I need help with the last question. if you were to total your car...

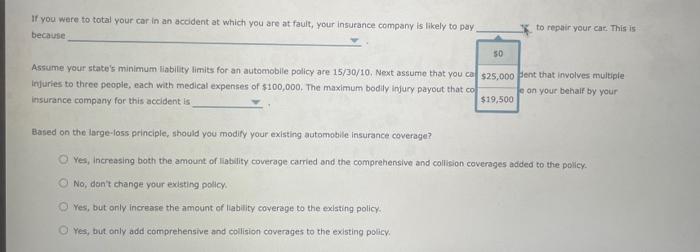

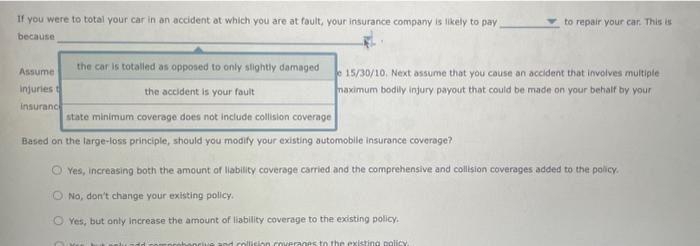

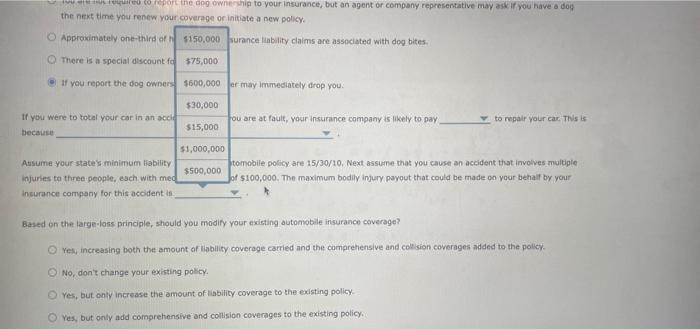

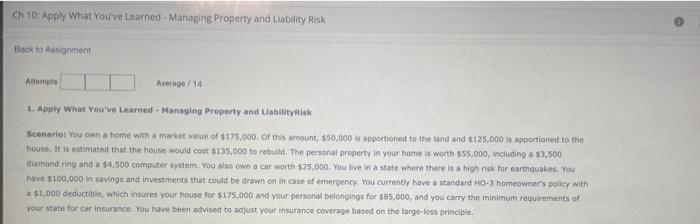

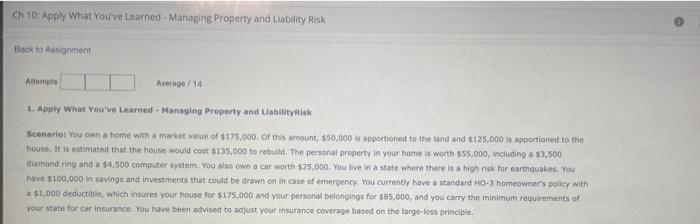

1. Apply What Youtve Learned - Managing Property and Liabilityfisk Scenariot You own a heme with a market value of $175,000, of this amount, $50,000 is apportioned to the land and $125,000 is apportioned to the house. it is estimated that the house would cost $135,000 to rebulid. The personal preperty in your home is worth $55,000, including a $3,500 diarnond ring and a $4,500 computer bystem. You also own a car warth $25,000. You live in a state where there is a high risk for earthquahes. You have 5100,000 in savings and investments that could be drawn on in case of emergency You currently have a standard lio-3 homeowner's polley with a $1,000 deductblic, which instires your house for $175,000 and your personal belongings for 585,000 , and you carry the minimum requirements of your state for car insurance. You have been advised to adjust your insurance coverage based on the largedess orinciple. If you were to total your car in an acoident at which you are at fault. vour insurance company is likely to psy to repair your cat. This is becausi Assume your state's minimum liability limits for an automobile policy are 15/30/10, Next assume that you a ent that involves multiple injuries to three people, each with medical expenses of $100,000. The maximum bodily infury payout that a insurance company for this aceident is Based on the large-lass principle, should you modify your existing automotile insurance coverage? ion your behalf by your Yes, increasing both the amount of liability coverage carried and the comprehensive and collision coverages added to the policy. No, don't change your existing pollcy. Yes, but only increase the amount of lability coverege to the exlsting policy. Yes, but only add comprehensive and collision coverages to the existing policy. If you were to total your car in an accident ot which you are at foult, your insurance company is likely to pay to repair your car. This is because \begin{tabular}{l} Assume the car is totalled as opposed to only stightly damaged \\ injuries t) \\ insuranc \\ the accident is your fault \\ state minimum coverage does not include collision coverage \\ \hline \end{tabular} Based on the large-loss principle, should you modify your existing automobile insurance coverage? Yes, increasing both the amount of liability coverage carried and the comprehensive and collision coverages added to the poincy. No, don't change your existing policy. Yes, but only increase the amount of liability coverage to the existing pollicy. the next time you renew your wyerage or initiate a new policy. incurance company for this accident is Based on the large-loss principle, should you madify your existing outomobile insurance coverage? Yes, increasing both the amount of liablity coverage carried and the campretiensive and coll sion conerages added to the pollicy. No, don' change your existing pokky. Yes, but onty increase the amount of tisbility coverage to the existing policy. Yes, but only add comprehonsive and collision coverages to the existing policy. 