I need help with these

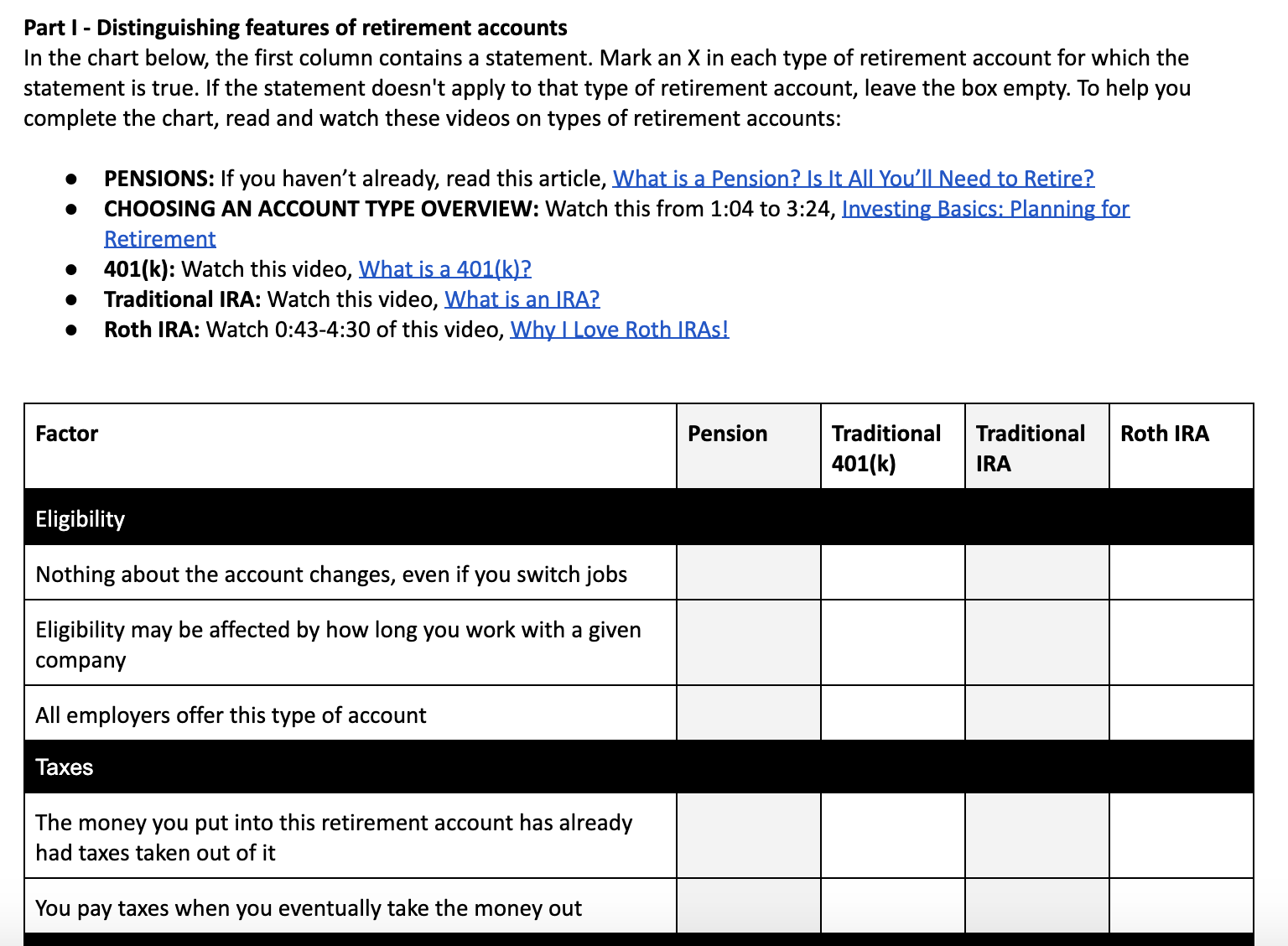

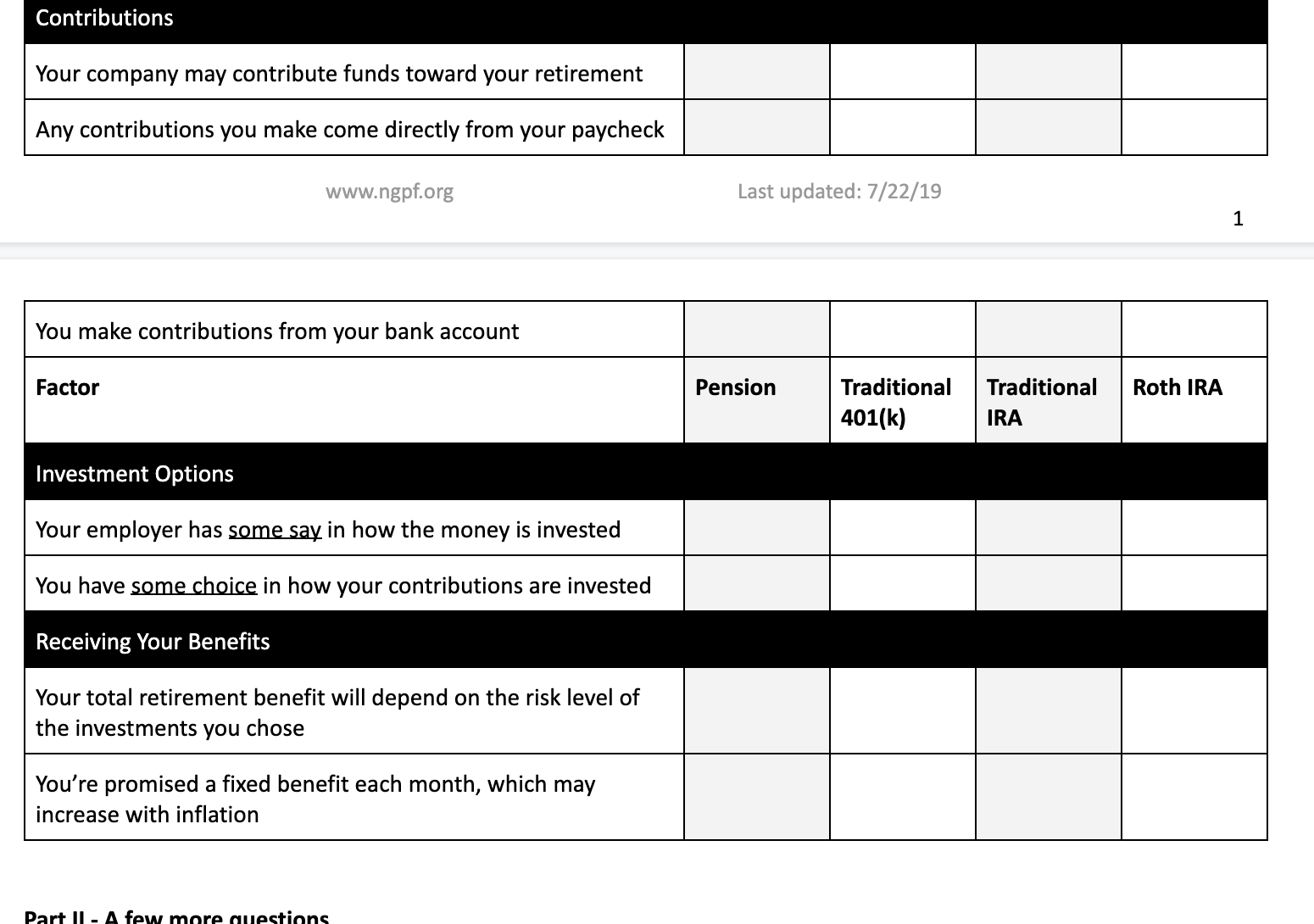

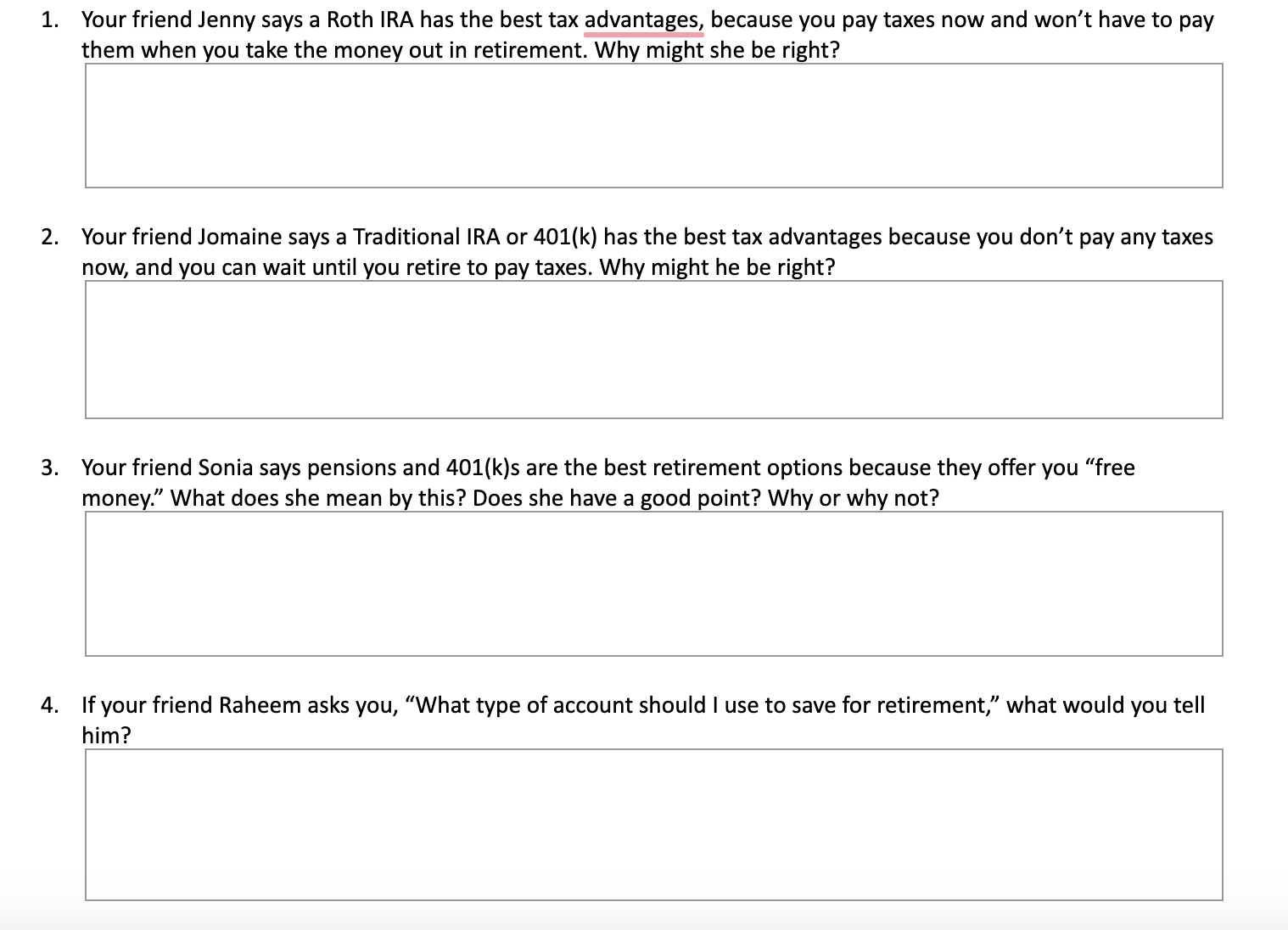

Part I - Distinguishing features of retirement accounts In the chart below, the first column contains a statement. Mark an X in each type of retirement account for which the statement is true. If the statement doesn't apply to that type of retirement account, leave the box empty. To help you complete the chart, read and watch these videos on types of retirement accounts: PENSIONS: If you haven't already, read this article, What is a Pension? Is It All You'll Need to Retire? CHOOSING AN ACCOUNT TYPE OVERVIEW: Watch this from 1:04 to 3:24, Investing Basics: Planning for Retirement 401(k): Watch this video, What is a 401(k)? Traditional IRA: Watch this video, What is an IRA? Roth IRA: Watch 