I need help with the solution and explanation in the whole question Please and Thank you.

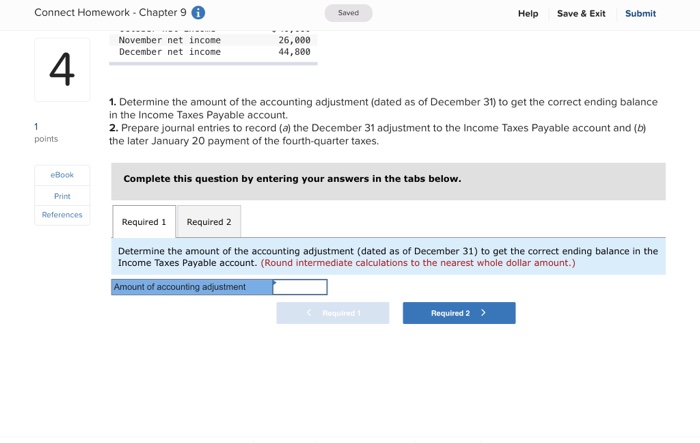

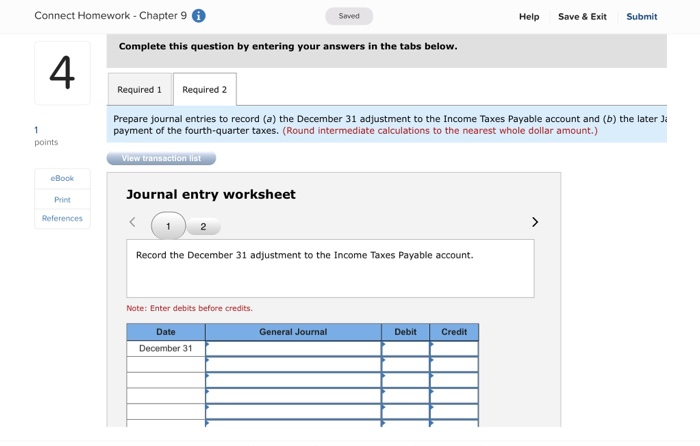

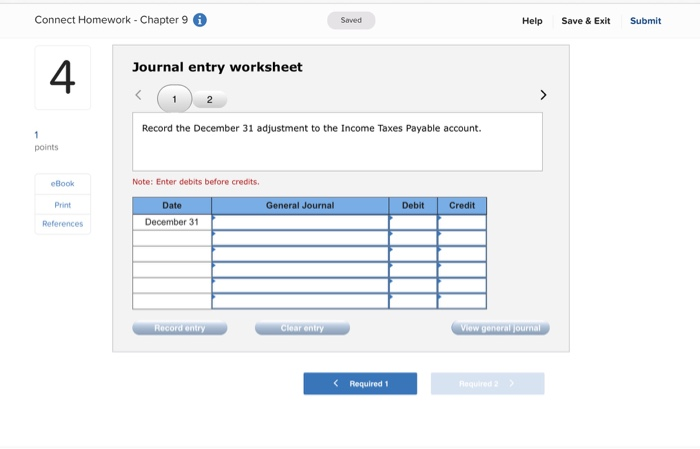

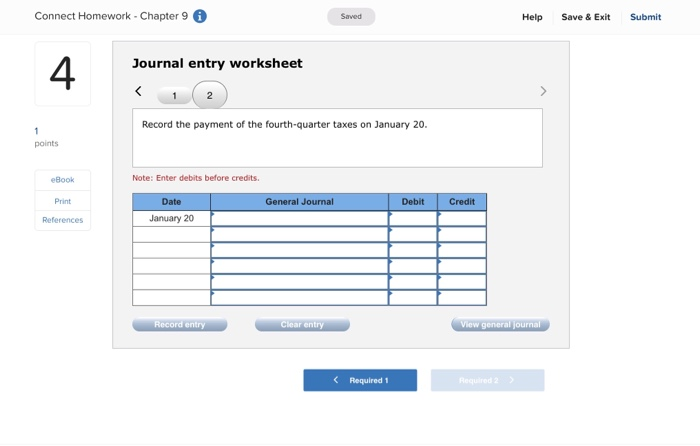

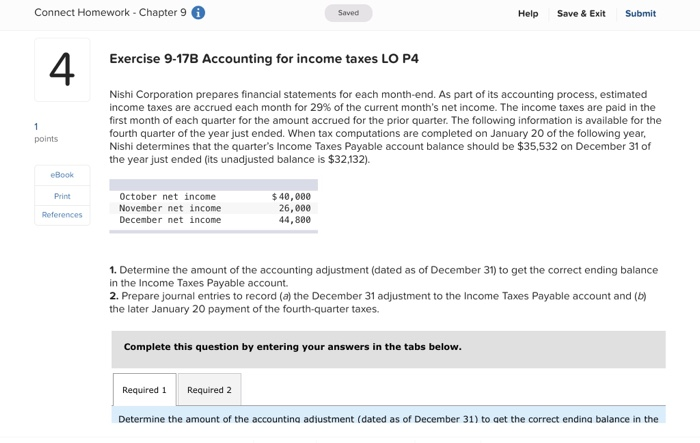

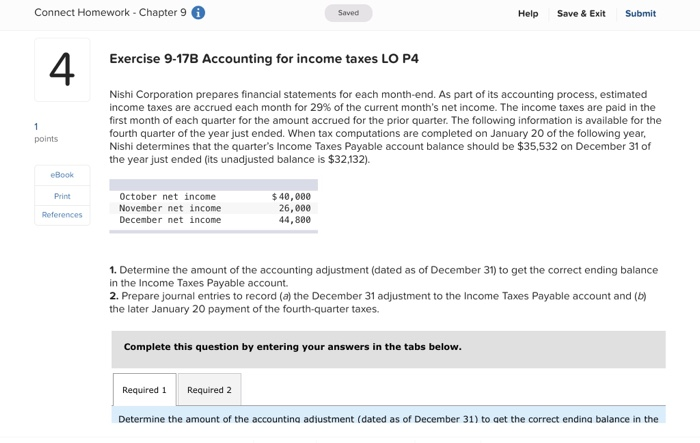

Connect Homework - Chapter 9 Saved Help Save & Exit Submit 4 Exercise 9-17B Accounting for income taxes LO P4 Nishi Corporation prepares financial statements for each month-end. As part of its accounting process, estimated income taxes are accrued each month for 29 % of the current month's net income. The income taxes are paid in the first month of each quarter for the amount accrued for the prior quarter. The following information is available for the fourth quarter of the year just ended. When tax computations are completed on January 20 of the following year, Nishi determines that the quarter's Income Taxes Payable account balance should be $35,532 on December 31 of the year just ended (its unadjusted balance is $32,132) 1 points eBook Print October net income $40,000 26,080 44,800 November net income December net income References 1. Determine the amount of the accounting adjustment (dated as of December 31) to get the correct ending balance in the Income Taxes Payable account. 2. Prepare journal entries to record (a) the December 31 adjustment to the Income Taxes Payable account and (b) the later January 20 payment of the fourth-quarter taxes. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Determine the amount of the accountina adiustment (dated as of December 31) to aet the correct endina balance in the Connect Homework Chapter 9 Saved Help Save & Exit Submit November net income December net income 26,000 44,800 4 1. Determine the amount of the accounting adjustment (dated as of