1. Apply What Youtve Learned - Managing Property and Liabilityfisk Scenariot You own a heme with a market value of $175,000, of this amount, $50,000 is apportioned to the land and $125,000 is apportioned to the house. it is estimated that the house would cost $135,000 to rebulid. The personal preperty in your home is worth $55,000, including a $3,500 diarnond ring and a $4,500 computer bystem. You also own a car warth $25,000. You live in a state where there is a high risk for earthquahes. You have 5100,000 in savings and investments that could be drawn on in case of emergency You currently have a standard lio-3 homeowner's polley with a $1,000 deductblic, which instires your house for $175,000 and your personal belongings for 585,000 , and you carry the minimum requirements of your state for car insurance. You have been advised to adjust your insurance coverage based on the largedess orinciple. If you were to total your car in an acoident at which you are at fault. vour insurance company is likely to psy to repair your cat. This is becausi Assume your state's minimum liability limits for an automobile policy are 15/30/10, Next assume that you a ent that involves multiple injuries to three people, each with medical expenses of $100,000. The maximum bodily infury payout that a insurance company for this aceident is Based on the large-lass principle, should you modify your existing automotile insurance coverage? ion your behalf by your Yes, increasing both the amount of liability coverage carried and the comprehensive and collision coverages added to the policy. No, don't change your existing pollcy. Yes, but only increase the amount of lability coverege to the exlsting policy. Yes, but only add comprehensive and collision coverages to the existing policy. If you were to total your car in an accident ot which you are at foult, your insurance company is likely to pay to repair your car. This is because \begin{tabular}{l} Assume the car is totalled as opposed to only stightly damaged \\ injuries t) \\ insuranc \\ the accident is your fault \\ state minimum coverage does not include collision coverage \\ \hline \end{tabular} Based on the large-loss principle, should you modify your existing automobile insurance coverage? Yes, increasing both the amount of liability coverage carried and the comprehensive and collision coverages added to the poincy. No, don't change your existing policy. Yes, but only increase the amount of liability coverage to the existing pollicy. the next time you renew your wyerage or initiate a new policy. incurance company for this accident is Based on the large-loss principle, should you madify your existing outomobile insurance coverage? Yes, increasing both the amount of liablity coverage carried and the campretiensive and coll sion conerages added to the pollicy. No, don' change your existing pokky. Yes, but onty increase the amount of tisbility coverage to the existing policy. Yes, but only add comprehonsive and collision coverages to the existing policy

I need help with the last question. if you were to total your car...

I need help with the last question. if you were to total your car...