I need help with these problems. Can you all answer these questions with explanations ?

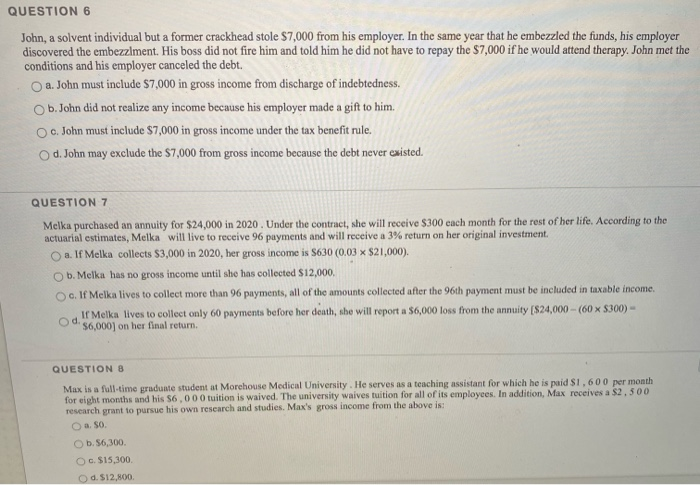

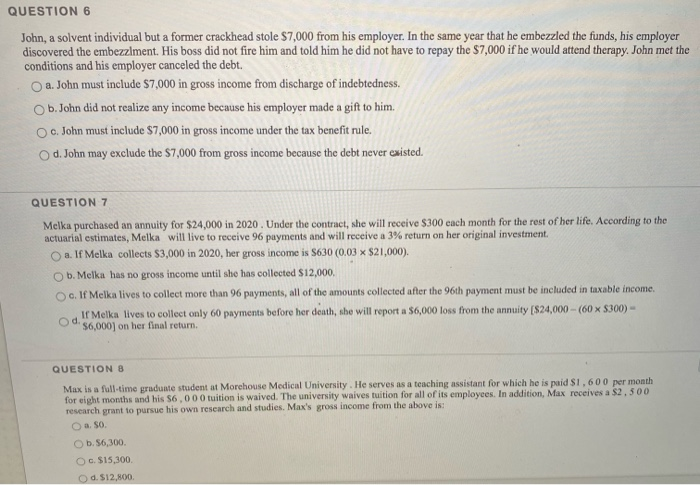

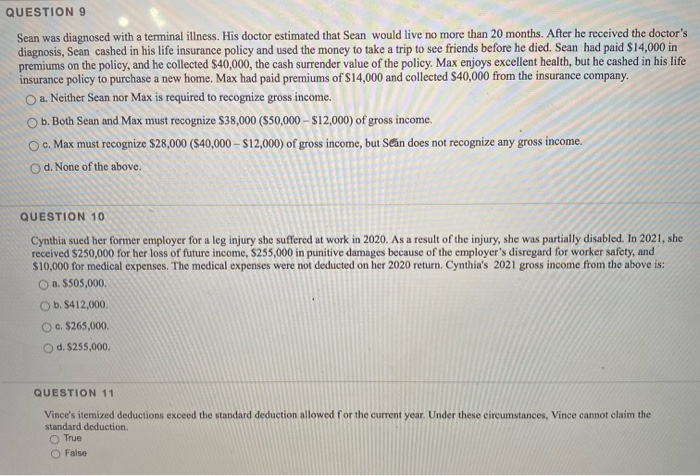

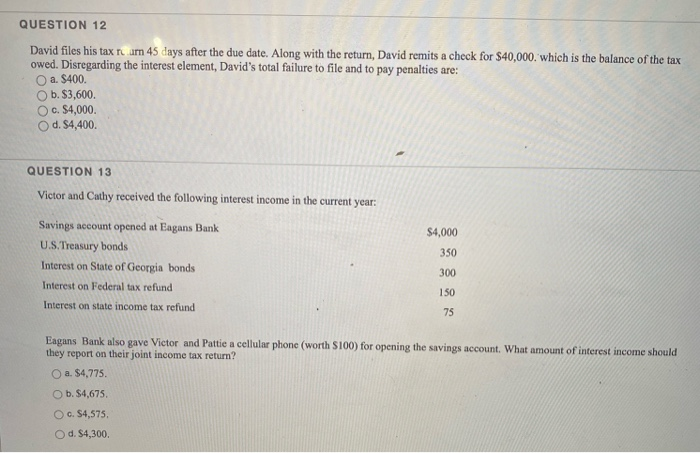

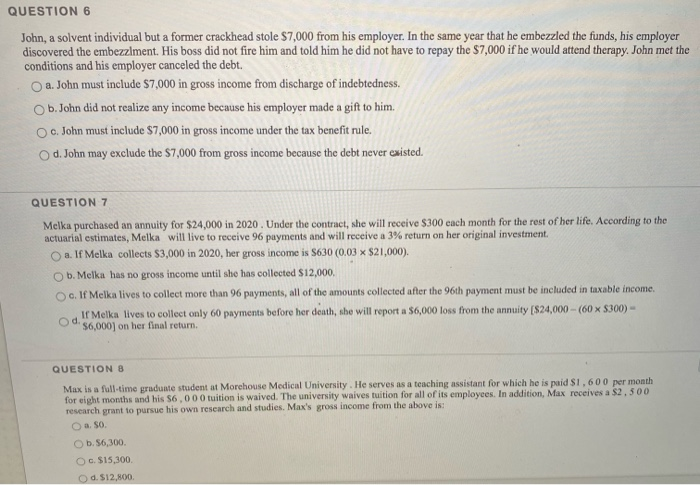

QUESTION 6 John, a solvent individual but a former crackhead stole $7,000 from his employer. In the same year that he embezzled the funds, his employer discovered the embezzlment. His boss did not fire him and told him he did not have to repay the $7,000 if he would attend therapy. John met the conditions and his employer canceled the debt. O a. John must include $7,000 in gross income from discharge of indebtedness. Ob.John did not realize any income because his employer made a gift to him. c. John must include $7,000 in gross income under the tax benefit rule. d. John may exclude the $7,000 from gross income because the debt never existed. QUESTION 7 Melka purchased an annuity for $24,000 in 2020. Under the contract, she will receive $300 each month for the rest of her life. According to the actuarial estimates, Melka will live to receive 96 payments and will receive a 3% return on her original investment a. If Melka collects $3,000 in 2020, her gross income is 5630 (0.03 * $21,000). b. Melka has no gross income until she has collected $12,000, Oo. If Melka lives to collect more than 96 payments, all of the amounts collected after the 96th payment must be included in taxable income. If Melka lives to collect only 60 payments before her death, she will report a $6,000 loss from the annuity ($24,000 (60 5300) - $6,000) on her final return Od QUESTIONS Max is a full-time graduate student at Morehouse Medical University. He serves as a teaching assistant for which he is paid $1,600 per month for eight months and his $6,000 tuition is waived. The university waives tuition for all of its employees. In addition, Max receives a $2,500 research grant to pursue his own research and studies. Max's gross income from the above is: a. So Ob. 56,300 O . $15,300 O d. 512,800 QUESTION 9 Sean was diagnosed with a terminal illness. His doctor estimated that Sean would live no more than 