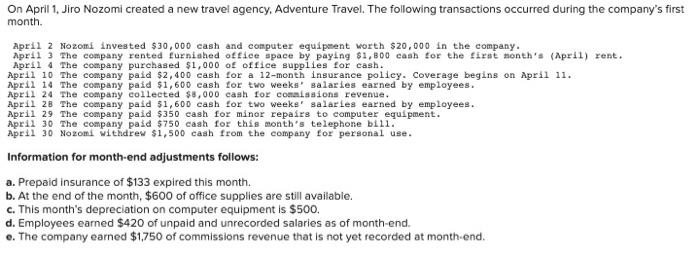

I need help with the last 2 journal entries.

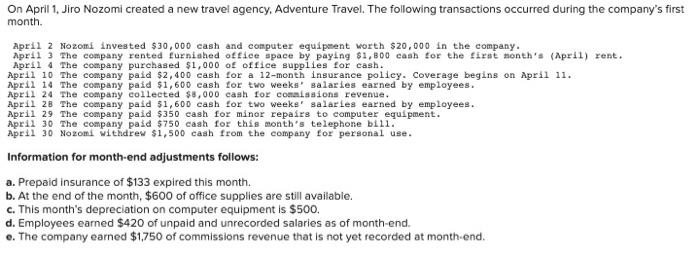

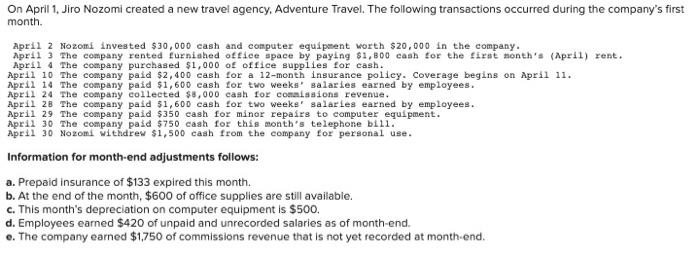

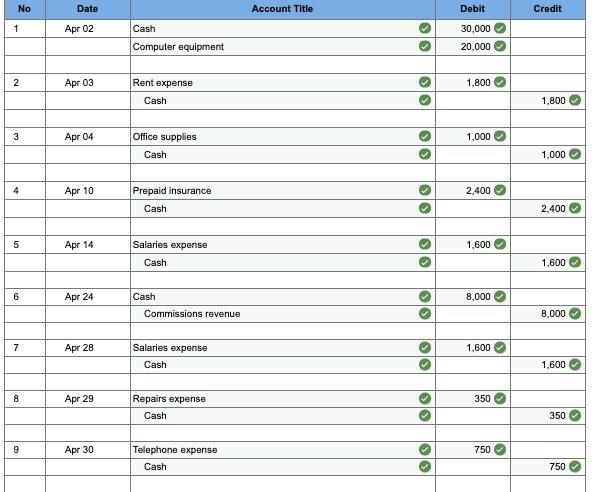

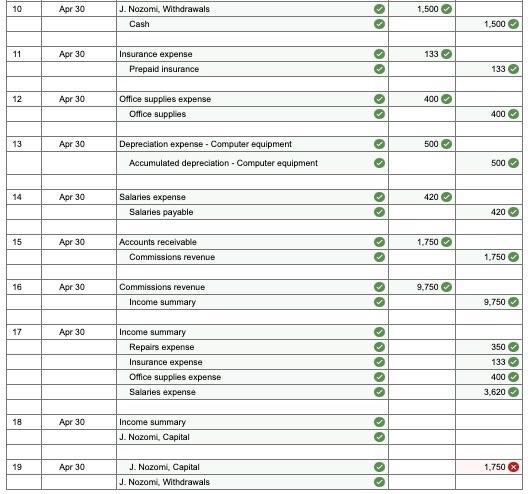

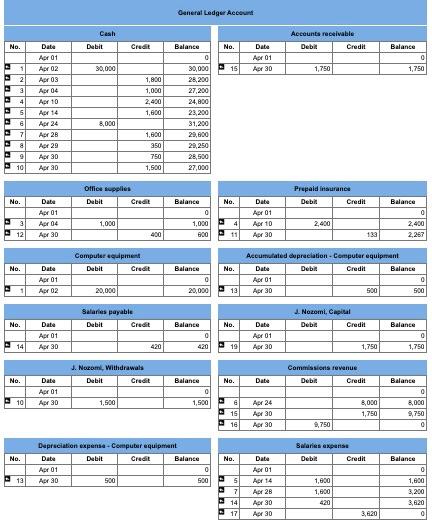

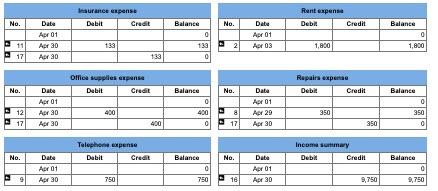

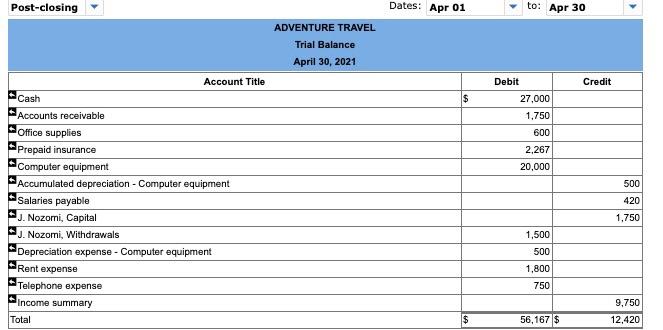

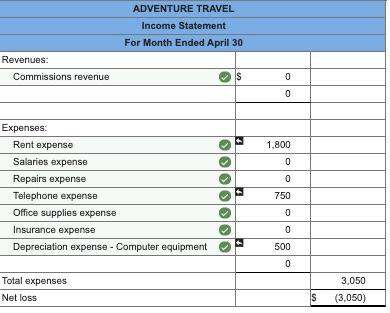

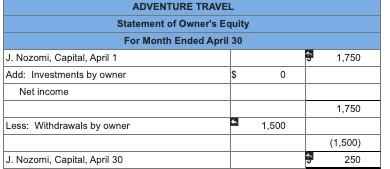

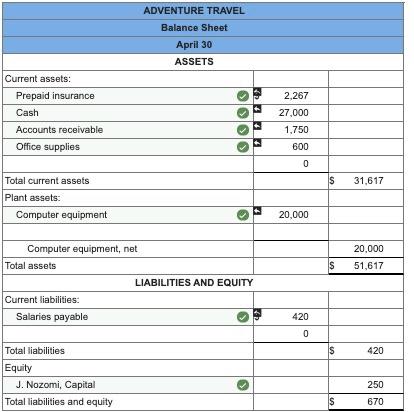

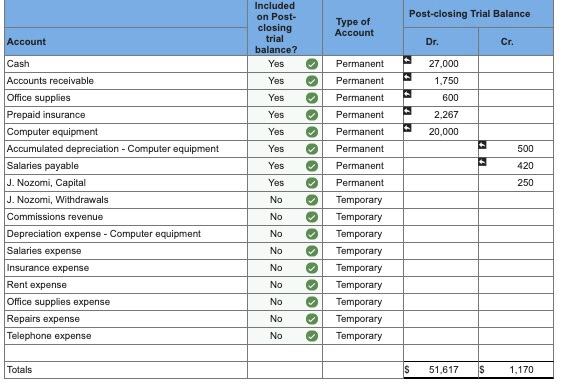

On April 1, Jiro Nozomi created a new travel agency, Adventure Travel. The following transactions occurred during the company's first month. April 2 Nozom invested $30,000 cash and computer equipment worth $20,000 in the company. April : The company rented furnished office space by paying $1,800 cash for the first month's (April) rent. April 4 The company purchased $1,000 of office supplies for cash. April 10 The company paid $2,400 cash for a 12-month insurance policy. Coverage begins on April 11. April 14 The company paid $1,600 cash for two weeks' salaries earned by employees. April 24 The company collected $8,000 cash for commissions revenue. April 28 The company paid $1,600 cash for two weeks' salaries earned by employees. April 29 The company paid $350 cash for minor repairs to computer equipment. April 30 The company paid $750 cash for this month's telephone bill. April 30 Nozomi withdrew $1,500 cash from the company for personal use. Information for month-end adjustments follows: a. Prepaid insurance of $133 expired this month. b. At the end of the month, $600 of office supplies are still available. c. This month's depreciation on computer equipment is $500, d. Employees earned $420 of unpaid and unrecorded salaries as of month-end. e. The company earned $1,750 of commissions revenue that is not yet recorded at month-end. No Date Account Title Debit Credit 1 Apr 02 Cash 30,000 Computer equipment 20.000 2 Apr 03 1,800 Rent expense Cash 1.800 3 Apr 04 1.000 Office supplies Cash 1,000 4 Apr 10 2,400 Prepaid insurance Cash OO 2.400 5 Apr 14 1,600 Salaries expense Cash O 1,600 6 Apr 24 Cash 8.000 Commissions revenue 8,000 7 Apr 28 1,600 Salaries expense Cash >> 1,600 8 Apr 29 350 Repairs expense Cash 350 9 Apr 30 750 Telephone expense Cash 750 10 