Question: i need help with these three. Homework B Seved Check my work mode 1 This shows what is correct or incorrect for the work you

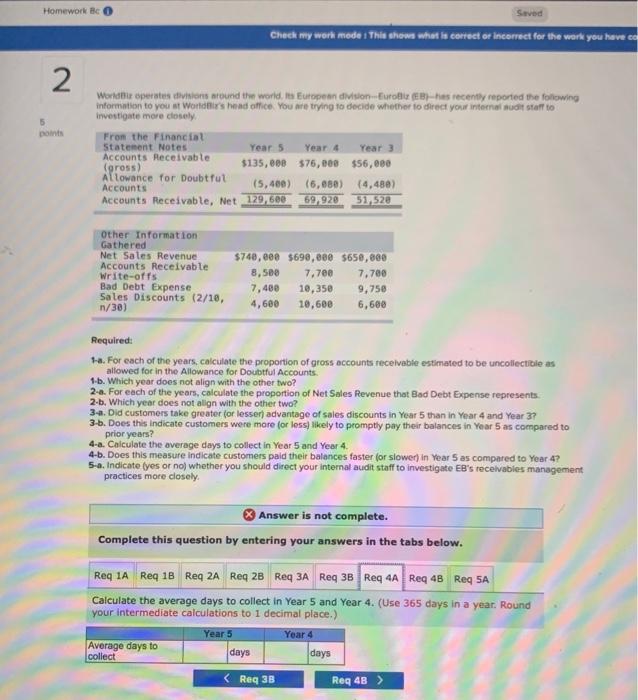

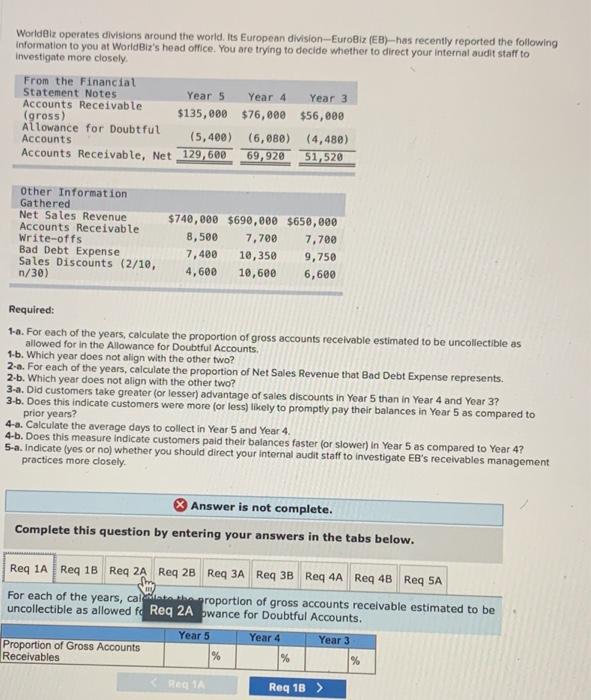

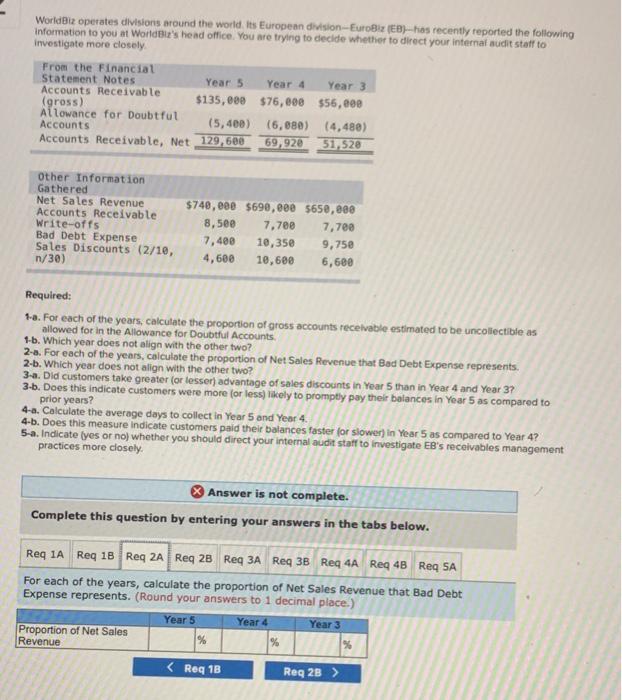

Homework B Seved Check my work mode 1 This shows what is correct or incorrect for the work you have co 2 5 Worldte operates divisions around the world. Its European division-Euro (EB)-has recently reported the following information to you at World's head office. You are trying to decide whether to direct your internal staff to investigate more closely From the Financial Statement Notes Year 5 Year 4 Year 3 Accounts Receivable (gross) $135,000 $76,000 $56,080 Allowance for Doubtful Accounts (5,400) (5,680) (4,480 Accounts Receivable, Net 129,608 69,920 51, 520 Other Information Gathered Net Sales Revenue Accounts Receivable Write-offs Bad Debt Expense Sales Discounts (2/18, n/30) $740,000 $690,000 $650,000 8,500 7.700 7.700 7,400 10,350 9,750 4,600 10,600 6,600 Required: ha. For each of the years calculate the proportion of gross accounts receivable estimated to be uncollectible as allowed for in the Allowance for Doubtful Accounts 1-b. Which year does not align with the other two? 2-e. For each of the years, calculate the proportion of Net Sales Revenue that Bed Debt Expense represents. 34. Did customers take greater for lesser) advantage of sales discounts in Year 5 than in Year 4 and Year 3? 3-b. Does this indicate customers were more or less likely to promptly pay their balances in Year 5 as compared to prior years? 4-a. Calculate the average days to collect in Year 5 and Year 4. 4-b. Does this measure indicate customers paid their balances faster for slower) in Year 5 as compared to Year 4? 5-a. Indicate (yes or no whether you should direct your internal audit staff to investigate EB's receivables management practices more closely. Answer is not complete. Complete this question by entering your answers in the tabs below. Req1A Req 1B Req 2A Req 2B Reg 3A Req 3B Req 4A Req 4B Req SA Calculate the average days to collect in Year 5 and Year 4. (Use 365 days in a year. Round your intermediate calculations to 1 decimal place.) Year 5 Year 4 Average days to collect days days Worldbiz operates divisions around the world. Its European division-EuroBiz (EB)--has recently reported the following information to you at WorldBiz's head office. You are trying to decide whether to direct your internal audit staff to investigate more closely. From the Financial Statement Notes Years Year 4 Year 3 Accounts Receivable (gross) $135,000 $76,000 $56,000 Allowance for Doubtful (5,408) (6,980) (4,480) Accounts Accounts Receivable, Net 129,600 69,920 51,520 Other Information Gathered Net Sales Revenue Accounts Receivable Write-offs Bad Debt Expense Sales Discounts (2/10, n/30) $740,000 $690,000 $650,000 8,500 7,700 7,700 7,400 10,350 9,750 4,600 10,600 6,600 Required: 1-a. For each of the years, calculate the proportion of gross accounts receivable estimated to be uncollectible as allowed for in the Allowance for Doubtful Accounts 1-b. Which year does not align with the other two? 2.a. For each of the years, calculate the proportion of Net Sales Revenue that Bad Debt Expense represents. 