December 31) to get the correct ending balance in the Income Taxes Payable account 2. Prepare journal entries to record (a) the December 31 adjustment to the Income Taxes Payable account and (b) the later January 20 payment of the fourth-quarter taxes. points eBook Complete this question by entering your answers in the tabs below. Print References Required 2 Required 1 Determine the amount of the accounting adjustment (dated as of December 31) to get the correct ending balance in the Income Taxes Payable account. (Round intermediate calculations to the nearest whole dollar amount.) Amount of accounting adjustment Required 1 Required 2 Connect Homework - Chapter 9 Saved Help Save & Exit Submit Complete this question by entering your answers in the tabs below 4 Required 1 Required 2 Prepare journal entries to record (a) the December 31 adjustment to the Income Taxes Payable account and (b) the later J payment of the fourth-quarter taxes. (Round intermediate calculations to the nearest whole dollar amount.) 1 points View transaction list eBook Journal entry worksheet Print References 1 2 Record the December 31 adjustment to the Income Taxes Payable account Note: Enter debits before credits. General Journal Date Debit Credit December 31 Connect Homework - Chapter 9 Saved Help Save & Exit Submit 4 Journal entry worksheet > 2 Record the December 31 adjustment to the Income Taxes Payable account. 1 points Note: Enter debits before credits. eBook Debit Credit Print Date General Journal December 31 References Record entry Clear entry View general journal Required 1 Required 2 Connect Homework - Chapter 9 Saved Save & Exit Submit Help 4 Journal entry worksheet

I need help with the solution and explanation in the whole question Please and Thank you.

I need help with the solution and explanation in the whole question Please and Thank you.