Apr 30 1,500 J. Nozomi, Withdrawals Cash 1,500 11 Apr 30 133 Insurance expense Prepaid insurance 133 ON Oo 12 Apr 30 400 Office supplies expense Office supplies 400 13 Apr 30 10 500 Depreciation expense - Computer equipment Accumulated depreciation - Computer equipment 500 14 Apr 30 420 Salaries expense Salaries payable 420 OOOO 15 Apr 30 1,750 Accounts receivable Commissions revenue 1.750 16 Apr 30 Commissions revenue 9.750 lol Income summary 9.750 17 Apr 30 Income summary Repairs expense Insurance expense Office supplies expense Salaries expense OOOOO 350 133 400 3,620 18 Apr 30 Income summary J. Nozomi, Capital OOOO 19 Apr 30 1.750 J. Nozomi, Capital J. Nozomi, Withdrawals General Ledger Account Cash Accounts receivable De Credit No. Debit Credit No. Balance Data Apr 01 Apr 30 30,000 15 1,750 1,750 2 Date Apr 01 Apr 02 Apr 08 Apr 04 Apr 10 Apr 14 Apr 24 Apr 28 Apr 29 Apr 30 Apr 30 1,800 1,000 2.400 1,600 4 Balance 0 30,000 26,200 27,200 24,800 23,200 31,200 29,800 29,250 28,500 27,000 5 PE 8,000 8 9 10 1,600 350 750 1500 Office supplies Debit Credit Prepaid insurance Debit Credit No. No. Balance 3 Date Ar 01 Apr 4 Apr 30 Balance 0 1,000 600 Date Apr 01 Apr 10 Ar 30 1,000 4 2,400 2,400 400 133 2,267 Computer open Debit Credit No. No. Data Apr 01 Apr 02 Balance 0 20,000 Accumulated depreciation - Computer equipment Date Dubit Credit Balance Apr 01 0 500 500 1 20,000 - 19 Ar 30 Salaries payable Debit Credit 1. Nozomi. Capital Debit Credit No. Balance No. Balance Data Apr 01 Apr 30 0 Date Apr 01 Apr 30 14 420 - 19 1,750 1,750 J. Novom, withdrawals Debit Credit Commissions revenue Debit Credit No. Balance No. Date Balance Data Apr 01 0 1,500 101 Ar 90 1,500 8,000 Apr 24 Ar 30 Apr 90 15 18 1,750 8,000 9,750 0 9,750 Bwares expense Debit Credit No. No. Balance Depreciation expense - Computer equipment Data Debit Credit Balance Apr 01 0 Apr 30 500 500 131 5 Data Apr 01 Apr 14 Aur 28 Apr 30 Apr 30 7 14 17 1,600 1,600 420 1,600 3,200 3,620 0 3,620 Insurance expense Debit Credit Rent expense Debil Credit No. Balance No. Balance Data Apr 01 Date Apr 01 Apr 30 Apr 20 133 133 2 11 17 Ar 03 1.800 1,800 Office supplies expense Debit Credit Repairs experts Debit Credit No. Balance No. Date Apr 01 Apr 30 Apr 30 Date Apr 01 Apr 29 Apr 30 Balance ol 350 0 400 400 350 12 17 8 17 400 350 Telephone expense