I need help with these finance questions ASAP (Please zoom picture if not too clear):

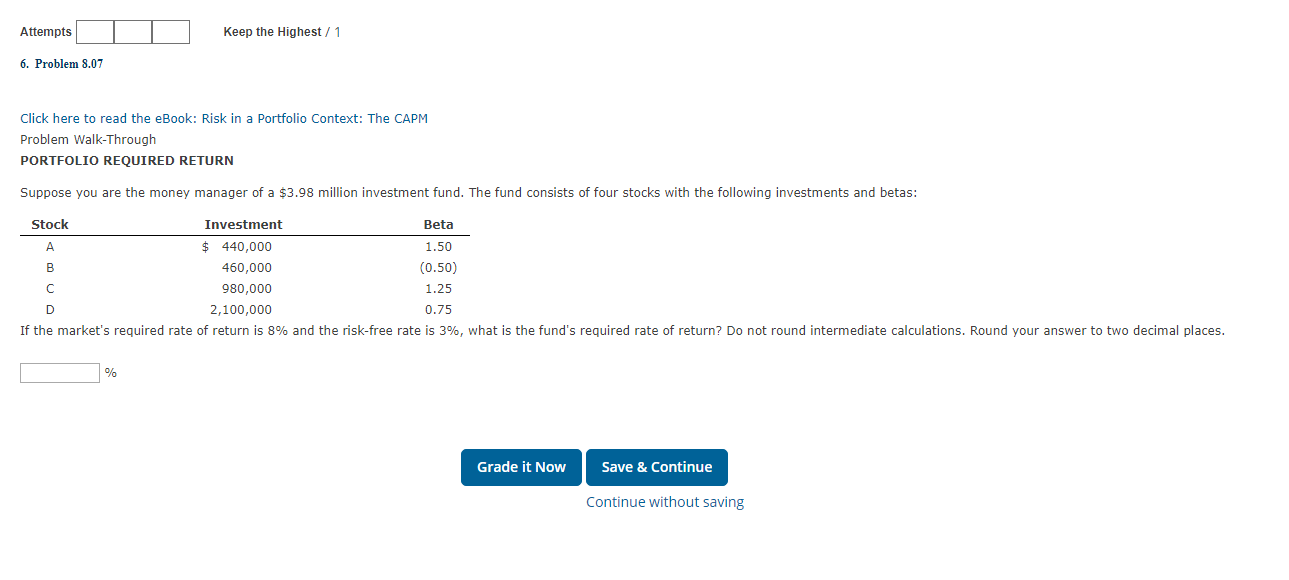

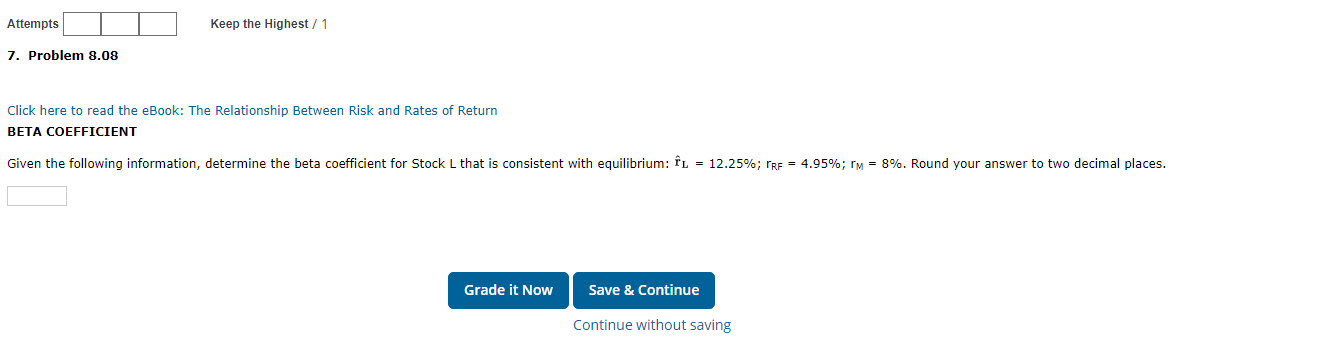

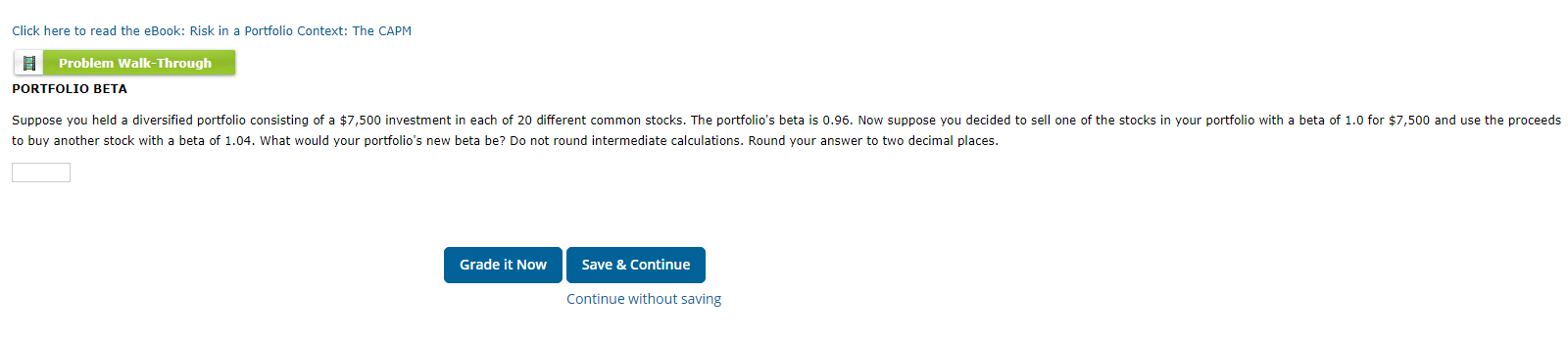

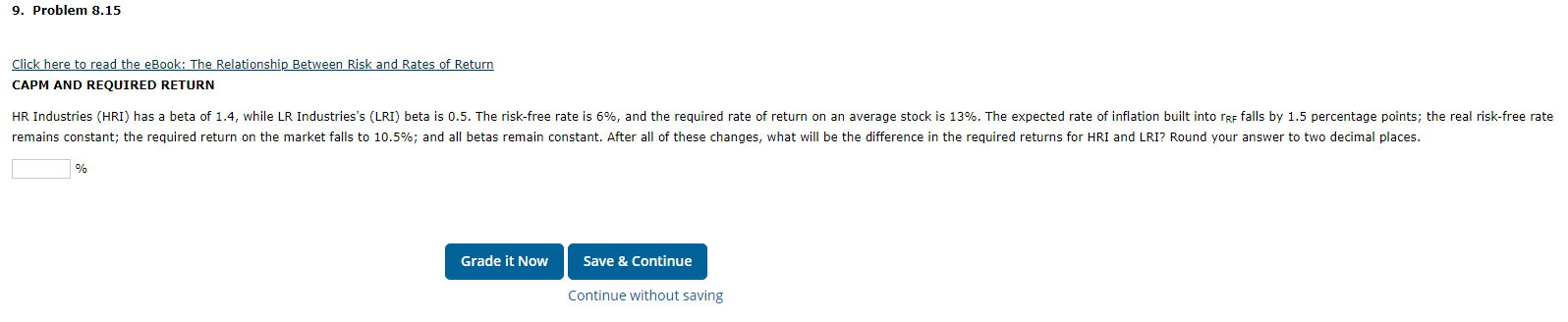

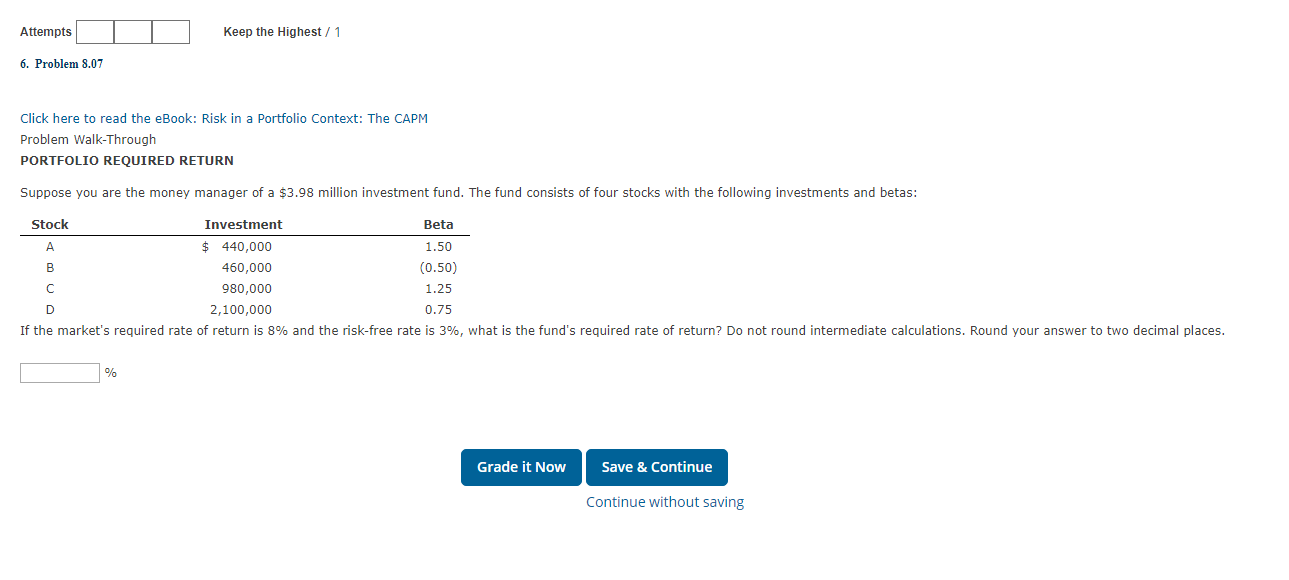

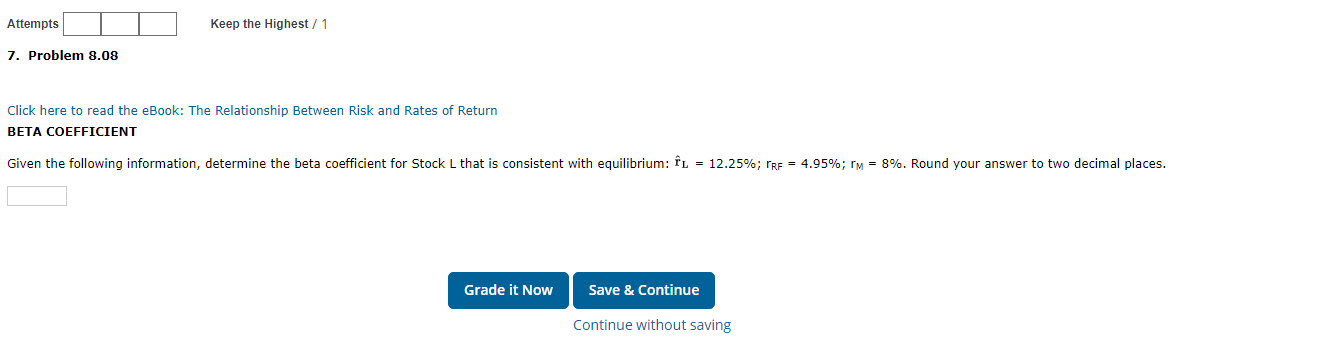

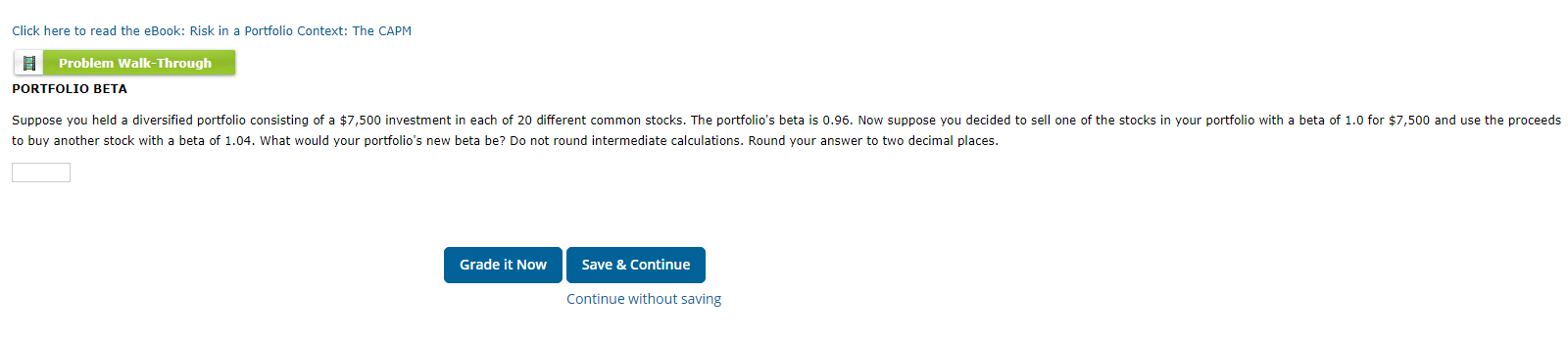

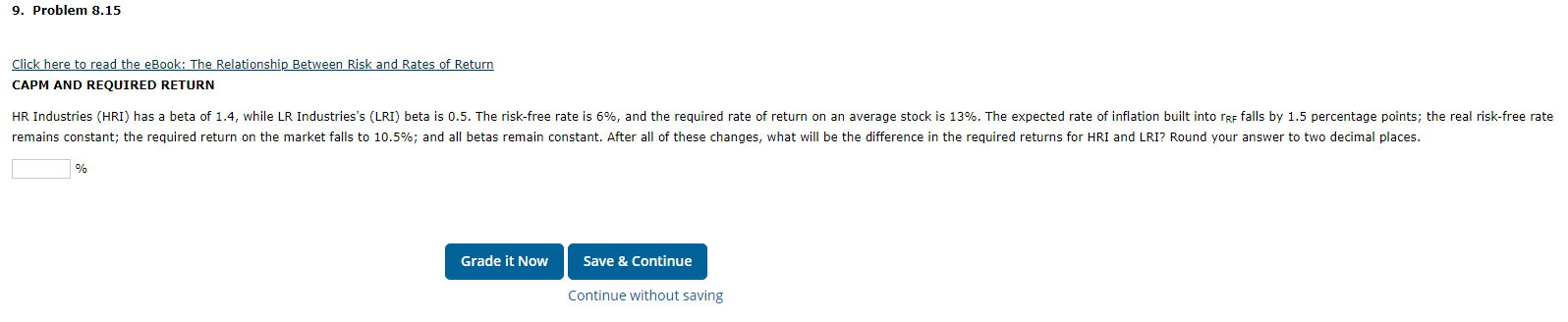

Attempts Keep the Highest / 1 6. Problem 8.07 Click here to read the eBook: Risk in a Portfolio Context: The CAPM Problem Walk-Through PORTFOLIO REQUIRED RETURN Suppose you are the money manager of a $3.98 million investment fund. The fund consists of four