Answered step by step

Verified Expert Solution

Question

1 Approved Answer

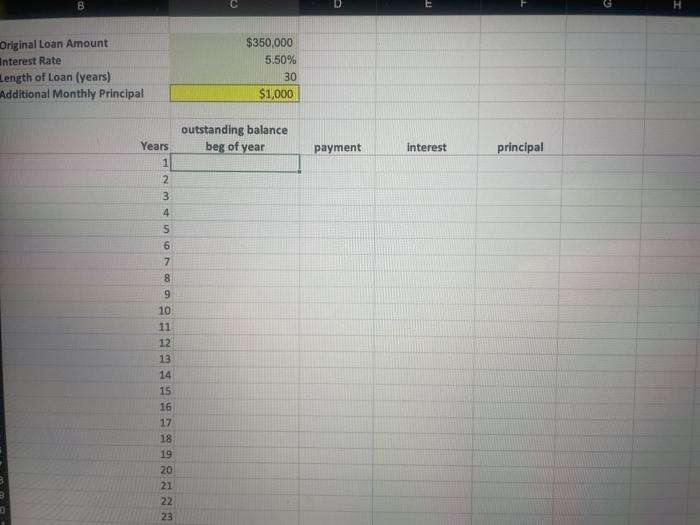

I need help with the second question (B) I'm not sure how I'd add the extra payment into excel? if you may show how that

I need help with the second question (B) I'm not sure how I'd add the extra payment into excel? if you may show how that would be great!

