Answered step by step

Verified Expert Solution

Question

1 Approved Answer

i need help with the journal entries please! 730,000 shares of no-par common stock were authorized; 150,000 shares were issued on January 1, 2022, at

i need help with the journal entries please!

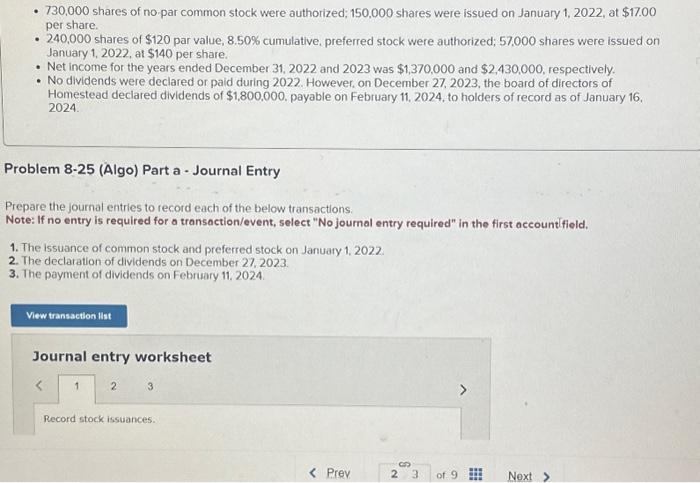

730,000 shares of no-par common stock were authorized; 150,000 shares were issued on January 1, 2022, at $17.00 per share. 240,000 shares of $120 par value, 8.50% cumulative, preferred stock were authorized; 57,000 shares were issued on January 1, 2022, at $140 per share. Net income for the years ended December 31, 2022 and 2023 was $1,370,000 and $2,430,000, respectively. No dividends were declared or paid during 2022. However, on December 27, 2023, the board of directors of Homestead declared dividends of $1,800,000, payable on February 11, 2024, to holders of record as of January 16, 2024. Problem 8-25 (Algo) Part a - Journal Entry Prepare the journal entries to record each of the below transactions. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. 1. The issuance of common stock and preferred stock on January 1, 2022. 2. The declaration of dividends on December 27, 2023. 3. The payment of dividends on February 11, 2024. View transaction list Journal entry worksheet 1 2 3 Record stock issuances.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started