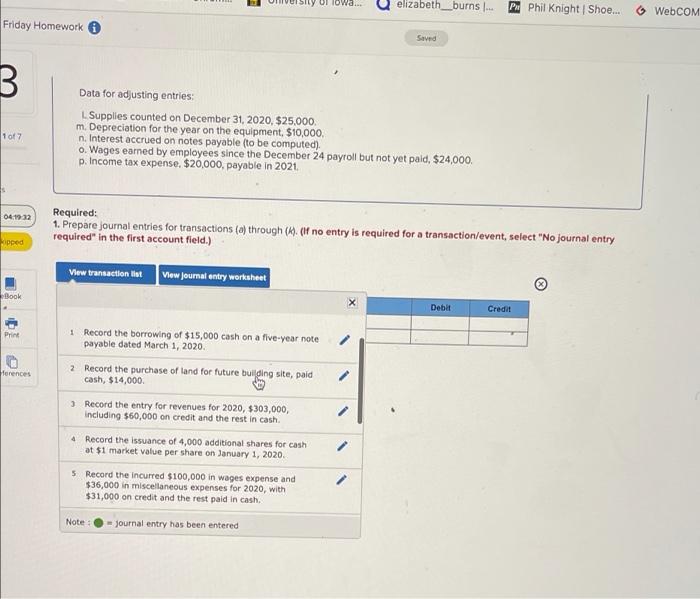

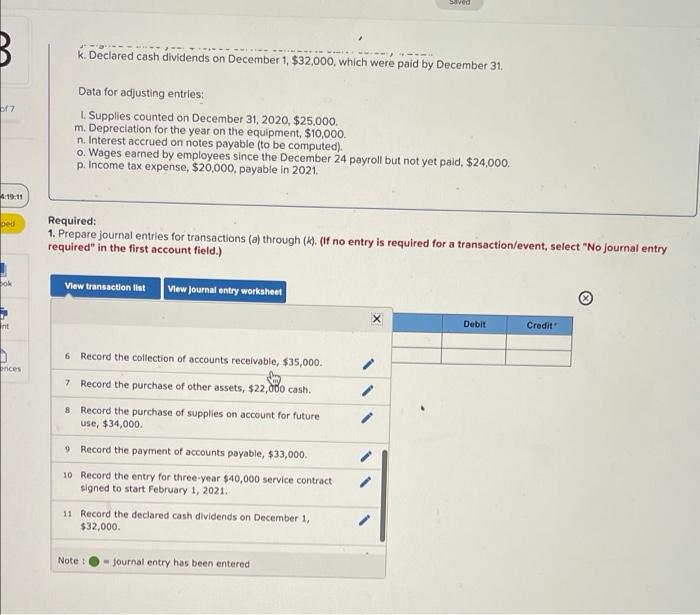

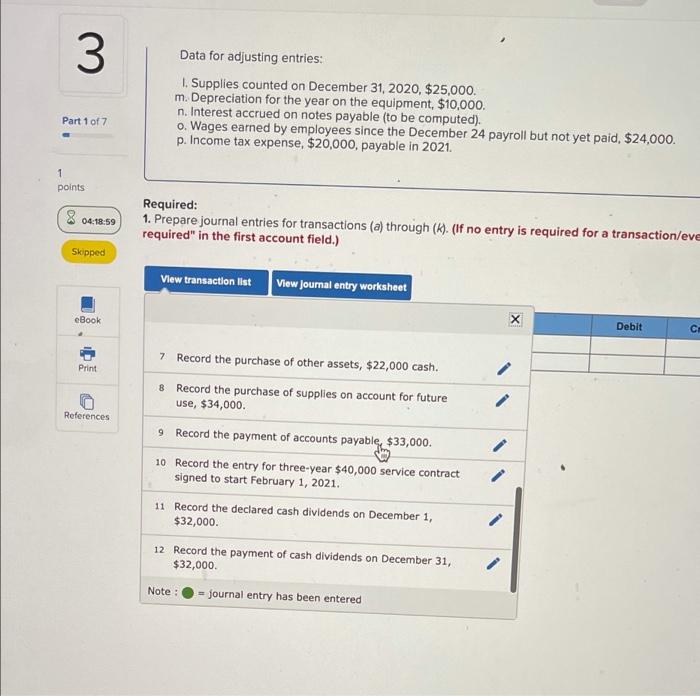

Required information Brothers Mike and Tim Hargenrater began operations of their tool and die shop (H & H Tool, Inc.) on January 1, 2019. The annual reporting period ends December 31. The trial balance on January 1, 2020, follows: H&H Tool, Inc. Trial Balance on January 1, 2020 Credit Debit 8,000 7.000 22,000 89,000 11,000 8,000 Cash Accounts receivable Supplies Land Equipment Accumulated depreciation (on equipment) Other noncurrent assets (not detailed to simplify) Accounts payable Wages payable Interest payable Dividends payable Income taxes payable Long-term notes payable Common stock (8,000 shares, $.50 par value) Additional paid-in capital Retained earnings Service revenue Depreciation expense Supplies expense Wagen expense Interest expense Income tax expense Miscellaneous expenses (not detailed to simplify) Totals 4,000 92,000 34,000 137,000 137/000 Transactions during 2020 follow: a. Borrowed $15,000 cash on a 5-year, 8 percent note payable, dated March 1, 2020. b. Purchased land for a future building site: pald cash, $14,000 c. Earned $303,000 in revenues for 2020, including $60,000 on credit and the rest in cash. d. Sold 4,000 additional shares of capital stock for cash at $1 market value per share on January 1, 2020. e. Incurred $100,000 in wages expense and $36,000 in miscellaneous expenses for 2020, with $31,000 on credit and the rest paid in cash 1. Collected accounts receivable, $35,000. g. Purchased other assets, $22,000 cash. h. Purchased supplies on account for future use, $34,000. 1. Paid accounts payable, $33,000. J. Signed a three-year $40,000 service contract to start February 1, 2021. k. Declared cash dividends on December 1, $32,000, which were paid by December 31 Data for adjusting entries CO 5 BY 3 4 ** 9 of 9 Next > Sy Ollowa.. elizabeth_burns .... Pu Phil Knight Shoe... WebCOM Friday Homework Saved B Data for adjusting entries: Supplies counted on December 31, 2020, $25,000 m. Depreciation for the year on the equipment, $10,000, n. Interest accrued on notes payable to be computed). o. Wages earned by employees since the December 24 payroll but not yet pald, $24,000. p. Income tax expense. $20,000, payable in 2021 1 of 7 04:19:32 Required: 1. Prepare journal entries for transactions (a) through required in the first account field.) no entry is required for a transaction/event, select "No journal entry Hipped View transaction that View journal entry worksheet Book Deb Credit Print 1 Record the borrowing of $15,000 cash on a five-year