stocks with the following investments and betas: Beta A B Stock Investment $ 440,000 1.50 460,000 (0.50) 980,000 1.25 2,100,000 0.75 If the market's required rate of return is 8% and the risk-free rate is 3%, what is the fund's required rate of return? Do not round intermediate calculations. Round your answer to two decimal places. D % Grade it Now Save & Continue Continue without saving Attempts Keep the Highest / 1 7. Problem 8.08 Click here to read the eBook: The Relationship Between Risk and Rates of Return BETA COEFFICIENT Given the following information, determine the beta coefficient for Stock L that is consistent with equilibrium: fl = 12.25%; PRE = 4.95%; IM = 8%. Round your answer to two decimal places. Grade it Now Save & Continue Continue without saving Click here to read the eBook: Risk in a Portfolio Context: The CAPM Problem Walk-Through PORTFOLIO BETA Suppose you held a diversified portfolio consisting of a $7,500 investment in each of 20 different common stocks. The portfolio's beta is 0.96. Now suppose you decided to sell one of the stocks in your portfolio with a beta of 1.0 for $7,500 and use the proceeds to buy another stock with a beta of 1.04. What would your portfolio's new beta be? Do not round intermediate calculations. Round your answer to two decimal places. Grade it Now Save & Continue Continue without saving 9. Problem 8.15 Click here to read the eBook: The Relationship Between Risk and Rates of Return CAPM AND REQUIRED RETURN HR Industries (HRI) has a beta of 1.4, while LR Industries's (LRI) beta is 0.5. The risk-free rate is 6%, and the required rate of return on an average stock is 13%. The expected rate of inflation built into rRf falls by 1.5 percentage points; the real risk-free rate remains constant; the required return on the market falls to 10.5%; and all betas remain constant. After all of these changes, what will be the difference in the required returns for HRI and LRI? Round your answer to two decimal places. % Grade it Now Save & Continue Continue without saving