i need help with this 6 questions

in the 3rd question there is a typo, max[S_T-42,0]^2 is correct.

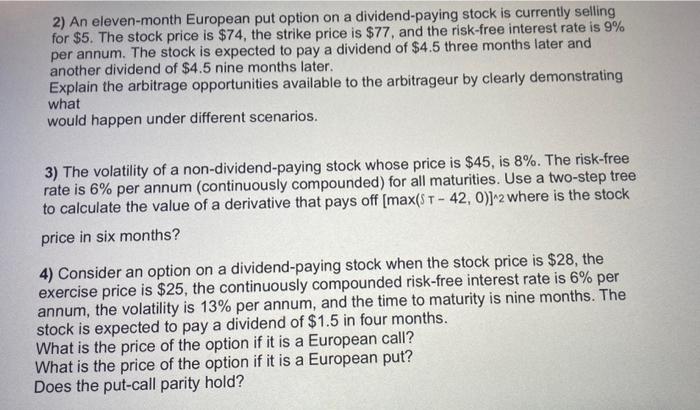

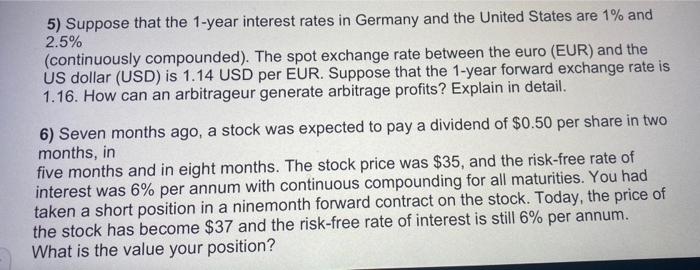

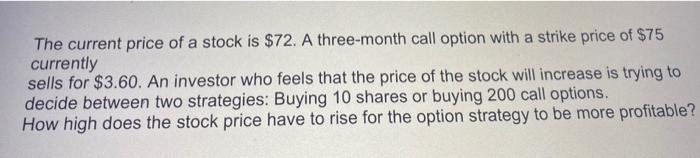

2) An eleven-month European put option on a dividend-paying stock is currently selling for $5. The stock price is $74, the strike price is $77, and the risk-free interest rate is 9% per annum. The stock is expected to pay a dividend of $4.5 three months later and another dividend of $4.5 nine months later. Explain the arbitrage opportunities available to the arbitrageur by clearly demonstrating what would happen under different scenarios. 3) The volatility of a non-dividend-paying stock whose price is $45, is 8%. The risk-free rate is 6% per annum (continuously compounded) for all maturities. Use a two-step tree to calculate the value of a derivative that pays off [max(ST42,0)]22 where is the stock price in six months? 4) Consider an option on a dividend-paying stock when the stock price is $28, the exercise price is $25, the continuously compounded risk-free interest rate is 6% per annum, the volatility is 13% per annum, and the time to maturity is nine months. The stock is expected to pay a dividend of $1.5 in four months. What is the price of the option if it is a European call? What is the price of the option if it is a European put? Does the put-call parity hold? 5) Suppose that the 1-year interest rates in Germany and the United States are 1% and 2.5% (continuously compounded). The spot exchange rate between the euro (EUR) and the US dollar (USD) is 1.14 USD per EUR. Suppose that the 1-year forward exchange rate is 1.16. How can an arbitrageur generate arbitrage profits? Explain in detail. 6) Seven months ago, a stock was expected to pay a dividend of $0.50 per share in two months, in five months and in eight months. The stock price was $35, and the risk-free rate of interest was 6% per annum with continuous compounding for all maturities. You had taken a short position in a ninemonth forward contract on the stock. Today, the price of the stock has become $37 and the risk-free rate of interest is still 6% per annum. What is the value your position? The current price of a stock is $72. A three-month call option with a strike price of $75 currently sells for $3.60. An investor who feels that the price of the stock will increase is trying to decide between two strategies: Buying 10 shares or buying 200 call options. How high does the stock price have to rise for the option strategy to be more profitable