note payable dated March 1, 2020 Herences 2 Record the purchase of land for future building site, paid cash, $14,000 Record the entry for revenues for 2020, $303,000, including 560,000 on credit and the rest in cash 4 Record the issuance of 4,000 additional shares for cash at $1 market value per share on January 1, 2020 5 Record the incurred $100,000 in wages expense and $36,000 in miscellaneous expenses for 2020, with $31,000 on credit and the rest paid in cash, Note: + journal entry has been entered saved B k. Declared cash dividends on December 1, $32,000, which were paid by December 31, . 17 Data for adjusting entries: 1. Supplies counted on December 31, 2020, $25,000. m. Depreciation for the year on the equipment, $10,000 n. Interest accrued on notes payable to be computed). o. Wages earned by employees since the December 24 payroll but not yet paid, $24,000. p. Income tax expense, $20,000, payable in 2021. ped Required: 1. Prepare journal entries for transactions (a) through (H). (if no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list View Journal entry worksheet int Debit Credit pnces 6 Record the collection of accounts receivable, $35,000 7 Record the purchase of other assets, $22,000 cash. 8 Record the purchase of supplies on account for future use, $34,000 9 Record the payment of accounts payable, $33,000 10 Record the entry for three-year $40,000 service contract signed to start February 1, 2021. 11 Record the declared cash dividends on December 1, $32,000. Note : - Journal entry has been entered 3 Data for adjusting entries: 1. Supplies counted on December 31, 2020, $25,000. m. Depreciation for the year on the equipment, $10,000. n. Interest accrued on notes payable (to be computed). o. Wages earned by employees since the December 24 payroll but not yet paid, $24,000. p. Income tax expense, $20,000, payable in 2021. Part 1 of 7 1 points 04:18:59 Required: 1. Prepare journal entries for transactions (a) through (k). (If no entry is required for a transaction/eve required" in the first account field.) Skipped View transaction list View Journal entry worksheet eBook Debit C- 7 Record the purchase of other assets, $22,000 cash. Print 8 Record the purchase of supplies on account for future use, $34,000. References 9 Record the payment of accounts payable $33,000. 10 Record the entry for three-year $40,000 service contract signed to start February 1, 2021. 11 Record the declared cash dividends on December 1, $32,000. 12 Record the payment of cash dividends on December 31, $32,000 = journal entry has been entered

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started