0:43-4:30 of this video, Why I Love Roth IRAs! Factor Pension Traditional Traditional Roth IRA 401(k) IRA Eligibility Nothing about the account changes, even if you switch jobs Eligibility may be affected by how long you work with a given company All employers offer this type of account Taxes The money you put into this retirement account has already had taxes taken out of it You pay taxes when you eventually take the money outContributions Your company may contribute funds toward your retirement Any contributions you make come directly from your paycheck www.ngpf.org Last updated: 7/22/19 You make contributions from your bank account Factor Pension Traditional Traditional Roth IRA 401(k) IRA Investment Options Your employer has some say in how the money is invested You have some choice in how your contributions are invested Receiving Your Benefits Your total retirement benefit will depend on the risk level of the investments you chose You're promised a fixed benefit each month, which may increase with inflation4. Your friend Jenny says a Roth IRA has the best tax advantages, because you pay taxes now and won't have to pay them when you take the money out in retirement. Why might she be right? Your friend Jomaine says a Traditional IRA or 401(k) has the best tax advantages because you don't pay any taxes now, and you can wait until you retire to pay taxes. Why might he be right? Your friend Sonia says pensions and 401(k)s are the best retirement options because they offer you \"free money.\" What does she mean by this? Does she have a good point? Why or why not? If your friend Raheem asks you, "What type of account should I use to save for retirement,\" what would you tell him