Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I NEED HELP WITH THE PART 3 DEPRECIATION SCHEDULE. I BELIEVE I GAVE ALL INFO NEEDED TO COMPLETE. DUE TODAY SO NEED DONE ASAP. PLEASE

I NEED HELP WITH THE PART 3 DEPRECIATION SCHEDULE. I BELIEVE I GAVE ALL INFO NEEDED TO COMPLETE. DUE TODAY SO NEED DONE ASAP. PLEASE AND THANK YOU!!!

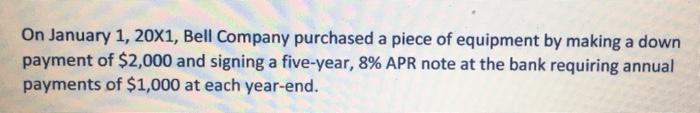

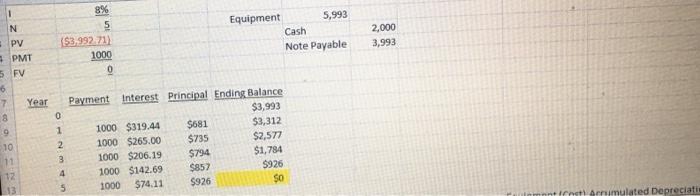

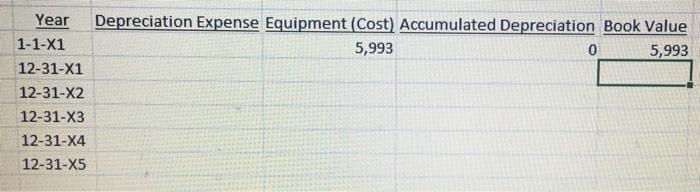

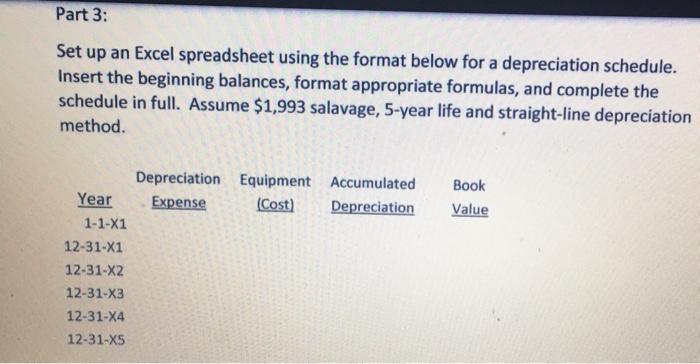

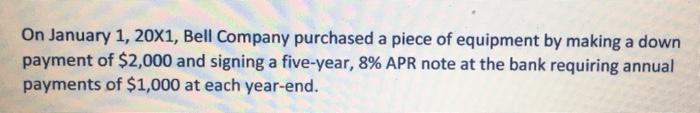

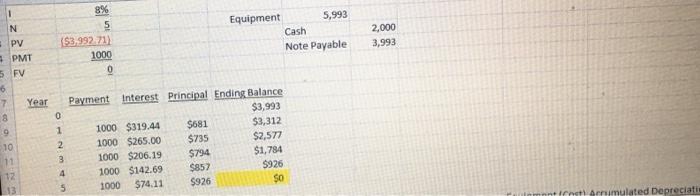

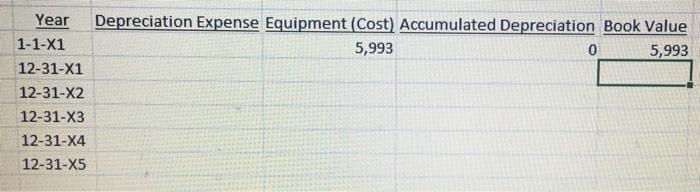

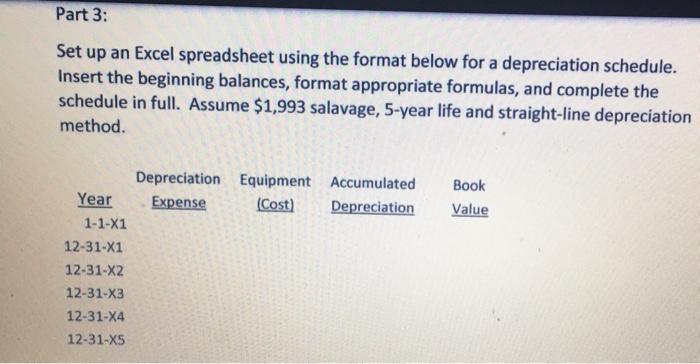

On January 1, 20x1, Bell Company purchased a piece of equipment by making a down payment of $2,000 and signing a five-year, 8% APR note at the bank requiring annual payments of $1,000 at each year-end. 2,000 3,993 1 8% N 5 Equipment 5,993 PV ($3.99271) Cash PMT 1000 Note Payable 5 FV 0 6 7 Year Payment Interest Principal Ending Balance 8 $3,993 9 1000 $319,44 $681 $3,312 10 2 1000 $265.00 $735 $2,577 11 1000 $206.19 $794 $1,784 12 4 1000 $142.69 $857 $926 1000 $74.11 $926 $0 ANO montina Arruimulated Depreciati Year Depreciation Expense Equipment (Cost) Accumulated Depreciation Book Value 1-1-X1 5,993 0 5,993 12-31-X1 12-31-X2 12-31-X3 12-31-X4 12-31-X5 Part 3: Set up an Excel spreadsheet using the format below for a depreciation schedule. Insert the beginning balances, format appropriate formulas, and complete the schedule in full. Assume $1,993 salavage, 5-year life and straight-line depreciation method. Book Value Depreciation Equipment Accumulated Year Expense (Cost) Depreciation 1-1-X1 12-31-X1 12-31-X2 12-31-X3 12-31-X4 12-31-XS

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started