Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I need help with these problems! Suppose that, holding yield constant, investors are inditferent as to whether thoy hold bonds issued by the lederal govemment

I need help with these problems!

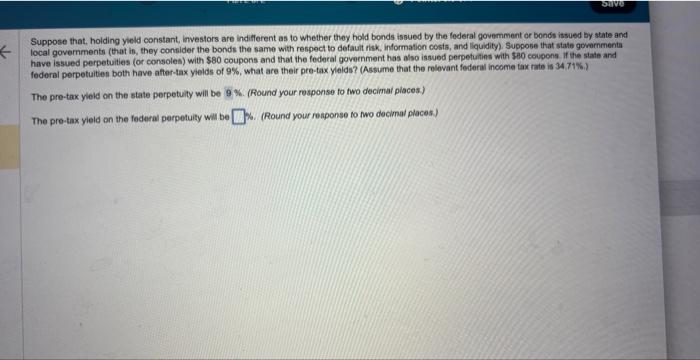

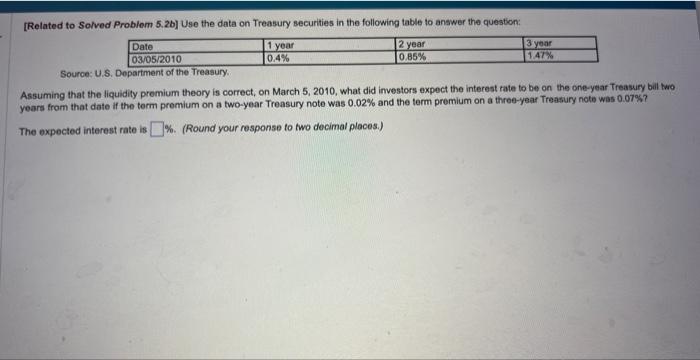

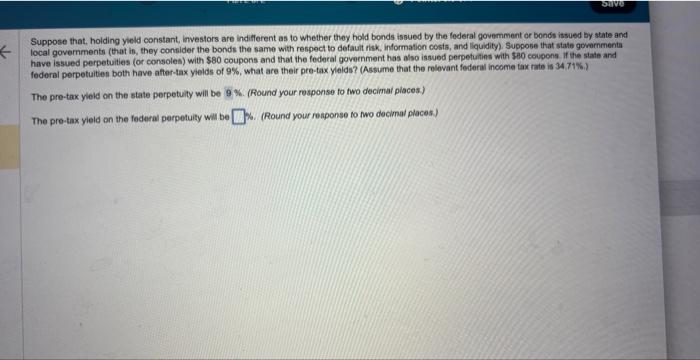

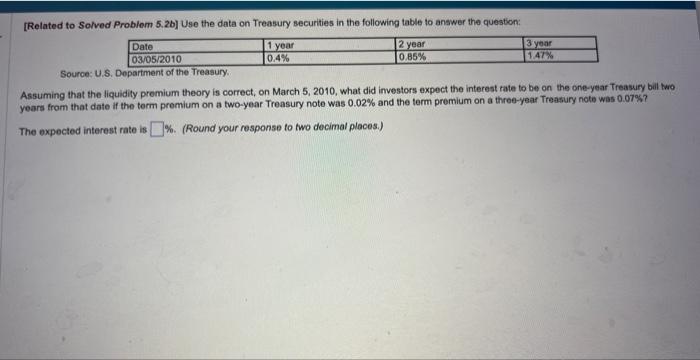

Suppose that, holding yield constant, investors are inditferent as to whether thoy hold bonds issued by the lederal govemment or bonds issued by state and local governments (that ib, they consider the bonds the same with respect to defauit risk. information costs, and liquidity). Suppose that state governmenta have issued perpetuities (or consoles) with $80 coupons and that the federal government has also issued perpetuitins with 500 coupons if ihe state and federbl perpotuitee both have aftet-tax yields of 9%, what are their pro-tax ylelds? (Assume that the relovant federal income tax rate is 34.71%.) The pre-tax yleld on the state perpetuity will be 9 \%. (Round your response fo hwo decimai piaces.) The pre-tax yield on the federal perpetuity wis be *. (Round your response to two decimal places) Assuming that the liquidity premium theory is correct, on March 5,2010 , what did investors expect the interest rate to be on the one-year Treasury bill two years from that date if the term premium on a two-year Treasury note was 0.02% and the term premium on a three-year Treasury note was 0.07% ? The expocted interest rate is \%. (Round your response to two decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started