Debit Credit Income rimary Credit No. Balance No. Balance Date Apr 01 Apr 30 Dube Apr 01 Apr 30 9 750 750 16 9,750 9.750 Post-closing Dates: Apr 01 to: Apr 30 ADVENTURE TRAVEL Trial Balance April 30, 2021 Account Title Credit $ Debit 27,000 1,750 600 2,267 20,000 500 420 Cash Accounts receivable Office supplies Prepaid insurance Computer equipment Accumulated depreciation - Computer equipment Salaries payable J. Nozomi, Capital J. Nozomi, Withdrawals Depreciation expense - Computer equipment Rent expense Telephone expense Income summary Total 1,750 1,500 500 1,800 750 9,750 12,420 $ 56,167 $ ADVENTURE TRAVEL Income Statement For Month Ended April 30 Revenues: Commissions revenue S 0 0 1,800 0 0 Expenses: Rent expense Salaries expense Repairs expense Telephone expense Office supplies expense Insurance expense Depreciation expense - Computer equipment 750 0 0 500 0 Total expenses Net loss 3.050 (3,050) S ADVENTURE TRAVEL Statement of Owner's Equity For Month Ended April 30 J. Nozomi, Capital, April 1 Add: Investments by owner S Net income 1,750 0 1.750 Less: Withdrawals by owner 1,500 (1.500) 250 J. Nozomi, Capital, April 30 ADVENTURE TRAVEL Balance Sheet April 30 ASSETS Current assets: Prepaid insurance Cash Accounts receivable Office supplies 2,267 27,000 1.750 600 0 S 31,617 Total current assets Plant assets: Computer equipment 20,000 20,000 51,617 S Computer equipment, not Total assets LIABILITIES AND EQUITY Current liabilities: Salaries payable 420 0 S 420 Total liabilities Equity J. Nozomi, Capital Total liabilities and equity 250 $ 670 Post-closing Trial Balance Type of Account Account Dr. Cr. Permanent Included on Post- closing trial balance? Yes Yes Yes Yes Yes Yes 00000 27,000 1,750 600 tt 2.267 20,000 LE 500 420 Yes 250 Cash Accounts receivable Office supplies Prepaid insurance Computer equipment Accumulated depreciation - Computer equipment Salaries payable J. Nozomi, Capital J. Nozomi, Withdrawals Commissions revenue Depreciation expense - Computer equipment Salaries expense Insurance expense Rent expense Office supplies expense Repairs expense Telephone expense Yes No Permanent Permanent Permanent Permanent Permanent Permanent Permanent Temporary Temporary Temporary Temporary Temporary Temporary Temporary Temporary Temporary No 2 2 2 2 2 2 2 ololololololo Totals s 51.617 IS 1,170