Answered step by step

Verified Expert Solution

Question

1 Approved Answer

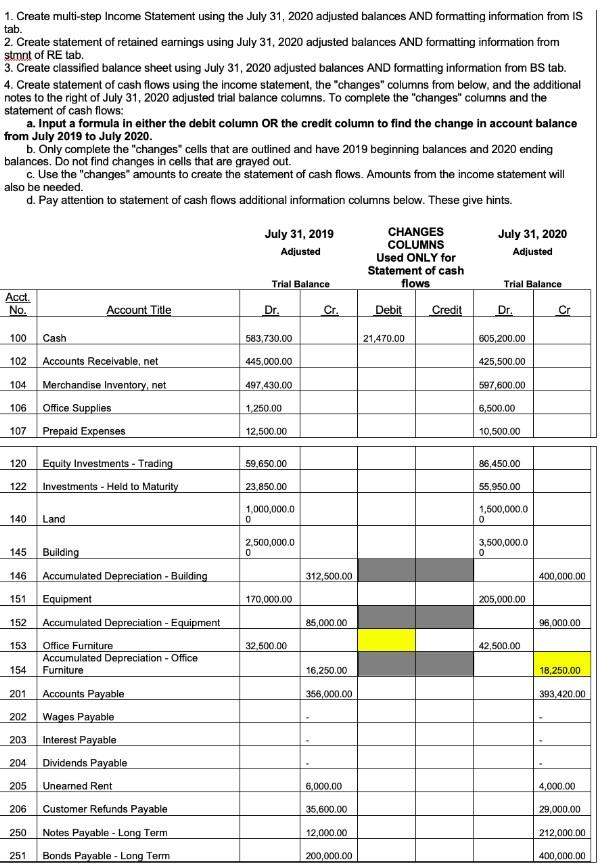

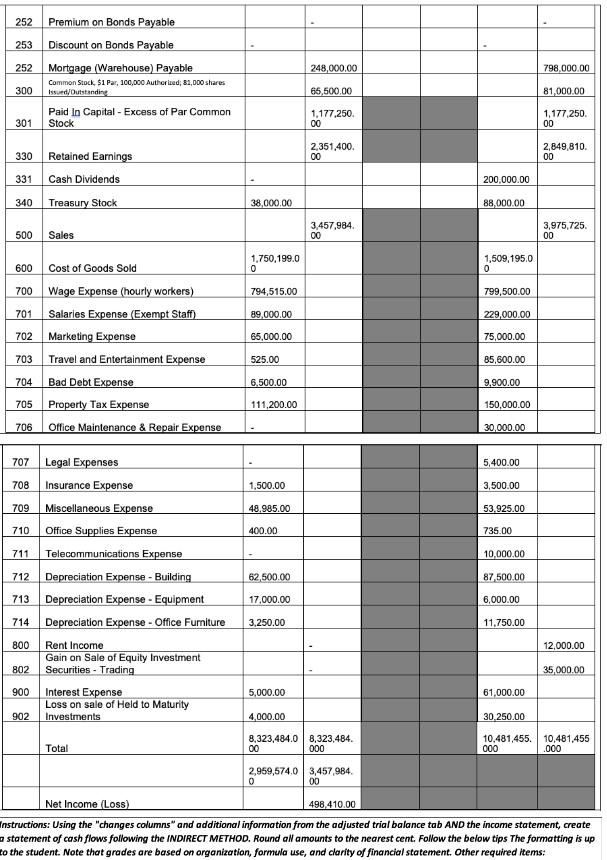

I need help with the number 4. Statement of Cash Flow. Income Statement For the Year Ended July 31, 2020 Sales $3,975,725.00 Cost of Goods

I need help with the number 4. Statement of Cash Flow.

| Income Statement | ||

| For the Year Ended July 31, 2020 | ||

| Sales | $3,975,725.00 | |

| Cost of Goods Sold | $1,509,195.00 | |

| Gross Profit | $2,466,530.00 | |

| Operating Expenses: | ||

| Wages Expense | $799,500.00 | |

| Salaries Expense | $229,000.00 | |

| Marketing Expense | $75,000.00 | |

| Travel and Entertainment Expense | $85,600.00 | |

| Bad Debt Expense | $9,900.00 | |

| Property Tax Expense | $150,000.00 | |

| Office Maintenance & Repair Expense | $30,000.00 | |

| Legal Expense | $5,400.00 | |

| Insurance Expense | $3,500.00 | |

| Miscellaneous Expense | $53,925.00 | |

| Office Supplies Expense | $735.00 | |

| Telecommunication Expense | $10,000.00 | |

| Depreciation Expense - Building | $87,500.00 | |

| Depreciation Expense - Equipment | $6,000.00 | |

| Depreciation Expense - Office Furniture | $11,750.00 | |

| Total Operating Expenses | $1,557,810.00 | |

| Income from Operations | $908,720.00 | |

| Other Income | ||

| Rent Income | $12,000.00 | |

| Gain on Sale of Equity Investment Securities - Trading | $35,000.00 | $47,000.00 |

| Other Expenses: | ||

| Interest Expense | $(61,000.00) | |

| Loss on Sale of Held to Maturity Investment | $(30,250.00) | $91,250.00 |

| Net Income | $864,470.00 | |

| Instructions: Using the "changes columns" and additional information from the adjusted trial balance tab AND the income statement, create a statement of cash flows following the INDIRECT METHOD. Round all amounts to the nearest cent. Follow the below tips The formatting is up to the student. Note that grades are based on organization, formula use, and clarity of financial statement. Other required items: | |||

| a. Only use accounts that have changes or cash flows | |||

| b. Include proper report title | |||

| c. Not all rows or columns need to be used. Formulas MUST be used when necessary. | |||

| TIPS PLEASE READ: | |||

| 1. Correct selection of "Increase" or "Decrease" in accounts must be used as part of the label where applicable | |||

| 2. Correct use of "cash paid" or "cash received" must be used where applicable | |||

| 3. Subtotals for each section MUST be properly identified as cash "used in" or "provided by" | |||

| 4. All changes utilize CASH. There ARE GAINS AND LOSSES from investments that must be included in operating activities | |||

| 5. Net change in cash + beginning cash balance (from a adjusted trial balance July 2019 column) must equal ending cash balance and be included at the bottom of this statement. |

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started