I need help with the journal entries. thank you.

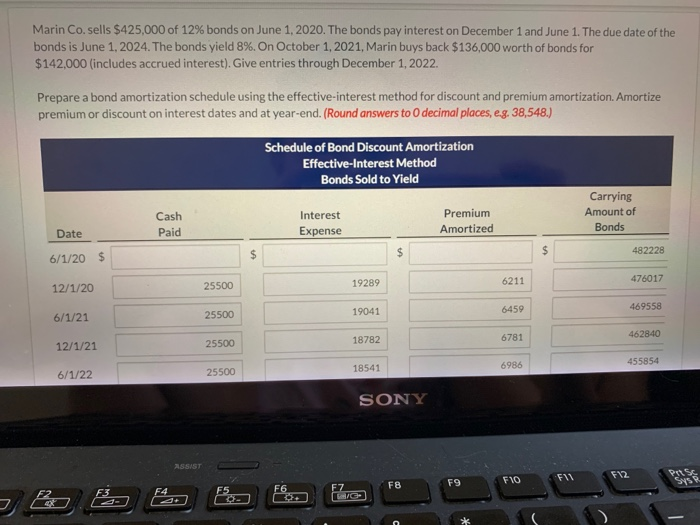

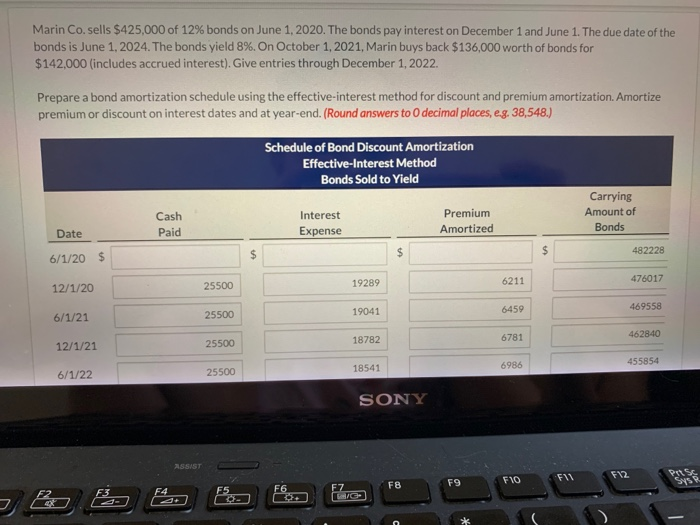

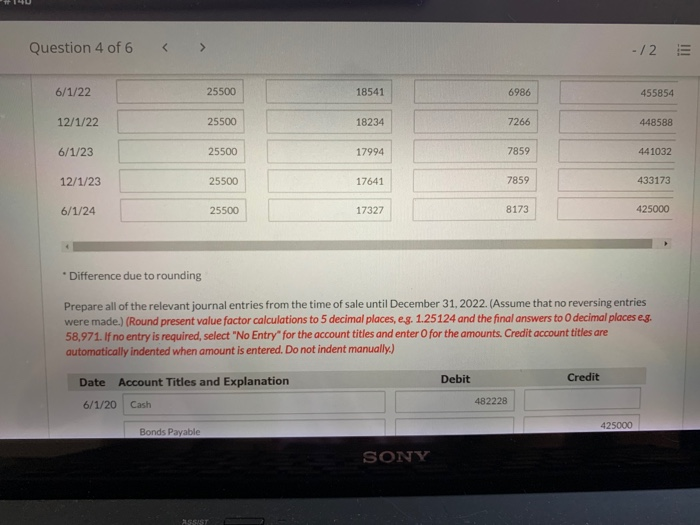

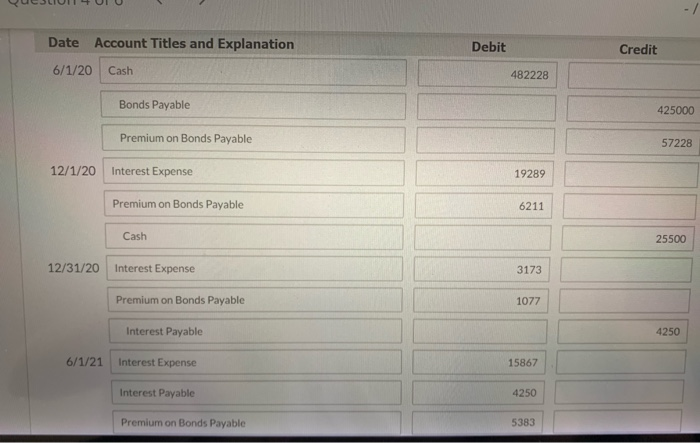

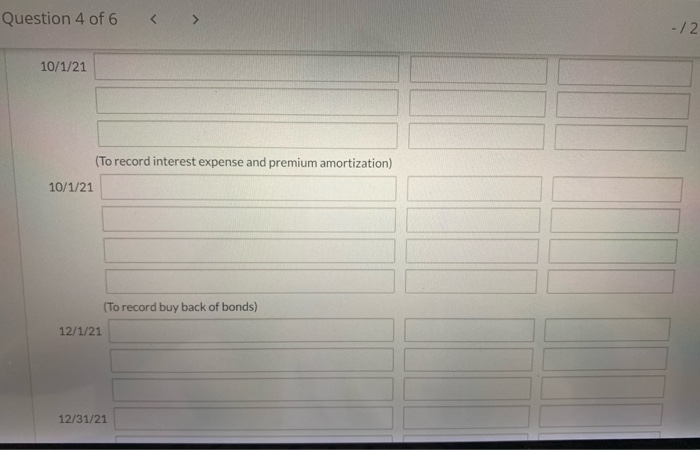

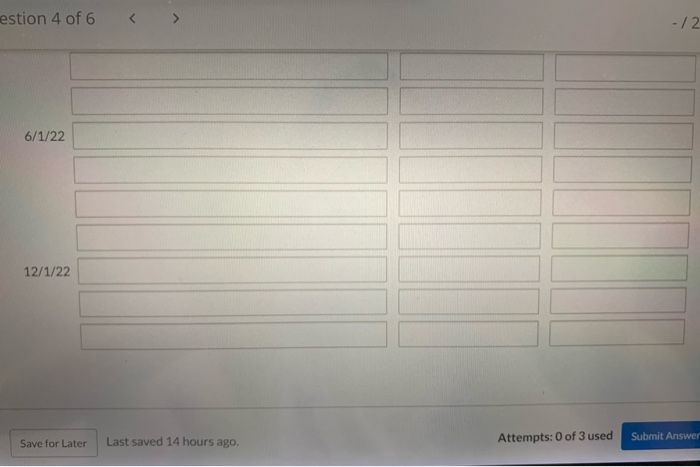

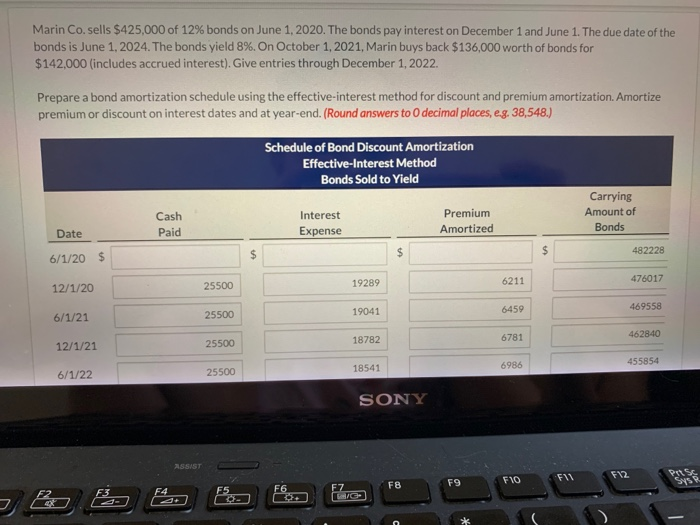

Marin Co. sells $425,000 of 12% bonds on June 1, 2020. The bonds pay interest on December 1 and June 1. The due date of the bonds is June 1, 2024. The bonds yield 8%. On October 1, 2021, Marin buys back $136,000 worth of bonds for $142,000 (includes accrued interest). Give entries through December 1, 2022. Prepare a bond amortization schedule using the effective-interest method for discount and premium amortization. Amortize premium or discount on interest dates and at year-end. (Round answers to decimal places, eg. 38,548.) Schedule of Bond Discount Amortization Effective Interest Method Bonds Sold to Yield Cash Paid Interest Expense Premium Amortized Carrying Amount of Bonds Date $ $ 482228 6/1/20 $ 476017 25500 19289 6211 12/1/20 6459 469558 19041 6/1/21 25500 18782 6781 462840 12/1/21 25500 6986 455854 18541 6/1/22 25500 SONY ASSIST FI 12 FIO F9 FB 2 F3 F4 F6 F7 55 Question 4 of 6 -12 6/1/22 25500 18541 