Answered step by step

Verified Expert Solution

Question

1 Approved Answer

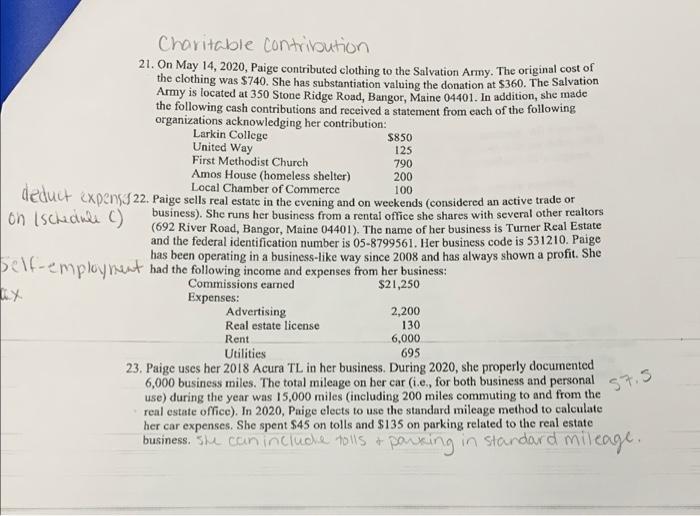

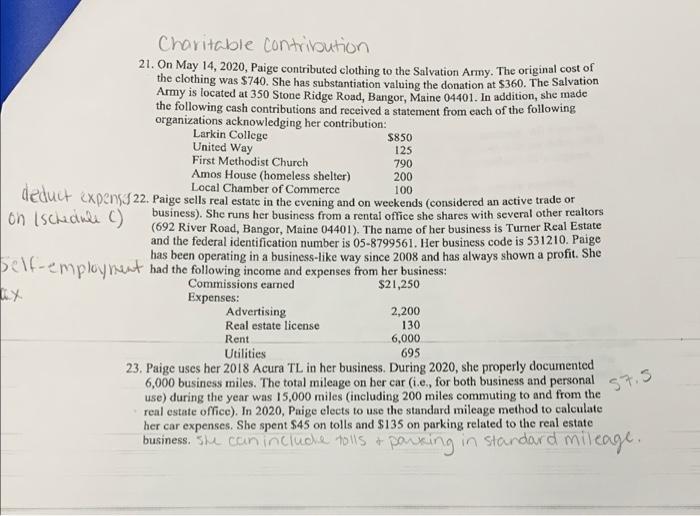

I need help with these questions. How would these be reported on their specific form. questions: 21,22,23 Thank you 5850 125 Charitable contribution 21. On

I need help with these questions. How would these be reported on their specific form.

5850 125 Charitable contribution 21. On May 14, 2020, Paige contributed clothing to the Salvation Army. The original cost of the clothing was $740. She has substantiation valuing the donation at $360. The Salvation Ammy is located at 350 Stone Ridge Road, Bangor, Maine 04401. In addition, she made the following cash contributions and received a statement from each of the following organizations acknowledging her contribution: Larkin College United Way First Methodist Church 790 Amos House (homeless shelter) 200 of deduct expensis 22. Paige sells real estate in the evening and on weekends (considered an active trade or on Ischedule C) business). She runs her business from a rental office she shares with several other realtors (692 River Road, Bangor, Maine 04401). The name of her business is Turner Real Estate and the federal identification number is 05-8799561. Her business code is 531210. Paige has been operating in a business-like way since 2008 and has always shown a profit. She Self-employment had the following income and expenses from her business: Commissions earned $ Expenses: Advertising 2,200 Real estate license Rent 6,000 Utilities 695 23. Paige uses her 2018 Acura TL in her business. During 2020, she properly documented 6,000 business miles. The total mileage on her car (1.e., for both business and personal use) during the year was 15,000 miles (including 200 miles commuting to and from the real estate office). In 2020, Paige elects to use the standard mileage method to calculate her car expenses. She spent $45 on tolls and $135 on parking related to the real estate business. She can include 10115 + parking in standard mileage. LY 130 57.5 5850 125 Charitable contribution 21. On May 14, 2020, Paige contributed clothing to the Salvation Army. The original cost of the clothing was $740. She has substantiation valuing the donation at $360. The Salvation Ammy is located at 350 Stone Ridge Road, Bangor, Maine 04401. In addition, she made the following cash contributions and received a statement from each of the following organizations acknowledging her contribution: Larkin College United Way First Methodist Church 790 Amos House (homeless shelter) 200 of deduct expensis 22. Paige sells real estate in the evening and on weekends (considered an active trade or on Ischedule C) business). She runs her business from a rental office she shares with several other realtors (692 River Road, Bangor, Maine 04401). The name of her business is Turner Real Estate and the federal identification number is 05-8799561. Her business code is 531210. Paige has been operating in a business-like way since 2008 and has always shown a profit. She Self-employment had the following income and expenses from her business: Commissions earned $ Expenses: Advertising 2,200 Real estate license Rent 6,000 Utilities 695 23. Paige uses her 2018 Acura TL in her business. During 2020, she properly documented 6,000 business miles. The total mileage on her car (1.e., for both business and personal use) during the year was 15,000 miles (including 200 miles commuting to and from the real estate office). In 2020, Paige elects to use the standard mileage method to calculate her car expenses. She spent $45 on tolls and $135 on parking related to the real estate business. She can include 10115 + parking in standard mileage. LY 130 57.5 questions: 21,22,23

Thank you

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started