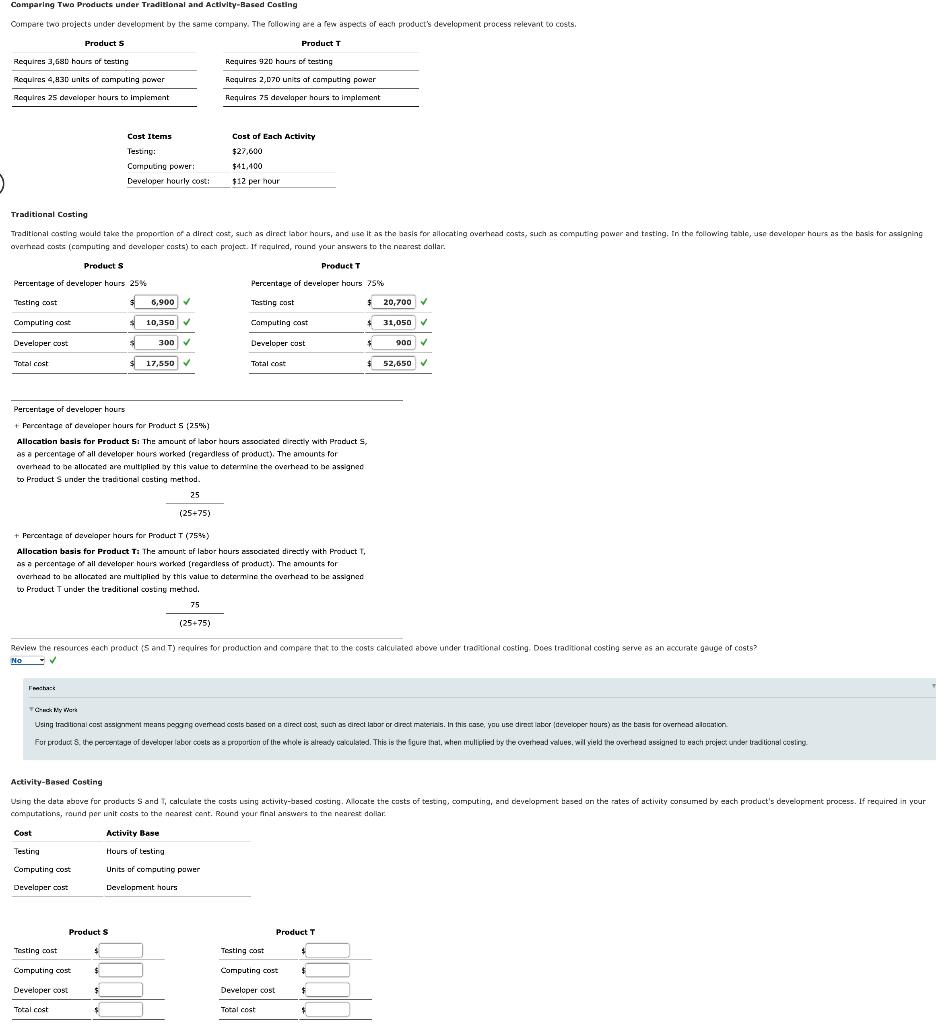

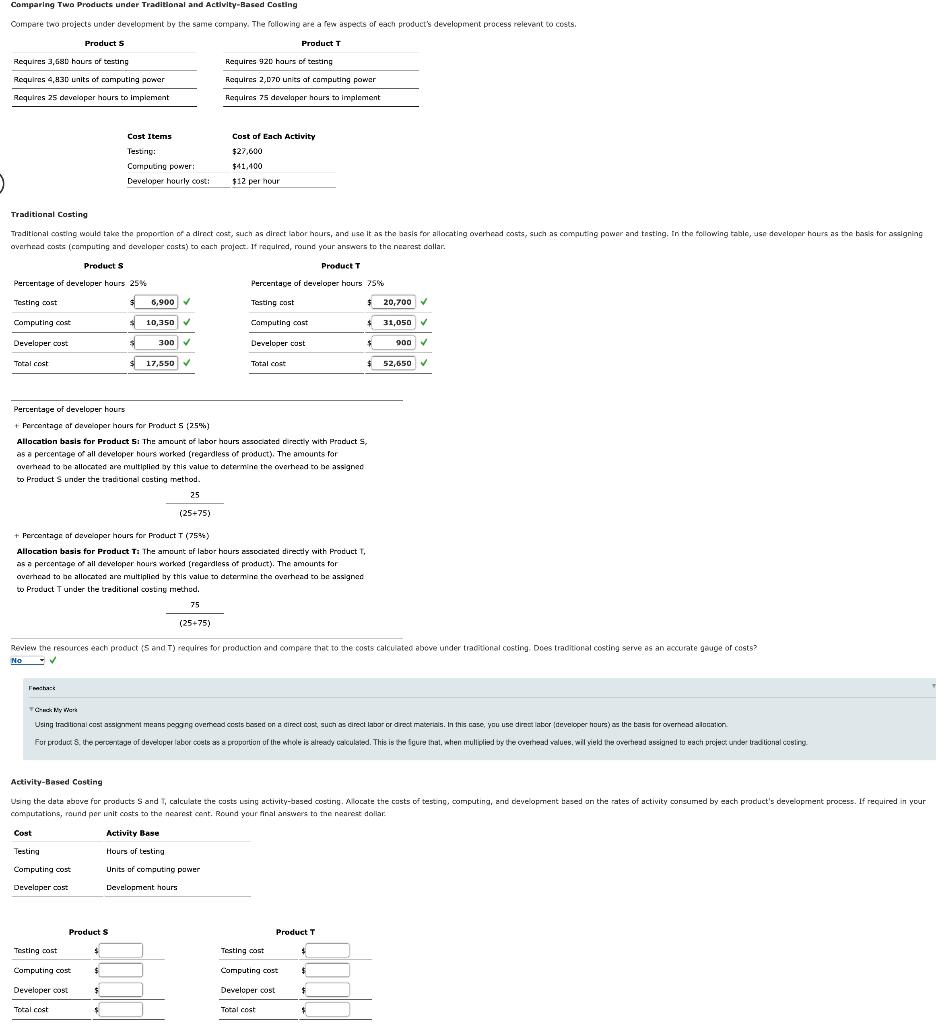

I need help with the second part of this question, it's the Activity-Based Costing section. Thank you!

Comparing Two Products under Traditional and Activity-Based Costing Compare two projects under development by the same company. The following are a few aspects of each product's development process relevant to costs. Products Product Requires 3,680 hours of testing Requires 920 hours of testing Requires 4,830 units of computing acner Requires 2,070 units of computing power Requires 25 developer hours to implement Requires 75 developer hours to implement Cost Items Testing: Cornputing power Developer hourly cost! Cost of Each Activity $27,600 $41,400 $12 per hour Traditional Casting Traditional casting would take the proportion of a direct cost, such as direct labor hours, and use it as the basis for allocating overhead costs, such as computing power and testing. In the following table, uso developer hours as the basis for assigning overhead costs (computing and developer costs) to each project. It required, round your answers to the nearest callar. Products Product T Percentage of developer hours 25% Percentage of developer hours 75% Testing cost 6,900 Testing cost $ $ 20,700 Computing cost $ 10,350 Computing cast $ 31,050 Develuper cost 300 Developer cost $ 900 Total cost sl 17,550 Total cost $ 52,650 Percentage of developer hours + Percentage of developer hours for Product S (25%) Allocation basis for Product S: The amount of lator hours associated directly with Products, as a percentage of all developer hours worked (regardless of product). The amounts for overhead to be allocated are multiplied by this value to determine the overhead to be assigned to Product S under the traditional casting method. 