20 months. After he received the doctor's diagnosis, Sean cashed in his life insurance policy and used the money to take a trip to see friends before he died. Sean had paid $14,000 in premiums on the policy, and he collected $40,000, the cash surrender value of the policy. Max enjoys excellent health, but he cashed in his life insurance policy to purchase a new home. Max had paid premiums of $14,000 and collected $40,000 from the insurance company. a. Neither Scan nor Max is required to recognize gross income. ob. Both Sean and Max must recognize $38,000 (S50,000 - $12,000) of gross income. c. Max must recognize $28,000 (840,000 - $12,000) of gross income, but Sen does not recognize any gross income. Od. None of the above. QUESTION 10 Cynthia sued her former employer for a leg injury she suffered at work in 2020. As a result of the injury, she was partially disabled. In 2021, she received $250,000 for her loss of future income, S255,000 in punitive damages because of the employer's disregard for worker safety, and $10,000 for medical expenses. The medical expenses were not deducted on her 2020 return. Cynthia's 2021 gross income from the above is: O a $505,000 Ob. $412,000 O . $265,000 O d. $255,000 QUESTION 11 Vince's itemized deductions exceed the standard deduction allowed for the current year. Under these circumstances, Vince cannot claim the standard deduction True O False QUESTION 12 David files his tax tu am 45 days after the due date. Along with the return, David remits a check for $40,000. which is the balance of the tax owed. Disregarding the interest element, David's total failure to file and to pay penalties are: O a $400 Ob. $3,600 OC. $4,000 O d. $4,400. QUESTION 13 Victor and Cathy received the following interest income in the current year: $4,000 350 Savings account opened at Eagans Bank U.S.Treasury bonds Interest on State of Georgia bonds Interest on Federal tax refund Interest on state income tax refund 300 150 75 Eagans Bank also gave Victor and Pattie a cellular phone (worth $100) for opening the savings account. What amount of interest income should they report on their joint income tax return? a. $4,775. b. $4,675. O . S4,575 O d. $4,300