I need help with this asap

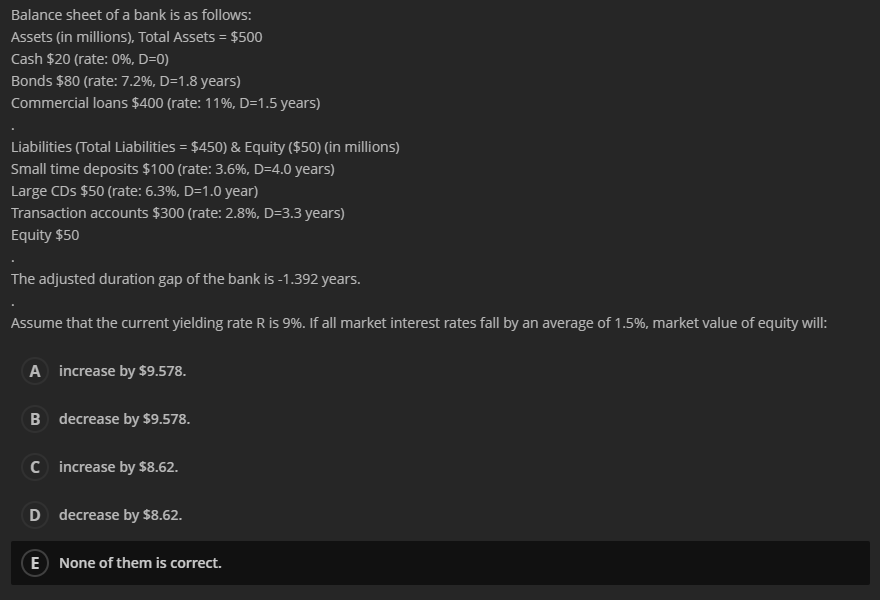

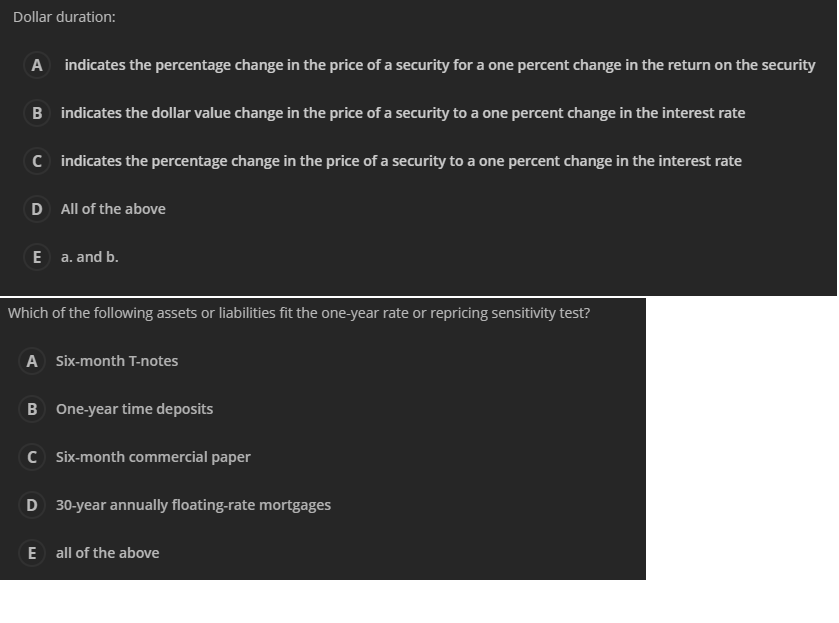

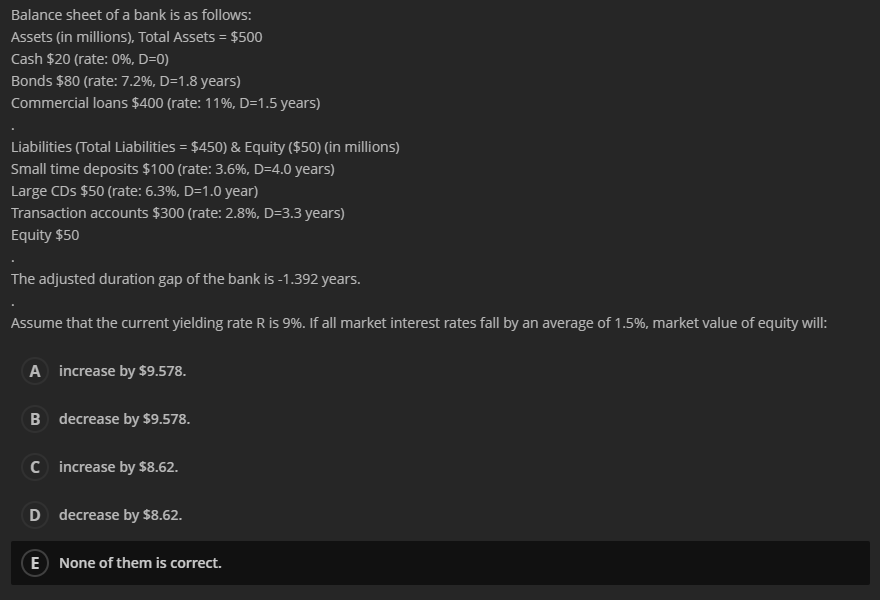

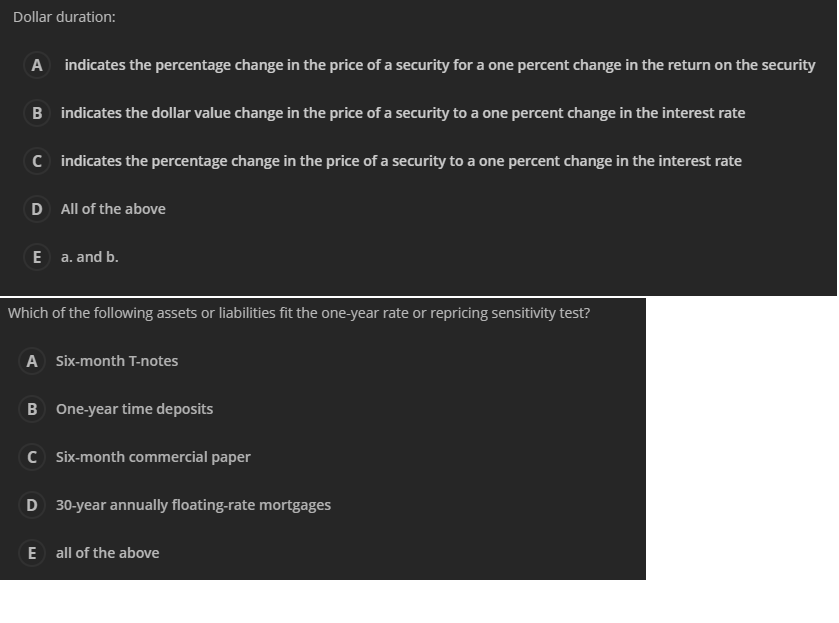

Balance sheet of a bank is as follows: Assets (in millions), Total Assets = $500 Cash $20 (rate: 0%, D=0) Bonds $80 (rate: 7.2%, D=1.8 years) Commercial loans $400 (rate: 11%, D=1.5 years) Liabilities (Total Liabilities = $450) & Equity ($50) (in millions) Small time deposits $100 (rate: 3.6%, D=4.0 years) Large CDs $50 (rate: 6.3%, D=1.0 year) Transaction accounts $300 (rate: 2.8%, D=3.3 years) Equity $50 The adjusted duration gap of the bank is -1.392 years. Assume that the current yielding rate Ris 9%. If all market interest rates fall by an average of 1.5%, market value of equity will: A increase by $9.578. B decrease by $9.578. C increase by $8.62. D decrease by $8.62. E None of them is correct. Dollar duration: A indicates the percentage change in the price of a security for a one percent change in the return on the security B indicates the dollar value change in the price of a security to a one percent change in the interest rate C indicates the percentage change in the price of a security to a one percent change in the interest rate D All of the above E a. and b. Which of the following assets or liabilities fit the one-year rate or repricing sensitivity test? A Six-month T-notes B One-year time