6986 455854 12/1/22 25500 18234 7266 448588 6/1/23 25500 17994 7859 441032 12/1/23 25500 17641 7859 433173 6/1/24 25500 17327 8173 425000 Difference due to rounding Prepare all of the relevant journal entries from the time of sale until December 31, 2022. (Assume that no reversing entries were made.) (Round present value factor calculations to 5 decimal places, eg. 1.25124 and the final answers to decimal places es. 58,971. If no entry is required, select "No Entry" for the account titles and enter for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually.) Date Account Titles and Explanation Debit Credit 6/1/20 Cash 482228 425000 Bonds Payable SONY ASSIST Date Account Titles and Explanation Debit Credit 6/1/20 Cash 482228 Bonds Payable 425000 Premium on Bonds Payable 57228 12/1/20 Interest Expense 19289 Premium on Bonds Payable 6211 Cash 25500 12/31/20 Interest Expense 3173 Premium on Bonds Payable 1077 Interest Payable 4250 6/1/21 Interest Expense 15867 Interest Payable 4250 Premium on Bonds Payable 5383 Question 4 of 6 -12 10/1/21 (To record interest expense and premium amortization) 10/1/21 (To record buy back of bonds) 12/1/21 12/31/21 estion 4 of 6 -12 6/1/22 12/1/22 Save for Later Last saved 14 hours ago. Attempts: 0 of 3 used Submit