Answered step by step

Verified Expert Solution

Question

1 Approved Answer

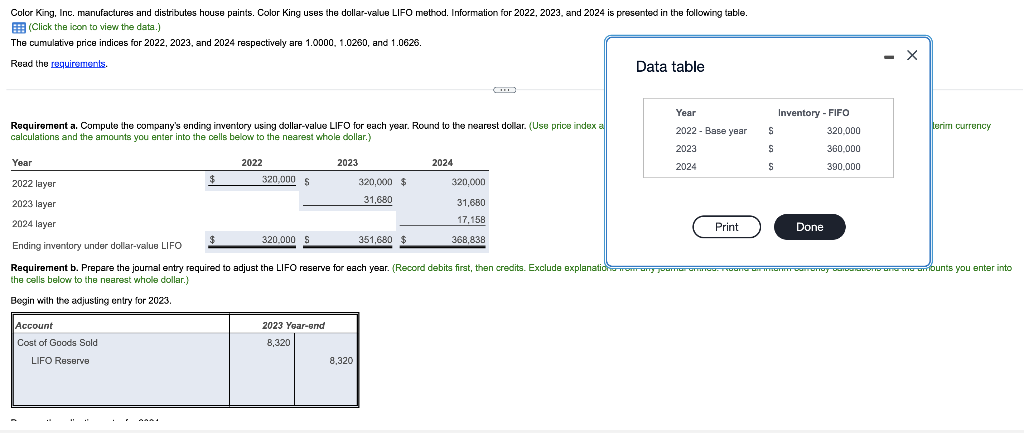

I need help with the last entry Color King, Inc. manufactures and distributes house paints. Color King uses the dollar-value LIFO method. Information for 2022,

I need help with the last entry

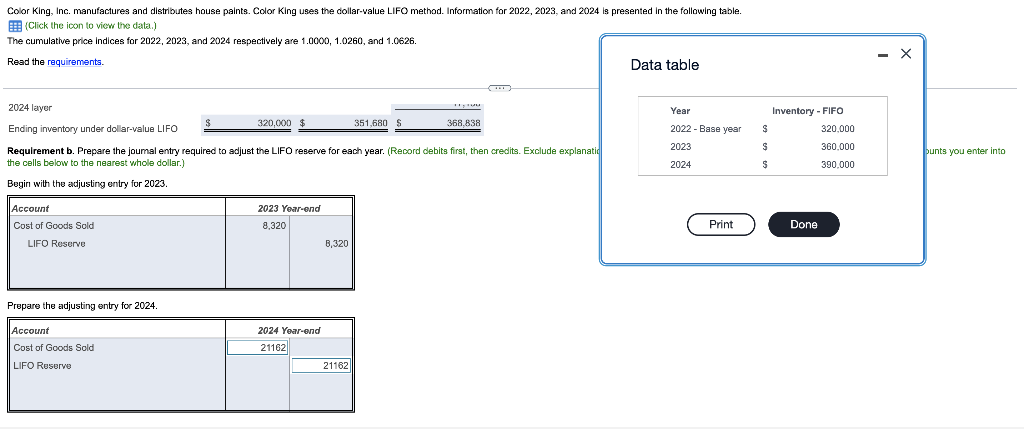

Color King, Inc. manufactures and distributes house paints. Color King uses the dollar-value LIFO method. Information for 2022, 2023 and 2024 is presented in the following table. (Click the icon to view the data.) The cumulative price indices for 2022, 2023, and 2024 respectively are 1.0000, 1.0260, and 1.0625. Read the requirements Data table Year Requirement a. Compute the company's ending inventory using dollar-value LIFO for each year. Round to the nearest dollar. (Use price index al calculations and the amounts you enter into the cells below to the nearest whole dollar.) Lerim currency 2022 - Base year 2023 2024 Inventory - FIFO S 320.000 S 360.000 Year 2022 2023 2024 S 390.000 2022 layer $ 320,000 $ 320,000 320,000 $ 31,680 2023 layer 31,680 17,158 2024 layer Print Done 320.000 S 351,680 $ 368,838 Ending inventory under dollar-value LIFO Requirement b. Prepare the journal entry required to adjust the LIFO reserve for each year. (Record debits first, then credits. Exclude explanatidaromony TCGTC. COCO CT com croyono one carbunts you enter into the cells below to the nearest whole dollar.) Bogin with the adjusting entry for 2023. Account Cost of Goods Sold 2023 Year-end 8,320 LIFO Reserve 8,320 Color King, Inc. manufactures and distributes house paints. Color King uses the dollar-value LIFO method. Information for 2022 2023, and 2024 is presented in the following table (Click the icon to view the data.) The cumulative price Indices for 2022, 2023, and 2024 respectively are 1.0000, 1.0260, and 1.0626. Read the requirements. Data table - X 2024 layer Year 320,000 $ 351,680 S 368,838 Ending inventory under dollar-value LIFO $ 2022 - Base year 2023 Inventory - FIFO 320.000 360.000 390.000 S punts you enter into 2024 $ Requirement b. Prepare the joumal entry required to adjust the LIFO reserve for each year. (Record debits first, then credits. Exclude explanatid the cells below to the nearest whole dollar.) Begin with the adjusting entry for 2023. Account Cost of Goods Sold 2023 Year-end 8,320 8,320 ( Print Done LIFO Reserve Prepare the adjusting entry for 2024. Account Cost of Goods Sold 2024 Year-end 21162|| LIFO Reserve 21162Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started