deposits C Six-month commercial paper D 30-year annually floating-rate mortgages E all of the above Balance sheet of a bank is as follows: Assets (in millions), Total Assets = $500 Cash $20 (rate: 0%, D=0) Bonds $80 (rate: 7.2%, D=1.8 years) Commercial loans $400 (rate: 11%, D=1.5 years) Liabilities (Total Liabilities = $450) & Equity ($50) (in millions) Small time deposits $100 (rate: 3.6%, D=4.0 years) Large CDs $50 (rate: 6.3%, D=1.0 year) Transaction accounts $300 (rate: 2.8%, D=3.3 years) Equity $50 The adjusted duration gap of the bank is -1.392 years. Assume that the current yielding rate Ris 9%. If all market interest rates fall by an average of 1.5%, market value of equity will: A increase by $9.578. B decrease by $9.578. C increase by $8.62. D decrease by $8.62. E None of them is correct. Dollar duration: A indicates the percentage change in the price of a security for a one percent change in the return on the security B indicates the dollar value change in the price of a security to a one percent change in the interest rate C indicates the percentage change in the price of a security to a one percent change in the interest rate D All of the above E a. and b. Which of the following assets or liabilities fit the one-year rate or repricing sensitivity test? A Six-month T-notes B One-year time deposits C Six-month commercial paper D 30-year annually floating-rate mortgages E all of the above