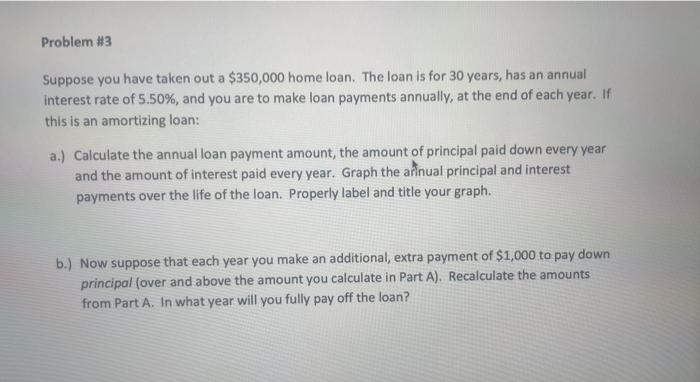

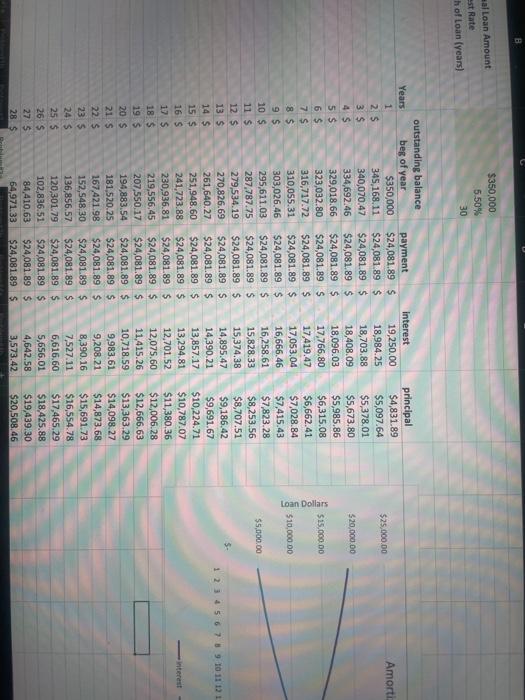

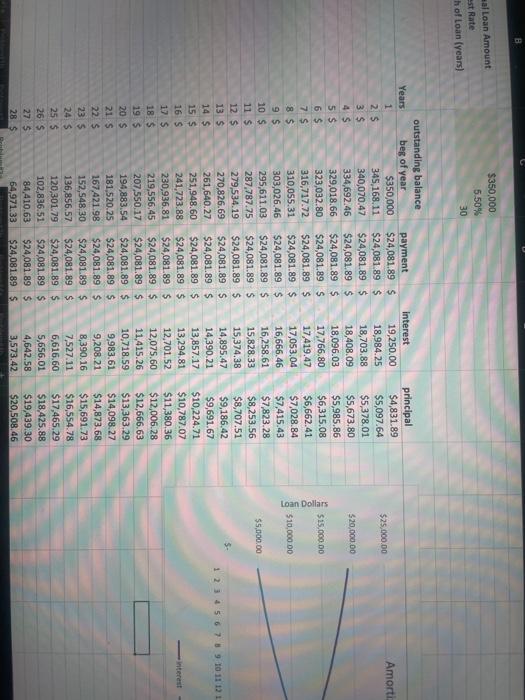

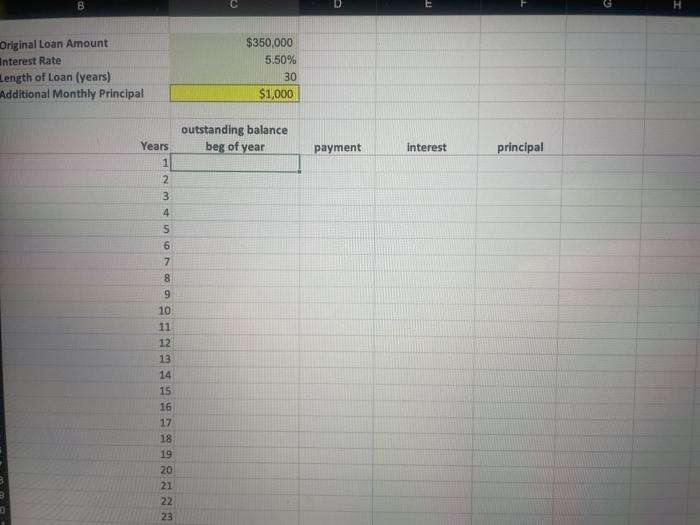

Problem #3 Suppose you have taken out a $350,000 home loan. The loan is for 30 years, has an annual Interest rate of 5.50%, and you are to make loan payments annually, at the end of each year. If this is an amortizing loan: a.) Calculate the annual loan payment amount, the amount of principal paid down every year and the amount of interest paid every year. Graph the arinual principal and interest payments over the life of the loan. Properly label and title your graph. b.) Now suppose that each year you make an additional, extra payment of $1,000 to pay down principal (over and above the amount you calculate in Part A). Recalculate the amounts from Part A. In what year will you fully pay off the loan? al Loan Amount est Rate hof Loan (years) $350,000 5.50% 30 $25,000.00 Amorti 520,000.00 $15,000.00 Loan Dollars $10,000.00 $5,000.00 outstanding balance Years beg of year 1 $350,000 2 S 345,168.11 3 $ 340,070.47 4 S 334,692.46 5 S 329,018.66 6 $ 323,032.80 7 $ 316,717.72 8 $ 310,055.31 9 $ 303,026.46 10 $ 295,611.03 11 $ 287,787.75 12 $ 279,534.19 13 S 270,826.69 14 $ 261,640.27 15 $ 251,948,60 16 S 241,723.88 17 $ 230,936.81 18 $ 219,556.45 195 207,550.17 20$ 194,883.54 21 S 181,520.25 22 $ 167,421 98 23 5 152,548,30 24 $ 136,856.57 25 S 120,301.79 26 S 102,836.51 27 5 84,410.63 28 $ 64971.33 payment $24,081.89 $ $24,081.89 $ $24,081.89 $ $24,081.89 $ $24,081.89 $ $24,081.89S $24,081.89 $ $24,081.89 $ $24,081.89 $ $24,081.89 $ $24,081.89 $ $24,081.89 $ $24,081.89 $ $24,081.89 $ $24,081.89 $ $24,081.89 $ $24,081.89 $ $24,081.89 $ $24,081.89 $ $24,081.89 $ $24,081.89 $ $24,081.89 $ $24,081.89 $ $24,081.89 $ $24,081.89 $ $24,081.89 $ $24,081.89 $ $24,081.89 $ 1 2 3 4 5 6 7 8 9 10 11 12 1 principal $4,831.89 $5,097.64 $5,378.01 $5,673.80 $5,985.86 $6,315.08 $6,662.41 $7,028.84 $7,415.43 $7,823.28 $8,253.56 $8,707.51 $9,186.42 $9,691.67 $10,224.71 $10,787.07 $11,380.36 $12,006.28 $12,666.63 $13,363.29 $14,098.27 $14,873.68 $15,691.73 $16,554.78 $17,465.29 $18.425.88 $19,439.30 $20,508,46 interest 19,250.00 18,984.25 18,703.88 18,408.09 18,096.03 17,766.80 17,419.47 17,053.04 16,666.46 16,258.61 15,828.33 15,374,38 14,895.47 14,390.21 13,857.17 13,294.81 12,701.52 12,075.60 11,415.26 10,718.59 9,983.61 9,208,21 8,390.16 7.527.11 6,616.60 5,656.01 4,642.58 3,573.42 interest B H Original Loan Amount Interest Rate Length of Loan (years) Additional Monthly Principal $350,000 5.50% 30 $1,000 outstanding balance beg of year payment interest principal Years 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started