25 (25+75) + Percentage of developer hours for Product T (759) Allocation basis for Product T: The amount of labor hours associated directly with Product T as a percentage of all developer hours worked (regardless of products. The amounts for overhead to be allocated are multiplied by this value to determine the overhead to be assigned to Product Tunder the traditional costing methud. T . 75 (25+75) Review the resources each product (5 and T) requires for production and compare that to the costs calculated above under traditional costing. Does traditional costing serve as an accurate gauge of costs? No sh Casa Ny were Using traditional cost assignment means pegang overhead costs based on a direct cost, such as direct labor cr direct materials. In this case, you use direct later developer hours) as the basis for overhead alocation Fur products. the percentage of developer laborals as a proportion u the whole is already calculated. This is the figure that when multiplied by the greed values, wil yield the overhead assigned to wach project under traditional cusing Activity-Based Costing Using the data above for products S and T, calculate the costs using activity-based costing. Alocate the costs of testing, computing, and deveopment based on the rates of activity corsumed by each product's development process. If required in your computations, round per unit costs to the nearest cent. Round your final answers to the nearest dollar Cost Activity Base Testing Computing cost Hours of testing Units of computing power Development hours Developer Cost Products Product T Testing cost Testing cost Computing cost $ Computing cost $ Developer OOS $ Developer cost $ Total cost $ Total cost $