Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I need help with the ones that have a red x next to them. Problem 18-9 (LO. 4) Plum Corporation will begin operations on January

I need help with the ones that have a red x next to them.

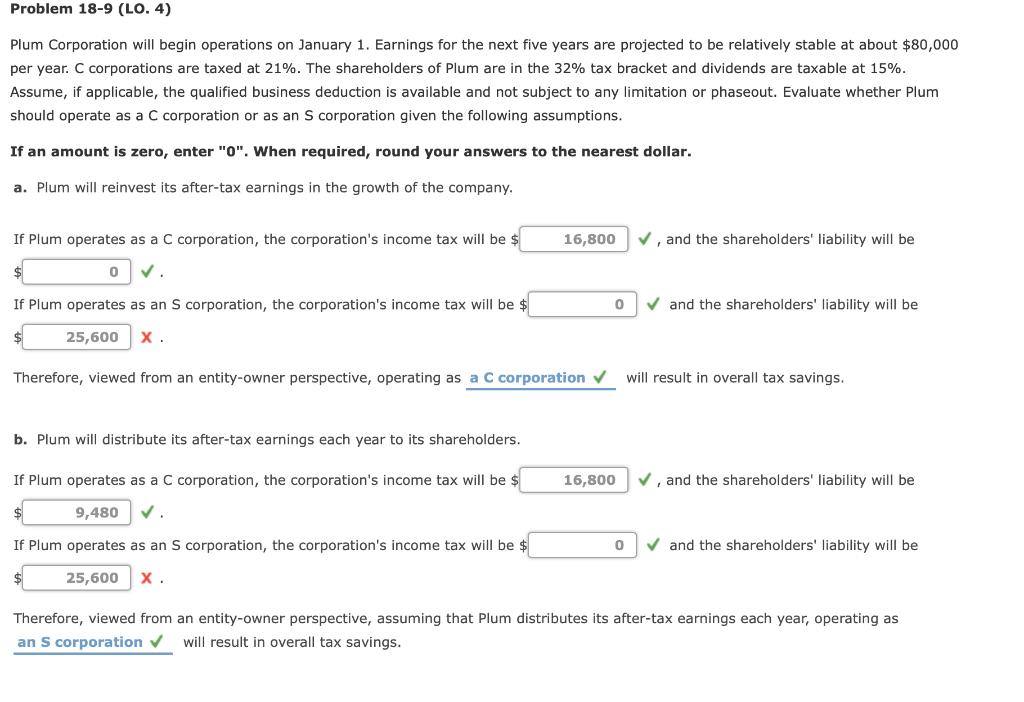

Problem 18-9 (LO. 4) Plum Corporation will begin operations on January 1. Earnings for the next five years are projected to be relatively stable at about $80,000 per year. C corporations are taxed at 21%. The shareholders of Plum are in the 32% tax bracket and dividends are taxable at 15% Assume, if applicable, the qualified business deduction is available and not subject to any limitation or phaseout. Evaluate whether Plum should operate as a C corporation or as an Scorporation given the following assumptions. If an amount is zero, enter "O". When required, round your answers to the nearest dollar. a. Plum will reinvest its after-tax earnings in the growth of the company. 16,800 V, and the shareholders' liability will be If Plum operates as a C corporation, the corporation's income tax will be $ $ 0 . If Plum operates as an S corporation, the corporation's income tax will be $ O and the shareholders' liability will be $ 25,600 x. Therefore, viewed from an entity-owner perspective, operating as a C corporation will result in overall tax savings. b. Plum will distribute its after-tax earnings each year to its shareholders. 16,800 V, and the shareholders' liability will be If Plum operates as a C corporation, the corporation's income tax will be $ $ 9,480 . 0 and the shareholders' liability will be If Plum operates as an S corporation, the corporation's income tax will be $ $ 25,600 Therefore, viewed from an entity-owner perspective, assuming that Plum distributes its after-tax earnings each year, operating as an S corporation will result in overall tax savingsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started