2-b. Which year does not align with the other two? 3-a. Did customers take greater (or lesser) advantage of sales discounts in Year 5 than in Year 4 and Year 3? 3-5. Does this indicate customers were more or less) likely to promptly pay their balances in Year 5 as compared to prior years? 4-a. Calculate the average days to collect in Year 5 and Year 4. 4-b. Does this measure indicate customers paid their balances faster (or slower) In Year 5 as compared to Year 4? 5-a. Indicate (yes or no) whether you should direct your internal audit staff to investigate EB's receivables management practices more closely. Answer is not complete. Complete this question by entering your answers in the tabs below. Req 1A Req 1B Req ZA Req 28 Req 3A Req 3B Req 4A Req 48 Req SA For each of the years, calitate the proportion of gross accounts receivable estimated to be uncollectible as allowed fo Req 2A pwance for Doubtful Accounts. Year 5 Year 4 Year 3 Proportion of Gross Accounts Receivables % % % Reg 1 Req 1B > WorldBiz operates divisions around the world. Its European division-EuroBiz (EB)-has recently reported the following Information to you at World's head office. You are trying to decide whether to direct your internal audit staff to investigate more closely From the Financial Statement Notes Year 5 Year 4 Year 3 Accounts Receivable (gross) $135,000 $76,600 $56,000 Allowance for Doubtful Accounts (5,400) (6,880) (4,480) Accounts Receivable, Net 129,600 69,92e 31,520 Other Information Gathered Net Sales Revenue Accounts Receivable Write-offs Bad Debt Expense Sales Discounts (2/10, n/30) $740,000 $690,000 $650,008 8,500 7,700 7,700 7,400 10,350 9,750 4,600 10,600 6,600 Required: 1-a. For each of the years, calculate the proportion of gross accounts receivable estimated to be uncollectible as allowed for in the Allowance for Doubtful Accounts 1-b. Which year does not align with the other two? 2a. For each of the years, calculate the proportion of Net Sales Revenue that Bed Debt Expense represents. 3-a. Did customers take greater (or lesser) advantage of sales discounts in Year 5 than in Year 4 and Year 3? 3-b. Does this indicate customers were more or less likely to promptly pay their balances in Year 5 as compared to prior years? 4-a. Calculate the average days to collect in Year 5 and Year 4. 4-b. Does this measure indicate customers paid their balances faster for slower) in Year 5 as compared to Year 4? 5-a. Indicate yes or no whether you should direct your internal audit staff to investigate EB's receivables management practices more closely Answer is not complete. Complete this question by entering your answers in the tabs below. Req IA Reg 1B Req ZA Reg 28 Reg 3A Reg 3B Req 4A Reg 48 Req SA For each of the years, calculate the proportion of Net Sales Revenue that Bad Debt Expense represents. (Round your answers to 1 decimal place.) Year 5 Year 4 Year 3 Proportion of Net Sales Revenue % % %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts